Bitcoin ETFs pull $562M after four days of bleeding, Arcium launches privacy layer on Solana and NY prosecutors slam new stablecoin law as German bank ING opens crypto trading.

📊 Market Updates

🔸 Bitcoin ETFs Break Losing Streak with $562M Inflow

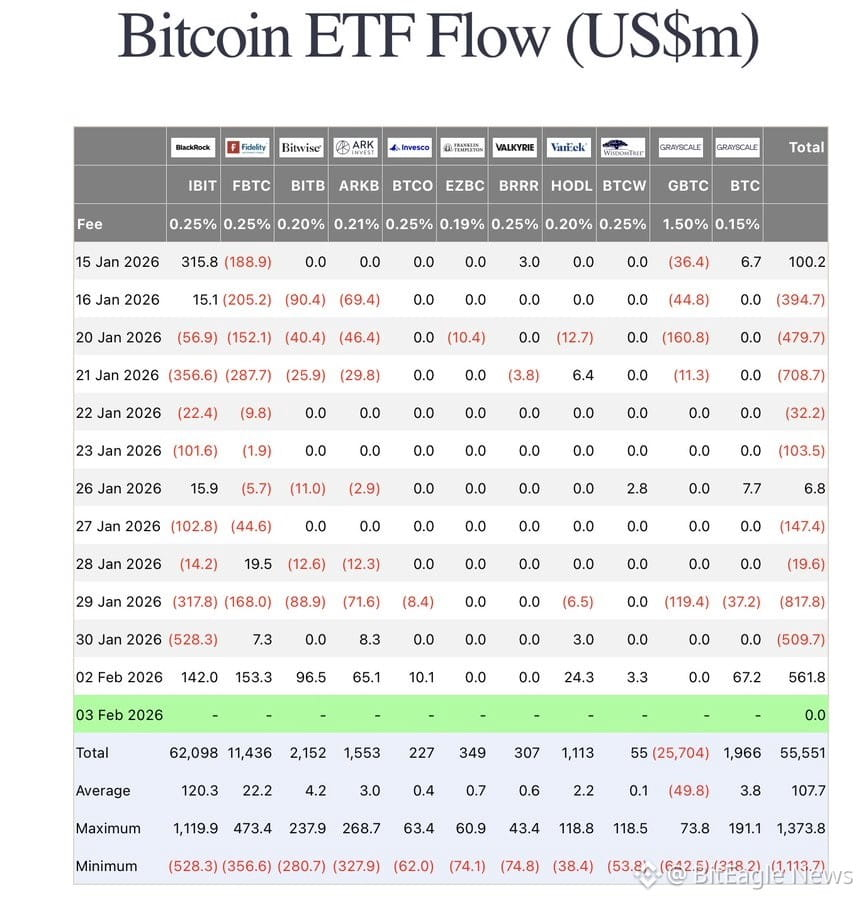

U.S. spot Bitcoin ETFs pulled in $561.9 million Monday after four straight days of outflows. Fidelity's FBTC led the way with $153.4 million followed by BlackRock's IBIT at $142 million. Bitwise grabbed $96.5 million while Grayscale, Ark, VanEck, Invesco and WisdomTree all saw money come in.

The buying happened as Bitcoin dropped to around $75,000 before bouncing back to $78,500 by end of day. Ethereum ETFs lost $2.86 million compared to Friday's $252.87 million in outflows. Analysts say long-term investors see current levels as cheap and are starting to buy again after Bitcoin tested the bottom twice in a short period.

🔸 BitMine Buys Another 41,788 ETH for $97M

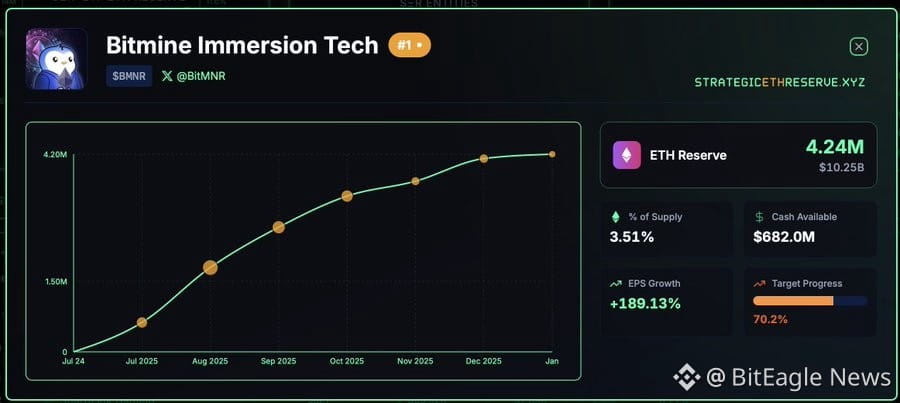

BitMine picked up 41,788 Ethereum for about $75.3 million at an average price of $2,317 per coin. Total holdings now sit at 4.285 million ETH worth $9.9 billion, making up 3.55% of Ethereum's total supply. The company also ramped up staking by nearly 900,000 ETH in the past week to 2.9 million total.

BitMine expects to make about $188 million a year from staking at current rates with more coming as the Made in America Validator Network launches in early 2026. Executive Chairman Tom Lee said Ethereum's fundamentals keep getting stronger while the price drops, with daily transactions hitting 2.5 million and active addresses near 1 million. The stock fell 9% in premarket trading Monday despite the buying.

🔸 NY Attorney General Slams New Stablecoin Law

New York Attorney General Letitia James and four district attorneys sent a letter to Democratic senators saying the GENIUS Act gives stablecoin issuers legal cover to profit from fraud. The law requires stablecoins to be backed 1-to-1 with liquid assets but doesn't force companies to return stolen funds to victims.

James singled out Tether and Circle, saying they earn interest on stolen customer funds. Chainalysis estimates 84% of all illegal crypto transactions in 2025 involved stablecoins. Circle's chief strategy officer Dante Disparte said the company follows all financial rules and will keep doing so when GENIUS takes full effect. Senator Warner's office said stablecoin issuers must cooperate with law enforcement to help victims recover stolen funds.

🔥 Highlights

🔸 Arcium Launches Privacy Network on Solana

Arcium went live with its Mainnet Alpha on Solana, bringing encrypted computation to the blockchain. The network lets developers build apps that keep data fully encrypted while still being verifiable and composable. Umbra launched as the first app on the network with a 'shielded finance layer' that offers private transfers and encrypted swaps.

Umbra is rolling out slowly with 100 users per week under a $500 deposit limit before opening up more access in February. Umbra raised nearly $155 million in an ICO on MetaDAO in October. Other projects like Melee, Vanish and Anonmesh are building on Arcium with Confidential SPL tokens coming soon to enable private tokens directly on Solana.

🔸 White House Tries to Break Crypto Bill Deadlock

The White House brought together crypto companies and banks Monday to hash out the biggest problem holding up the CLARITY Act: whether exchanges should offer yield on stablecoins. Patrick Witt, Trump's crypto adviser, led the two-hour meeting but no deal got done.

Banks say stablecoin rewards create unfair competition for deposits. Crypto companies like Coinbase argue their rewards don't involve risky lending. The White House wants a deal by end of February. Blockchain Association CEO Summer Mersinger called the meeting 'an important step forward' while Digital Chamber said both sides are making progress on finding middle ground.

🔸 CBOE Plans Return of All-or-Nothing Options

CBOE Global Markets is talking to retail brokers about bringing back binary options that pay a fixed amount or nothing. The move targets the prediction market boom where Kalshi and Polymarket hit $17 billion in volume last month. CBOE tried binary options in 2008 but killed them after they went nowhere.

The exchange plans to stick with financial markets rather than branching into sports or politics betting. CBOE's global head of derivatives Rob Hocking said they want to offer simpler event-style contracts and hope investors graduate to more complex options trading. No timeline set yet as talks are still early and need regulatory approval.

🔸 CZ Fires Back at 'Imaginative FUD' About Binance

Binance co-founder CZ pushed back against claims that he and his exchange caused the weekend crypto crash. He denied Binance dumped $1 billion in bitcoin, saying user trades caused wallet changes not the exchange selling. CZ also laughed off suggestions that his comment about being 'less confident' in the supercycle killed the bull market.

On the SAFU fund conversion to bitcoin, CZ said Binance plans to buy over 30 days using its own exchange since it has the best liquidity. He added that $1 billion over 30 days won't move Bitcoin's $1.7 trillion market. The comments come as parts of the crypto community keep blaming Binance for October's flash crash that wiped out $19 billion in leveraged positions.

🔸 ING Germany Opens Crypto Trading to Retail

ING Deutschland now lets retail customers buy Bitcoin, Ethereum and Solana ETPs through regular bank accounts. The products come from 21Shares, Bitwise and VanEck and trade on regulated exchanges via ING's Direct Depot platform. The bank is waiving trading fees for orders over 1,000 euros while charging 3.90 euros for smaller trades.

ING says this makes crypto investing easier by using familiar banking infrastructure without needing to manage wallets or private keys. The bank warned that crypto ETPs carry major risks and said digital assets have no intrinsic value. ING joins a growing list of European banks adding regulated crypto products as institutional confidence grows.

ETFs bounce back, privacy goes live on Solana and regulators battle over stablecoins. See you tomorrow.