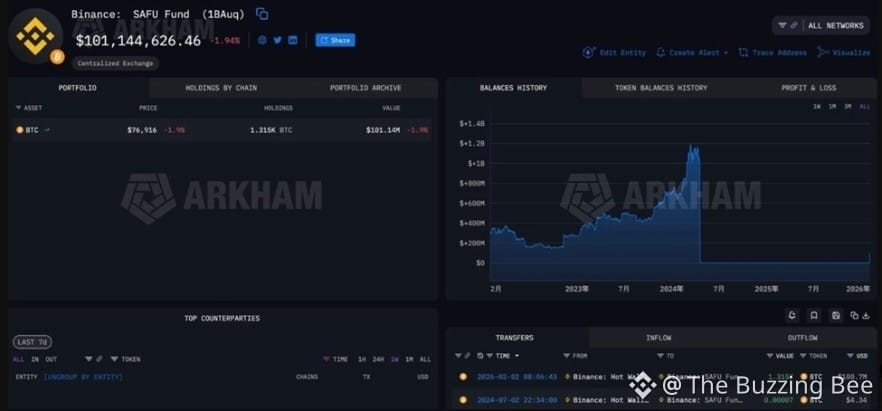

Binance has executed the first Bitcoin purchase under its newly announced $1 billion SAFU conversion plan, acquiring 1,315 BTC, valued at approximately $100.7 million.

The purchase, coming just days after the repurposing of its SAFU fund to a Bitcoin reserve, comes as markets struggle through another bout of heavy selling pressure.

On February 2, on chain data confirmed that the Binance SAFU Fund address received 1,315 BTC worth $100.7 million.

It marks the first completed tranche of the exchange’s plan to convert its Secure Asset Fund for Users from stablecoins into Bitcoin over a 30 day period.

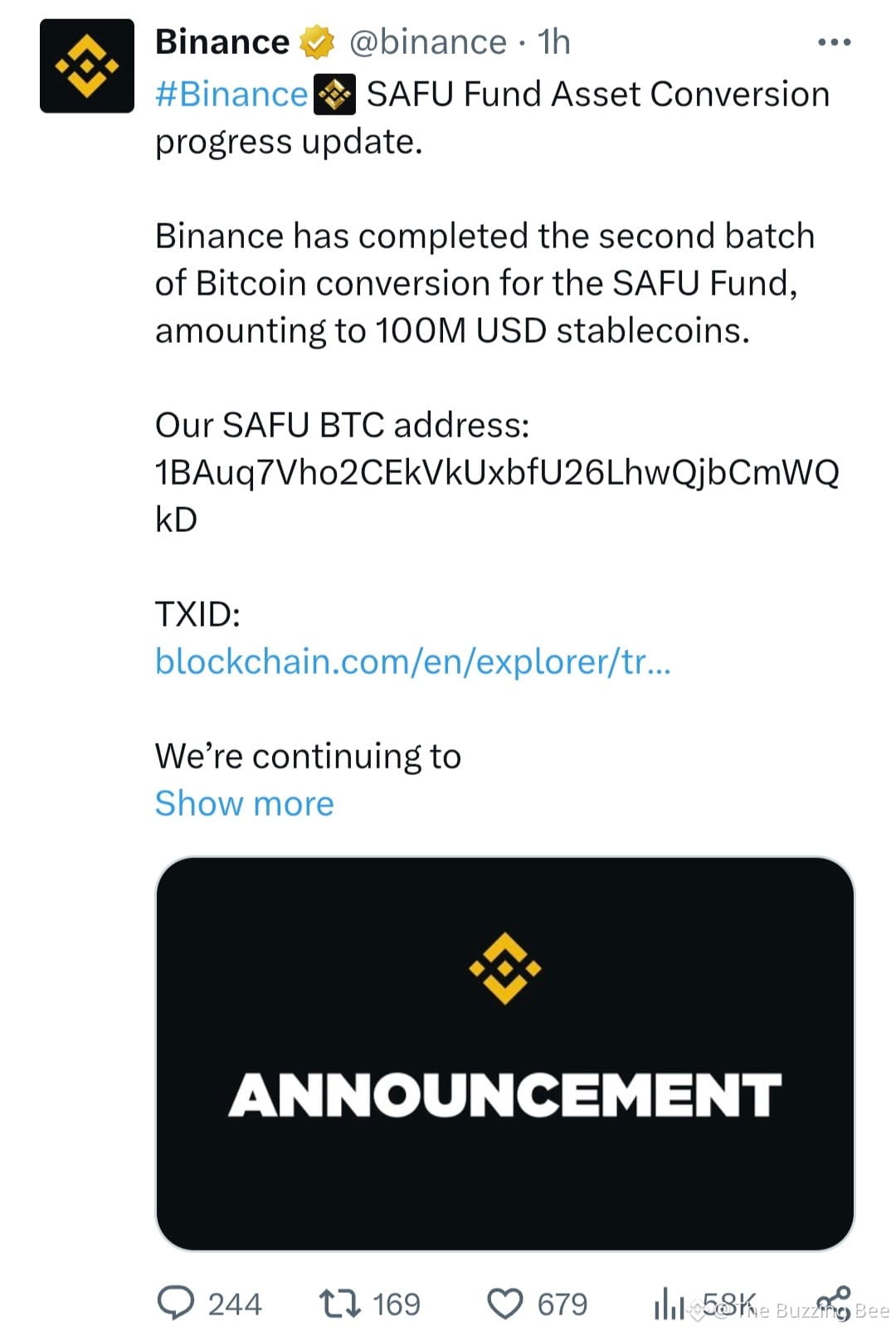

Binance later confirmed the transaction, stating that $100 million in stablecoins had been converted and that further BTC acquisitions would follow until the full $1 billion target is reached.

While Binance did not explicitly describe the move as a market intervention, the timing is indeed consequential. It comes as Bitcoin price remains in murky waters, trading below the psychological $80,000 threshold.

“I am always surprised that those who have the most to lose by a falling bitcoin ($80,000 line in the sand) don’t defend it over the weekend,” remarked Jim Cramer, host of CNBC’s Mad Money.

Indeed, Bitcoin suffered a brutal weekend, revealing a deep market divide between opportunity and structural vulnerability.