$RIVER When I started crypto trading, I was very excited. I saw people posting big profits and screenshots, and I thought futures trading would help me grow my money faster. But after trying it myself, I learned some very important lessons that I want to share with beginners like me.

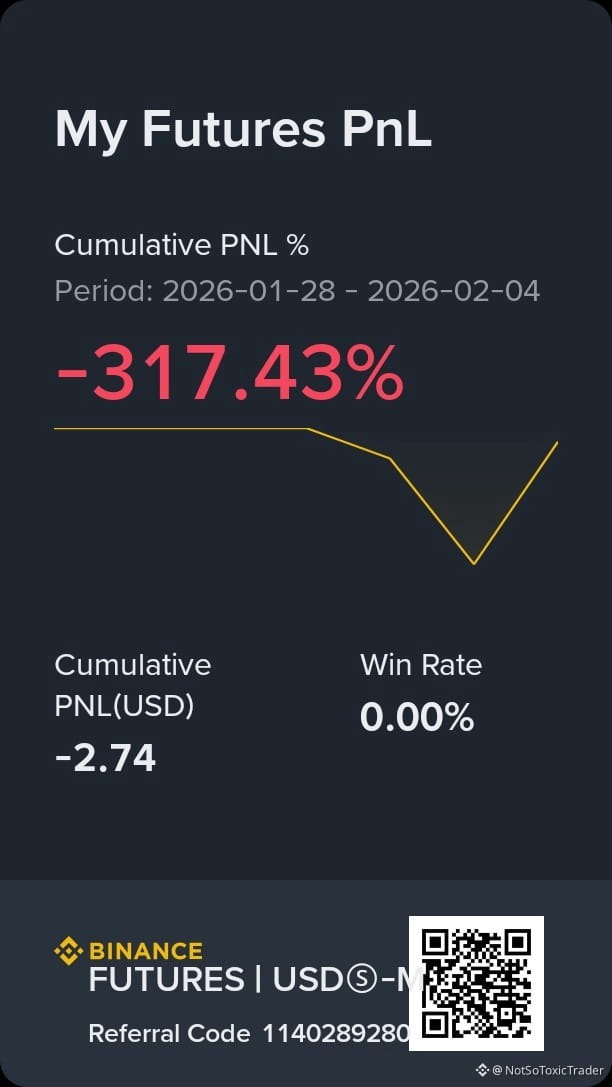

At first, futures trading looks easy. You can use leverage, like 10×, 20× or even higher. This means small price movements can give big profit. But what many beginners don’t understand is that the same leverage can destroy your account very fast.

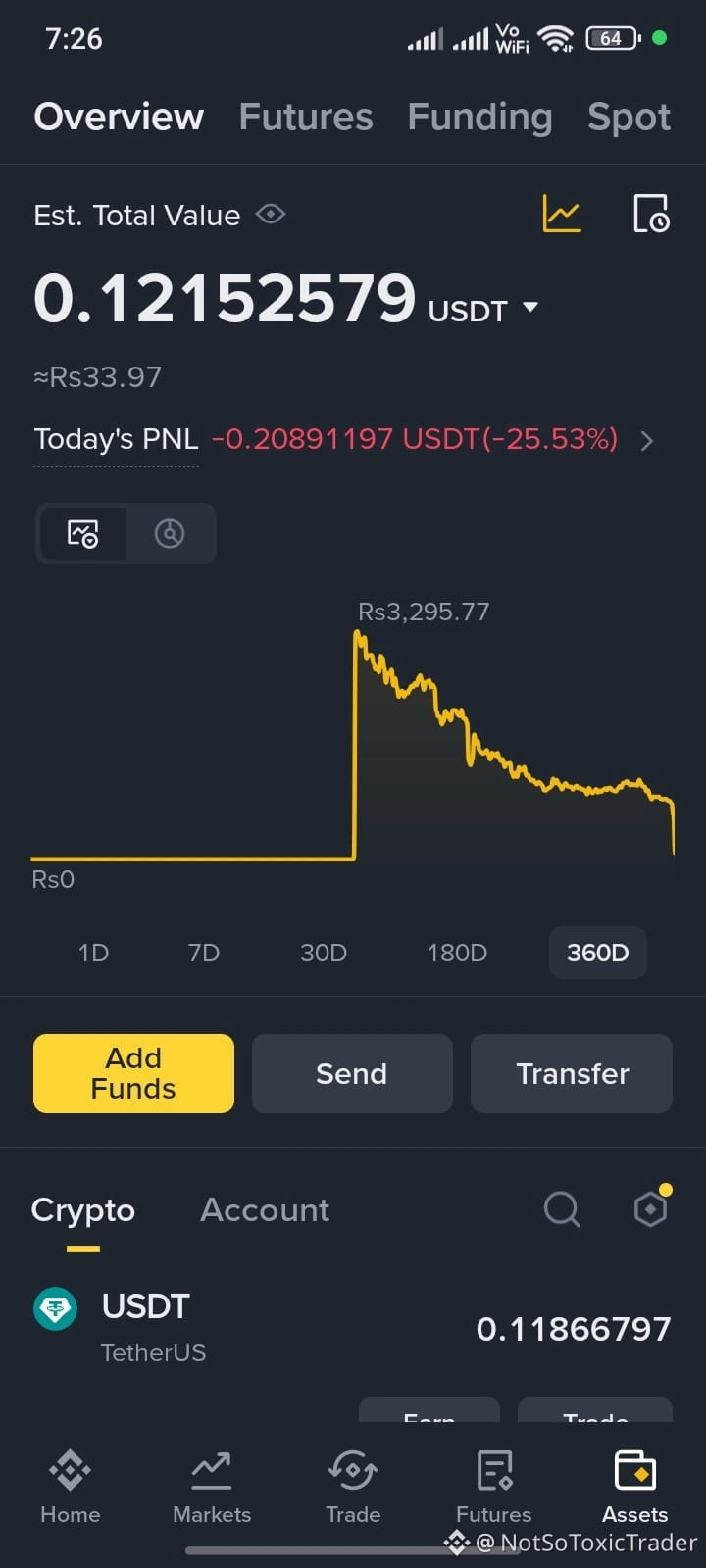

I opened a futures trade with very small money, but high leverage. The price moved slightly against me, and suddenly Binance showed warnings like “low margin”. My loss increased very fast, even though the price did not move much. That’s when I realized futures is not like spot trading. In spot, you can wait. In futures, you don’t get much time.

Another big mistake beginners make is risking money they can’t afford to lose. Trading should never affect your bank account or daily life. If one loss can wipe your balance, then the position size or leverage is already wrong.

After this experience, I understood why many traders say: “Protect your capital first. Profit comes later.”

Now I prefer spot trading, buying dips with small amounts, taking small profits, and learning slowly. It may look slow, but it’s safer and helps build discipline.

My advice to new traders:

Don’t rush into futures

Avoid high leverage

Start with spot trading

Learn risk management first

Crypto is a marathon, not a race.