So, I want to talk about how I got Plasma working with fintech companies and neobanks to handle global payments. It turns out, simply having great tech wasn't enough to get people to use it. If a blockchain settlement system is going to be taken seriously, it has to play nice with how money already moves around. That’s what I was trying to make happen – connecting new tech with the existing financial setup.

First, I had to get my head around how neobanks and payment companies actually work. These guys deal with tons of users, a crazy amount of rules, and loads of transactions every second. Anything we did with Plasma had to be super reliable, safe, and easy to keep track of. So, I spent months figuring out their systems, how they balance their books, and what the government expects from them.

First, I had to get my head around how neobanks and payment companies actually work. These guys deal with tons of users, a crazy amount of rules, and loads of transactions every second. Anything we did with Plasma had to be super reliable, safe, and easy to keep track of. So, I spent months figuring out their systems, how they balance their books, and what the government expects from them.

Getting them to trust us was key. Banks don't easily trust in new tech. To get them comfortable, I opened our work to audits and testing, and ran test programs, all to the end to show how solid Plasma was. We had to come up with a heap of info about how sure Plasma was, its protection, and how little risk there was.

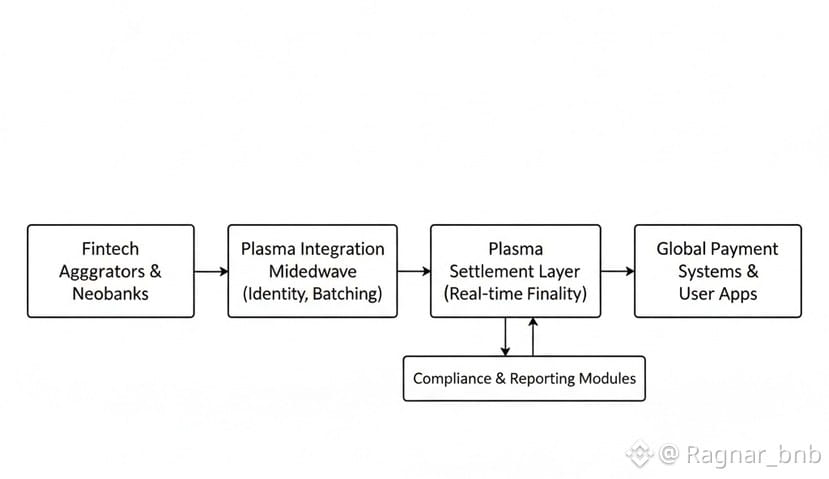

Getting the tech to fit wasn't easy either. A lot of these fintech companies were working with old payment methods and their own computer languages. I had to work with the coders to make something that could translate what they were using into something Plasma could understand. This 'translator' would check identities, group transactions, and confirm payments.

Staying within the rules was one of the trickiest things. Neobanks are watched closely. So, we built stuff that could keep an eye on transactions, report anything fishy, and keep records, all inside Plasma. That way, we could follow the rules without compromising what makes blockchain so great.

Making sure there was enough cash on hand was also my job. Payment companies need to know they can always complete transactions. So, I teamed up with the money guys to make sure there were always enough stablecoins to cover everything. We put in systems that would automatically balance things out to avoid any shortages.

We also had to think about the user. Folks shouldn't even realize there's blockchain going on behind the scenes. So, I worked on ways to present Plasma payments as quick, normal bank transfers. This meant people could use it without having to learn all the blockchain stuff.

Keeping things running smoothly was a constant worry. Our financial friends needed near-perfect uptime. We built backup systems, ways to switch over if something failed, and monitoring to catch issues early. We even practiced responding to problems so we could bounce back fast.

Keeping the books in order was an issue too. Finance likes reports and matching numbers. Plasma works in real-time, so we had to come up with new ways to keep track of things. I helped design systems that would automatically sync the blockchain records with their normal accounting software.

Expanding to different countries made things even more complicated. Each place has its own rules. So, we tweaked Plasma to fit those rules but kept the core tech the same.

Getting the partners up to speed was important for later on. We held workshops, training, and briefings to show them how things work with blockchain. That way, they knew what it could do and what its limits were.

As more people started using it, feedback became super important. I got insights from the neobanks and aggregators and kept improving the system.

One of the coolest things about all this was how we made cross-border payments so much faster and cheaper. Sending money overseas used to take days and cost a ton. Now it was happening in seconds.

Keeping things secure was always a top concern. We created security groups with our partners to talk about risks and review what was happening. This way strengthened the whole system.

These partnerships turned Plasma into something bigger. It wasn't just some blockchain project; it was the engine for apps, businesses, and international payments.

In the end, getting Plasma to work with fintech companies wasn't just about the tech. It was about understanding the rules, being reliable, and working together. I learned that the key to the payment system, involves linking decentralized networks with the old guard of finance.