@Plasma As blockchain infrastructure matures, the industry is moving away from one size fits all networks toward chains optimized for specific economic functions. Within this trend, Plasma positions itself as a Layer 1 blockchain built expressly to handle stablecoin settlement. Rather than serving as a general smart contract platform, it concentrates on a single mission: becoming the most efficient, reliable settlement layer for stablecoin-based payments and transfers. This focus responds to structural weaknesses that have become increasingly evident as stablecoins evolve into core components of global digital finance.

The Structural Gap in Stablecoin Infrastructure

#Plasma Dollar pegged stablecoins such as USDT and USDC now account for a majority of on chain transaction volume and economic activity. Despite this, they largely operate on blockchains that were never designed around their specific requirements. As a result, users face several persistent inefficiencies: confirmation times that are too slow for real time payments, transaction fees denominated in volatile native tokens, and security assumptions that may fall short for infrastructure increasingly used in large scale financial flows. Plasma is designed to resolve this mismatch between stablecoins’ role as value settlement instruments and the generalized networks they currently rely on.

Why Solving This Matters

Stablecoins have moved well beyond experimental crypto assets and are now embedded in payment, remittance, and treasury workflows across both Web3 and traditional finance. Their usefulness depends on fast settlement, cost predictability, and operational simplicity. Delayed finality makes them impractical for everyday commerce, while requiring users to hold volatile assets just to pay transaction fees creates friction particularly for institutions and non crypto native users. As stablecoins become more systemically important, the neutrality, censorship resistance, and durability of their settlement layer also become critical. Addressing these constraints is essential for stablecoins to function as reliable digital cash at scale.

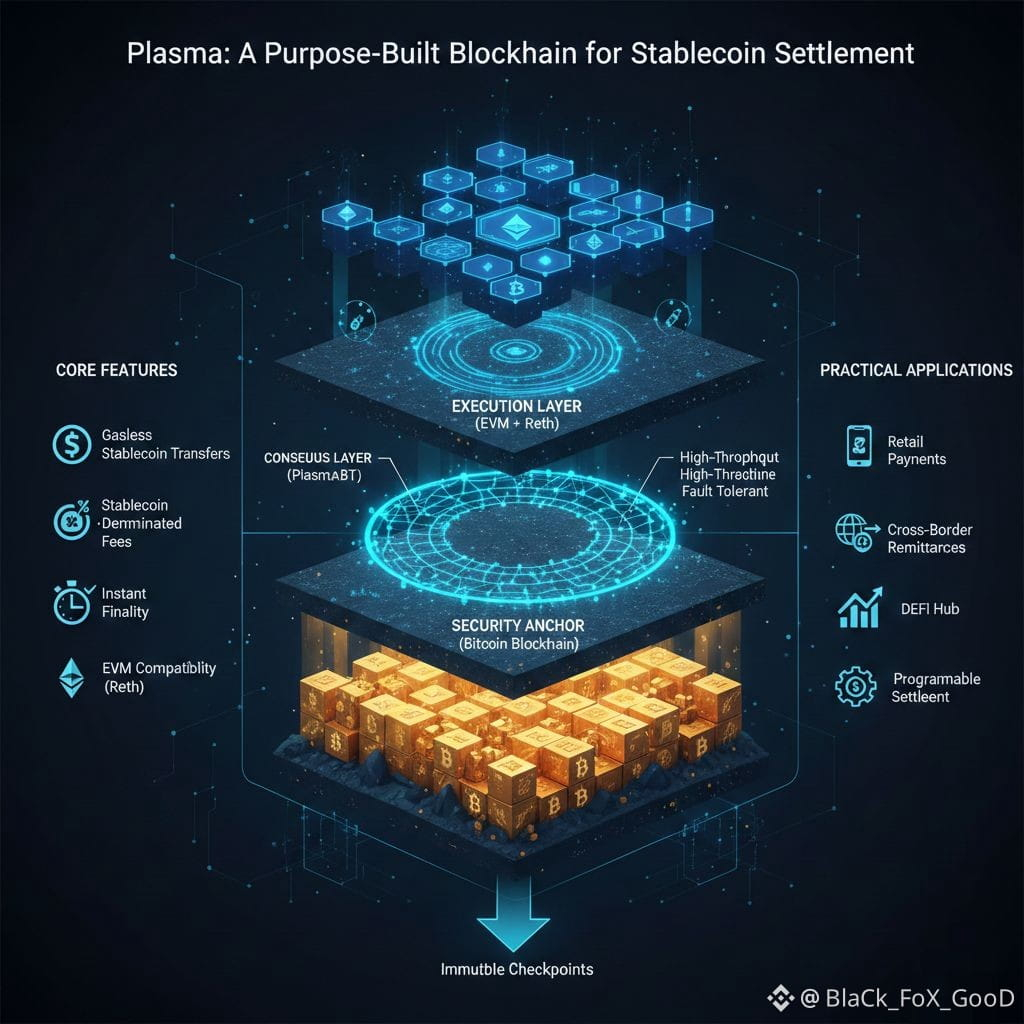

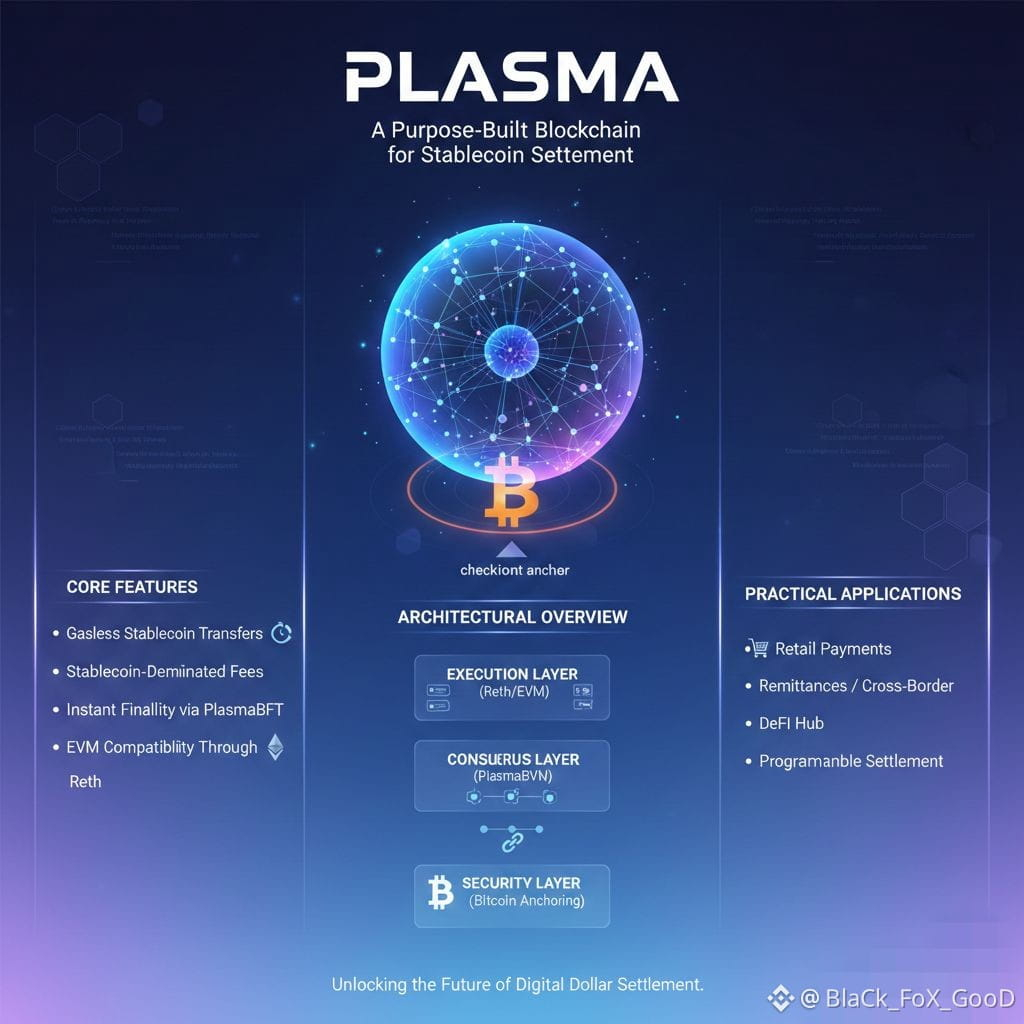

How Plasma Works at a High Level

Plasma is an independent blockchain that combines several technologies to create an environment optimized for stablecoin transfers. At the execution level, it uses Reth, a Rust based Ethereum execution client, providing full Ethereum Virtual Machine EVM compatibility. This allows Ethereum native smart contracts, decentralized applications, and developer tooling to be deployed on Plasma with minimal changes, ensuring immediate integration with the broader Ethereum ecosystem.

Consensus and finality are handled through PlasmaBFT, a Byzantine Fault Tolerant mechanism engineered for high performance. This system delivers deterministic finality in under a second, meaning transactions are conclusively settled as soon as they are confirmed an essential property for payment and settlement use cases.

Plasma also introduces an additional security layer by periodically anchoring its state or finality proofs to the Bitcoin blockchain. By doing so, it seeks to inherit Bitcoin’s unmatched security and political neutrality, making historical transaction data significantly harder to censor or alter.

Core Features and Design Choices

Gasless Stablecoin Transfers Plasma enables sponsored transactions for major stablecoins, allowing users to send funds without holding the chain’s native token, eliminating a major onboarding obstacle.

Stablecoin Denominated Fees When transaction fees are required, they can be paid directly in the stablecoin being transferred, aligning cost mechanics with user intent.

Instant Finality via PlasmaBFT Sub second, deterministic finality supports real world payment scenarios where delayed confirmation is unacceptable.

EVM Compatibility Through Reth Full EVM support ensures seamless migration of wallets, DeFi protocols, bridges, and infrastructure focused on stablecoin activity.

Architectural Overview

#PlasmaXPL system architecture can be divided into three layers. The execution layer processes smart contracts and manages EVM state using Reth. The consensus layer, powered by PlasmaBFT, ensures rapid agreement and block finalization among validators. The third layer extends security outward by committing checkpoints to Bitcoin, reinforcing the immutability of Plasma’s transaction history. Together, these components combine Ethereum’s developer accessibility, BFT based performance, and Bitcoin’s settlement security.

Practical Applications

A blockchain optimized for stablecoin settlement unlocks use cases across multiple domains. In retail payments, particularly in regions with unstable local currencies, Plasma enables near instant, low cost transactions at the point of sale. For remittances and cross border business payments, it provides a faster and more predictable alternative to both legacy financial rails and congested blockchains. Within decentralized finance, Plasma can function as a high efficiency hub for stablecoin lending, trading, and treasury operations. Institutional users can deploy programmable settlement logic, where smart contracts automate payments with guaranteed finality.

Developer and User Experience

From a developer standpoint, Plasma offers a familiar EVM based environment tailored specifically for applications centered on stablecoin movement. Features like gas abstraction and fast finality reduce friction when designing payment centric systems. For end-users, the experience is intentionally simple: transactions feel instantaneous, fees are intuitive, and there is no need to manage multiple tokens. The result resembles traditional digital payments while preserving crypto native benefits such as self custody and programmability.

Security and Trust Model

PlasmaBFT provides resilience against faulty or malicious validators under standard Byzantine assumptions, ensuring reliable consensus as long as less than one third of validators act dishonestly. Bitcoin anchoring is designed to further harden the system by making historical revisions economically and computationally infeasible. This layered security model aims to reduce reliance on social governance or centralized intervention, reinforcing stablecoins’ role as neutral settlement instruments.

Performance, Scalability, and Ecosystem Growth

As a dedicated Layer 1, Plasma’s throughput is governed by the efficiency of its consensus protocol and validator infrastructure. PlasmaBFT is optimized for high volume, low latency transfers, making it well suited for stablecoin heavy workloads. EVM compatibility remains its primary driver of ecosystem expansion, enabling interoperability with the widest possible range of Web3 tools. By optimizing specifically for stablecoin transfers, Plasma can achieve lower and more predictable costs than general purpose chains.

Long Term Positioning and Challenges

Plasma enters a crowded field of Layer 1 and Layer 2 networks, but its strategy is narrowly defined. Its success depends on establishing itself as the preferred settlement layer for stablecoin issuers, payment applications, and financial infrastructure. Key challenges include scaling validator decentralization, building deep liquidity and reliable bridges, and convincing users and developers to shift activity away from entrenched networks. Rather than competing broadly with platforms like Ethereum, Plasma’s objective is to be categorically superior for one critical function: stablecoin settlement.

Conclusion

Plasma represents a focused evolution in blockchain design, treating stablecoins as foundational financial primitives that warrant specialized infrastructure. Through EVM compatibility, rapid finality, user friendly fee mechanics, and a Bitcoin anchored security model, it proposes a streamlined settlement layer for digital dollars. Its value lies not in speculative appeal, but in removing the technical and economic friction that currently prevents stablecoins from operating as a true global payment standard.