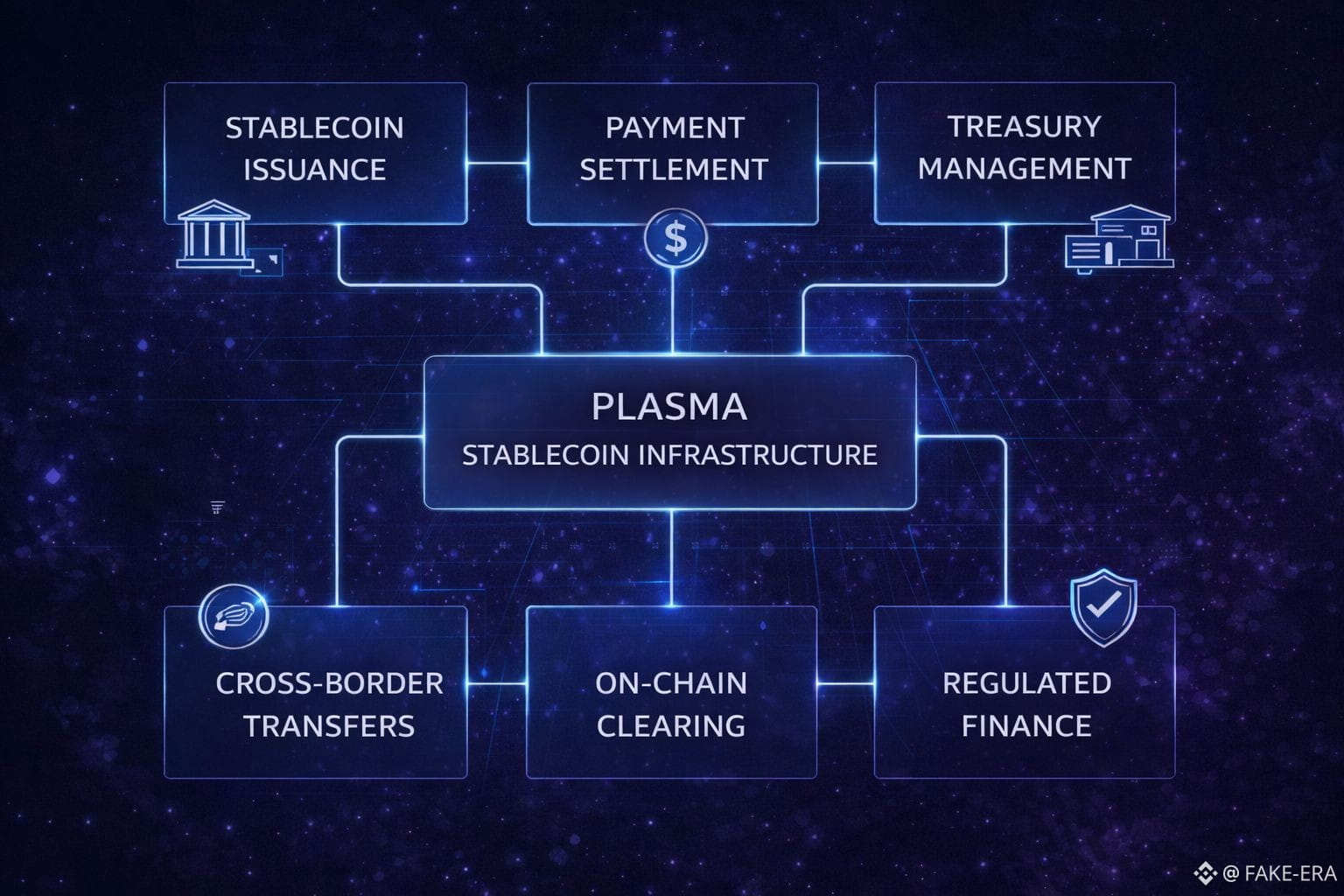

Most blockchains talk about applications. Plasma talks about infrastructure. That difference matters. Plasma is not trying to reinvent social apps, NFTs, or short-term DeFi primitives. It is focused on something far more foundational: how digital money actually moves, settles, and remains reliable at scale. Its use cases emerge not from speculation, but from the structural problems of stablecoins and financial rails.

At its core, Plasma is designed for environments where predictability matters more than novelty. This makes its use cases less flashy, but significantly more durable.

Stablecoin Issuance at Institutional Scale

One of Plasma’s most important use cases is large-scale stablecoin issuance. Today, most stablecoins operate on general-purpose blockchains that were never designed for monetary reliability. Fees fluctuate, execution ordering is unpredictable, and finality assumptions can break under stress. Plasma addresses this by treating stablecoins not as tokens, but as monetary instruments.

For issuers, this means a chain where settlement behavior is deterministic. Transactions behave the same way every time, regardless of congestion. This is critical for entities that issue regulated or reserve-backed stablecoins, where unpredictability is a liability. Plasma provides a base layer where issuance, minting, burning, and circulation happen under controlled conditions, closer to financial infrastructure than consumer crypto.

High-Volume Payment Settlement

Payments are not about throughput alone. They are about consistency under load. Plasma’s architecture is well suited for payment settlement systems where thousands or millions of transactions must clear without surprises. Retail payments, remittances, and merchant settlements require more than speed — they require timing guarantees.

Plasma enables payment processors to build systems where stablecoin transfers behave like digital cash registers. No fee spikes. No reordering. No ambiguous settlement windows. This makes Plasma suitable for back-end payment rails that users may never see, but depend on every day.

Stablecoin-Based Treasury Management

Another underappreciated use case is treasury management. Corporations, DAOs, and institutions increasingly hold stablecoins as operational capital. On most chains, treasury operations are exposed to execution risks, MEV, and unpredictable costs.

Plasma allows treasuries to move, allocate, and rebalance stablecoin holdings in an environment optimized for capital preservation, not yield chasing. Treasury flows can be automated, audited, and executed with confidence that the system itself will not introduce unintended financial risk.

On-Chain Clearing and Settlement Layers

Traditional finance separates execution from settlement. Crypto often collapses them into one step. Plasma reintroduces this separation by acting as a clearing and settlement layer for stablecoin-denominated activity.

This enables financial applications to execute trades, obligations, or transfers elsewhere, while final settlement happens on Plasma. The result is reduced systemic risk. Obligations are finalized in a deterministic environment, lowering the chance of cascading failures during market stress.

Cross-Border Stablecoin Infrastructure

Cross-border payments remain slow, expensive, and fragmented. Stablecoins solve part of the problem, but infrastructure limitations remain. Plasma’s use case here is subtle but powerful: acting as a neutral settlement backbone where cross-border flows converge.

Instead of routing stablecoins through multiple chains, bridges, and liquidity pools, Plasma provides a consistent layer where international transfers can finalize cleanly. This is especially relevant for corridors where regulatory clarity exists but technical reliability is lacking.

Regulated Financial Products

Plasma is structurally aligned with regulation-friendly financial products. This includes tokenized deposits, compliant stablecoins, and future digital cash instruments. Its deterministic execution model allows rules to be enforced at the protocol level rather than through external monitoring.

This makes Plasma suitable for institutions that need programmable compliance without sacrificing performance. Rules are not layered on top — they are embedded into how the system operates.

Financial Infrastructure for Builders, Not Traders

Perhaps the most important use case of Plasma is abstract: it enables builders to create financial systems without worrying about base-layer instability. Developers can assume consistent behavior and focus on product logic rather than defensive engineering.

Plasma becomes the plumbing layer — invisible when it works, catastrophic only when missing. And that is exactly how good financial infrastructure should behave.

Use Cases Rooted in Reality

Plasma’s use cases do not promise instant excitement. They promise durability. In an ecosystem crowded with experimentation, Plasma is building for the parts of finance that must not fail. Stablecoins, payments, settlement, and treasury operations are not optional features of the future financial system they are its backbone.

Plasma is not trying to sit on top of finance. It is trying to run underneath it.