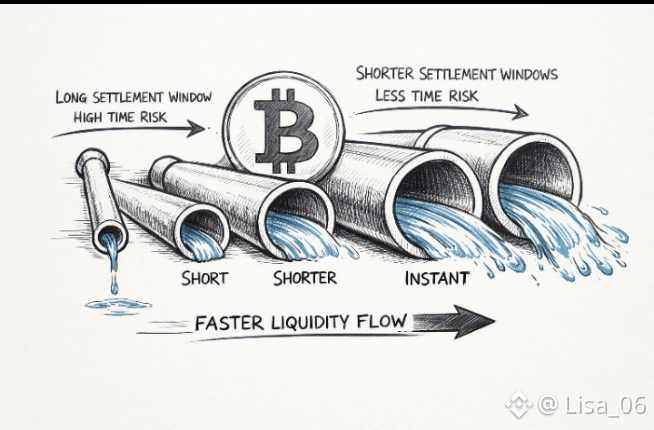

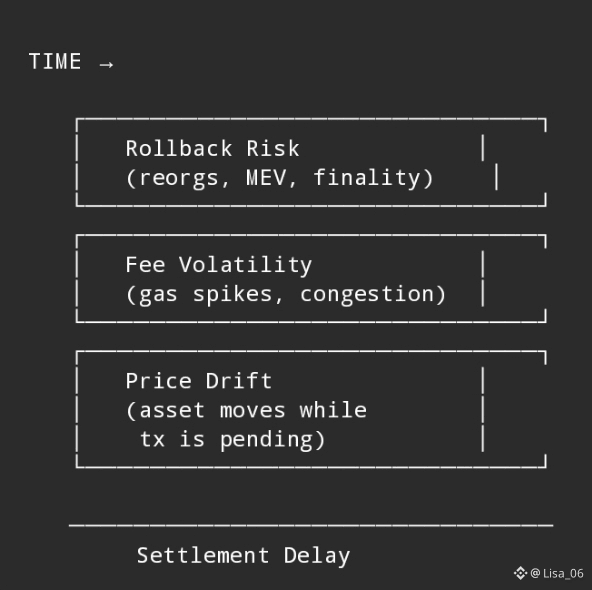

The most underestimated cost in blockchain systems is not fees or throughput, but time. Every second between transaction intent and final settlement introduces temporal risk: price drift, counterparty exposure, liquidation uncertainty, and operational hesitation.

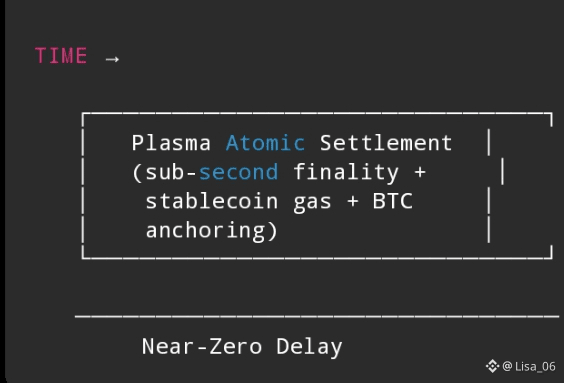

Plasma’s architecture directly attacks this hidden variable. Sub-second finality through PlasmaBFT compresses the settlement window so tightly that stablecoin transfers begin to resemble deterministic events rather than probabilistic ones. Gasless USDT execution removes another temporal distortion: fee spikes that delay or reorder value movement.

Plasma’s architecture directly attacks this hidden variable. Sub-second finality through PlasmaBFT compresses the settlement window so tightly that stablecoin transfers begin to resemble deterministic events rather than probabilistic ones. Gasless USDT execution removes another temporal distortion: fee spikes that delay or reorder value movement.  Anchoring security to Bitcoin further constrains rollback horizons, externalizing trust away from local consensus politics. Observed through a payments lens, this design reduces hesitation behavior in both retail and institutional flows, where delayed finality often causes capital to idle unnecessarily. When time risk is minimized, liquidity circulates more confidently and systems behave closer to traditional real-time settlement rails—without inheriting their centralization. Plasma suggests that the future of crypto infrastructure will be defined less by speed metrics and more by how effectively chains collapse uncertainty into near-instant resolution.

Anchoring security to Bitcoin further constrains rollback horizons, externalizing trust away from local consensus politics. Observed through a payments lens, this design reduces hesitation behavior in both retail and institutional flows, where delayed finality often causes capital to idle unnecessarily. When time risk is minimized, liquidity circulates more confidently and systems behave closer to traditional real-time settlement rails—without inheriting their centralization. Plasma suggests that the future of crypto infrastructure will be defined less by speed metrics and more by how effectively chains collapse uncertainty into near-instant resolution.