Mr. Copper: The Trader Who Once Controlled the Global Copper Market

In the world of commodities, few figures are as legendary — or as controversial — as “Mr. Copper.”

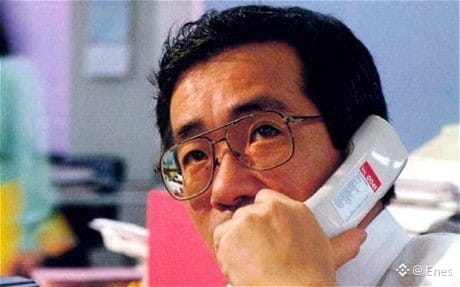

Behind the nickname was Yasuo Hamanaka, a trader whose actions in the 1980s and 1990s reshaped the copper market and permanently changed how commodity exchanges are regulated.

Who Was Mr. Copper?

“Mr. Copper” was the nickname given to Yasuo Hamanaka, the former head of the metal-trading division at the Japanese trading giant Sumitomo Corporation.

During the mid-1980s, Hamanaka rose to fame by turning Sumitomo into the largest copper trader in the world — despite the company owning no copper mines.

At the peak of his influence:

Hamanaka controlled around 5% of the world’s copper supply

Traders gave him another nickname: “Mr. Five Percent”

His positions were powerful enough to influence global copper prices

How One Man Cornered a Global Commodity

Hamanaka’s strategy relied on a combination of:

Massive physical copper holdings

An aggressive accumulation of futures and options contracts

Maintaining long positions to squeeze short sellers

Because copper was relatively illiquid, controlling even a small percentage of supply gave Sumitomo outsized influence. Traders knew something was wrong, but at the time, the London Metal Exchange (LME) did not require detailed position disclosures.

That lack of transparency made it nearly impossible to prove market manipulation — until it was too late.

From Market Hero to Rogue Trader

For years, Hamanaka was admired inside Sumitomo for delivering enormous profits. But when market conditions shifted in 1995, increased copper supply triggered a price correction.

Suddenly, Sumitomo’s massive long positions became a liability.

In 1996, the truth emerged:

Hamanaka had engaged in fraud and forgery

His trades resulted in $2.6 billion in losses

He was convicted and sentenced to seven years in prison

Sumitomo denied knowledge of the illegal activity but ultimately paid $150 million to settle regulatory claims.

How Mr. Copper Changed the Market Forever

The fallout didn’t just affect Sumitomo.

In response, the London Metal Exchange introduced stricter rules on:

Position reporting

Market transparency

Limits on concentration

These reforms were designed to ensure that no single trader could ever again corner a global commodity market the way Hamanaka did.

Why the Mr. Copper Story Still Matters

The story of Mr. Copper is more than a financial scandal — it’s a lesson in:

The dangers of opaque markets

The power of leverage in illiquid assets

Why transparency and regulation matter

Decades later, traders still reference Mr. Copper as a reminder of what happens when one person gains too much control over a market.

Final Take

Yasuo Hamanaka’s rise and fall stands as one of the most dramatic episodes in commodities history.

He proved that markets can be bent — but also that they eventually snap back.

And when they do, the consequences are rarely small.