I have been following @Dusk for some time now, and what keeps impressing me is how deliberately they are building infrastructure for the kind of finance that actually needs to exist in the digital era. Privacy and compliance are no longer optional trade offs; they are both essential, and Dusk is one of the few projects that treats them as non negotiable requirements rather than features to add later.

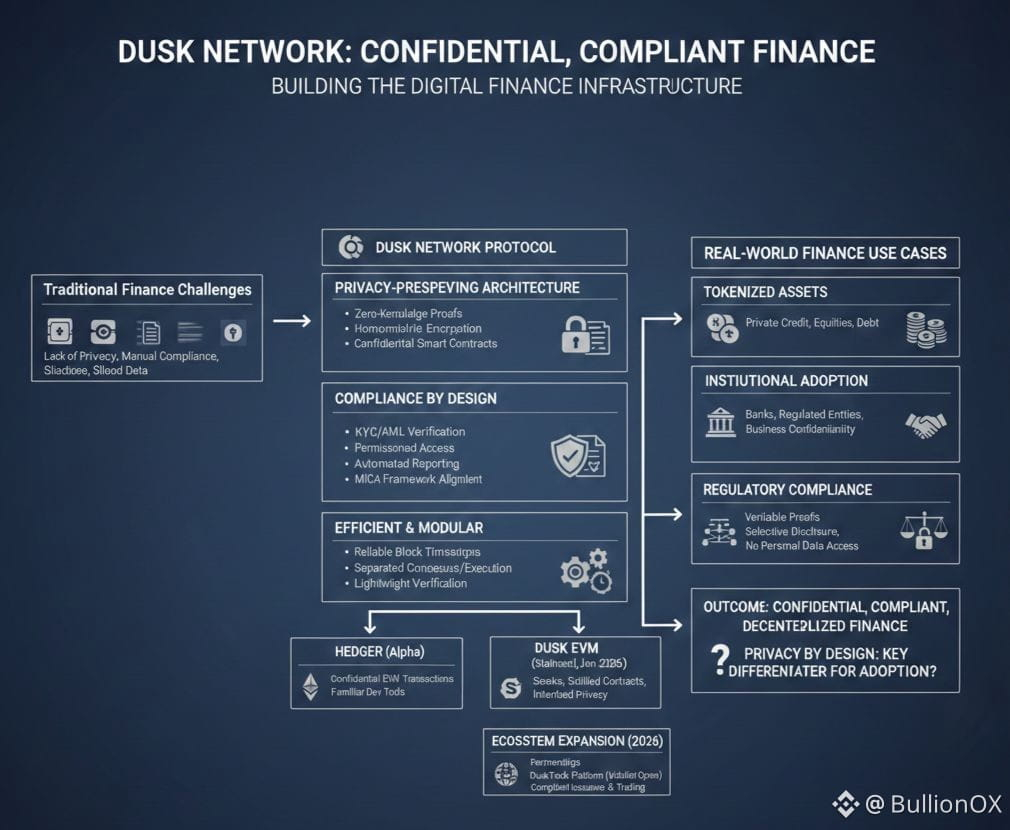

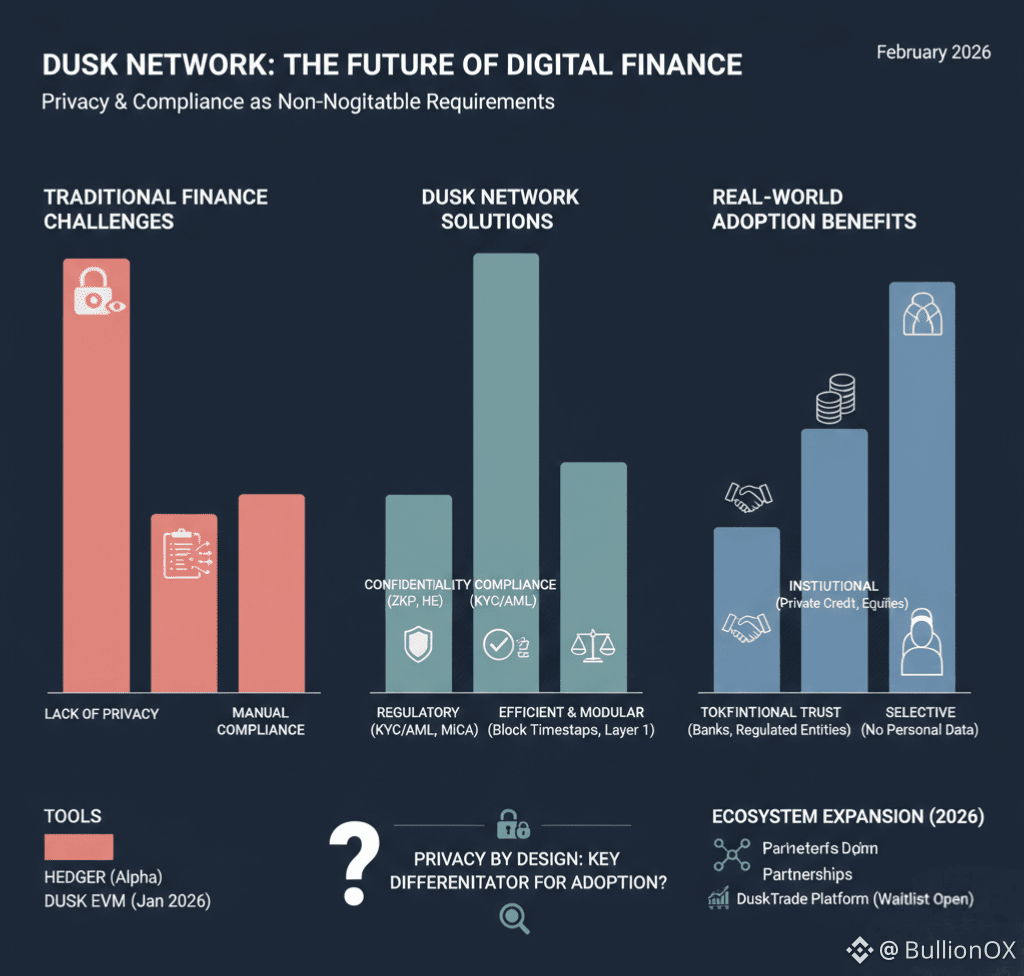

The foundation of Dusk is its privacy preserving architecture. It uses zero knowledge proofs and homomorphic encryption to enable confidential smart contracts. This means financial logic can execute fully on chain while keeping amounts, counterparties, and sensitive terms completely private. The system still proves correctness and regulatory compliance through cryptographic verification, so no one has to rely on blind trust.

This design is especially valuable for real world finance. Institutions and regulated entities cannot operate in an environment where every transaction is publicly visible. Dusk allows tokenized real-l world assets, such as private credit, equities, or debt instruments, to be issued and managed with built-in privacy. At the same time, native tools for KYC/AML verification, permissioned access, and automated reporting ensure alignment with frameworks like MiCA in Europe.

Confidentiality by design reduces many traditional barriers. Issuers can protect proprietary deal structures and investor lists. Participants maintain business confidentiality. Regulators receive verifiable proofs of compliance without accessing underlying personal or commercial data. This selective disclosure model makes onchain finance feel closer to how regulated markets already operate off chain.

The protocol supports this efficiently. Transactions are sequenced with reliable block timestamps, allowing time sensitive rules like vesting schedules or interest accrual to be enforced privately. The modular separation of consensus, execution, and data availability keeps verification lightweight, so privacy does not come at the expense of performance or cost.

Hedger, currently in Alpha, brings confidential execution to EVM compatible transactions. Developers can build using familiar tools while ensuring settlements on Dusk's Layer 1 remain private and compliant. DuskEVM, live on mainnet since January 2026, further lowers the entry barrier by supporting standard Solidity contracts with privacy protections inherited from the protocol.

The ecosystem is expanding steadily around this vision. Partnerships with regulated entities show that real tokenized volume can be handled without compromising confidentiality. The upcoming DuskTrade platform, phased for 2026 with waitlist already open, will extend these capabilities to compliant issuance and secondary trading of tokenized securities.

Dusk is quietly demonstrating that digital-era finance does not have to sacrifice privacy for compliance or decentralization for regulation. It is building a foundation where confidential, compliant operations become the default, not the exception.

What do you think?

In a world moving toward more regulated digital assets, does privacy by design become the key differentiator for adoption?

Have you explored any of Dusk's recent developments?

I would love to hear your perspective.