Solana ($SOL L) is showing solid strength in the current market, maintaining a bullish structure despite overall market volatility. Buyers are clearly defending key levels, and momentum is slowly shifting back in favor of the bulls. 🐂✨

📊 Technical Overview:

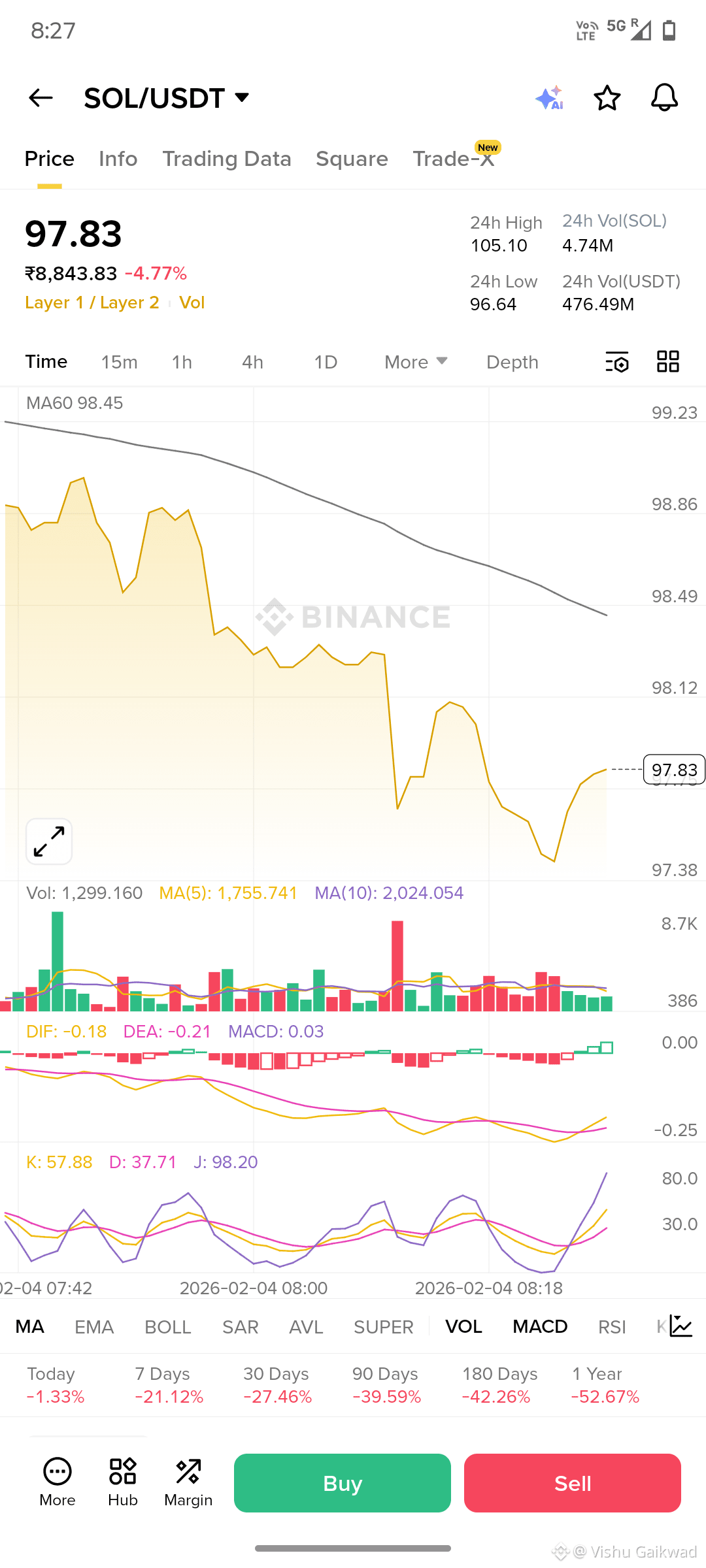

Current Price: ~$102 – 105 USDT

Key Support Zone: 95 – 98 USDT 🛡️

Immediate Resistance: 110 USDT 🚧

Major Breakout Level: 118 – 120 USDT 🔓

📈 Market Structure Insight:

SOL has respected its higher-low formation on the 4H timeframe, signaling healthy accumulation. Volume is gradually increasing, which often precedes a sharp impulsive move. If price sustains above the psychological 100 USDT level, we could see an accelerated push toward higher resistance zones. ⚡

🎯 Bullish Scenario Targets:

TP1: 110 USDT

TP2: 118 USDT

TP3: 130+ USDT (if momentum expands) 🚀

⚠️ Bearish Risk (Invalidation):

A clean breakdown below 95 USDT may invite short-term selling pressure. Until then, the trend remains bullish-biased.

🔥 Conclusion:

Solana continues to be one of the strongest Layer-1 performers, supported by ecosystem growth and steady demand. As long as SOL holds above key support, dip-buying opportunities remain attractive for short- to mid-term traders.

📌 Stay sharp, manage risk, and watch the breakout!