There’s a version of privacy crypto that sounds good online and dies the moment it touches real money. It’s loud, absolutist, and obsessed with hiding everything. That version keeps retail entertained and regulators hostile.

Dusk is not building that version.

What made me pay attention to Dusk wasn’t a roadmap or a launch date. It was the way its privacy narrative doesn’t try to impress crypto people. It sounds almost… inconvenient. And that’s usually a signal that someone is solving the right problem.

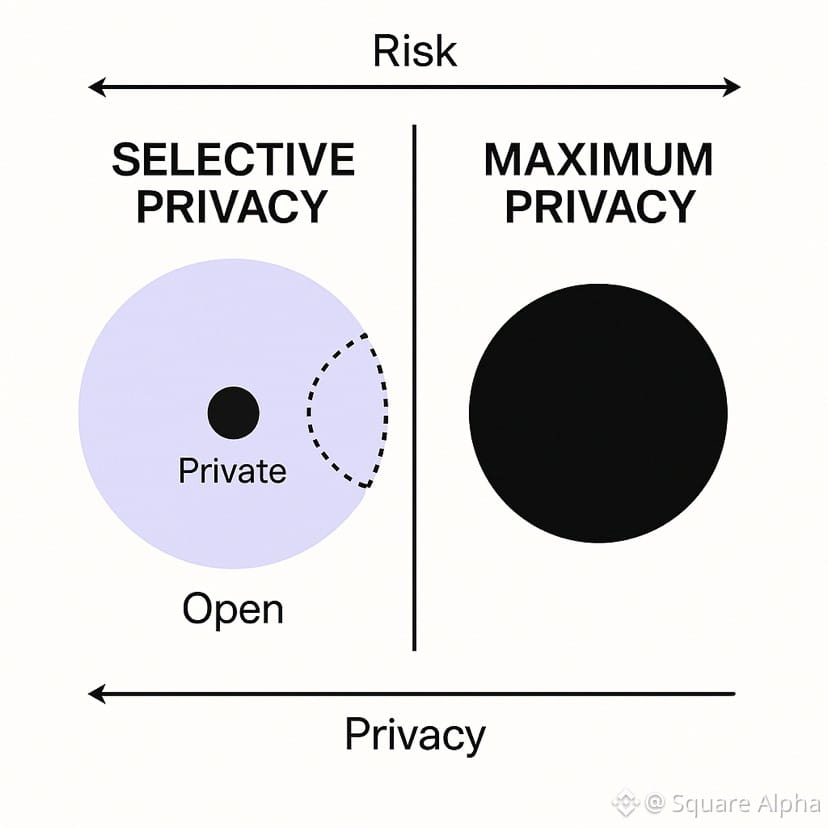

In real markets, privacy is not about disappearing. It’s about control.

Banks don’t want the world watching their flows. Funds don’t want competitors front-running their positions. Issuers don’t want every balance sheet move turned into public spectacle. At the same time, none of these players can afford to be opaque to regulators. Total secrecy is not privacy — it’s liability.

This is where most privacy chains break down. They confuse privacy with invisibility. Regulators see invisibility as non-compliance. The conversation ends there.

Dusk’s framing is different: privacy by default, disclosure by design.

That distinction sounds subtle, but it changes everything.

Why “Selective Privacy” Is a Stronger Market Bet Than “Maximum Privacy”

Markets don’t reward ideology. They reward systems that reduce risk.

Dusk treats privacy as a behavioral layer, not a political stance. Some transactions are private because broadcasting them makes no economic sense. Some information is revealed because law and trust demand it. The protocol isn’t embarrassed by that duality — it’s built around it.

That’s why Dusk privacy keeps coming up in the same sentence as compliance. Not as a compromise, but as a requirement.

This is uncomfortable for crypto-native users who want simple narratives. It’s extremely comfortable for institutions who live in gray zones every day.

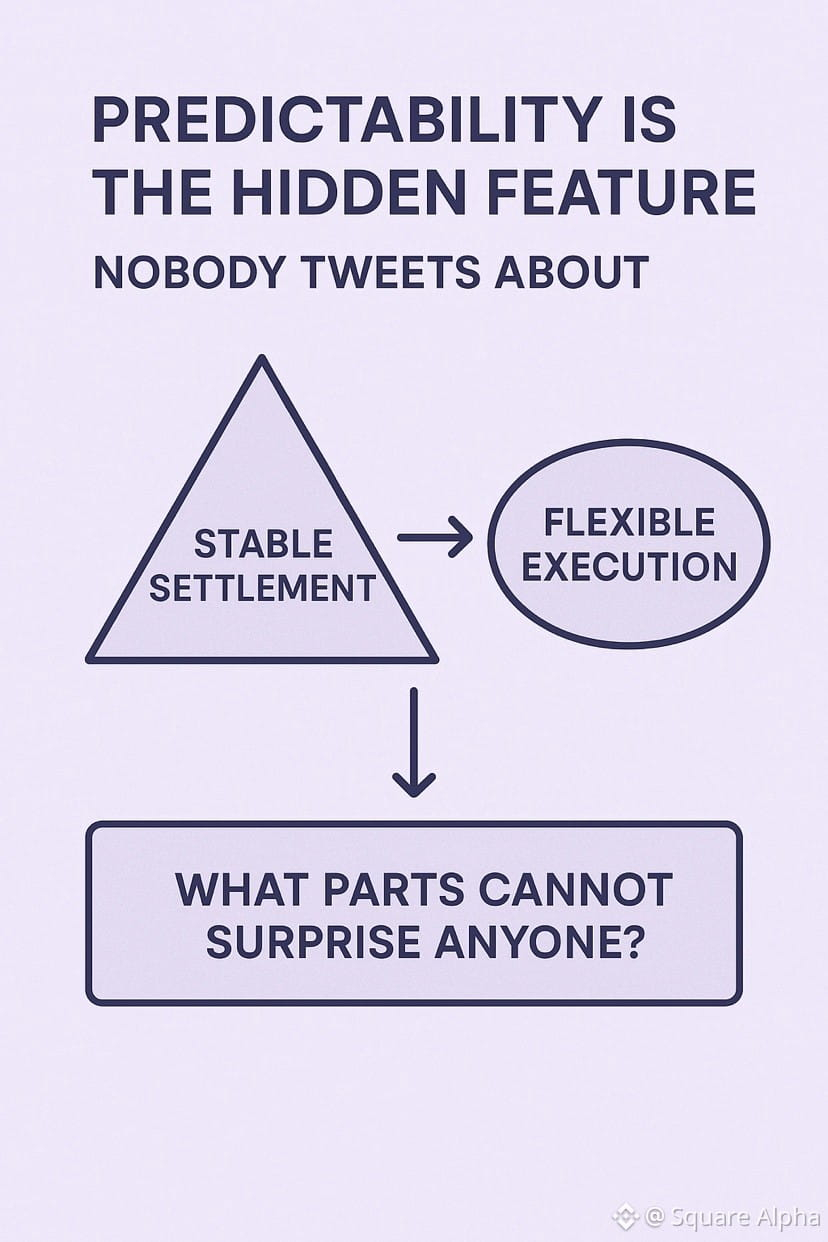

Predictability Is the Hidden Feature Nobody Tweets About

Another thing that separates Dusk from most Layer 1s is how little it seems to care about being exciting.

Most chains feel like they’re optimized for demos. Dusk feels optimized for audits.

That’s not an insult — it’s the point.

When your target users include regulated exchanges, asset issuers, and compliance teams, unpredictability is the enemy. Constant architectural changes, experimental execution models, and “move fast and fix later” thinking don’t scale into finance. They scale into lawsuits.

Dusk’s structure — stable settlement, flexible execution — reads like someone asked: what parts of this system absolutely cannot surprise anyone?

That question alone puts it in a different category.

Why the Market Struggles to Price Dusk Correctly

Here’s the uncomfortable part for traders.

Dusk doesn’t produce obvious hype signals. Its success won’t look like viral usage charts or retail frenzy. If it works, it will show up quietly: regulated flows choosing it because it causes fewer problems than alternatives.

That makes Dusk hard to trade emotionally.

The token doesn’t scream urgency. The privacy narrative doesn’t inflame culture wars. The roadmap doesn’t promise instant domination. Everything about it says “slow, deliberate, defensible.”

Markets hate waiting. Especially crypto markets.

That’s why Dusk often feels misunderstood. It’s priced like a speculative asset but designed like infrastructure. Those two timelines rarely align cleanly.

The Real Question Isn’t “Will Dusk Moon?”

The real question is simpler and more uncomfortable:

If regulated on-chain finance actually grows — if tokenized securities, compliant settlement, and institutional DeFi become real instead of theoretical — what kind of chain survives that environment?

A chain optimized for radical transparency?

Or a chain built around controlled privacy, auditability, and predictable behavior?

Dusk is making a very specific bet on that answer.

It may take longer than traders want. It may never become flashy. But it’s one of the few projects where the design choices make sense outside crypto Twitter.

And that, ironically, is why it’s worth paying attention to.