WAL feels like one of those rare coins where the chart is only half the conversation and the other half is a very real problem the internet keeps running into, because blockchains are great at proving ownership and enforcing rules, yet they’re painfully clumsy when you ask them to hold large files like videos, images, datasets, game assets, app media, and the heavy data modern applications quietly depend on. I’m watching WAL the way I watch infrastructure trades, not like a quick meme rotation, because the deeper question is whether decentralized systems can finally store and serve big data without pretending that copying everything everywhere is sustainable, and if they can, then a token tied to that capability can move with a special kind of momentum that’s part fundamentals and part emotion. They’re building the kind of primitive that most people won’t celebrate until it works so well nobody thinks about it anymore, and that’s exactly why it can be thrilling to trade: the market keeps trying to price the future before the future becomes obvious.

At the heart of this story is a simple tension that never goes away: decentralization wants redundancy, but redundancy is expensive, and if you solve it by brute force replication you get safety at the cost of making storage feel like a luxury item. Walrus exists because the ecosystem needed something more disciplined than “just store it on chain” and more credible than “just trust this server,” and the design is basically a promise that big data can be stored across many independent operators while still being recoverable, verifiable, and hard to censor. If it becomes normal for decentralized apps to treat storage like a reliable service rather than a messy workaround, then WAL stops feeling like an optional side token and starts feeling like part of the plumbing that supports everything else, which is why We’re seeing traders lean in whenever the market mood shifts toward real utility and away from pure speculation.

Here’s how it works in a way that stays human instead of getting lost in jargon, even though the engineering underneath is serious. When someone wants to store a file, the system doesn’t keep it as one intact object sitting on one machine, and it doesn’t blast full copies to every node either, because both extremes are either fragile or wasteful. Instead the file is transformed into many smaller pieces, and those pieces are encoded with redundancy so the original can be reconstructed even if a meaningful portion of the network is offline or misbehaving. The storage nodes each hold fragments rather than full blobs, and the network coordinates who holds what and for how long, so availability isn’t a rumor, it’s something the system can measure and enforce. The flow begins with a write request, then the file is encoded, fragments are distributed, and the network produces a verifiable signal that the data is actually stored, after which the storage obligation continues across time rather than ending the moment the upload finishes, because storage is not a single action, it’s a living promise.

Retrieval is where the design shows its maturity, because reading data back is the moment users emotionally decide whether a protocol is real. A client asks for the blob, pulls the metadata needed to know what to fetch, then downloads enough fragments from the network and checks them as they arrive, reconstructing the file once it has the required threshold. The beauty is that the network doesn’t have to be perfect to be useful, it just has to be resilient, and that resilience comes from the fact that you only need a sufficient subset of correct fragments to recover the whole. This is why the system can survive node churn, partial outages, and the kind of chaos that shows up in real distributed networks when everyone is stressed and traffic spikes. They’re not selling “never fails,” they’re selling “keeps working through failure,” and traders should notice the difference because it’s the difference between a narrative and an engineered product.

The technical choice that matters most is the redundancy model, because it defines both cost and reliability, and Walrus leans on erasure coding rather than full replication so the network can be robust without being absurdly expensive. That choice is not a minor optimization; it changes what kinds of apps can exist because storage cost determines whether builders can serve real users without quietly falling back to centralized providers. Another big choice is using a smart contract platform as the control layer, which keeps coordination, proofs, and ownership rules programmable instead of hard coded into a closed system. This is the part that makes Walrus feel like more than storage, because storage becomes something applications can reason about, compose with, pay for, extend, and govern, and that composability is where ecosystems get sticky. If It becomes common for apps to store critical content in a way that can be verified and managed like an on chain resource, then the network becomes less like a niche service and more like an always on shared utility.

Now the token, because the token is where traders either get disciplined or get emotional in the wrong ways. WAL sits inside the machine as both an incentive and a security bond, which means it’s not only about paying for storage, it’s also about aligning node behavior with the long term health of the network. Staking and delegation influence who carries storage responsibility and who earns a share of the network’s fees, so stake becomes a signal of trust and a mechanism of accountability at the same time, and that’s why I treat staking participation as a market input rather than a background detail. If users pay for storage in WAL and if operators earn in WAL, then demand and supply pressure are tied to real usage, but you still have to respect the reality of emissions, unlock schedules, and early subsidies that might be used to accelerate adoption. This is where pro traders keep their heart warm but their head cold, because a good product can still have rough token flows early on, and a good chart can still be lying if you ignore the underlying distribution dynamics.

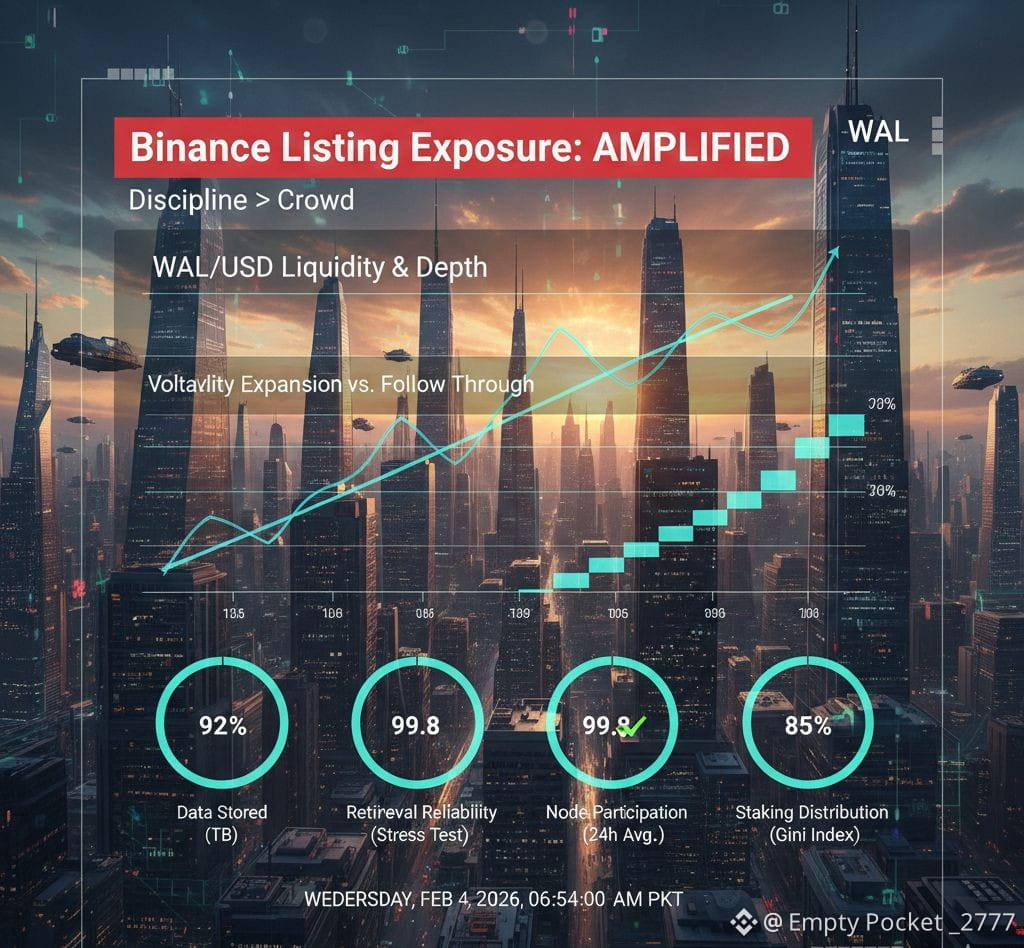

If you want to watch WAL like a pro, the market metrics that matter aren’t mystical, they’re practical, and they connect directly to the protocol’s purpose. I’m looking at liquidity and depth because thin liquidity can manufacture fake breakouts and then punish everyone with sharp reversals, and I’m looking at volatility expansion versus follow through because infrastructure assets often trend best when dips get bought methodically instead of emotionally. I’m also watching signs of real adoption, not in the vague “community growth” sense, but in the sense of whether more data is being stored, whether retrieval reliability holds during stress, whether node participation remains healthy across time, and whether staking becomes broadly distributed instead of concentrated. Binance listing exposure can amplify all of this, because it makes access easier and accelerates the feedback loop between narrative, liquidity, and price discovery, but that same acceleration can also intensify overreactions, so discipline matters even more when the crowd is loud.

The risks are real, and they’re the kind of risks traders should respect even when the chart looks invincible. There is technical risk in any network that relies on sophisticated encoding, coordination, and verification, because distributed systems don’t fail politely, they fail at the edges, under stress, and sometimes in ways nobody predicted. There is economic risk if incentives are mis tuned, because storage networks need operators to stay profitable and users to stay confident, and those two groups can pull in different directions when markets are volatile. There is governance and centralization risk if stake concentrates and committee selection becomes dominated by a small set of powerful players, because then the network can drift away from its decentralization promise in subtle ways that only show up when something goes wrong. There is also narrative risk, and I’m saying this gently but clearly: confusion around tickers, branding, or what the project actually does can create sudden bursts of irrational demand followed by harsh corrections when reality catches up, and a pro trader doesn’t mock that behavior, they plan for it.

So how might the future unfold from here, and why does WAL keep pulling attention back to itself? If Walrus proves it can deliver reliable, censorship resistant, cost efficient blob storage that developers can integrate without drama, then demand can grow quietly at first and then all at once when a few high visibility applications make it feel normal. If the network’s reliability, pricing approach, and staking participation mature smoothly, then WAL can trade less like a short lived hype coin and more like a long duration infrastructure bet, where the market starts valuing sustained usage and durable fees rather than only the next headline. If adoption is slower, then WAL may remain more sentiment driven for a while, with sharp spikes and deep pullbacks as the crowd alternates between dreaming and doubting, and that’s still tradable, but it requires a steadier hand and a stronger respect for risk management. We’re seeing an era where data is becoming the center of everything, and when you zoom out far enough, the idea of verifiable decentralized storage stops sounding like a niche feature and starts sounding like a missing layer of the internet.

I’ll close this the way I’d close it for a trader who wants both excitement and clarity: WAL is the kind of asset that can reward you for paying attention to the real machine underneath the price, because if the system works, the market eventually notices, and if it struggles, the market eventually stops forgiving it. I’m not here to tell you what to do with your money, but I am here to say this is a story where patience can be a skill and curiosity can be an edge, and if you trade it with respect, you can stay grounded while still letting yourself feel that rare, electric possibility that comes from watching a new piece of infrastructure try to become permanent.