Why Dusk Puts Institutions First

Most blockchain projects rush to grab attention from everyday users. They lean hard into hype, airdrops, and big promises. Dusk Network just doesn’t play that game. Instead, Dusk goes straight for the institutions—banks, exchanges, asset issuers, groups that live and breathe regulation. This isn’t because Dusk doesn’t care about retail users or plans to keep them out. It’s just that real change in finance starts at the top, where rules matter, and where blockchain can actually stick.

Dusk sits right where law, finance, and cryptography meet. That’s home turf for institutions. They have compliance teams, auditors, legal departments—the works. Any blockchain that claims to plug into real-world finance can’t dodge these rules or just tack on compliance later. But a lot of retail-focused chains do exactly that. Dusk flips that idea on its head. By building for institutions from day one, Dusk bakes regulation into its DNA, not as an afterthought or a patch.

Privacy is a big part of this approach. Dusk doesn’t treat privacy as hiding everything from everyone. It’s about sharing information only with the right people—regulators, auditors, courts—while keeping it private from everyone else. That’s how banks already work. They don’t post your transaction history on a public board, but they’ll share it with authorities when needed. Institutions get that instantly. For them, privacy isn’t just a nice-to-have—it’s non-negotiable. Retail users care about privacy too, but for institutions, it’s a requirement.

Then there’s legitimacy. Institutions are the ones issuing stocks, bonds, funds, and all kinds of financial products. Regular people only get to buy in once those products exist. So, if Dusk helps institutions issue and settle these assets in a compliant way, retail adoption just follows. The reverse isn’t true. Chains built for fast retail speculation usually can’t win over major issuers later. They never built the trust or the guardrails that institutions need.

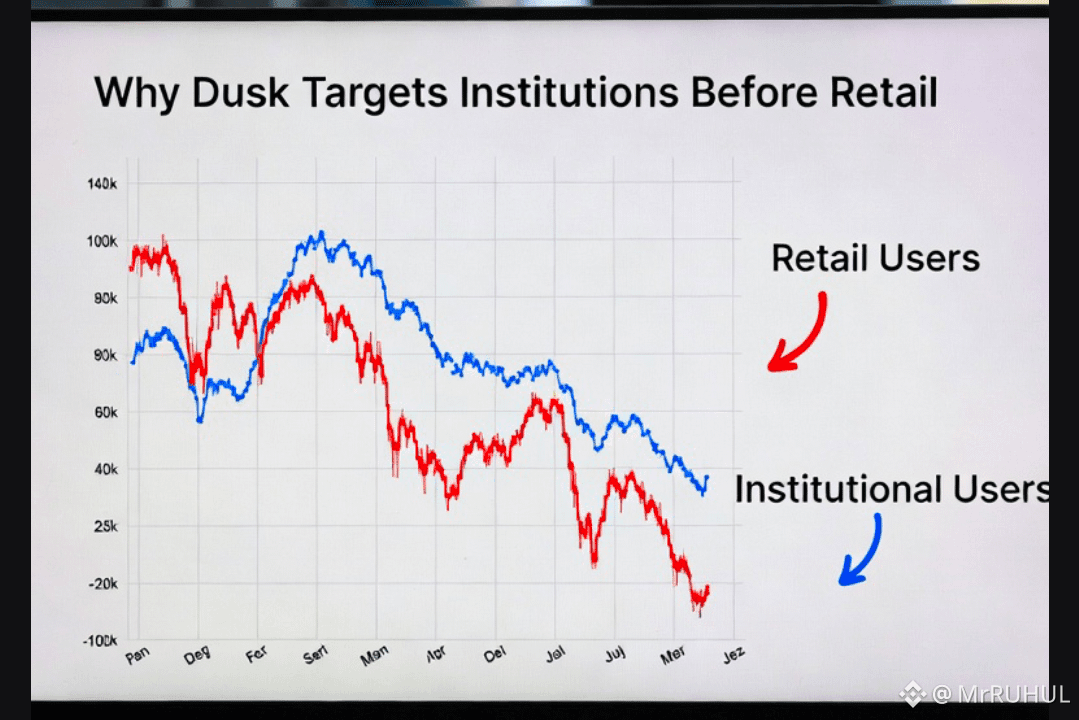

Another thing: institutions aren’t quick to change, but when they do, they commit. Retail trends can spike and fade overnight—everyone piles in, then bails out. Institutions, though, move slow and steady. When a bank or exchange adopts new tech, they stick with it for years. Dusk aims for this kind of lasting impact, not just viral moments. The goal is to build tools that survive both regulators and bear markets.

Governance matters too. Institutions want rules they can count on, not protocols that swing with community mood swings. Dusk keeps protocol changes separate from the noise of speculation or popularity contests. Maybe that feels less “Web3” or grassroots, but for institutions, it’s a huge plus. They need stability before they’ll risk their money or their reputation.

Retail users aren’t left out, though. They just get a different role. When institutions lay down the rails, everyone benefits. Retail users get better security, clearer legal protections, and products that actually follow the rules. Instead of asking people to trust wild experiments, Dusk wants to make blockchain feel safe and familiar. For most people, that’s how adoption really happens. Trust comes first. The crowds follow.

Dusk also gets that blockchain won’t take over finance overnight. Real adoption happens by plugging into the system we have, fixing what’s broken, and working with the rules already in place. Institutions hold the keys. By solving their toughest problems—privacy, compliance, issuing assets, settling trades—Dusk becomes part of the backbone, not just another loud idea.

So, why start with institutions? Because it’s the harder road, but it’s the one that lasts. Dusk is betting on depth, not just numbers. Trust, not just hype. If it works, retail users won’t need to be sold—they’ll just show up, using systems that already fit the world they know. Quietly, securely, and for the long haul.@Dusk #Dusk $DUSK