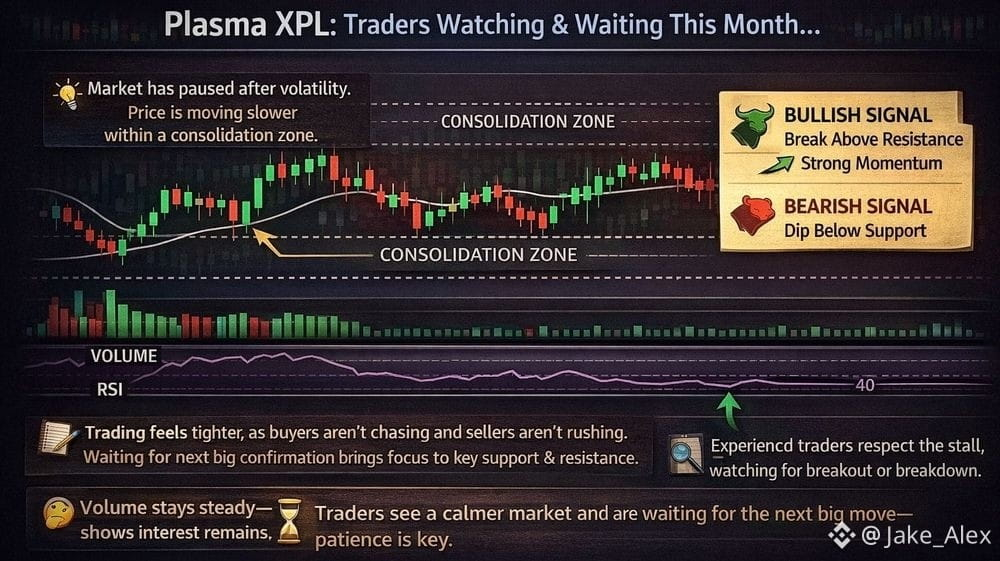

Plasma is one of those Layer 1 tokens that immediately signals its difference not through headlines or hype, but through how it moves—or doesn’t—on a chart. Holding it, the first thing you notice isn’t volatility, it’s the way liquidity behaves. Price often drifts slowly, then jumps in sharp bursts, and not always in response to news or sentiment. That pattern isn’t random; it’s a reflection of how the protocol is structured around stablecoin settlement, sub-second finality, and Bitcoin-anchored security. When you watch closely, you see that market behavior is inseparable from the chain’s incentives and architectural choices.

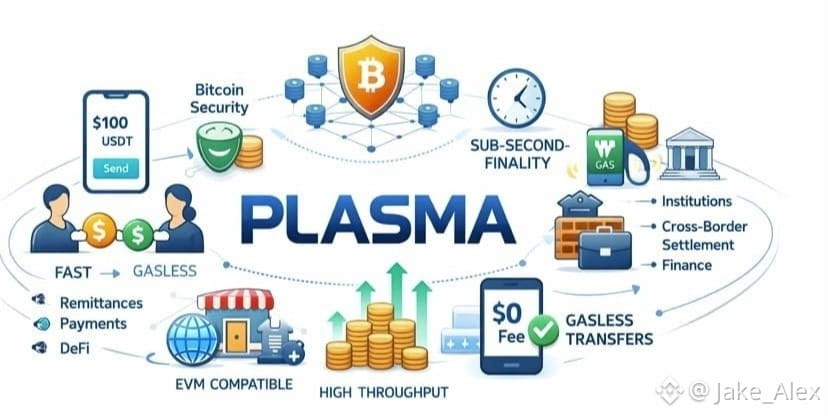

The stablecoin-first design shapes VAN-like behavior quietly. Gasless USDT transfers and stablecoin-native gas mean that most activity occurs where utility intersects with necessity rather than speculation. You see this in the charts: bursts of activity align with periods of payments or transfers, followed by stretches where volume drops to near nothing. Traders unfamiliar with these mechanics assume stagnation, mispricing the token. The token isn’t being ignored; the usage is episodic and functional, not reflexive. That creates liquidity gaps that feel arbitrary until you understand the underlying flows.

EVM compatibility adds another layer of subtlety. Because developers can deploy Reth contracts seamlessly, adoption can grow independently of token movement. You notice periods where the chain is busy with smart contract deployment, yet Plasma’s token barely moves. That decoupling frustrates momentum traders, but it reflects an intentional separation between ecosystem activity and token velocity. Incentives leak slowly into the market through staking or validator rewards, compounding over time. Price reactions often lag adoption, creating a persistent misalignment between perception and reality.

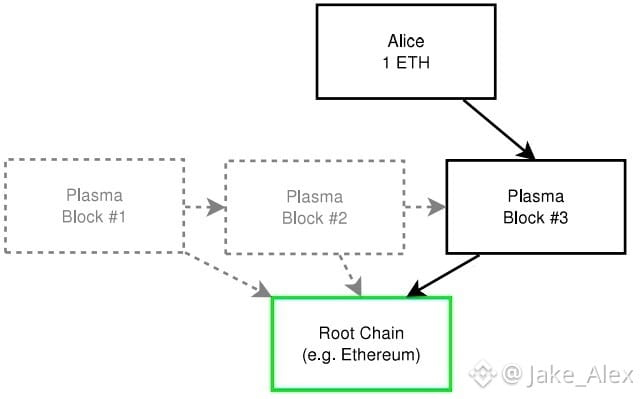

Sub-second finality and Bitcoin-anchored security further shape liquidity. The network settles payments quickly, but that speed doesn’t create continuous market churn. Traders accustomed to conventional blockchains expect reflexive liquidity, but Plasma’s structure absorbs shocks differently. You see how order books thin during quiet periods, then suddenly respond when stablecoin flows hit the chain. Those micro-gaps aren’t random volatility—they’re structural. Misunderstanding this produces trading mistakes and mispricing that appears irrational to casual observers.

Stablecoin-centric features have a paradoxical effect on token psychology. Because USDT transfers can occur gaslessly, most users interact with the chain without touching the native token. That limits visible demand, thinning order books in ways the market often misinterprets. Price can drift for days even when usage is high. Traders misread activity gaps as lack of adoption, when in reality the ecosystem functions precisely as intended. The token absorbs systemic pressure rather than driving it, and that pattern requires a mindset shift: you trade the token, but you must watch the underlying flow to understand it.

Liquidity gaps are amplified when adoption skews toward institutional flows. Payments, cross-border remittances, and financial settlements often occur in discrete, predictable clusters. You notice sudden jumps in volume during end-of-day or payroll windows, followed by long idle periods. Conventional chart reading fails here. Plasma doesn’t generate constant speculative demand; its usage is dictated by operational cadence. Traders who assume continuous flow overestimate activity and get trapped by perceived breaks in momentum.

There’s a real tension between infrastructure and market psychology. Plasma’s design emphasizes neutrality, censorship resistance, and predictable settlement, but those same qualities produce behavior that looks erratic to speculative eyes. Price reacts sharply to small shifts in available liquidity because a significant portion of the token supply is either staked or idle. Unlocking events or validator adjustments can create disproportionate market moves. I’ve held through these stretches, seeing the disconnect between activity and perceived interest, and learned that mispricing here is rarely about fundamentals; it’s about expectations misaligned with structural reality.

The effect of this structure compounds over time. As more institutions or high-adoption users interact with the chain, bursts become larger but remain infrequent. You begin to notice the rhythm: adoption doesn’t chase price, price chases adoption. That inversion frustrates traders expecting conventional reflexive markets. The token behaves like a utility lever, not a speculative instrument. Understanding Plasma means reading flows and timing, not narratives or social sentiment. Market misreadings are baked into every chart until you internalize that distinction.

Watching Plasma teaches an uncomfortable truth about stablecoin-focused infrastructure: its market will always feel discontinuous. Quiet periods aren’t failure; sudden spikes aren’t speculation. They are the natural expression of an ecosystem built for functional utility first, market attention second. Traders who fail to adjust interpret every lull as weakness, but the rhythm is consistent once you see it. The token reflects operational cadence more than headlines, and liquidity gaps are a mirror of adoption cycles, not disorder.

Ultimately, Plasma should be read not as a conventional Layer 1 token but as a reflection of stablecoin settlement flows. Its market behavior is the shadow of protocol choices: gasless USDT transfers, Bitcoin-anchored security, sub-second finality, and episodic usage. Price volatility emerges from perception mismatched with structure, not from fundamental instability. Observing Plasma closely teaches that infrastructure assets often move according to the ecosystem’s internal logic, not the speculative narratives surrounding them. Recognizing that allows a trader to see the market as it is, not as it is imagined.