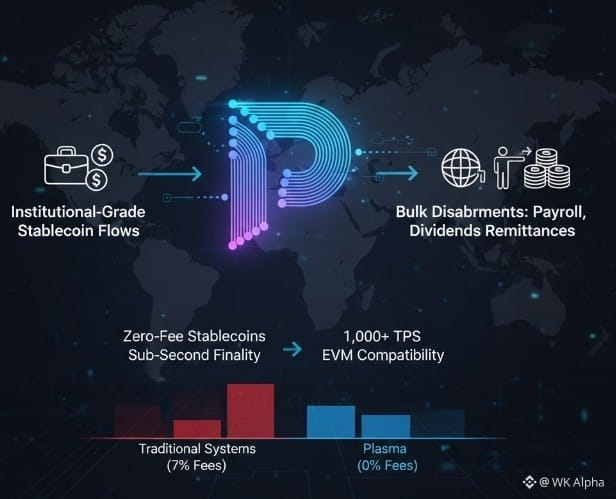

I explain this because Many in crypto assume stablecoins shine brightest in everyday payments, but Plasma blockchain flips this by prioritizing payouts those bulk distributions like payroll, dividends, or remittances that demand efficiency at scale. Instead of retail hype, Plasma optimizes for institutional-grade stablecoin flows, turning clunky transfers into streamlined global operations.

The Core Thesis: Payouts as Stablecoin's Killer App

Plasma's Layer 1 design centers on stablecoins like USDT for high-volume payouts, not just peer-to-peer sends. With zero-fee mechanisms, it handles mass disbursements without the gas wars of Ethereum. This matters because global payouts exceed $1.5 trillion annually in remittances alone, yet traditional systems eat 7% in fees. Plasma makes stablecoins the go-to for frictionless bulk outflows, bridging crypto's promise with real-world finance.

Key Features and Tech: Built for Bulk Efficiency

Powered by PlasmaBFT consensus, the chain achieves 1,000+ TPS with sub-second finality, ideal for payout batches. Integrations like Chainlink oracles ensure accurate, automated distributions, while paymaster sponsorship covers fees for recipients. EVM compatibility lets devs build custom payout smart contracts. It's like upgrading from mailing checks to instant wire transfers – but decentralized and cost-free for stablecoins.

Benefits for Users and Institutions: Streamlining Global Flows

For freelancers or gig workers, Plasma means instant payout receipt without borders or banks, earning yields on held stablecoins via Plasma One. Institutions slash costs on employee salaries or supplier payments, with confidential txs protecting sensitive data. Real impact? In regions like Southeast Asia, it could cut remittance fees by 90%, empowering millions. This utility drives adoption beyond speculation.

Comparisons and Risks: Weighing the Edge

Unlike Tron, which mixes payments and entertainment, Plasma's stablecoin focus gives it a payout edge in throughput and security via Bitcoin anchoring. But risks loom: dependency on USDT's peg stability, or integration delays with legacy systems. What could go wrong? Regulatory crackdowns on stablecoins could hinder growth, though Plasma's VASP licenses mitigate some compliance hurdles. Balanced view: It's innovative, but not invincible.

Future Vision: Payouts Powering a New Economy

Plasma sees payouts evolving into AI-orchestrated, on-chain ecosystems, where DAOs automate dividends or governments distribute aid via stablecoins. Scaling to trillions, it could redefine corporate finance.

In summary, Plasma elevates stablecoins from payments to powerhouse payouts, fostering innovation with tangible impact. Radical idea: What if Plasma's tech enables universal basic income on blockchain, distributing wealth globally without intermediaries?