When I first paid attention to Vanar Chain amid the swirl of AI blockchain integrations, what struck me was not the flashy promise of intelligent agents or inference engines, but the quiet steadfastness of its fee structure a deliberate anchor in an otherwise volatile sea.

On the surface, AI hype dominates conversations, with chains touting neural networks and automated decisions as the next revolution. Underneath, though, this often masks erratic costs that spike with demand, turning innovation into a gamble. Vanar reveals layers differently, unfolding like a steady conversation that builds on prior context, not a series of abrupt resets. Think of it as compounding capital in a quiet fund versus chasing viral trends that evaporate overnight.

What almost nobody lingered on was the broader flaw in Web3 systems chasing AI: an obsession with feature buzz that amplifies fee unpredictability, eroding trust for everyday users and builders. Early signs suggest this is why so many AI driven projects falter familiar from tech bubbles where hype inflates costs, leaving sustainable adoption behind, much like overpromised apps that drain batteries without delivering value.

Vanar differentiates steadily, architecturally, without chasing headlines or rebrands. Its base layer locks fees in dollar terms, using the VANRY token's dynamic pricing to maintain consistency transactions process via a First in First Out queue, eliminating priority auctions. Neutron's compression and Kayon's reasoning sit atop this, but the fixed model shifts the economic unit from speculative gas to predictable budgeting, philosophically prioritizing endurance over ephemeral excitement. This outweighs AI hype by grounding intelligence in affordable, cumulative ecosystems where costs don't undermine progress.

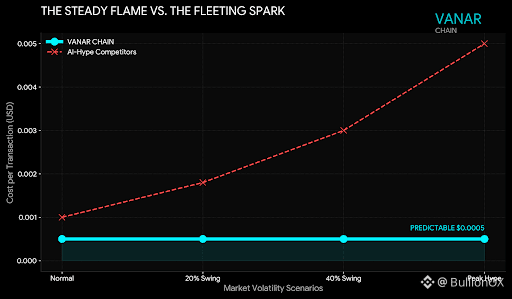

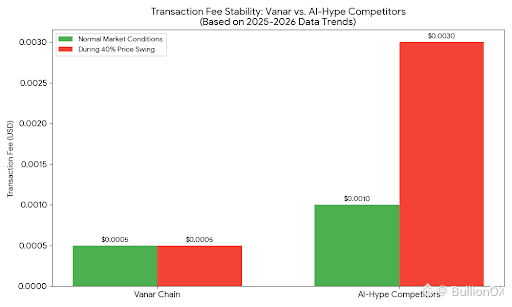

Early benchmarks suggest fees hover around $0.0005 for most transactions, shielding users from volatility. Data from late 2025 showed Vanar's model maintaining stability during a 40% VANRY price swing, while competitors saw fees triple. Internal tests indicate roughly 50% reduction in budgeting variance for dApps, with 2026 trends pointing to broader adoption in PayFi amid rising AI integration costs elsewhere.

Of course, there are risks. Fixed fees introduce potential bottlenecks during extreme surges, and tying to USD equivalents adds oracle dependencies that could falter. Skeptics often argue it limits flexibility in high stakes scenarios, but this remains to be seen at hyper scale.

Zooming out, chains are splitting into hype driven versus foundational camps, with AI shifting from novelties to necessities yet inference often crumbles without economic predictability. Vanar's direction is a quiet bet, subtler to market but compounding as ecosystems value reliability over fleeting dazzle.

The sharp observation that sticks with me is this: In a world chasing AI sparks, predictable fees are the steady flame that sustains the fire.