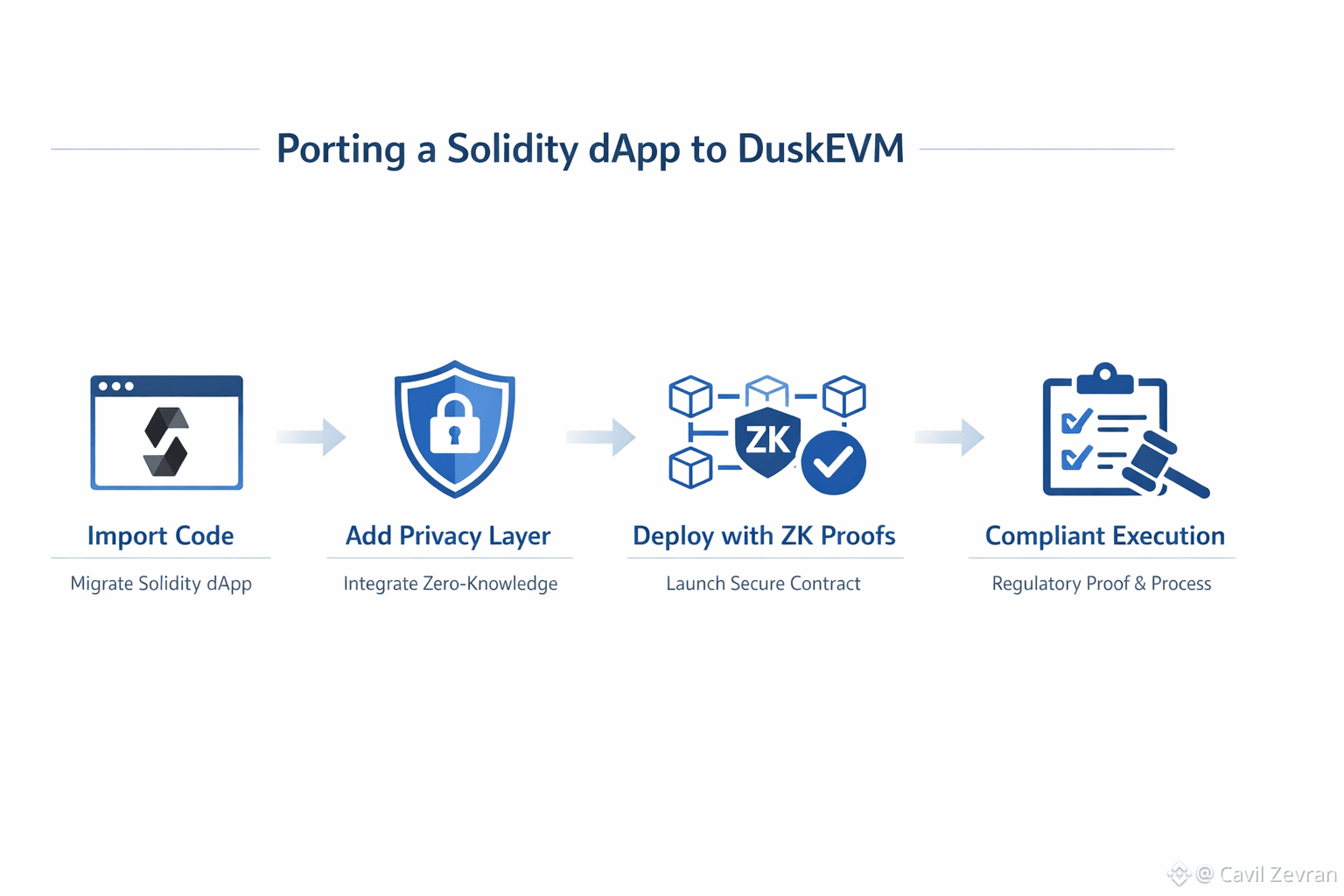

Now the developers have a chance to port Solidity-based dApps with native privacy that integrates the familiarity of Ethereum with the privacy protection of zero-knowledge accounts as DuskEVM becomes live in early 2026. The compliant DeFi entails a big advantage to Dusk as this high-leverage primitive places it in a prime position to cater to institutions that want scalable, confidential finance without having to code-overhaul their applications.

The soundtracks of DuskEVM in Privacy Tech.

DuskEVM is a layer that is compatible with the Ethereum Virtual Machine and incorporates native privacy as a part of smart contracts. In contrast to the more ancient EVM chains, in which data disclosure is a vulnerability, Dusk ensures confidential transactions through zero-knowledge proof, which enables them to make computations without sensitive information being disclosed. It is difficult to mimic this design, and provides low-latency execution that is appropriate to support high-volume DeFi applications such as lending protocols or DEXes.

Its release in January 2026 already aroused the interests of the developers, as they allow smooth Ethereum migrations and introduce privacy layers. As an example, compliance checks are an automated system that operates on-chain, making tokenized assets less regulated. This institution-prepared design reduces gas expenses and improves throughput, which makes Dusk an option of builders who are concerned with security in unstable markets.

On-Chain Metrics After the DuskEVM/Launch.

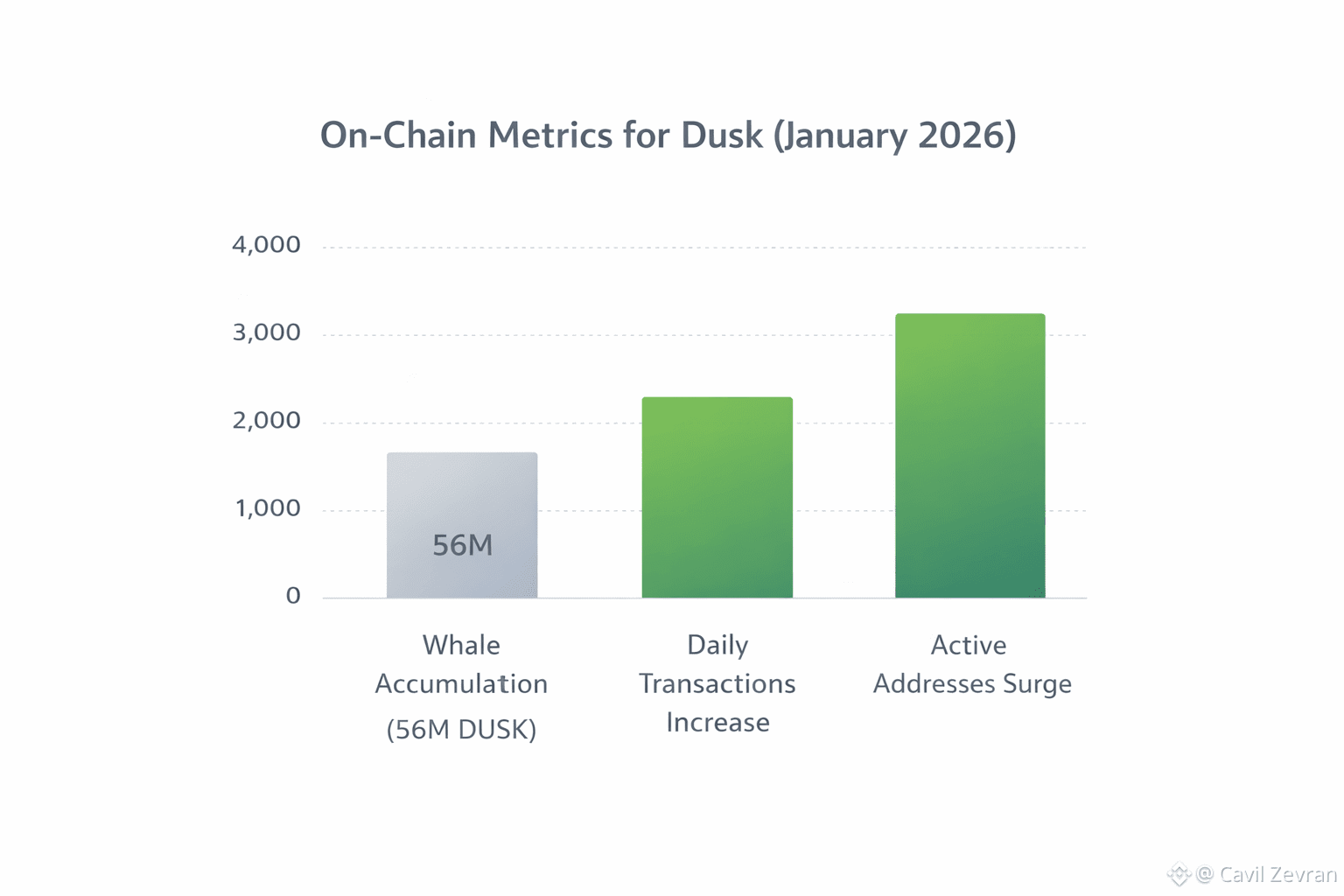

On-chain statistics show that it has a promising traction since the activation of DuskEVM. Whale wallets, top 100 addresses, deposited 56 million DUSK tokens at the end of January, which is an indication of trust in the utility of the network despite a correction in the market. Active addresses have increased and there are daily transactions which are increasing as developers test privacy enhanced dApps.

Educational dive: Measures like the volume of transfers that are confidential displayed tools such as the explorer at Dusk that have shown a surge since after upgrading to mainnet. To users who follow flows, spying on staking participation rates, which are currently incentivized using emissions that do not dilute core security. This information is critical to the point of organic expansion of Dusk in which privacy primitives are the spur to actual engagement and not speculative hyperbole.

Macro Regulatory Landscape in 2026 by Dusk Fit.

With tougher world regulations such as increased enforcement of MiCA, the conformist structure of Dusk links macro trends to blockchain innovation. With central banks driving towards data sovereignty, the privacy tools offered by Dusk allow tokenized RWAs without impacting audits, which is in line with the estimated trillions of assets that need to be digitalized.

This macro synergy is generalized to cross-border finance where Dusk lessens the fragmentation through the consolidation of the liquidity pools that are covered by privacy shields. Its placement appears to be intelligent in the greater context of the movements toward regulated privacy coins, and its decentralized approach to centralized data silos is a welcome counter-mechanism in the era of increased cyber threats.

Alliances that are important to enhance the ecosystem of Dusk.

Strategic relationships increase the momentum of Dusk. The Chainlink integration will enable secure tokenization of RWA securities, already securitizing (already) more than EUR200 million of securities and intending to securitize (planned) EUR300 million more through the NPEX dApp. Liquidity and ease of access are improved through collaborating with exchanges such as HTX that were conducting APY-promotional campaigns in January.

Such partnerships do not just surface, but when integrated into a business workflow, be it stock exchange or payment rail, they make Dusk a part of it. The Bitfinex trading also solidifies its presence, attracting traders to the site where privacy in volatile circumstances is appreciated.

The Sustainable Competitiveness of Dusk in Decentralized Finance.

Finally, the combination of EVM and zero-knowledge features developed by Dusk provides a strong base of DeFi evolution in the long term. It appeals to ecosystems desperate to be efficient through its practical primitives such as instant settlements and automated compliance. Dusk project takes the direction of this in 2026, with a protocol that is protocol-engineered to ensure privacy without compromises.