The market is bleeding, but the smart money is watching the infrastructure. While the SOLUSDT pair has recently dipped below the psychological $100 level, the underlying network metrics suggest a massive divergence between "Price" and "Value."

As of early February 2026, Solana isn't just a "fast blockchain" anymore—it has become the institutional settlement layer of the future. Here is why the current volatility is the ultimate setup for the next leg up. 🧵👇

1️⃣ The Price Gap: Extreme Oversold Signals 📉

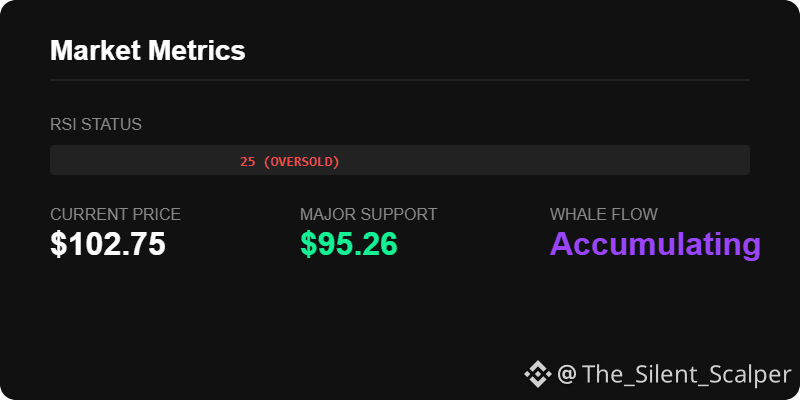

Solana (SOL) is currently trading around $102.75, having pulled back from its January highs. While the short-term structure looks bearish, look at the indicators:

RSI Alert: The daily Relative Strength Index (RSI) has crashed to 25, signaling an extreme oversold condition.

Whale Activity: Despite the price drop, on-chain data shows large holders ("whales") moving tens of millions in SOL off exchanges into private wallets—a classic sign of long-term conviction.

The Floor: Immediate support is holding at the $95.26 level, while a reclaim of $116 would invalidate the bearish thesis.

2️⃣ The "Alpenglow" Revolution: Sub-Second Finality ⚡

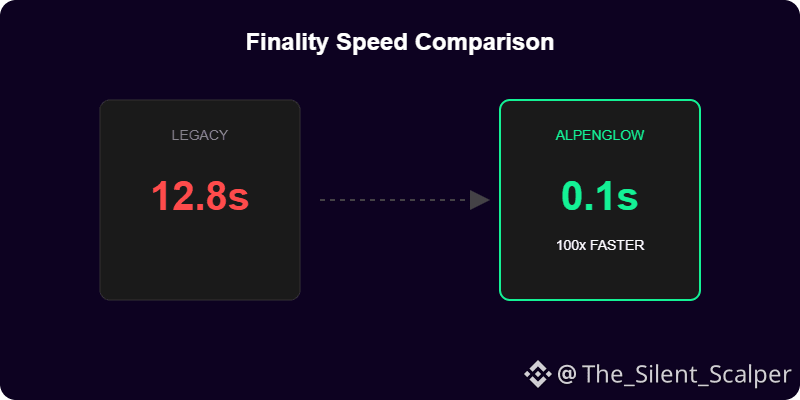

Forget what you knew about "fast." The Alpenglow upgrade (Q1 2026) is a total consensus re-architecture that moves Solana into a different league :

100ms Finality: Transaction finality is dropping from 12.8 seconds to just 100–150 milliseconds. That is on par with Visa and Google search response times.

Firedancer is LIVE: The independent validator client developed by Jump Crypto is now on mainnet, capable of processing 1 million TPS in test environments.

Validator Economics: The upgrade reduces minimum stake requirements for a profitable validator from ~4,850 SOL to approximately 450 SOL, drastically improving decentralization.

3️⃣ Regulatory Alpha: The Pakistan Explosion 🇵🇰

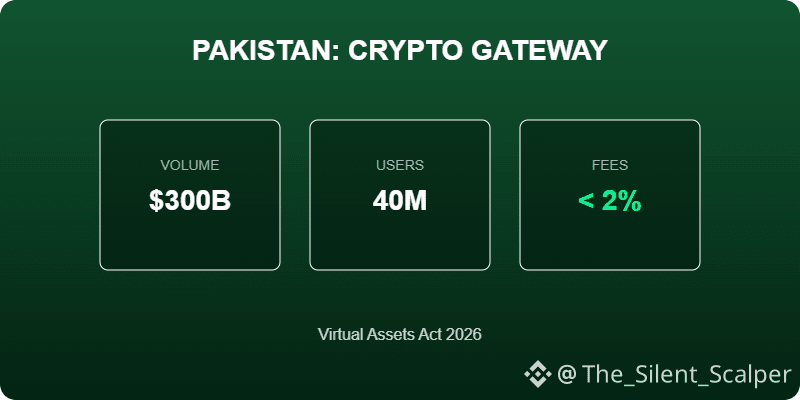

One of the biggest fundamental drivers in 2026 is the legal transformation of Pakistan into a global crypto hub.

$300 Billion Volume: With 40 million users and massive annual trading volume, Pakistan has officially introduced the Regulation of Virtual Assets Act 2026.

PVARA Power: The new Pakistan Virtual Assets Regulatory Authority (PVARA) is already inviting global exchanges to apply for licenses.

The Remittance Game: Regulated crypto rails are projected to reduce remittance costs from 7% to under 2%, potentially saving the national economy billions.

4️⃣ DeFi Dominance & The Stablecoin "Cash" King 💸

Solana has become the preferred venue for "Digital Cash."

Stablecoin Velocity: Solana’s stablecoin supply has hit $14.07 billion, with USDC maintaining a 56.74% dominance.

Revenue Flip: Solana is generating significantly higher chain fees (~$1.03M/24h) compared to the aggregated fees of the Ethereum Layer 2 basket (~$182K).

Ecosystem Health: Protocols like Jupiter ($2.38B TVL) and Kamino ($2.06B TVL) continue to see robust activity despite the price correction.

5️⃣ The Mathematical Bull Case 🧮

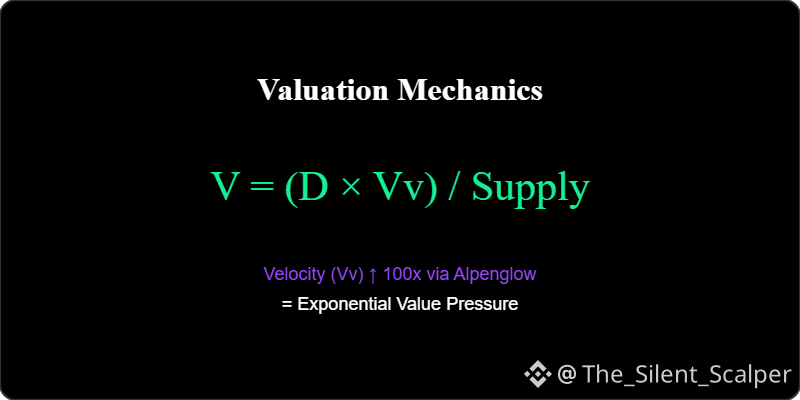

Long-term valuation is driven by the supply-demand equilibrium. Consider the relationship between network value ($V$), demand ($D$), velocity ($V_{velocity}$), circulating supply ($S$), and the staking ratio ($R_{stake}$):

$$V = \frac{D \times V_{velocity}}{S \times (1 - R_{stake})}$$

As the Alpenglow upgrade increases $V_{velocity}$ through sub-second finality and the staking ratio stays high (~70%), the mathematical pressure on $V$ remains strongly upward as adoption scales.

🚀 The Bottom Line

Institutional analysts at VanEck and Standard Chartered have maintained long-term targets ranging from $500 to $3,000+ by 2030.

The market is currently in an "Infrastructure Phase." While the chart looks red, the network is becoming faster, more decentralized (Firedancer), and more regulated (Pakistan Act) than ever before.

Are you selling the fear, or buying the future? 💎