By February 2026, the global economy still feels fragile. Inflation hasn’t fully gone away, government debt keeps growing, and political tensions remain high. In times like this, investors look for assets that don’t depend too much on governments or policies. That’s why gold and Bitcoin continue to matter.

Gold: Stability in Uncertain Times

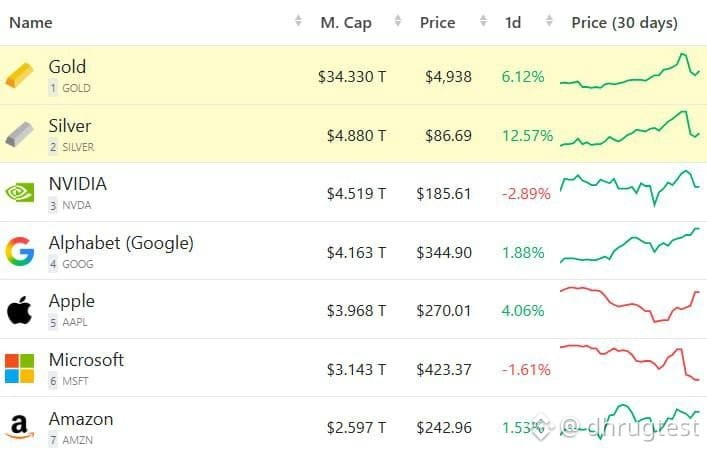

Gold is trading close to $4,950 per ounce, and its strength isn’t a surprise. When confidence in currencies and governments weakens, gold usually benefits.

Central banks are buying more gold, which says a lot. These are the same institutions that control money, yet they are choosing to hold gold instead. That shows how cautious the world has become.

With a market value above $34 trillion, gold stands far above stocks and other assets. While equities move up and down with earnings and news, gold moves with long-term trust in the financial system.

Over the past 20 years, gold has steadily climbed, especially during crises. In 2026, it’s less about quick profits and more about protecting wealth.

Bitcoin: A Different Kind of Hedge

Bitcoin is trading around $75,500 after recent price swings. Volatility is still part of the story, but that hasn’t changed its long-term direction. with a market cap near $1.5 trillion, $BTC is much smaller than gold, but it has grown fast for a young asset. Its value comes from its design: limited supply, no central control, and global access.

Bitcoin reacts quickly to news and regulation, which makes it risky in the short term. But over time, adoption by institutions and everyday users has made it harder to ignore.

Gold vs Bitcoin

Gold and Bitcoin are not the same, and they don’t solve the same problem.

Gold protects against inflation and economic stress. Bitcoin protects against loss of trust in financial systems.

$XAU is steady and slow. Bitcoin is fast and unpredictable.

That’s why many investors now hold both. Gold adds stability, while Bitcoin adds growth potential.

Looking Ahead

If global risks increase, gold could continue moving higher, even if slowly. Bitcoin could see bigger moves, especially if regulation becomes clearer and adoption grows but price swings will remain.

In 2026, the real lesson isn’t choosing one over the other. It’s understanding why each exists and how they fit together in a world that feels less certain every year.