When I first sat with Plasma's design for stablecoins, what struck me was not the usual chase for peg stability or yield gimmicks, but the quiet way it elevates them from isolated assets to something woven into the fabric of movement like breath in a body, essential yet unremarked.

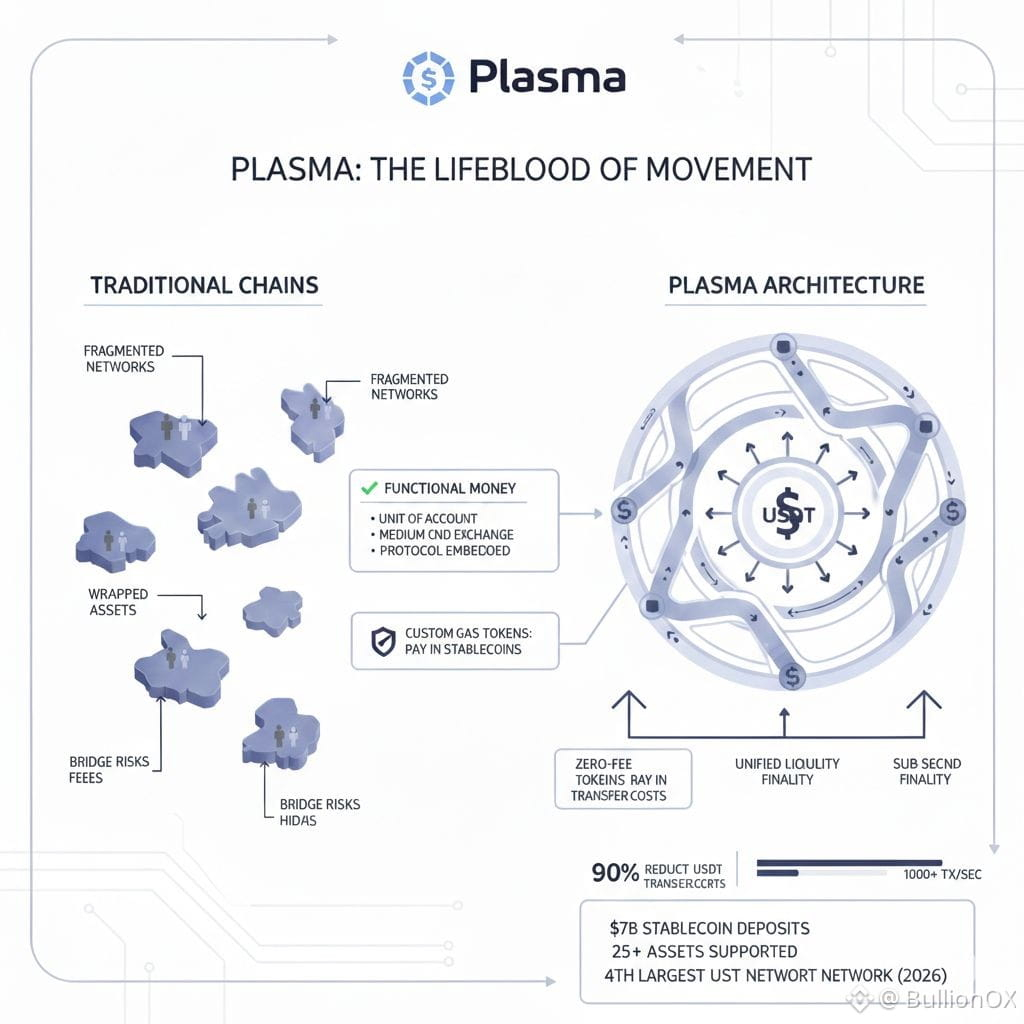

On the surface, stablecoins look like tokens: swappable, yield bearing, pegged to a dollar dream. Underneath, though, they're often trapped in chains that treat them as afterthoughts, resetting value with every cross bridge hop. It's like commuters rushing through a city without ever settling.always transient, never rooted. On the surface, markets celebrate their trillion-dollar volumes. Underneath, the fragmentation breeds redundancy: wrapped versions, bridge risks, fees that erode the very stability they promise.

What almost nobody lingered on was how general purpose chains, obsessed with versatility, dilute stablecoins into mere placeholders. Early signs suggest this is why adoption stalls much like early internet protocols that prioritized speed over reliable delivery, leading to brittle systems that couldn't scale trust. Data from late 2025 showed stablecoin transfers fragmented across a dozen networks, with bridge exploits costing over $500 million in losses alone.

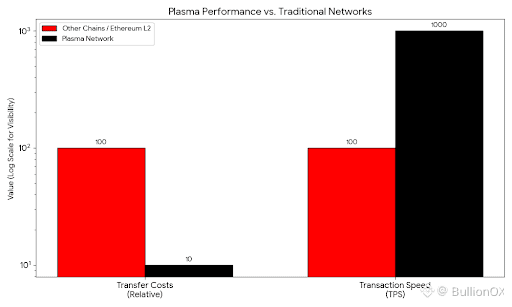

Plasma approaches this differently, steadily architecting stablecoins as functional money: the unit of account, the medium of exchange, embedded at the protocol level. Key primitives like zero-fee USDT transfers sponsored by a native paymaster shift the paradigm, allowing seamless movement without holding volatile gas tokens. Custom gas tokens let users pay fees directly in stablecoins, turning them into the chain's lifeblood. This fosters cumulative behavior: liquidity unifies under one settlement layer, reducing redundancy and enabling sub-second finality. Early benchmarks suggest over 1,000 transactions per second, with internal tests indicating a 90% reduction in transfer costs compared to Ethereum layers. By 2026 trends, Plasma's $7 billion in stablecoin deposits and support for 25+ assets position it as the fourth largest network by USDT balance, quietly compounding network effects.

Of course, there are risks. This specialization introduces new failure modes in consensus, like PlasmaBFT's reliance on fast validators, which skeptics argue could falter under global latency spikes. Privacy features add governance complexity, and market timing remains uncertain stablecoin regulations could reshape everything, though early integrations in 150 countries show resilience.

Zooming out, ecosystems are splitting: generalists versus specialists, with AI shifting from passive tools to active participants in value flows. Plasma's direction feels like a quiet bet on memory over inference prioritizing persistent, functional money in a world of fleeting tokens.

The sharp observation that sticks with me is this: In treating stablecoins as the chain's native pulse, Plasma reminds us that true money isn't held it's moved, steadily reshaping what we build around it.