Recently, $BTC price suddenly went down sharply, falling around the $74,000 level. Other big cryptocurrencies like Ethereum also dropped heavily at the same time. This has created strong selling pressure through the whole crypto market.

1. Heavy Liquidations (Forced Selling)

Many traders borrow money to bet that Bitcoin will go up. When the price instead falls, the exchange forces them to close those positions or liquidates their trades. This pushes the price down even faster in a chain reaction.

2. Investors Taking Profits or Getting Out

After months of rising prices, many big investors are selling to lock in profits or reduce risk. When large investors move out of Bitcoin, prices decline because demand weakens.

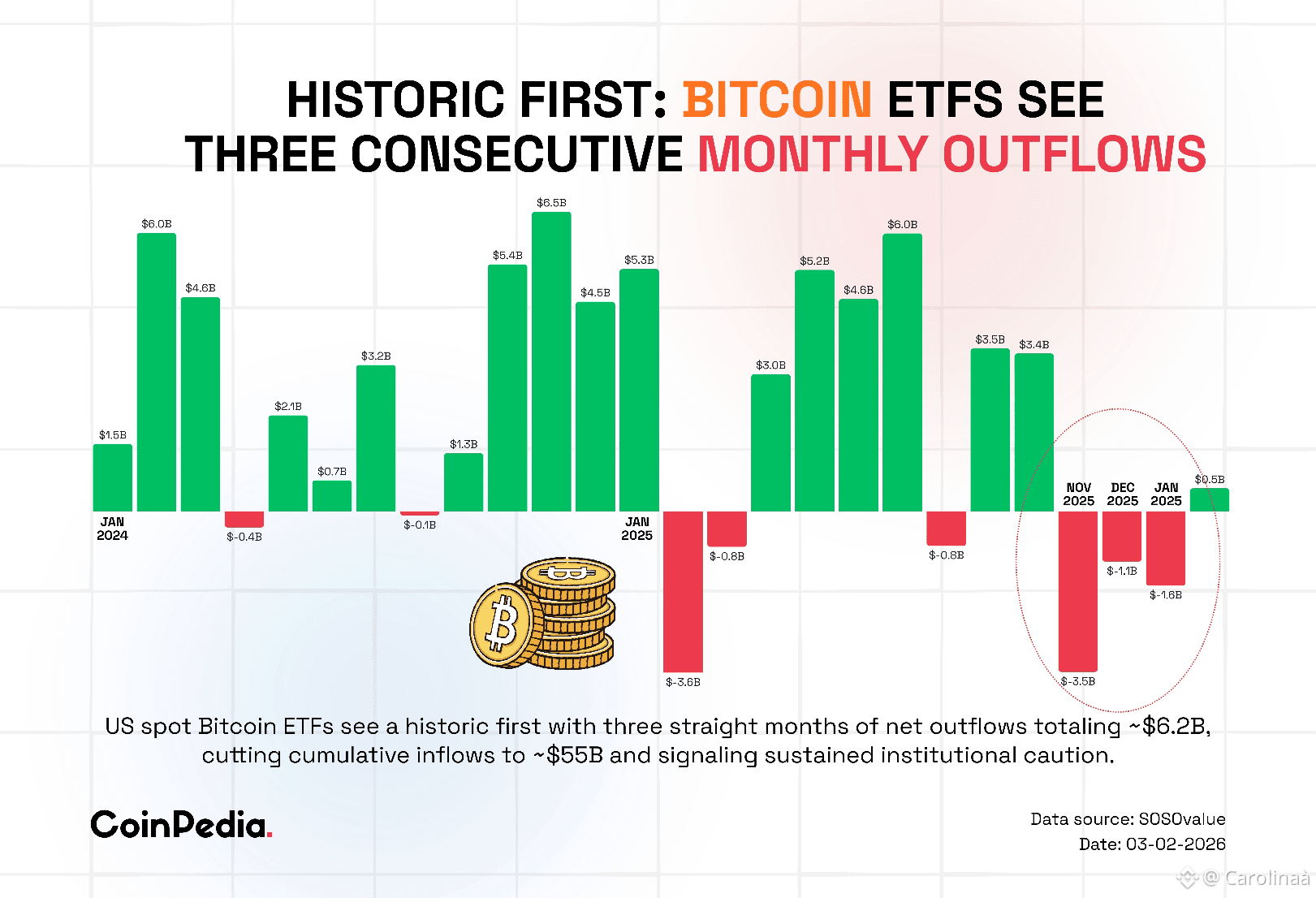

3. Outflows from Bitcoin ETFs

Bitcoin exchange-traded funds (ETFs) — investment funds that hold Bitcoin — have seen large outflows of money recently. When investors sell these ETF shares, it reduces buying pressure for Bitcoin itself.

4. Market Fear & ‘Risk-Off’ Mood

Crypto markets are in “extreme fear” right now — a measure of how worried investors are. This often makes people sell more and hold cash instead of riskier assets like Bitcoin.

Some Analysts Predict Even Lower Levels

Some market experts believe that Bitcoin could continue falling if current trends continue — possibly below $40,000 — because the market may still have more downward pressure.

All of these forces happening at once create a cascade of selling, which sharply pushes Bitcoin’s price down.