The first thing you notice when you track Dusk on-chain isn’t activity spikes or retail churn it’s how little meaningless noise there is. Wallet behavior is sparse, clustered, and unusually patient. That’s not because demand is absent; it’s because the actors Dusk is courting don’t behave like DeFi yield tourists. Regulated capital moves in batches, not drips. It waits for legal sign-off, internal approvals, and counterparties. That means Dusk’s chain-level metrics will always look underwhelming right up until they suddenly don’t — and when that flip happens, it won’t look like the usual liquidity mining sugar rush. It’ll look like locked workflows.

Most traders misprice privacy chains because they model them as speculative user networks. Dusk isn’t that. It’s closer to market plumbing, where value accrues through replacement, not growth. When an SME equity issuance migrates on-chain, it doesn’t 10x transaction count it removes an entire legacy process. That substitution dynamic is slow, but once it locks, it doesn’t churn. The market keeps trying to value DUSK on velocity metrics when it should be valuing it on integration friction. Lower friction here doesn’t mean UX polish; it means how easily compliance teams can sign off without escalating risk.

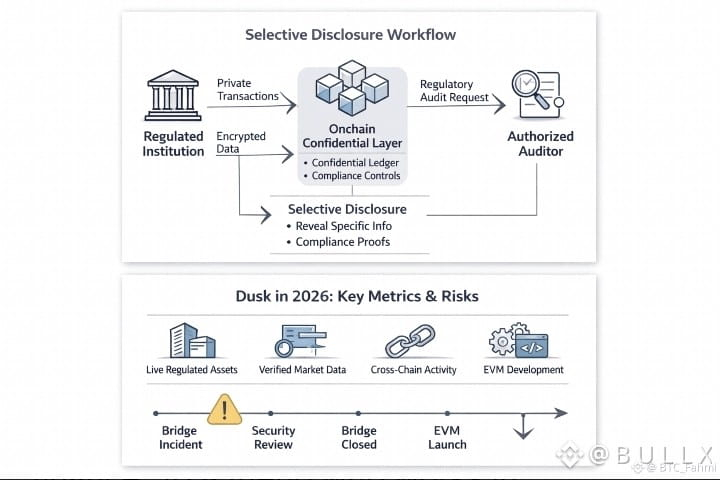

The architectural shift toward a modular stack is less about developer friendliness and more about political realism. Institutions don’t want “innovative execution environments.” They want known ones with constrained blast radii. By isolating DuskDS as the settlement and privacy anchor while pushing execution into an EVM layer, Dusk is implicitly conceding that execution will commoditize but settlement rules won’t. That’s a subtle but important bet. If execution becomes interchangeable across chains, then whoever controls settlement semantics and disclosure rules captures the long-term moat.

What’s underappreciated is how selective disclosure changes capital behavior under stress. In volatile markets, transparency isn’t neutral it accelerates reflexivity. When positions, balances, and flows are fully public, large actors either fragment liquidity or stay off-chain entirely. Dusk’s model dampens that reflexivity by allowing participants to stay solvent without advertising fragility. That’s not a philosophical privacy argument; it’s a volatility management tool. Chains that leak balance sheet data push sophisticated capital away during drawdowns. Chains that don’t can retain it.

Token economics here are deliberately boring, and that’s a feature, not a flaw. There’s no aggressive emission-driven growth loop because regulated users don’t subsidize experimentation with balance sheet risk. Staking on Dusk functions more like insurance underwriting than yield farming low headline APY, high requirement for uptime and reputation. That creates a validator set that looks more like infrastructure operators than speculators. From a market perspective, this reduces reflexive sell pressure but also caps narrative momentum. DUSK won’t pump on vibes; it’ll reprice on proof.

The NPEX integration matters less for its headline numbers and more for what it signals operationally. A regulated exchange doesn’t integrate a chain unless custody, disclosure, and failure modes are already mapped internally. That due diligence is invisible on Crypto Twitter but extremely expensive to replicate. If Dusk clears one venue, it lowers the cost for the next. That’s how infrastructure adoption compounds not through user growth, but through compliance reuse.

Chainlink adoption here isn’t about oracle decentralization; it’s about liability distribution. When price feeds, settlement messages, and cross-chain actions rely on a standardized provider, responsibility is shared across entities legal teams already understand. That reduces counterparty risk perception, which is often the real blocker to on-chain adoption. Traders look at CCIP as a bridge primitive. Institutions look at it as a blame surface. Dusk aligning with that tells you who they’re optimizing for.

The January bridge incident is actually one of the most telling data points. Bridges are where narrative chains die because teams treat them as peripheral. Dusk didn’t. They paused, recycled addresses, coordinated with centralized exchanges, and accepted timeline slippage. That response is anti-momentum but pro-survival. In regulated finance, shipping late is survivable; shipping broken is terminal. Traders should internalize that difference because it explains why Dusk’s roadmap always feels conservative and why that conservatism is the product.

From a capital rotation standpoint, Dusk sits in an awkward but interesting pocket. Risk appetite in 2026 is selective. Traders are happy to lever narratives but only when liquidity exits are obvious. Infrastructure that doesn’t cater to retail flows gets ignored until macro conditions favor durability over velocity. If rates stay higher and speculative capital thins, chains that monetize process replacement rather than user attention get re-rated. Dusk is positioned for that regime, not the current one which is exactly why it’s mispriced.

The real tell going forward won’t be TVL or daily active wallets. It’ll be wallet concentration stability. If top wallets aren’t rotating out during drawdowns, that implies holders are strategic, not speculative. It’ll be transaction regularity, not volume spikes — consistent settlement events tied to business cycles, not market cycles. And it’ll be the absence of incentives. When usage persists without emissions, you’re looking at real infrastructure.