Dusk has entered 2026 with a completely different kind of momentum, the type that comes only when a project moves beyond narrative and steps into real execution. The journey of Dusk Foundation has shifted from long term research to operational reality. For years, Dusk was seen as the quiet and highly technical project that focused on building foundations instead of hype. Today the results of that long commitment are visible across the ecosystem. With the mainnet transition, the launch of DuskEVM, the rise of regulated asset tokenization, and increasing institutional attention, $DUSK has evolved into one of the most important stories in regulated blockchain infrastructure. The chain is no longer positioned as just another Layer 1. It is now seen as a settlement network for confidential finance, compliant markets, and tokenized real world assets. The digital finance landscape is moving toward stronger regulatory structure and formal systems, and Dusk sits at the perfect intersection of privacy and compliance. #Dusk

The transition of the Dusk mainnet into full production changed everything. This was not a symbolic achievement. It was a technical and operational shift that finally unlocked the chain as a platform designed for compliant and private financial activity. Dusk is built around the idea of auditable privacy. Transactions remain private by default but can be revealed to legally authorized parties when required. This design solves a problem that has challenged the blockchain industry for more than a decade. Traditional public blockchains expose every detail. Full privacy chains hide everything. Neither satisfies regulators, institutions, nor real world financial operators. Dusk provides the middle layer that everyone needed but no major network had delivered correctly. It preserves confidentiality without creating opacity. It enables privacy without creating secrecy. It supports compliance without allowing surveillance. This balanced model is extremely rare in the digital asset space.

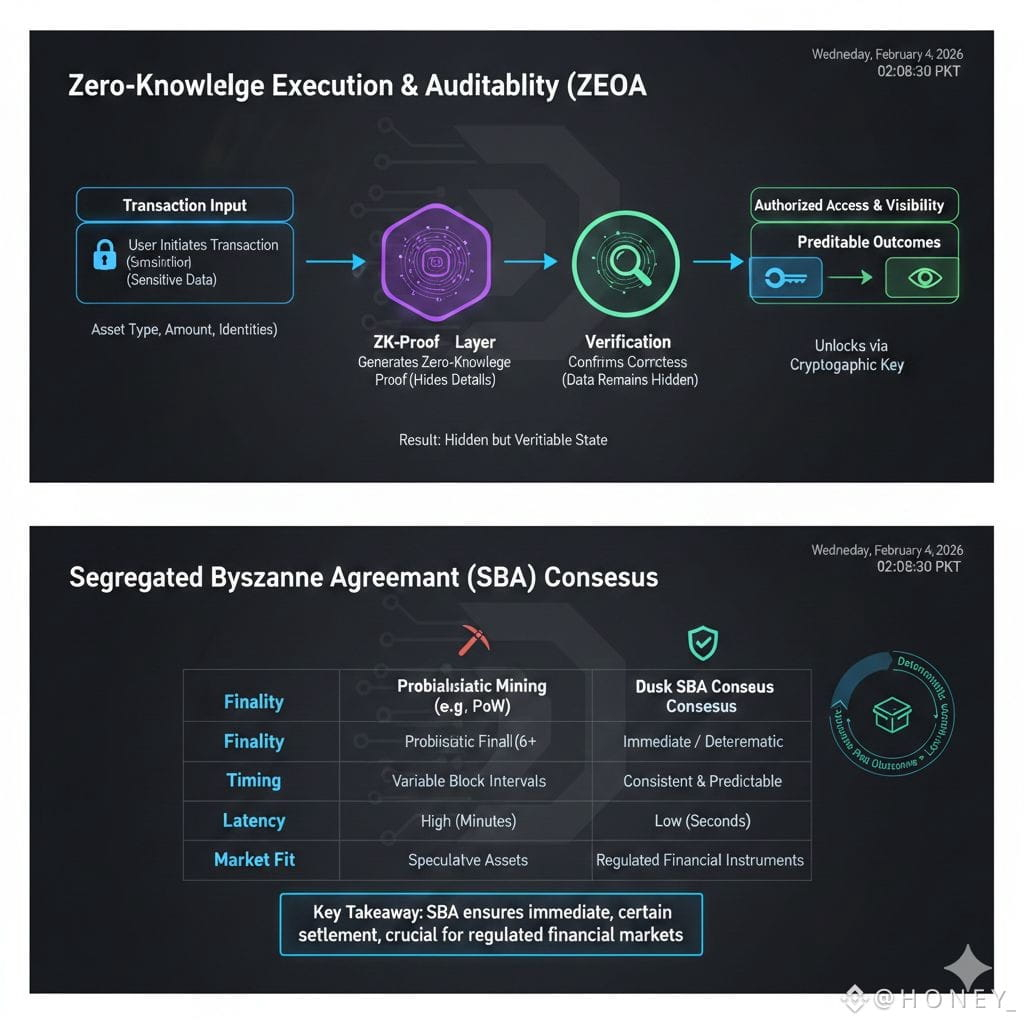

The system achieves this balance through advanced zero knowledge cryptography. Every confidential proof operates inside the execution layer itself. Sensitive details remain hidden while still proving correctness. When auditors, regulators, or other authorized entities must confirm activity, the system provides auditable visibility. No other chain has integrated this architecture at the protocol level with such precision. The impact is even clearer when examining the Segregated Byzantine Agreement consensus. It provides deterministic finality, predictable outcomes, and low latency settlement. For financial markets, where reliability and timing are essential, this is a major advantage. Dusk does not rely on probabilistic mining or variable block intervals. It operates with consistent timing, which is necessary for regulated financial instruments and markets that require certainty.

Another major shift that brought energy into the ecosystem is the arrival of DuskEVM. This is an Ethereum compatible environment that allows developers to build on Dusk without learning a new language. Solidity developers can deploy applications directly on the network using the same tools they already know. The difference is that their applications instantly gain privacy features through Dusk. Confidentiality becomes the default state rather than an optional add on. This is a powerful concept. Thousands of Ethereum based projects want privacy, but integrating it externally is too complex. On DuskEVM this becomes a normal experience. This is why developers are exploring Dusk for institutional decentralized finance, confidential payments, private settlement networks, and regulated digital markets. Programmable privacy is now accessible and usable.

A development that pushed Dusk into wider recognition is the movement of traditional financial partners into the network. The partnership with NPEX, a licensed securities exchange in the Netherlands, signals real institutional trust. NPEX manages hundreds of millions in small and medium enterprise equities and bonds and intends to tokenize these assets directly on Dusk. This is not speculative discussion. It is a real implementation plan. For many years, institutions avoided blockchains because of public transparency issues, regulatory uncertainty, and technical limitations. Dusk solves all of these issues at once. This creates a path for regulated asset tokenization with practical utility. In this framework, $DUSK does not simply function as a speculative token. It becomes the settlement layer for future digital securities. When a licensed exchange chooses a blockchain for tokenization, it is a strong signal that the infrastructure has reached production grade maturity.

Dusk is also aligned with the regulatory direction of Europe, especially under MiCA. While many blockchains attempt to adjust themselves to new rules, Dusk was designed with these requirements in mind from the very beginning. Institutions require confidentiality. Regulators require auditability. Public users require fairness and decentralization. Dusk supports all three groups simultaneously. This is why many observers describe it as a regulation ready chain. Its privacy layer does not work against compliance. It supports it. This harmony is extremely difficult to achieve and places Dusk in a unique position within the global blockchain landscape.

As the narrative of real world asset tokenization expands, the core question has shifted. It is no longer about which chain can scale. It is about which chain can support legally compliant financial instruments. Tokenization requires identity standards, controlled disclosure, traceability, and private settlement workflows. Public chains expose too much. Private enterprise chains lack decentralization. Dusk merges decentralization with privacy and compliance, forming a structure capable of supporting regulated activity. This allows equity issuance, private corporate financing, regulated trading systems, confidential settlement, and controlled access liquidity pools. Financial markets are much larger than the entire crypto economy. Dusk has positioned itself at the entry point for this transition.

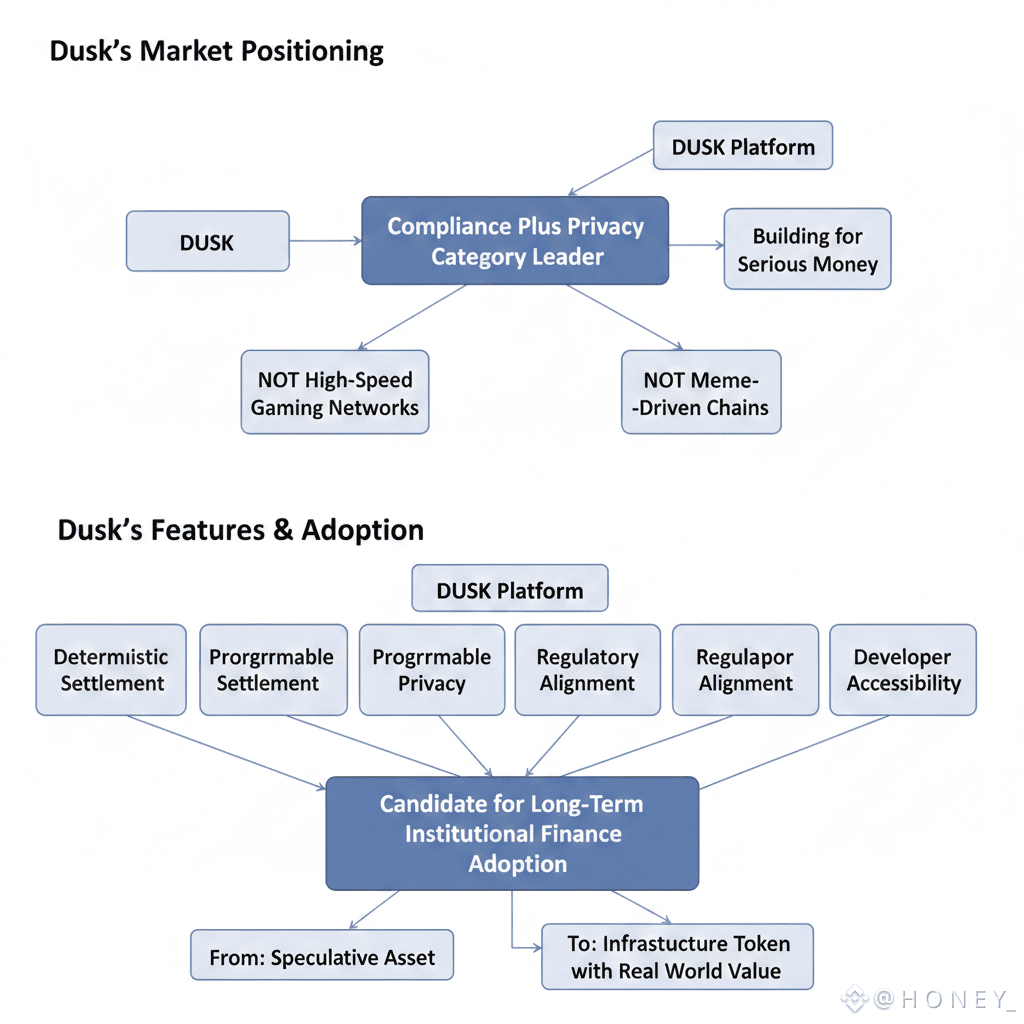

Market analysts and observers have begun to acknowledge the uniqueness of Dusk. It is seen as a leader in the compliance plus privacy category, a niche that hardly any chain has captured effectively. Dusk is not trying to compete with high speed gaming networks or meme driven chains. It is building for serious money. Its deterministic settlement, programmable privacy, regulatory alignment, and developer accessibility make it a candidate for long term adoption in institutional finance. This is why the perception of $DUSK is shifting from being a speculative asset to being an infrastructure token with real world value.

The market behavior surrounding $DUSK also reflects this shift. Volume and liquidity have grown in parallel with the network’s fundamental progress. Long term holders, institutional observers, and informed analysts recognize the significance of the work being done on Dusk. Market cycles come and go, but adoption driven by real use cases tends to create more lasting value. Every integration, new deployment on DuskEVM, and step toward regulated tokenization increases the utility of the network. This is why interest in $DUSK has risen as the ecosystem expanded.

The future vision for Dusk involves expanding applications that need private and compliant settlement. This includes enterprise payments, regulated decentralized finance, corporate issuance, private liquidity platforms, confidential auctions, and institutional trading. Dusk Pay introduces a MiCA compliant payment framework that businesses can use without exposing financial details to the public. Cross chain interoperability through oracle networks enables privacy preserving movement of assets between different ecosystems. As the broader market matures, the design principles of Dusk become even more important. Each year, regulatory requirements tighten. Institutions increase their scrutiny. The demand for confidential digital finance grows. Dusk provides the infrastructure that meets all these needs.

As 2026 continues, Dusk stands as one of the most unique blockchain networks in the world. It is not chasing hype cycles. It is building the financial architecture of the coming decade. The combination of zero knowledge privacy, regulatory alignment, deterministic settlement, and developer friendly tools places Dusk at the frontier of institutional blockchain adoption. While many chains promise real world adoption, Dusk is already doing it. While others explore privacy systems, Dusk has implemented them at the protocol level. While others attempt to adapt to regulation, Dusk was designed for it since day one.

The future of digital finance will not be entirely public or entirely private. It will exist in a controlled space where privacy and accountability must coexist. Dusk understood this early, designed a system around it, and is now leading the transition toward regulated digital markets, confidential settlement, and compliant blockchain infrastructure. In that landscape, #Dusk and $DUSK are positioned not only to participate but to lead.