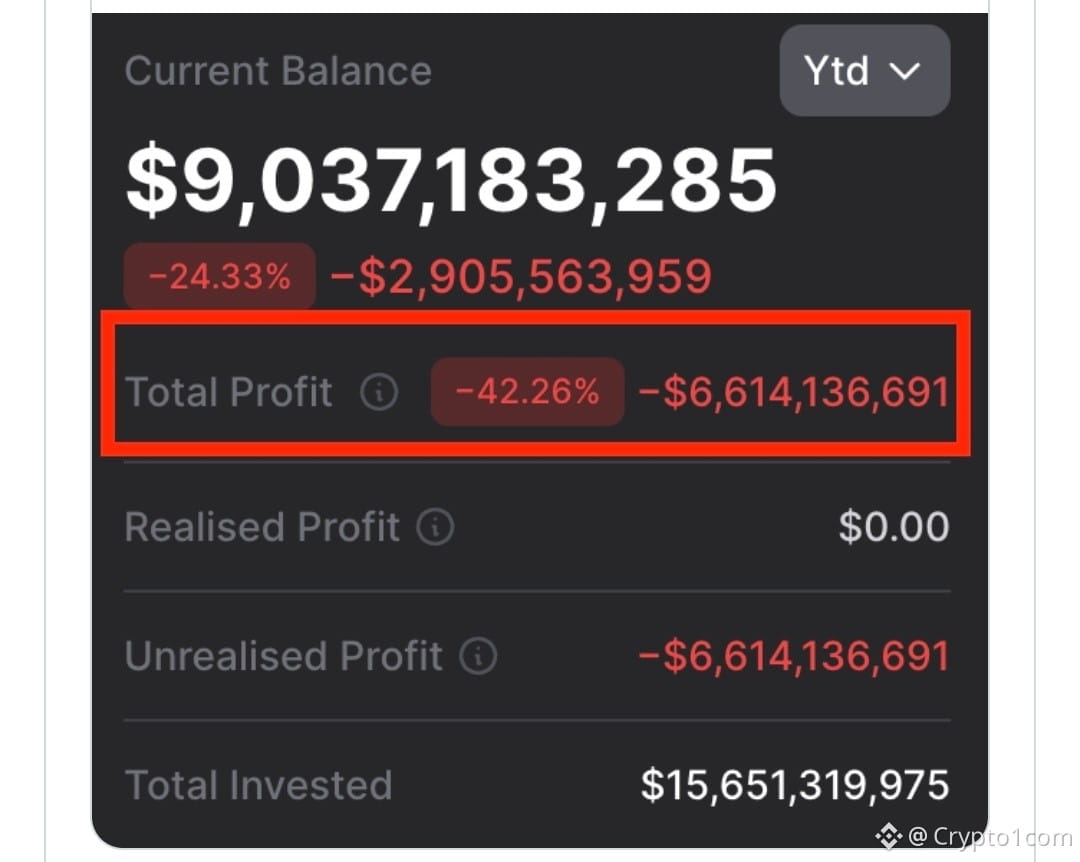

BitMine Immersion chairman Tom Lee defended the company's more than $6 billion in unrealized ether losses as an expected outcome of its long-term ethereum treasury strategy rather than a failure of execution.

Lee said BitMine is structured to track and ultimately outperform ether over a full market cycle, comparing it to an index-style product and arguing that paper losses are a feature of its approach during crypto downturns.

The company has continued to accumulate ETH, now holding about 4.24 million coins and earning staking revenue, even as Lee warns that a broader crypto deleveraging phase could pressure markets into early 2026.

BitMine Immersion chairman Tom Lee pushed back against criticism of its growing paper losses this week, saying the drawdown reflected the design of its ethereum treasury strategy rather than a flaw in execution.

In a series of posts on X, Lee said BitMine is built to track the price of ether and outperform it over a full market cycle, likening its structure to an index-style product rather than a tactical trading vehicle.

With crypto markets in a downturn, however, the firm said unrealized losses on its ETH holdings are inevitable.

“Crypto is in a downturn, so naturally ETH is down,” Lee wrote, adding that paper losses are “not a bug — it’s a feature,” and questioning whether similar scrutiny is applied to index funds during market declines.