With all the shutdown chaos, been thinking about which crypto projects might actually survive volatility...Like BTC or RIVER? BUT

Been watching @Plasma (XPL) for a few weeks and honestly? it's one of the less annoying stablecoin plays i've seen lately

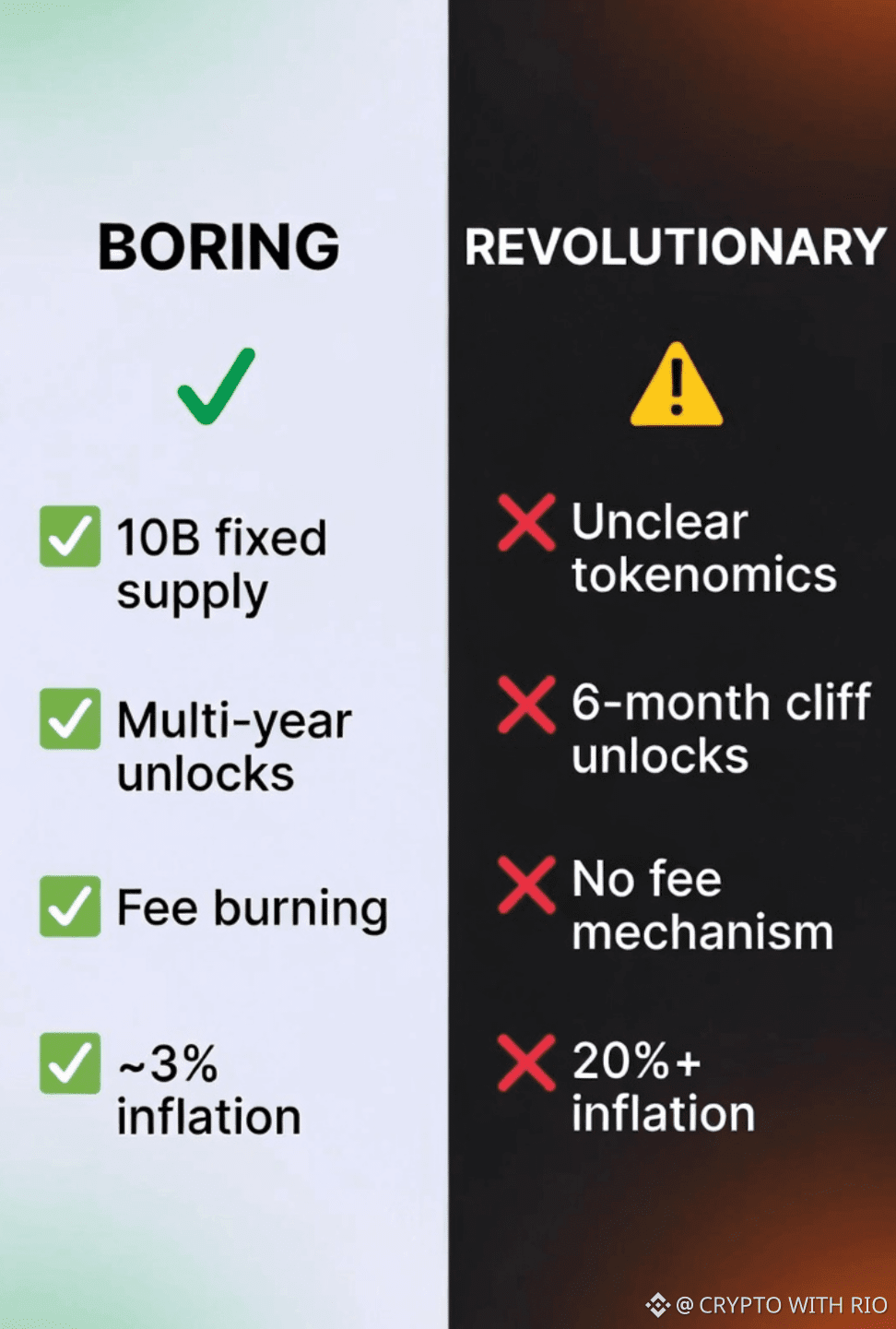

most of these "payment optimized" chains are just vaporware with better marketing. but Plasma actually committed to some boring fundamentals that matter

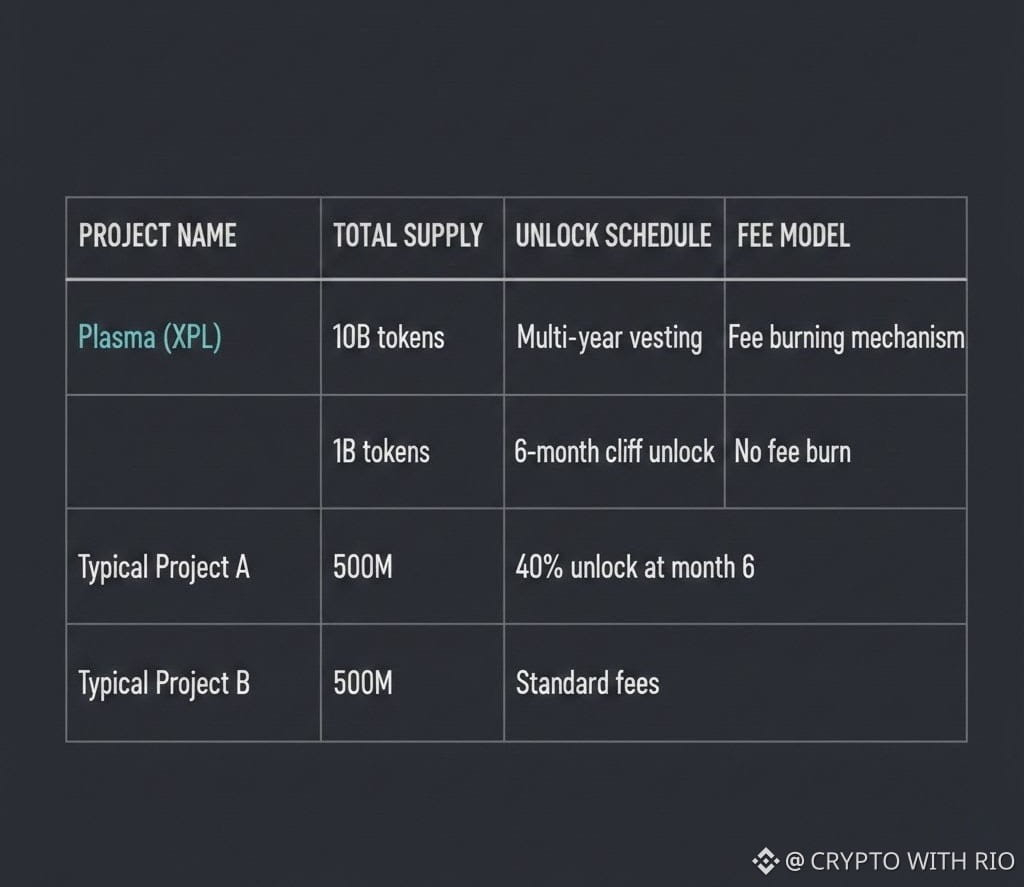

Tokenomics that don't scream exit:

• 10B supply (not the usual inflate-to-infinity model)

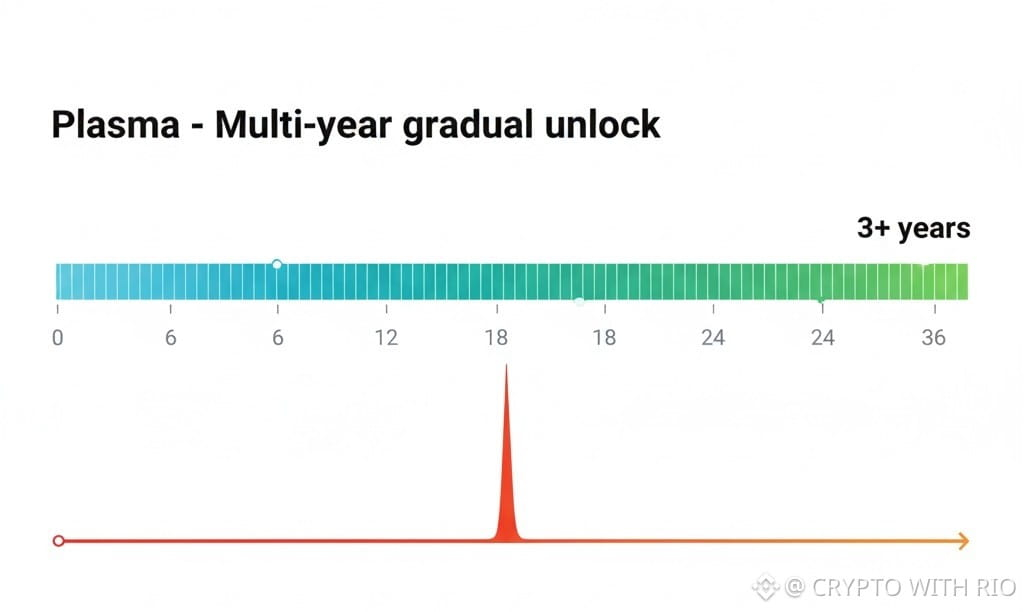

• unlock schedules stretching years, not months

• fees get burned → inflation trends down to ~3% over time

is it perfect? nah.

the validator set is still pretty centralized last i checked, and "zero fee" chains usually end up with spam problems eventually. those are real concerns.

but compared to the usual pump-and-dump tokenomics where insiders unlock 40% in month 6? this actually feels like they want the project to exist in 2027.

What made me pay attention:

they didn't launch with a 50-page whitepaper full of equations no one reads. just "here's how it works, fees are low, supply is fixed-ish, validators stake, done."

not everything needs to be revolutionary. sometimes "boring and probably won't collapse" is the alpha.

currently on my watch list. what's your take on the centralization trade-off?