As real-world assets are set to be tokenized into the trillions of worth by 2030, Vanar Chain is positioned at the forefront of the process by bringing AI into the realm of commodity tokenization, to make not inanimate resources (gold, copper) dynamic and compliant. This naturalized smart offers unrivaled automation and verifiability beating its traditional platforms that depend on manual programs.

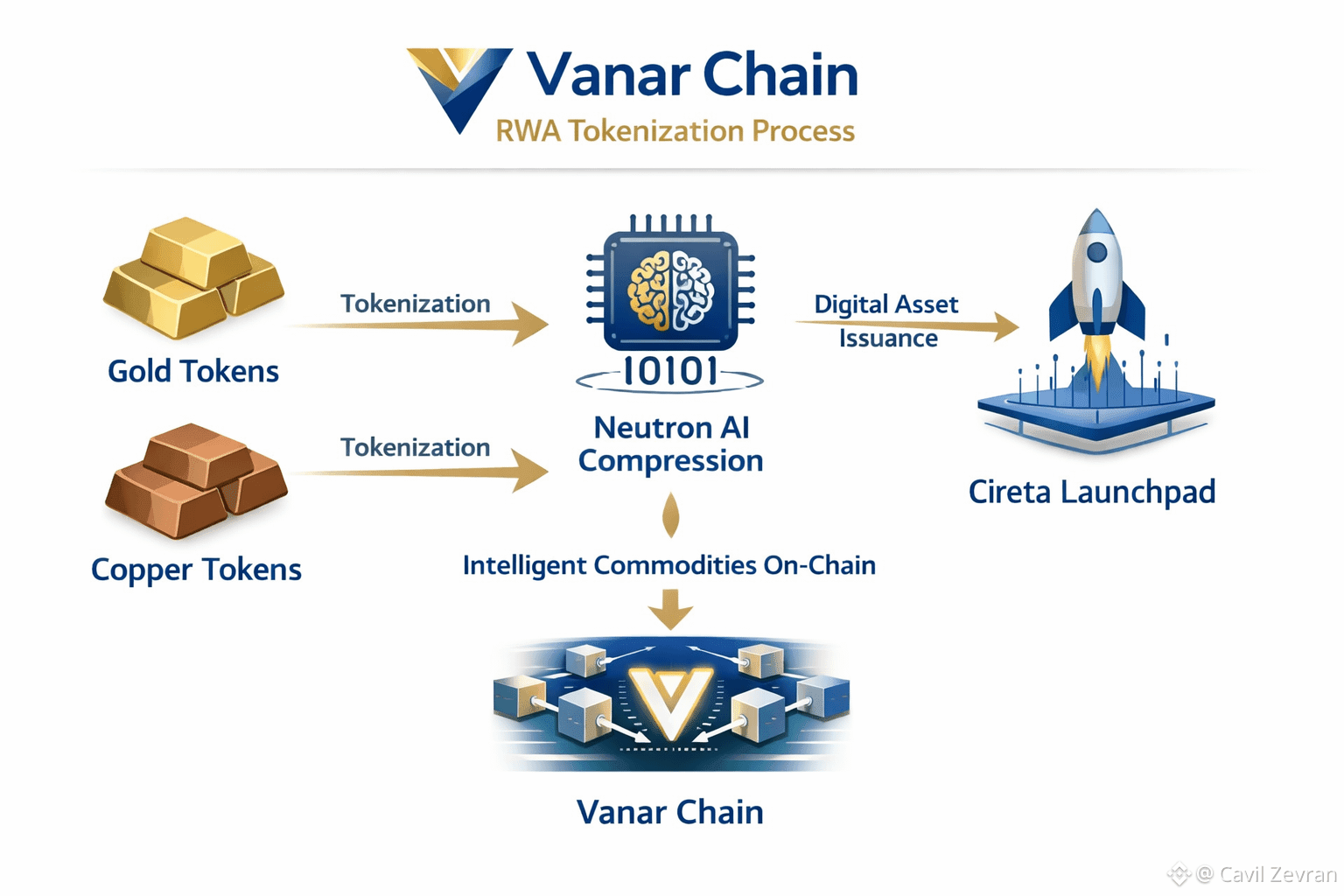

The RWA Framework of Vanar, based on AI.

The modular L1 chain Vanar Chain upgrades, supported by the V23 upgrade in the end of 2025, does well with tokenized commodities with seamless integration with AI. The massive volumes without congestion of the chain are supported by its design of a high-throughput that benefits institutional-grade assets. The latest projects such as the $230 million Dubai project show that Vanar is proficient in connecting the traditional market to blockchain.

Alliances such as the one that involves Veduta in the tokenization of gold and copper through the Cireta launchpad showcase more than 200 million in assets which are already in digital form. It is a framework that utilizes on-chain proofs to bring about transparency, which is a progressive move compared to competitors that depend on off-chain custodians.

Asset Intelligence Semantic Power of neutron.

Commodity data is converted by Neutron into AI-readable Seeds and huge records such as mining reports or ownership chains are turned into high-quality queryable formats on-chain. This removes links that are fragile and it also allows real time contextual analysis which can be verifying purity or provenance without middlemen.

In tokenized gold applications, compression ratios by Neutron to 500:1 reduce costs but also make the assets smart so that they can trigger a trade or audit automatically. This is an advantage that was polished in early 2026 expansions and makes Vanar the choice of compliant RWAs in volatile commodity markets.

Reasoning behind Compliant Automation by Kayon.

Kayon puts decentralized logic as tokenized assets in which compliance rules and market intents are processed on-chain. In the case of copper tokens, it is able to authenticate the ESG criteria or, agentic sales conditional on price orchestras, at less than a second speed and verifiably transparent.

Implementing post-Quantum encryption in the middle of 2026 is also a significant addition to these assets to protect against new security risks to provide the security in the long term. EVM tools are adopted by developers to implement such features to encourage innovations such as hybrid RWA-DeFi protocols.

Off-Chain RWA Adoption Insights.

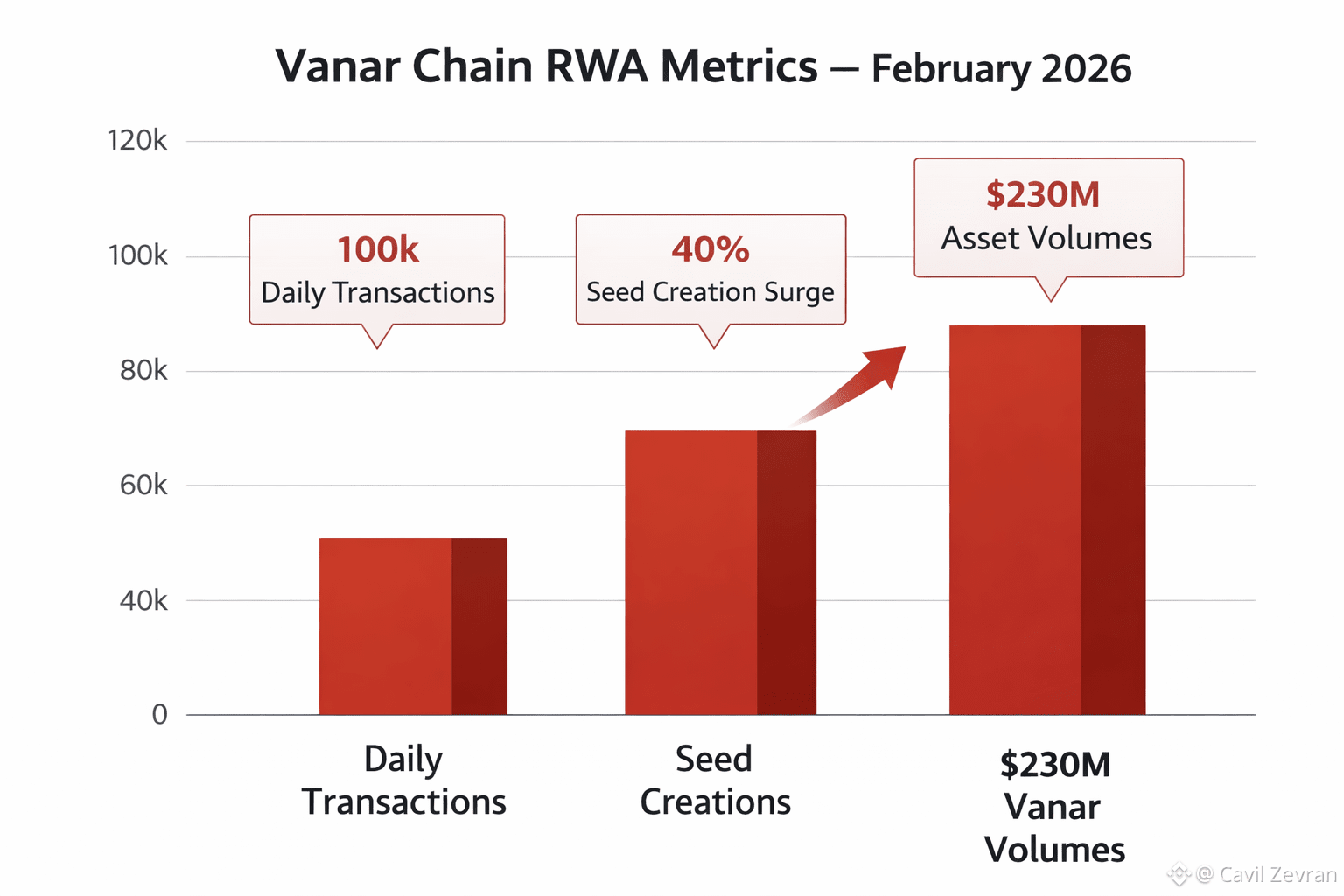

According to the metrics provided by Vanar, the picture of growth is as follows: RWA-related transactions will have reached over 100,000 daily in February 2026, and Seed creations of commodities will be increased by 40 percent after V23. These flows are followed by the explorers, and Veduta integrations are those that drive volume.

Monitoring asset burns, compliance inferences are learned in educational tutorials on scanners, which identify patterns such as increased inflows to institutions. These figures testify to the fact that Vanar has a competitive advantage in tokenized economies in terms of scale.

Vanar in Macro RWA Landscape.

Vanar Chain is aligned to the macro boom of 2026 in asset tokenization due to regulatory favor such as EU standards and UN commodity digitization pilots. It has been featured in events like TOKEN2049 Dubai in April that focus on the need to track sustainable resources.

Concerning the market background, the trade widget displays how VANRY is incorporated in this developing industry.

Modeling Tokens Markets of Tomorrow.

With Vanar implementing RWA compliance models in 2026, it opens fresh opportunities on the path of intelligent commodities combining AI and blockchain to have a resilient global trade.

What opportunities can improve ESG verification of tokenized mining assets by Seeds by Neutron? What would the automation of commodity derivatives in decentralized markets mean to Kayon?