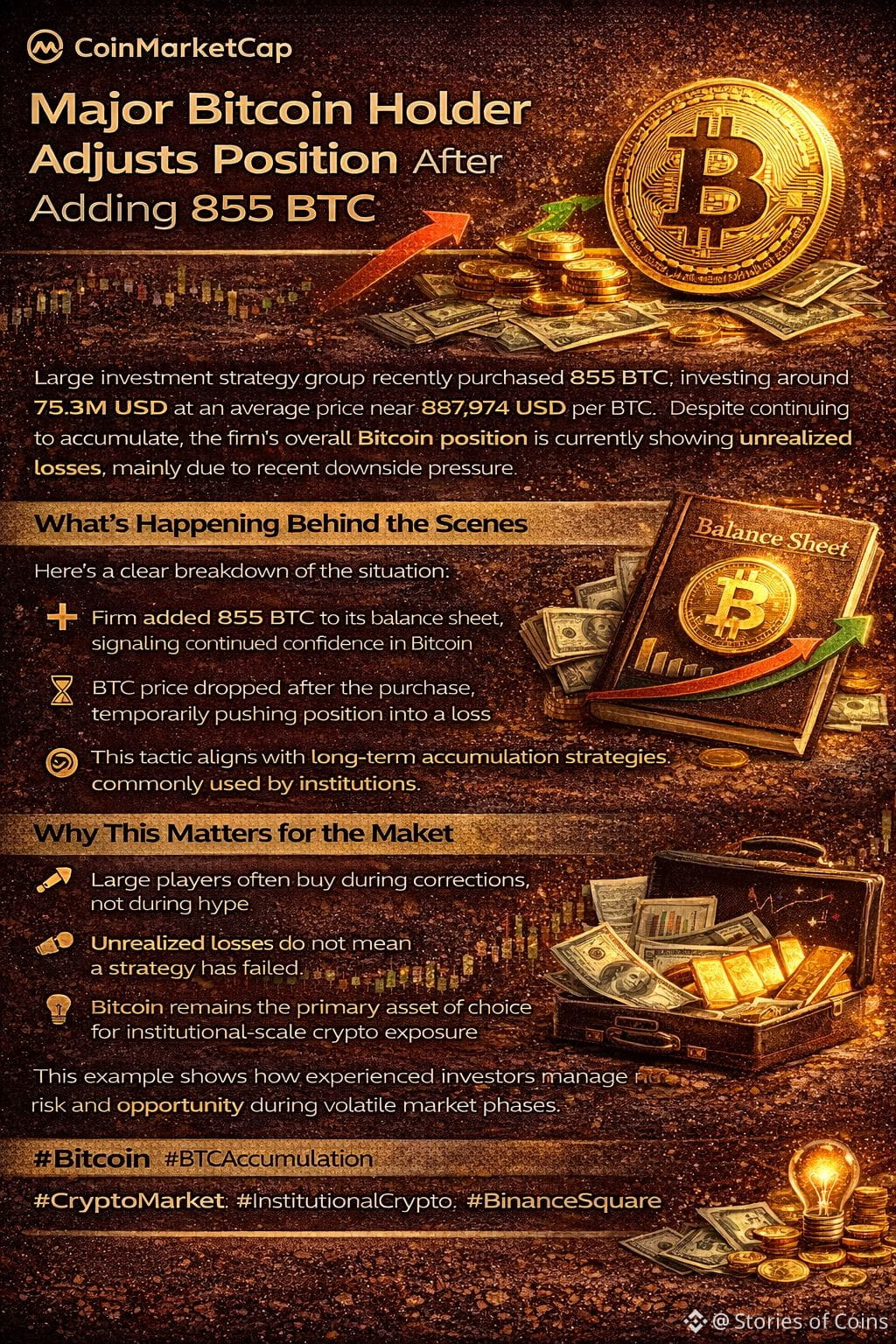

📉 Major Bitcoin Holder Adjusts Position After Adding 855 BTC

Recent data from the CoinMarketCap community shows that a large investment strategy group has expanded its Bitcoin holdings by purchasing 855 BTC, investing approximately 75.3 million USD at an average price near 87,974 USD per BTC.

Despite continuing to accumulate, the firm’s overall Bitcoin position is currently showing unrealized losses, mainly due to recent downside pressure across the broader crypto market.

📊 What’s Happening Behind the Scenes

Here’s a clear breakdown of the situation:

The firm added 855 BTC to its balance sheet, signaling continued confidence in Bitcoin

Since the purchase, BTC price has declined, pushing the total position temporarily into negative territory

This behavior aligns with a long-term accumulation strategy, where short-term losses are accepted in exchange for future upside

This approach is commonly seen among institutions that focus on multi-year Bitcoin exposure rather than short-term price fluctuations.

🔍 Why This Matters for the Market

This move highlights several important market signals:

📌 Large players often buy during corrections, not during hype

📌 Unrealized losses do not necessarily mean a strategy has failed

📌 Bitcoin remains the primary asset of choice for institutional-scale crypto exposure

Watching how major holders behave during volatile periods can offer valuable insight into broader market sentiment.

🧠 Key Takeaways for You

If you’re navigating the crypto market, keep these lessons in mind:

Price pullbacks can be strategic accumulation zones

Short-term losses are part of long-term positioning

Institutional behavior often prioritizes conviction over emotion

This example reinforces how experienced investors manage risk and opportunity during uncertain market phases.

🔥 Hashtags

#Bitcoin

#BTCAccumulation

#CryptoMarket

#InstitutionalCrypto

#BinanceSquare