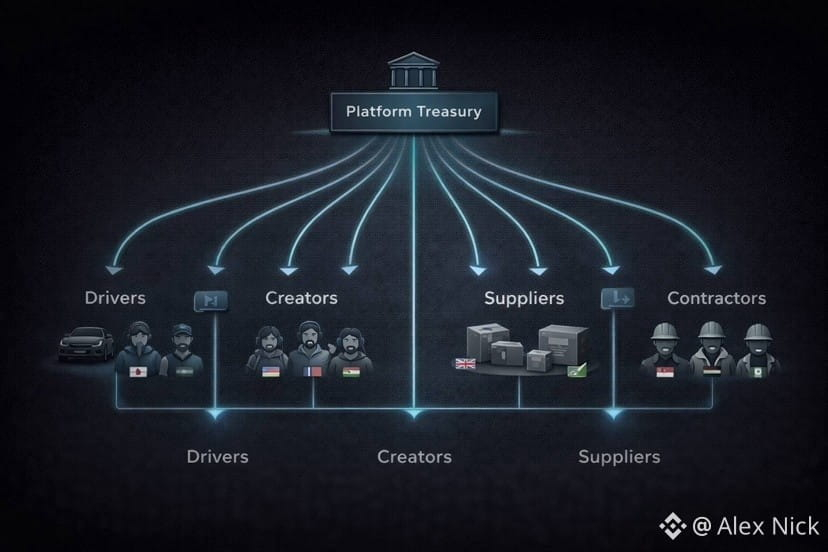

Most people picture stablecoins as one person sending USDT to another. I used to think that way too. But when I step back and look at how money actually moves, that idea feels tiny. Real money flows are messy and wide. Platforms pay thousands of workers. Marketplaces send daily earnings to sellers. Companies batch pay suppliers. Game studios compensate contractors across many countries. Creator platforms distribute revenue across borders every week. This is where traditional finance becomes slow expensive and frustrating.

When I look at Plasma, I stop thinking about simple payments and start thinking about payouts. That shift changes everything. Plasma does not feel like it was built for casual transfers between friends. It feels like it was designed for finance teams who have to move money at scale and answer for every cent later.

Platforms are the real drivers of stablecoin adoption

Individuals adopting stablecoins matters but it moves slowly. People need time to change habits. Platforms are different. When a platform switches its payout rail it changes behavior for thousands or millions of users overnight. That is why payouts are such a powerful wedge.

I keep thinking about ride hailing apps delivery services affiliate networks freelancer platforms ad networks creator tools and gaming ecosystems. All of them collect money in one place and then distribute it outward to many people in many regions. Today that process is painful. Bank wires are slow and fail for trivial reasons. Card payouts are expensive. Local wallet systems differ by country. Reconciliation takes forever. Support teams drown in tickets. Eventually every platform builds a payout operations team just to handle exceptions.

What excites me about Plasma is that it wants to live right inside this chaos and simplify it rather than asking platforms to learn crypto for fun.

Why payouts are harder than simple payments

Sending a payment is one action. Running payouts is an entire machine.

A payout system has to respect time. Some people want daily payouts others weekly others instant. Identities must be verified because you cannot send money to unknown recipients. Formats differ by rail and region. Failures happen and retries are required. Audit trails must exist for years. And when something breaks the platform gets blamed not the bank or the network.

This is why payouts break operations unless the rails are built to absorb the complexity. Stablecoins matter here not because they are trendy but because digital dollars can move quickly and clearly across borders when the infrastructure is designed for it.

Plasma as a payout rail inside existing systems

The most practical future I see is Plasma plugging into payout orchestration systems that businesses already use. In that setup Plasma is not replacing banks. It becomes another rail inside the payout engine.

Those orchestration systems already know how to route money across countries handle compliance and convert currencies. When stablecoins become a first class option inside them stablecoins stop being niche. They become normal for payroll supplier payments and global settlements.

That kind of adoption is quiet. It does not require users to download wallets or understand chains. It just reduces pain where money is already flowing.

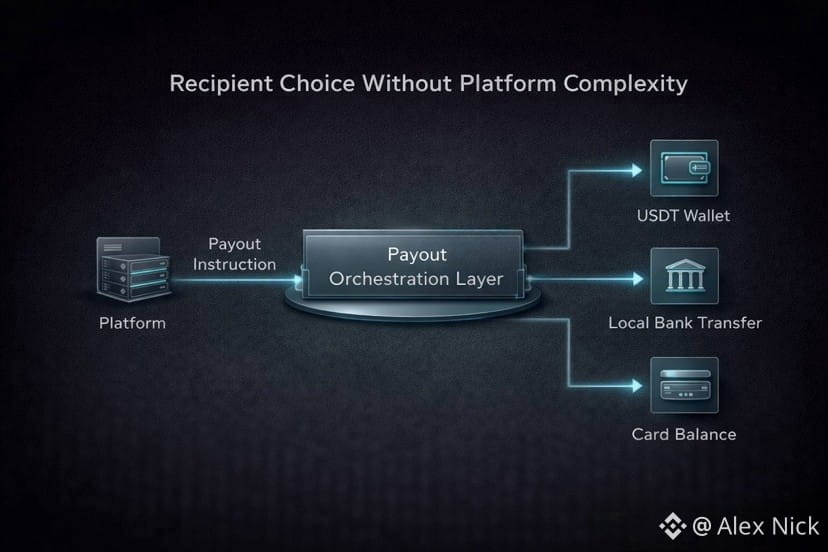

Giving recipients choice without breaking platforms

One idea changes the entire equation. The recipient chooses how to receive money.

One worker may want USDT because they trust dollars more than their local currency. A supplier may want local fiat to pay bills. A creator might want a mix. Platforms cannot realistically support all of this without exploding their payout logic.

Stablecoin payout rails solve this by separating platform intent from recipient preference. The platform pays once. The rail handles conversion or delivery in the format the recipient chooses. The platform stays sane while users get flexibility.

This is how infrastructure wins. Not through debates but by removing friction where money already moves.

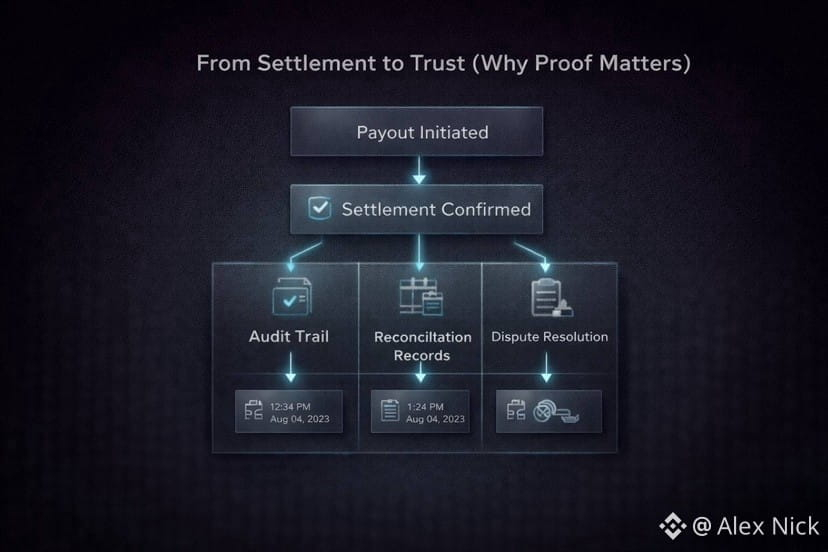

Evidence and reconciliation matter more than raw speed

Speed sounds good in marketing. In payouts speed only matters if you can prove what happened.

Finance teams ask different questions. Can I reconcile this payout file easily. Are identifiers clean. Is timing consistent. Can I audit this later. Can disputes be resolved quickly.

A good payout rail keeps the back office quiet. A bad one turns it into a war room.

Plasma becomes interesting when I view it as a reconciliation pipeline. Predictable traceable stablecoin payouts reduce time spent matching records and chasing breaks. That is real value.

Predictable settlement changes how platforms grow

There is a deeper economic effect. When payouts are slow and uncertain platforms hold larger buffers delay payments and create complex rules to manage risk. When settlement is predictable those safety margins shrink.

Platforms can pay faster with confidence. Workers and sellers trust them more. Expansion into new regions becomes less scary. Faster payouts are not a perk. They retain users suppliers and creators.

At that point Plasma is no longer about crypto adoption. It is about business growth.

After the payout the money must still be usable

Another overlooked part is what happens after the payout lands. Can recipients use the money easily. Can they track it. Can they convert it. Can systems handle spikes like payday or campaign settlements.

Monitoring and verification are not glamorous but they are essential. Payout days create load spikes. When rails fail support tickets explode.

A network that wants to power payouts must treat monitoring and verification as core features because paying people is not a hobby. It is a business process.

Plasma as the plumbing of the online economy

If I had to summarize the idea simply I would say this. Plasma is building the plumbing of the online economy.

It is not for traders. It is not for hype. It sits underneath daily operations paying workers suppliers creators and sellers across borders.

That is why I see Plasma as part of a broader shift where stablecoins stop being digital assets and start acting like financial tools. Tools do not need excitement. They need reliability.

What success actually looks like

Success does not look like viral charts. It looks ordinary.

A creator platform lets users choose stablecoins or local money. A marketplace clears payouts faster and sees fewer complaints. A contractor platform pays globally without delays. Finance teams spend less time reconciling. Support teams see fewer tickets. Recipients get paid in the form they prefer.

This kind of adoption spreads because it saves time money and stress.

If Plasma earns trust as a payout rail inside real payout orchestration systems it stops being just another blockchain. It becomes a universal layer where stablecoins finally feel convenient.