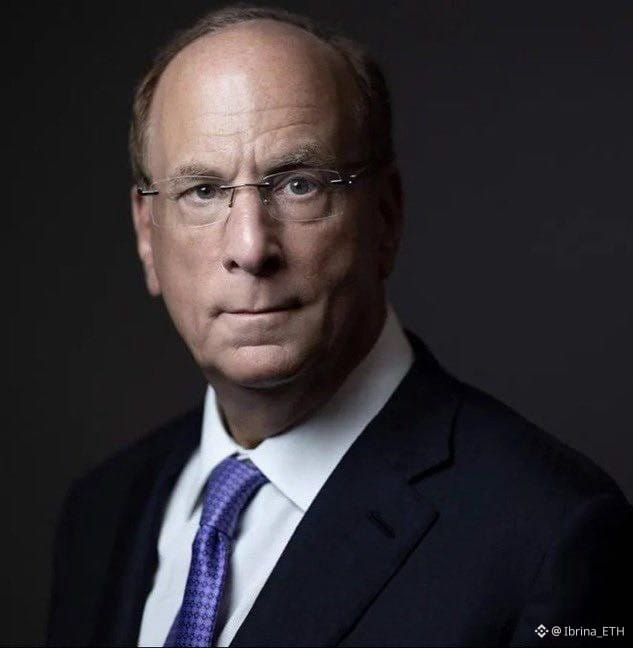

BlackRock just added $60 million worth of Bitcoin through its ETF, and this matters more than a price candle. Most people struggle with one big question in crypto: is this just speculation, or is real money actually committing long term? This answers it. ETFs don’t chase hype they absorb capital slowly, legally, and at scale. For context, $60M is roughly 1,400+ BTC, quietly removed from liquid supply, while retail traders are still debating short-term moves. In previous cycles, sustained ETF inflows came before broader market confidence, not after it. Think of it like this: when the world’s largest asset manager buys, it’s not asking “will this pump tomorrow?” — it’s positioning for years. The real lesson here isn’t bullish or bearish… it’s understanding who is buying, why they’re buying, and what timeframe they’re playing on. Retail often reacts to price; institutions react to structure. If you were watching this move, what do you think comes next slow accumulation or sudden re-pricing? Drop your thoughts 👇 below