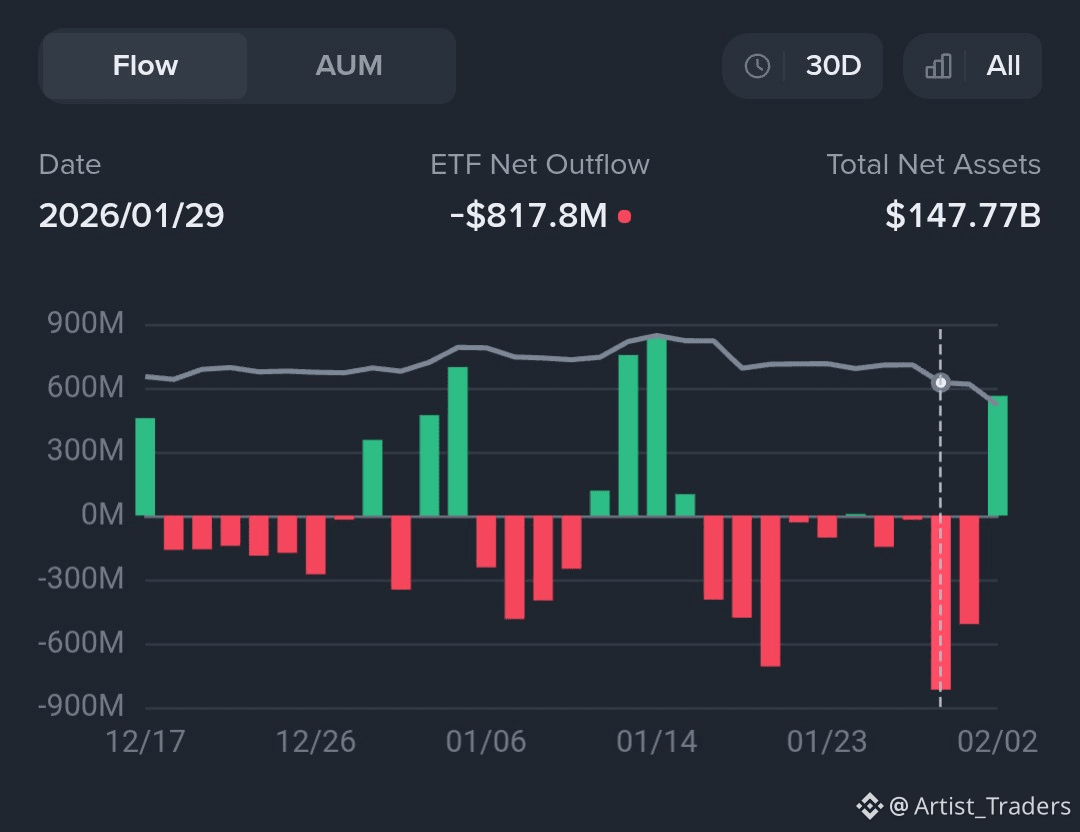

Bitcoin has experienced volatility recently, with prices dipping (currently trading around $75,000–$78,000 range amid broader market pressure). Some on-chain trackers highlighted significant BTC movements out of certain wallets, which sparked claims of "dumping" and market manipulation.

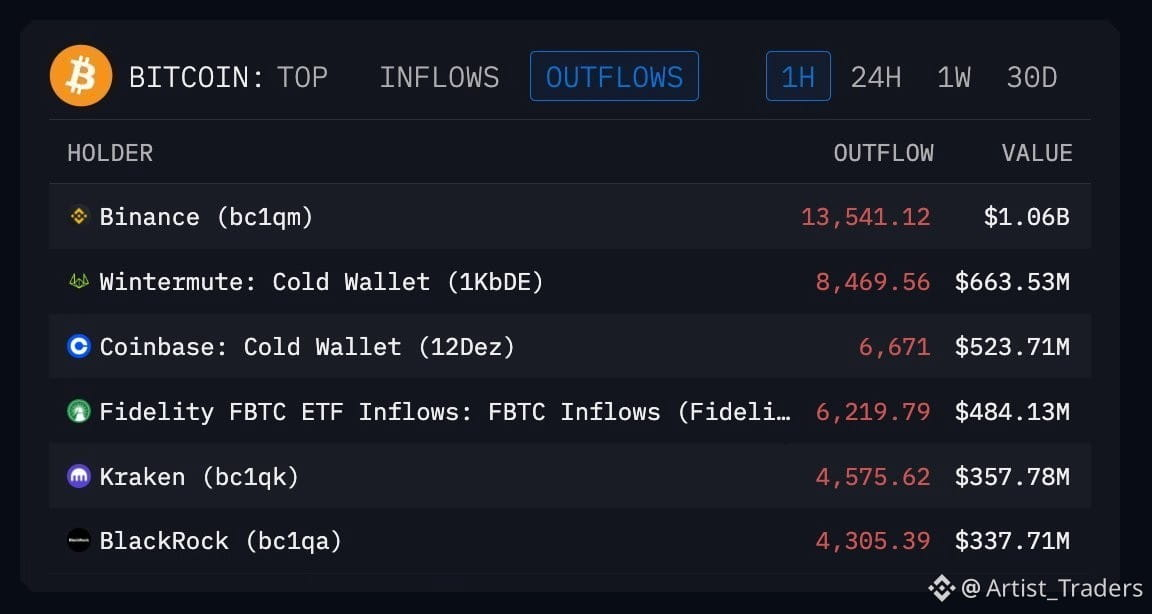

Key outflows reported in this snapshot (values approximate at ~$78,000/BTC):

Binance (hot/cold wallet cluster: bc1qm...): ~13,541 BTC outflow ≈ $1.06 billion

Wintermute (market maker cold wallet: 1KbDE...): ~8,470 BTC outflow ≈ $664 million

Coinbase (cold wallet: 12Dez...): ~6,671 BTC outflow ≈ $524 million

Fidelity FBTC (ETF inflows labeled, but shown in outflows context): ~6,220 BTC movement ≈ $484 million — Note: This is likely labeled as "inflows" to the ETF fund itself (buying BTC), but appears in the outflows table — common confusion in trackers.

Kraken (bc1qk...): ~4,576 BTC outflow ≈ $358 million

BlackRock (bc1qa... likely IBIT-related): ~4,305 BTC outflow ≈ $338 million

Total visible in this list: Over ~43,000 BTC (~$3.4B+ at time of data) moved out of these labeled addresses.

Important Context — Not Necessarily "Selling" or "Dumping"

These are on-chain transfers, not confirmed sales on the open market:

Exchanges like Binance, Coinbase, and Kraken frequently move BTC between hot wallets (for user withdrawals/deposits), cold storage (security), or internal consolidation. Large outflows often reflect routine housekeeping, customer withdrawals, or rebalancing — not always aggressive selling.

Market makers like Wintermute handle huge volumes for liquidity provision; movements can be internal shifts or transfers to trading venues.

ETF-related entries (Fidelity FBTC, BlackRock IBIT) typically show inflows when institutions buy BTC to back new ETF shares (bullish), but trackers sometimes label movements confusingly. Recent ETF data actually shows net inflows in some sessions (e.g., ~$562M into U.S. spot Bitcoin ETFs on a recent day, led by Fidelity and BlackRock), countering pure "dump" narratives.

No strong evidence of coordinated insider manipulation from reliable sources — these claims often arise in volatile periods but usually trace back to normal large-player activity or misread transfers.

Why the Market Felt Pressure

Bitcoin has seen a pullback (down ~10–15% in recent weeks from higher levels), driven by factors like:

Macro uncertainty (e.g., economic/geopolitical risks).

Liquidations in leveraged positions.

Periodic ETF outflows in prior weeks (though inflows returned recently).

Large on-chain moves can amplify fear, uncertainty, and doubt (FUD) in thin liquidity, contributing to short-term dips — but they don't always mean sustained selling.

TL;DR: Big BTC movements from exchanges/institutions are common and often benign (internal transfers/withdrawals). While they can coincide with price pressure, labeling them as "coordinated dumping" or "insider manipulation" is speculative and usually overstated. Always cross-check with multiple sources (e.g., ETF flow trackers like SoSoValue/Farside, on-chain tools, and price context) rather than single screenshots.

If this is from a specific date/tool, feel free to share more details for deeper clarification!