Most crypto projects love to talk about what they plan to build. I have learned to judge them differently. I look at what they already treat as non negotiable. Things like reproducible execution, strict separation between components, and an internal proof system that is owned and maintained. That stuff is not flashy, but it is exactly what real finance demands. Banks and exchanges do not choose platforms because they look exciting. They choose systems that behave the same way every single time, especially when conditions are bad.

This is how I think about Dusk Network. Not as an app ecosystem first, but as an engineering system designed to remove surprises from on chain execution.

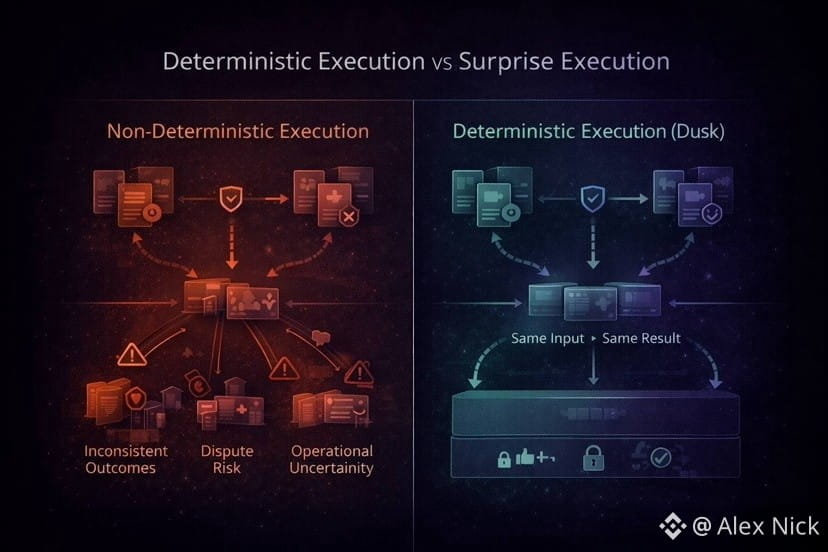

Determinism is the quiet requirement institutions actually care about

In consumer software, a bit of inconsistency is annoying. In financial infrastructure, it is dangerous. If two nodes process the same input and produce different outputs, that is not a market. That is chaos.

Dusk treats this as a core problem, not an edge case. Its core node implementation called Rusk is built as the engine of the network. People can run it locally, test behavior, and contribute directly. That tells me something important. This system is meant to be executed and verified, not just described in docs or tweets.

From my perspective, the philosophy is clear. The chain is a deterministic execution engine first. Everything else sits on top of that.

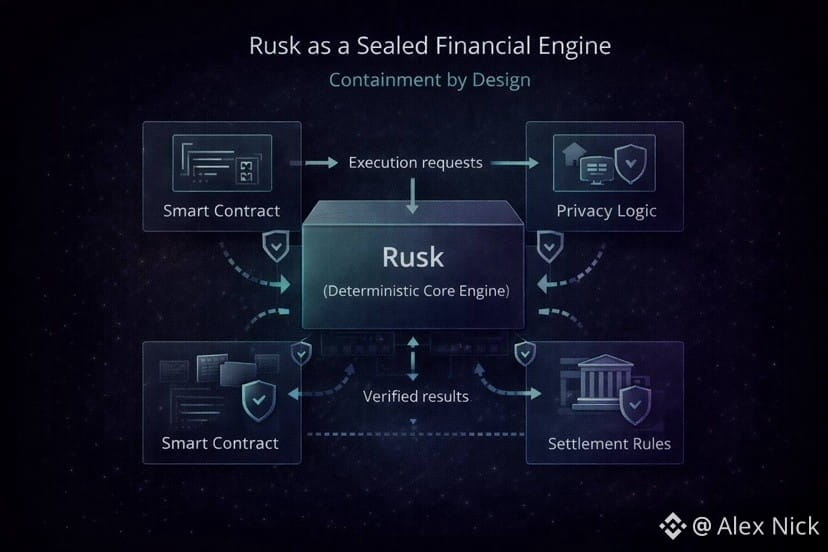

Rusk is not just a node, it is enforced execution discipline

When people hear node software, they usually think about networking and block propagation. Rusk is different. It is where execution discipline lives. Non deterministic behavior is treated as a bug category, not a tolerable quirk.

I remember reading development updates where the team talked about fixing non deterministic behavior in test blocks and tightening prover related logic. That kind of update does not sell tokens. It does signal engineering seriousness.

If the long term goal is privacy, compliance, and complex financial assets, then the base must behave identically across machines and environments. Determinism is not a bonus feature. It is the floor.

Two developer paths without destabilizing settlement

A lot of chains fight for attention by shouting about Solidity support. Dusk does support an EVM equivalent execution environment through DuskEVM, which fits into its modular stack and shares the same settlement guarantees.

What stands out to me is that this is not the only path. Dusk also supports a native Rust first execution approach. You can see this in the tooling, including an official ABI crate for building contracts against the Rusk VM.

This tells me Dusk is not betting everything on a single developer culture. It supports an application oriented path through EVM tools and a systems oriented path through Rust and WASM style execution, while keeping settlement rules stable underneath.

That feels like infrastructure thinking, not trend chasing.

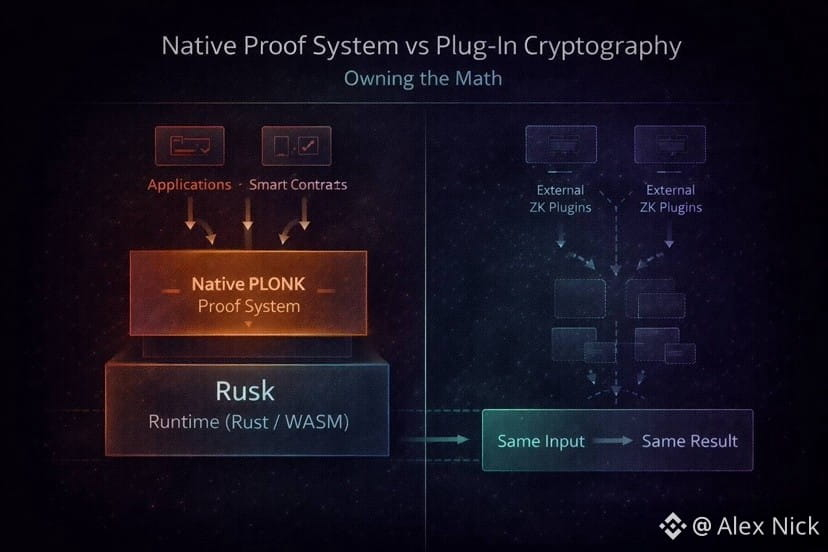

Owning the proof system instead of renting it

Another signal that matters to me is cryptography ownership. Many projects rely on external proving systems and adapt them. Dusk chose a harder route. It maintains its own pure Rust implementation of PLONK.

This includes native support for BLS12 381, a modular polynomial commitment scheme, and custom gates tuned for efficiency. There is also an audit referenced. That is not a small detail.

Owning the proving stack allows tighter control over performance, constraints, and alignment with runtime behavior. For institutions, cryptography is not a feature. It is part of the risk model. I see this as a confidence signal rather than a marketing one.

The fact that the PLONK repository is actively maintained also matters. It suggests this is production engineering, not abandoned research.

Why deterministic execution plus native proofs is a real product feature

Privacy systems only work when execution and proofs agree on what is valid. If runtime behavior is loose, proofs become weak. If proofs are strict but runtime is inconsistent, gaps appear between what contracts claim and what the chain enforces.

Dusk tries to minimize that gap by pairing a deterministic core with an owned proof system. Disclosure becomes a managed capability rather than accidental leakage. The network supports different transaction models, but the important part for me is that disclosure is intentional and controlled.

That only works when execution is predictable and proofs are consistent everywhere.

Modularity as a safety strategy, not a scaling slogan

In crypto, modularity is often sold as a performance upgrade. In Dusk documentation, modularity reads more like a safety choice. DuskEVM is one module in a stack that sits on top of DuskDS, the settlement layer.

This separation means execution environments can evolve without rewriting the rules of truth. That reduces the blast radius of upgrades. From an infrastructure standpoint, that is huge. Change becomes incremental instead of catastrophic.

I do not see this as chasing throughput. I see it as reducing risk.

The boring checklist that makes Dusk interesting

If I strip away branding, what remains is a very unexciting list, and that is the point.

A reference node engine built for operators and contributors.

Non determinism treated as a defect class.

A maintained ABI for the core VM.

A native Rust PLONK implementation with audits.

A modular architecture designed to limit upgrade risk.

This is not how you win hype cycles. It is how you build something that survives contact with real financial use.

That is why I judge Dusk less by apps and more by execution discipline. In markets where privacy and verification must coexist, boring engineering choices are not a weakness. They are the product.