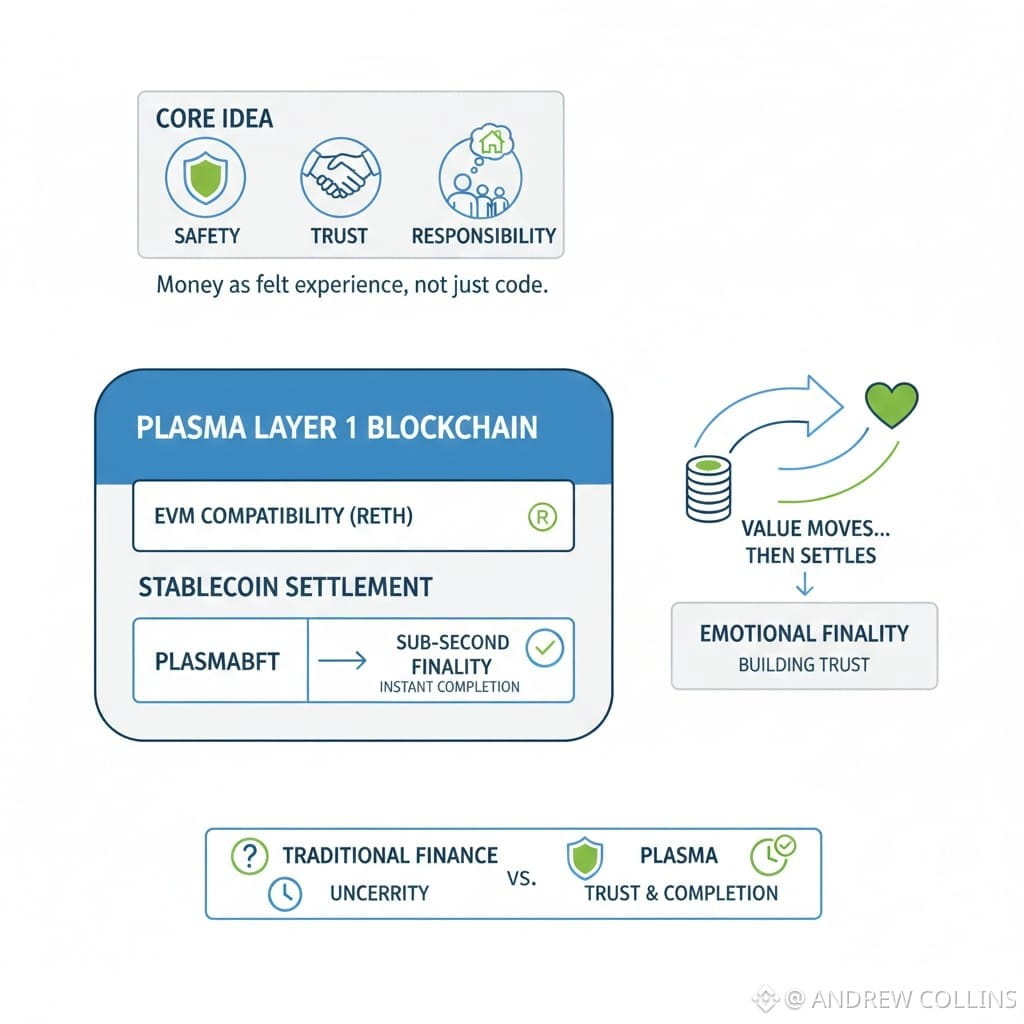

At its core @Plasma begins with a quiet realization that most financial systems forget. People do not experience money as code or infrastructure. They experience it as responsibility safety and trust. Plasma is a Layer 1 blockchain built specifically for stablecoin settlement because stablecoins already live inside everyday life. The system operates with full EVM compatibility through Reth so developers are not pushed into unfamiliar territory. What changes is the feeling of completion. PlasmaBFT delivers sub second finality so transactions do not linger in uncertainty. Value moves and then it settles. That emotional finality matters more than most technical discussions admit. If it becomes normal to send value and immediately feel done the foundation of trust forms naturally.

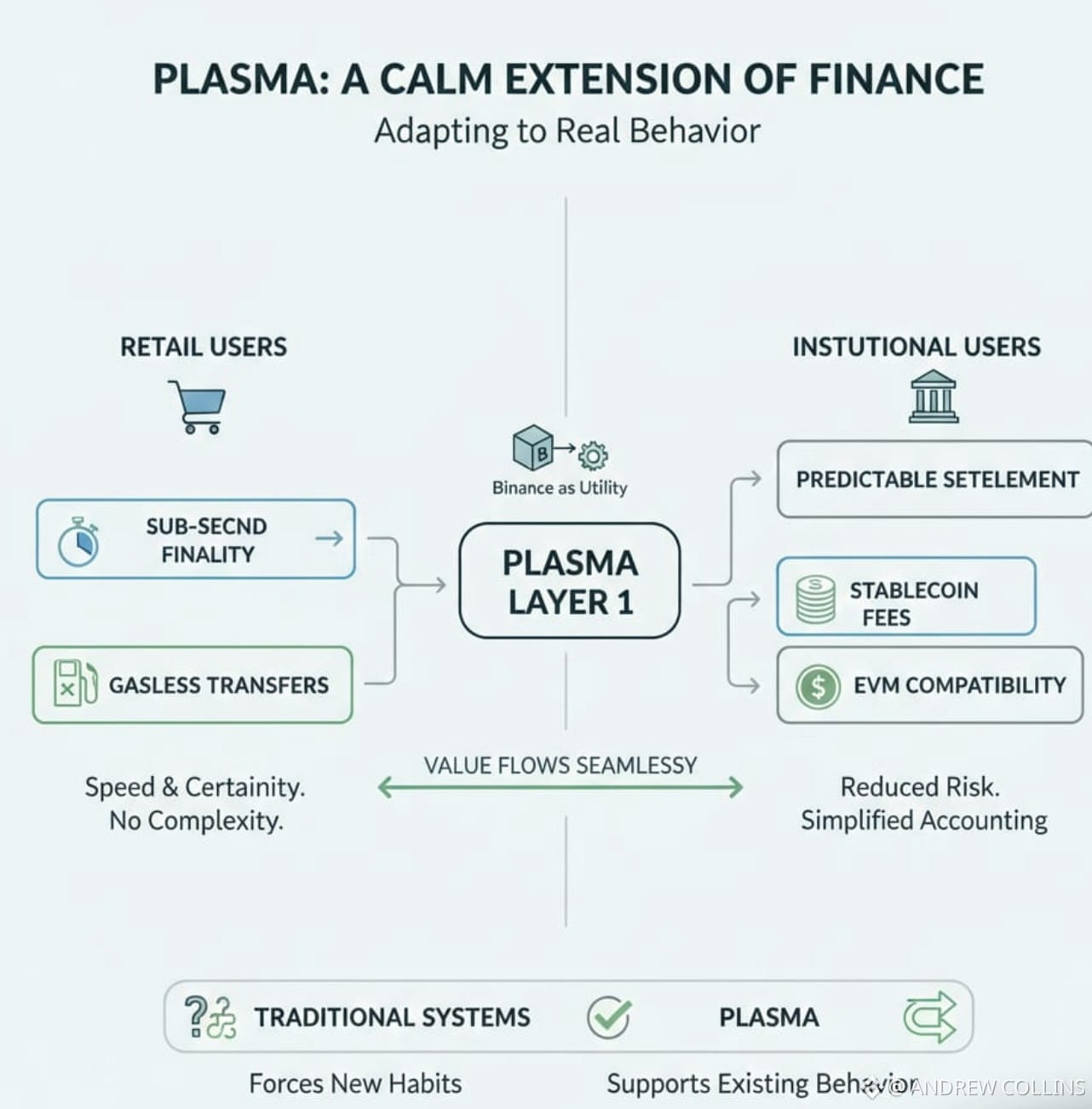

Stablecoin first mechanics deepen that trust. Gasless USDT transfers and gas paid in stablecoins remove a subtle barrier that has kept many people at arm’s length from blockchain systems. Users are not required to hold volatile assets just to participate. They are allowed to stay in the currency they already rely on. I am noticing how much this choice respects the user. They are not being trained or converted. They are being supported.

In the real world Plasma feels less like a new chain and more like a calm extension of existing financial behavior. Retail users in high adoption regions need speed and certainty not complexity. Sub second finality removes the tension of waiting. Gasless transfers remove the fear of being stuck mid action. The system stays out of the way while value does what it needs to do. Institutions encounter a different but equally important benefit. Predictable settlement reduces reconciliation risk. Stablecoin denominated fees simplify internal accounting. EVM compatibility allows compliance and payment systems to connect without being rebuilt from scratch. If an exchange enters this environment it does so through mature infrastructure where Binance operates as a utility rather than a spectacle. We are seeing Plasma adapt to real behavior instead of forcing users into new habits.

The architectural decisions behind Plasma feel shaped by experience rather than ambition. Reth is used because reliability and performance matter when money is involved. PlasmaBFT exists because probabilistic settlement is unacceptable for payments that carry real world consequences. These are not flashy choices but they are careful ones. Bitcoin anchored security adds another layer of intentional restraint. It recognizes that neutrality and censorship resistance cannot be declared into existence. They are inherited from systems that have survived pressure over time. By anchoring to Bitcoin Plasma borrows a long tested foundation of fairness and independence. They are building with the expectation that scrutiny will increase not disappear.

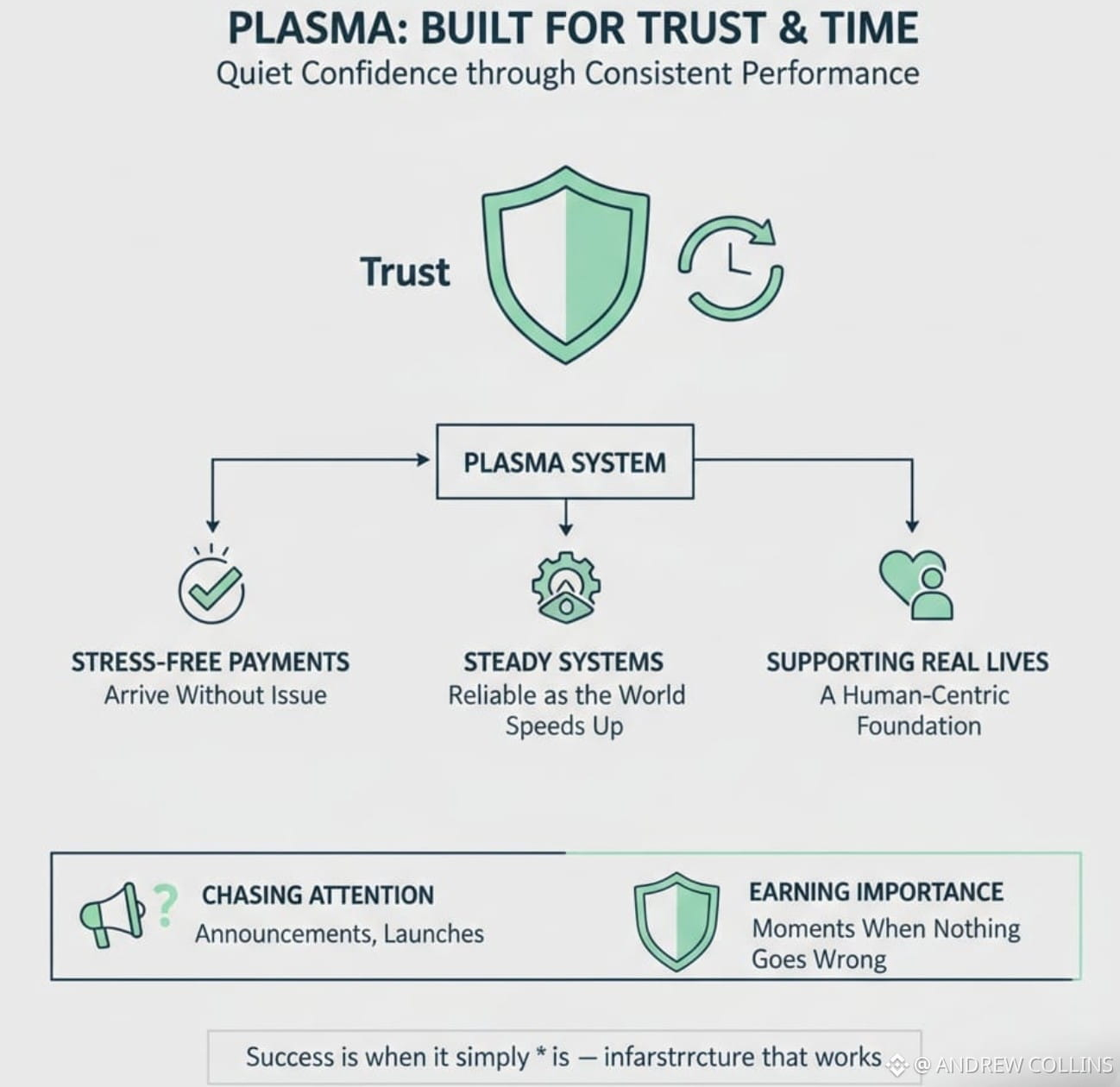

Progress for Plasma will not always announce itself loudly. It will appear in consistency. Finality that remains fast during periods of high usage. Fees that stay predictable. A growing share of transactions connected to payroll remittances and commerce rather than speculation. Developers deploying and continuing to build without constantly fighting the base layer. Institutions quietly moving from pilots to daily operations. If people stop asking how Plasma works and start assuming it will work that is the truest signal of success. We are seeing the early formation of infrastructure that values reliability over attention.

No system designed for money is without risk and Plasma does not avoid this reality. Stablecoins depend on issuers regulation and geopolitical forces. Bitcoin anchoring strengthens neutrality but does not remove complexity. Consensus mechanisms must perform under stress not just during calm periods. Ignoring these realities early only increases their cost later. What gives Plasma credibility is that it does not pretend these risks do not exist. By focusing tightly on settlement it limits unnecessary complexity. By keeping execution familiar it avoids fragile experimentation. Understanding where things could fail is part of respecting the people whose value flows through the system. They are not being asked to trust blind optimism.

The long term vision of Plasma feels patient and human. Retail users may begin with simple transfers and grow into savings commerce and everyday coordination. Institutions may start with internal settlement and later open those rails outward. The system does not force a single future or ideology. It leaves space for growth shaped by real usage. If it becomes truly successful Plasma will fade into the background. It will feel less like a product and more like infrastructure that simply works.

When I step back Plasma does not read like a project chasing attention. It feels like something built with time in mind. Trust is not won through announcements or launches. It is earned in moments when nothing goes wrong. In payments that arrive without stress. In systems that remain steady as the world moves faster. I am left with a quiet confidence that if Plasma continues honoring these principles it will not need to prove its importance. It will simply be there supporting real lives in a way that finally feels human.