Blockchain technology has already transformed how value moves across the internet, but when it comes to regulated financial assets, the industry still faces major challenges. Traditional token models often struggle with compliance, privacy, and real-world legal requirements. This is where Security Token Offerings (STOs) come into play—and this is exactly where Dusk Network is positioning itself as a game-changer.

In this article, we explore how STOs on Dusk Network redefine digital securities by combining privacy, compliance, and decentralization, and why this approach could unlock the next wave of institutional adoption in Web3.

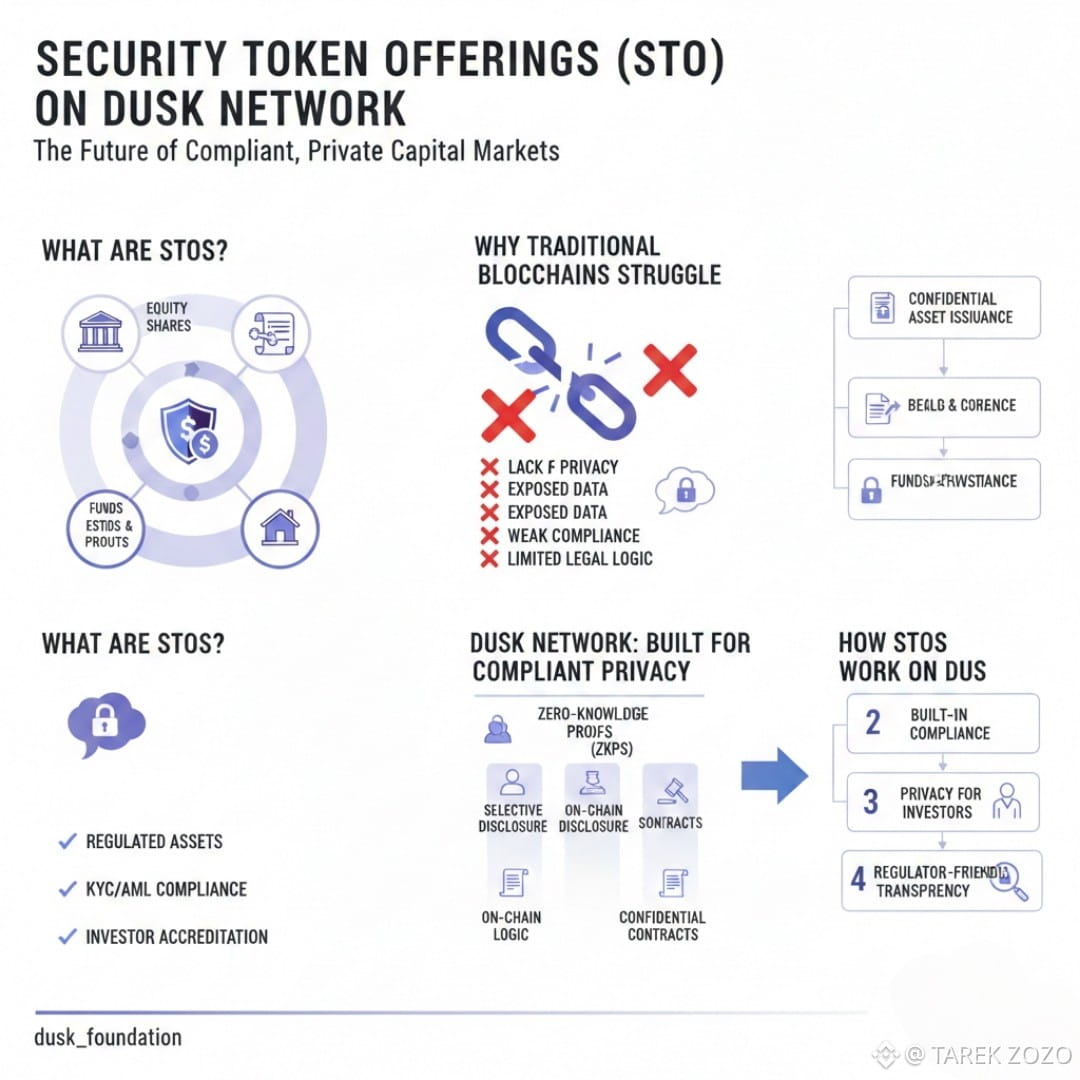

What Are Security Token Offerings (STOs)?

A Security Token Offering (STO) is a regulated fundraising method where tokenized assets represent real-world securities such as:

Equity shares

Bonds and debt instruments

Real estate ownership

Funds and structured products

Unlike utility tokens, security tokens must comply with financial regulations, including KYC, AML, investor accreditation rules, and jurisdictional restrictions. This compliance requirement is exactly what makes STOs powerful—but also complex.

Most blockchains were never designed with these constraints in mind. Dusk Network was.

Why Traditional Blockchains Struggle with STOs

While many Layer 1 networks focus on speed or DeFi innovation, they often fall short in key STO requirements:

❌ Lack of transaction privacy

❌ Public exposure of investor data

❌ Weak compliance enforcement

❌ Limited programmability for legal rules

Financial institutions cannot afford to expose sensitive investor data on public ledgers. Regulators also require selective transparency, not full anonymity. This creates a critical gap—one that Dusk Network is built to solve.

Dusk Network: Built for Compliant Privacy

Dusk Network is a privacy-focused Layer 1 blockchain specifically designed for regulated financial applications, including STOs. Instead of forcing institutions to compromise between privacy and compliance, Dusk delivers both.

Key pillars of Dusk’s architecture include:

Zero-Knowledge Proofs (ZKPs)

Selective disclosure mechanisms

On-chain compliance logic

Confidential smart contracts

This means sensitive financial data stays private, while regulators can still verify compliance when required.

How STOs Work on Dusk Network

Security Token Offerings on Dusk follow a compliant-by-design framework:

1. Confidential Asset Issuance

Issuers can tokenize securities without revealing sensitive information such as ownership distribution or transaction history to the public.

2. Built-In Compliance

Rules like investor eligibility, transfer restrictions, and jurisdictional limits are enforced directly at the protocol level.

3. Privacy for Investors

Investor identities and balances remain private through zero-knowledge cryptography, reducing the risk of data leaks and front-running.

4. Regulator-Friendly Transparency

Authorized entities can audit transactions without exposing data to the entire network—achieving true selective transparency.

The Role of Smart Contracts in STOs on Dusk

Unlike generic smart contracts, Dusk smart contracts are privacy-aware. This allows issuers to encode complex legal and financial logic, such as:

Dividend distribution

Voting rights

Vesting schedules

Transfer lockups

All of this happens without compromising confidentiality—something that is nearly impossible on traditional public blockchains.

Why STOs on Dusk Matter for Institutions

Institutional players care about three things: regulation, risk, and reputation. Dusk Network directly addresses all three.

Benefits for institutions include:

Reduced compliance costs

Secure investor data handling

Regulatory alignment from day one

Global capital access without sacrificing privacy

This makes Dusk a strong candidate for banks, asset managers, and enterprises exploring tokenized securities.

$DUSK Token Utility in the STO Ecosystem

The native token $DUSK plays a crucial role in the network:

Paying transaction and execution fees

Securing the network through staking

Powering confidential smart contract execution

Incentivizing validators and ecosystem participants

As STO adoption grows, demand for $DUSK naturally increases due to higher network activity and institutional usage.

Real-World Use Cases for STOs on Dusk

Security Token Offerings on Dusk unlock a wide range of applications:

Tokenized real estate with private ownership records

Private equity funds on-chain

Corporate bonds with automated compliance

Regulated crowdfunding for startups

These are not experimental ideas—they are realistic financial products that require Dusk’s privacy-first design.

The Future of Capital Markets on Dusk Network

As global regulations become clearer and institutions seek blockchain solutions, privacy-preserving compliance will become non-negotiable. Dusk Network is not chasing hype—it is building the infrastructure for the next generation of capital markets.

With STOs, Dusk bridges the gap between traditional finance and decentralized technology, offering a future where assets are programmable, compliant, and private by default.

Final Thoughts

Security Token Offerings represent the evolution of blockchain beyond speculation—and Dusk Network is at the forefront of this shift. By enabling compliant, private, and scalable STOs, Dusk is laying the foundation for real institutional adoption.

If you believe the future of Web3 includes regulated finance done right, then STOs on Dusk Network are a narrative worth watching closely.