Bitcoin is in a pressure cooker. Price keeps slipping under key levels, confidence is thinning out, and on-chain data is flashing stress signals — but not the kind that usually mark a full market washout. 📉🔥

After topping near $125K, Bitcoin rolled over and has struggled to reclaim $80K, with each bounce lacking conviction. According to on-chain analyst Axel Adler, the market entered a bear phase in late 2025 and is now navigating a mid-cycle correction, not the final bottom.

And the blockchain is backing that view.

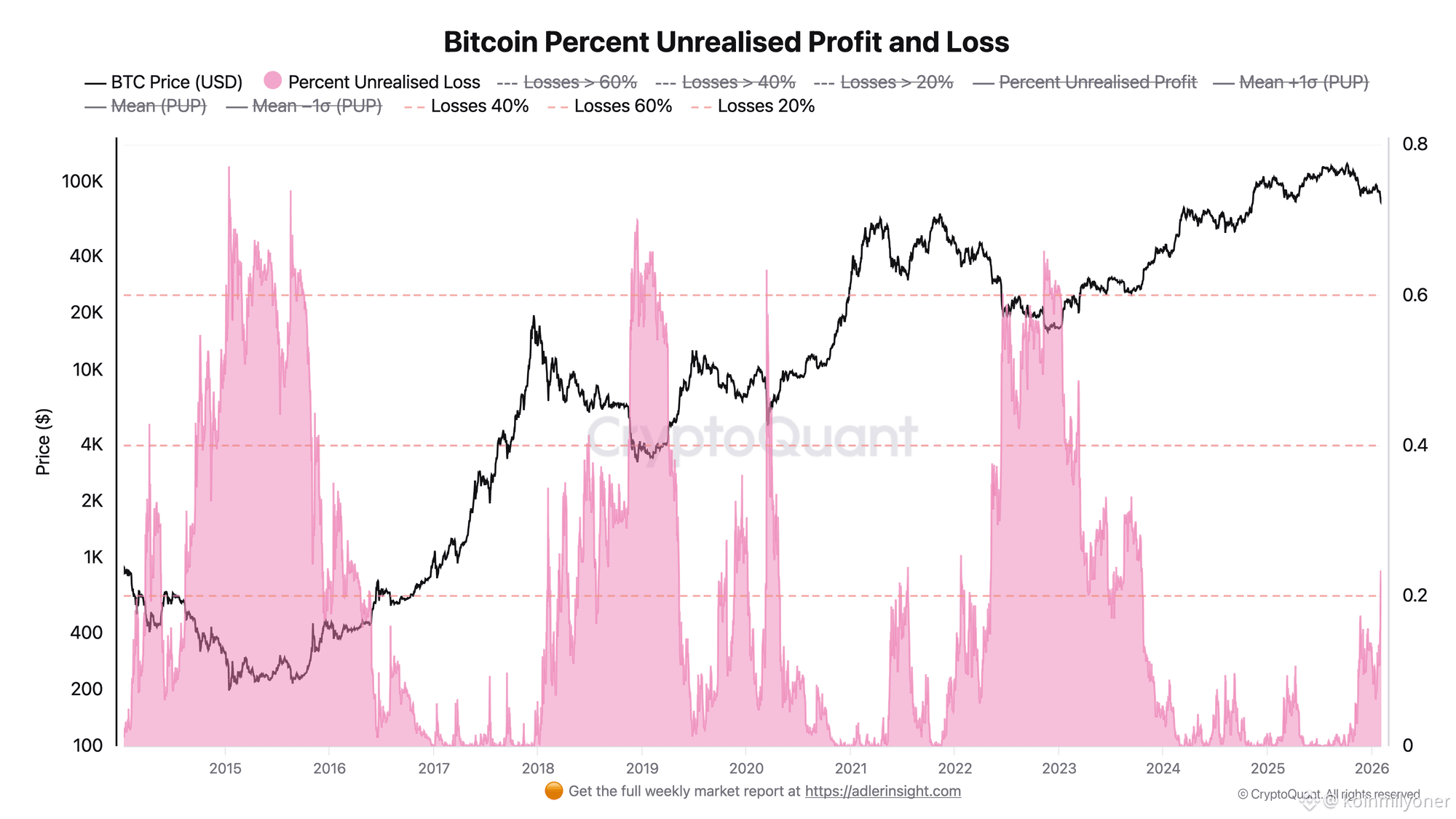

📊 Unrealized Losses Climb — But Not Panic Territory

One of the clearest stress gauges is Percent Unrealized Loss. This metric has tripled since January, jumping from about 7% to 22% as BTC slid from $95K toward the high-$70Ks.

That’s uncomfortable. But historically? Still mild.

Deep capitulation phases in 2019 and 2023 saw unrealized losses spike into the 40–60% zone. That’s when fear takes over, weak hands puke coins, and forced selling cascades. We’re not there yet. Right now, holders are stressed — not surrendering. 😬

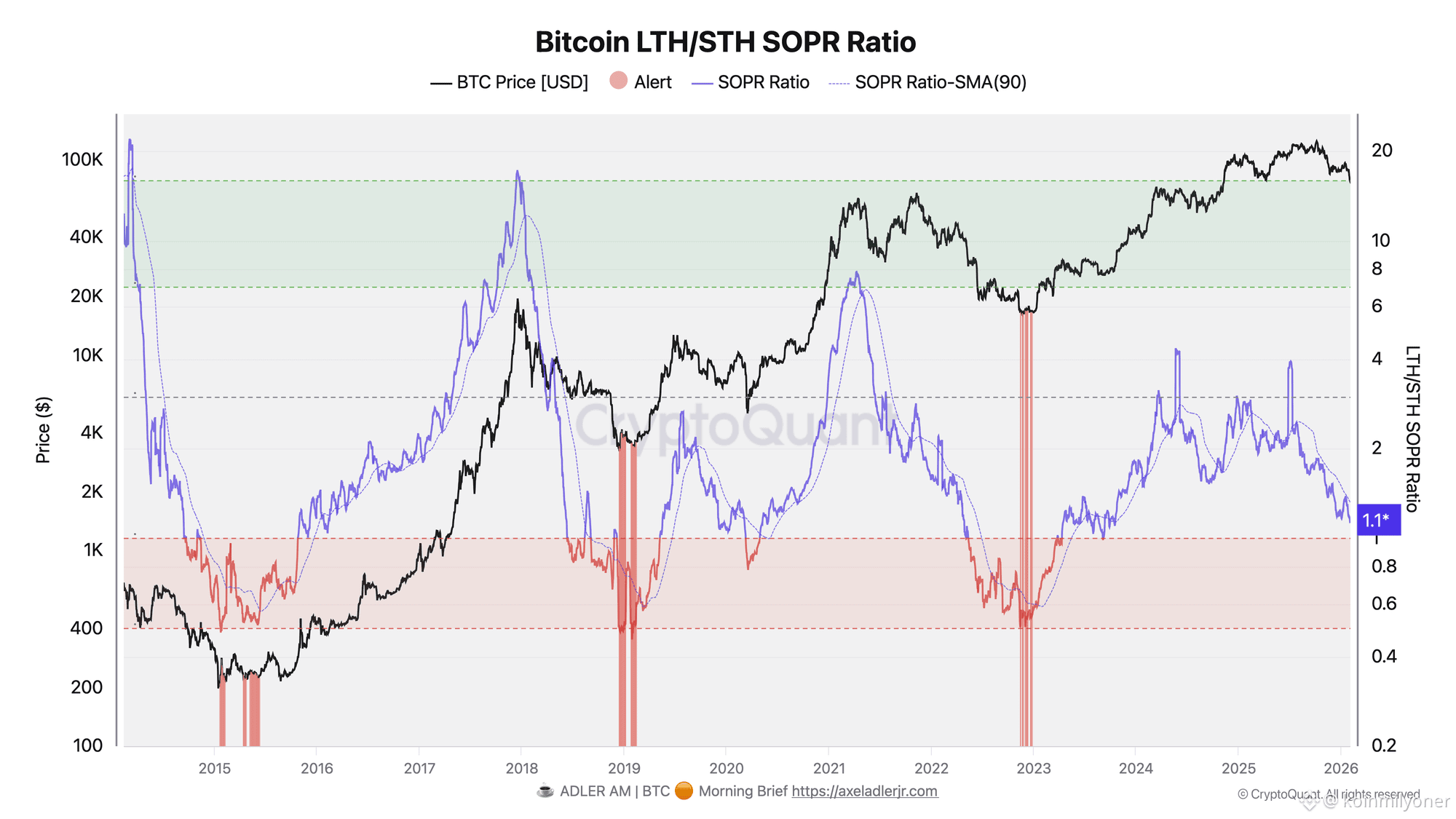

🔍 SOPR Ratio: Profit Shrinking, Not Vanishing

Adler also highlights the LTH/STH SOPR Ratio, which compares profitability between long-term holders (LTH) and short-term holders (STH).

• October peak: 1.85

• Now: ~1.13

➡️ A 40% drop in realized profit efficiency

This compression shows margins are getting squeezed across the board. But here’s the key: the ratio is still above 1.0.

Historically, true capitulation begins when SOPR falls below 1.0, meaning investors are realizing losses en masse. Full cycle bottoms often pushed this metric into the 0.6–0.8 range.

We’re not seeing that level of pain yet. Long-term holders, on average, are still exiting above cost. That’s stress — not collapse. 🧠

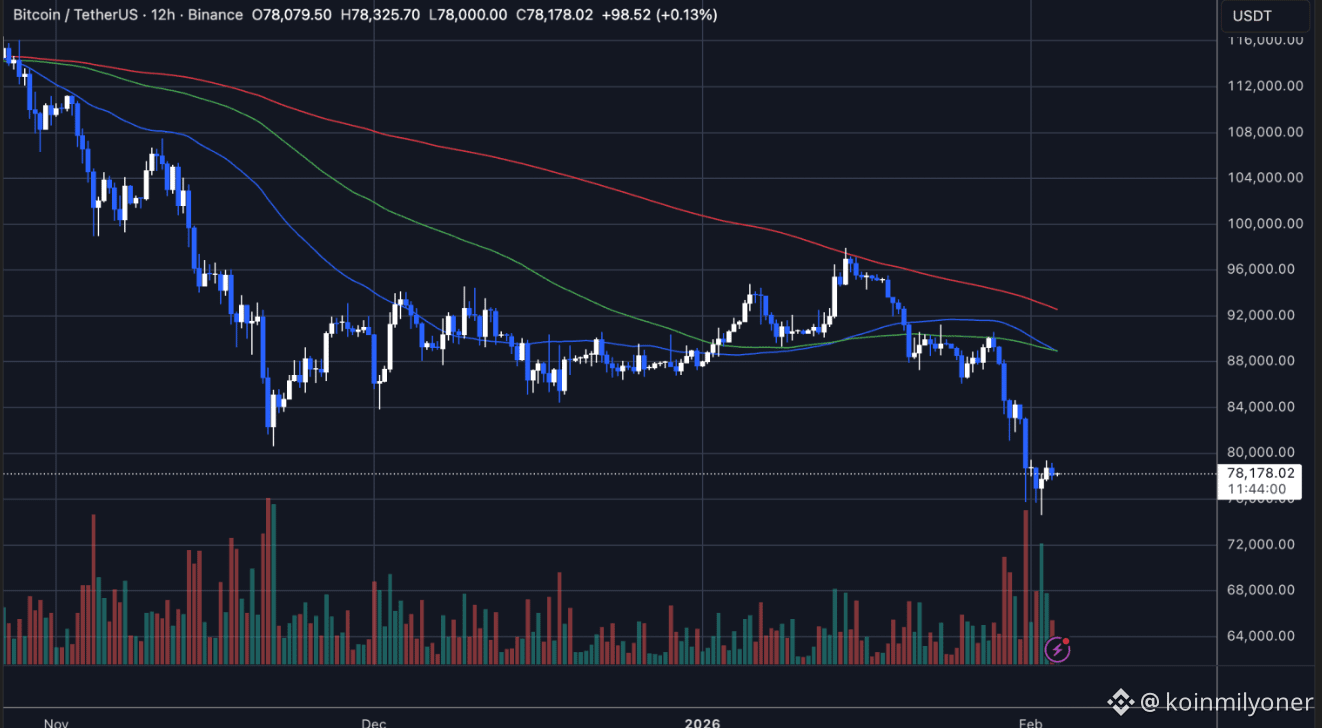

📉 Price Structure Confirms Bearish Regime

The technical picture tells a similar story.

After dumping from the mid-$90Ks, Bitcoin sliced through multiple moving averages with heavy volume, signaling liquidation-driven selling rather than orderly profit-taking. Since bottoming near $78K, price has attempted to stabilize — but the rebound is weak.

Key problem: BTC remains below declining short- and mid-term moving averages, which are now acting as dynamic resistance.

Former support at $88K–$90K has flipped into a supply wall. Every rally into that zone gets sold. That’s classic bear market structure. 🐻

🧩 Relief Pause, Not Reversal

Current price action looks like consolidation after impact, not accumulation before liftoff. Momentum has cooled, but there’s no strong evidence of higher-timeframe buyers stepping in aggressively.

As long as Bitcoin stays trapped below descending resistance, the risk remains skewed to the downside.

🔑 Levels That Matter Now

Bullish shift requires:

➡️ Reclaiming $82K–$85K and holding it

Bearish continuation risk:

⬇️ Losing the $78K low opens doors to deeper liquidity zones

🧠 Bottom Line

The market is hurting. Unrealized losses are rising. Profits are shrinking. But capitulation — the emotional, forced-selling finale — hasn’t arrived.

This is the stress phase, not the surrender phase.

In crypto cycles, bottoms aren’t built on discomfort.

They’re built on exhaustion.

#TrumpProCrypto #StrategyBTCPurchase #USCryptoMarketStructureBill #GoldSilverRebound $BTC