Vanar Chain did not emerge from the familiar playbook of crypto infrastructure built to impress other crypto natives. It was not designed to win Twitter debates about block times or to chase liquidity with mercenary incentives. It was designed to solve a far less glamorous but far more consequential problem: how value, identity, and behavior move when blockchain infrastructure is embedded inside entertainment, games, and brands rather than financial abstractions. That single design decision changes almost everything about how the chain behaves, how capital flows through it, and why most analysts still misunderstand its trajectory.

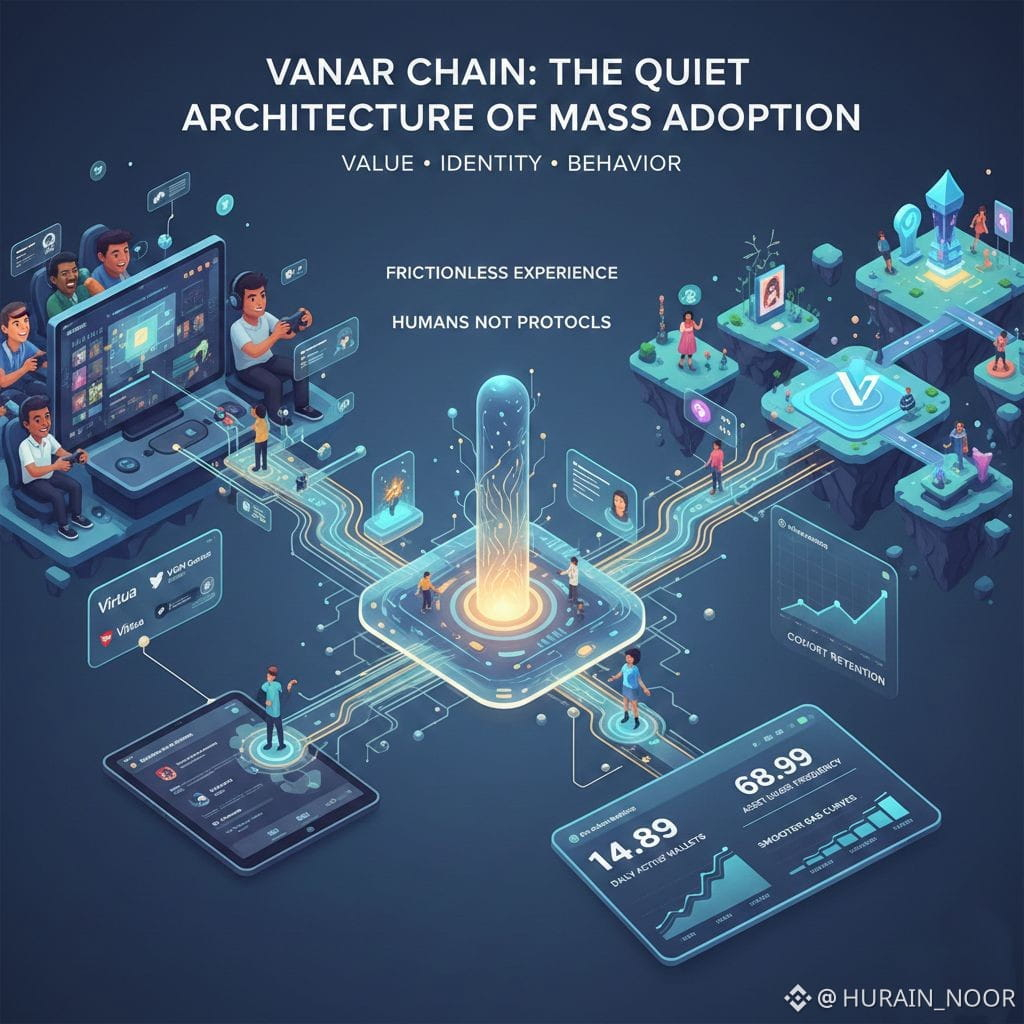

Most Layer-1 chains optimize for throughput, composability, or developer tooling because their users are protocols. Vanar optimizes for frictionless experience because its users are humans who do not think in wallets, gas fees, or transaction hashes. That distinction is not philosophical; it shows up directly in on-chain data. When wallets are created implicitly through gameplay or digital ownership rather than explicitly through DeFi onboarding, retention curves behave differently, transaction clustering looks different, and economic activity spreads horizontally instead of concentrating into liquidity pools. Traders who only look at TVL miss this entirely.

At the protocol level, Vanar’s choice to remain EVM-compatible while deviating from Ethereum’s cultural assumptions is its most underappreciated move. EVM compatibility is not about attracting Solidity developers anymore; it is about tapping into the global tooling stack for analytics, indexing, wallets, and security. Vanar inherits Ethereum’s economic language without inheriting Ethereum’s congestion economics. This matters because consumer applications do not tolerate fee volatility. In game economies, a transaction fee is not a cost; it is friction that alters player behavior. When friction rises, activity collapses non-linearly. Vanar’s architecture is tuned to prevent that collapse long before it shows up in charts.

The consensus layer tells an even more revealing story. Vanar’s Proof of Reputation model is not a branding gimmick; it is an attempt to price trust directly into block production. In ecosystems where brands, IP holders, and entertainment companies interact with blockchain rails, reputational risk matters more than yield. Validators are not anonymous capital pools but known entities with asymmetric downside if the network fails. This reshapes the attack surface. Instead of defending against purely economic attacks, the system defends against reputational contagion. The result is a chain where security incentives are anchored in off-chain realities, something most purely financial blockchains ignore.

This becomes critical when examining Vanar’s flagship environments like Virtua Metaverse. Metaverses fail not because of graphics or lore but because their internal economies collapse under speculative extraction. Most Web3 virtual worlds front-load value into land sales and token emissions, creating an economy that peaks before users arrive. Virtua reverses that order. Asset creation is downstream of participation, not upstream of speculation. On-chain, this shows up as lower initial velocity of assets but higher long-term holding periods. The charts that matter here are not floor prices but cohort retention curves tied to asset usage frequency.

The same economic discipline is visible in the VGN Games Network. GameFi usually fails because it confuses rewards with income. When players enter a game primarily to extract value, the game becomes a labor market with infinite labor supply and collapsing wages. Vanar’s gaming stack instead treats the token as an infrastructural lubricant rather than a paycheck. VANRY is consumed through participation rather than farmed through repetition. That subtle shift aligns player incentives with developer incentives, which is why daily active wallets in entertainment-driven chains often look modest early on but decay far more slowly than yield-driven ecosystems.

From a market structure perspective, VANRY’s behavior makes sense only when viewed through this lens. The token does not yet function as a reflexive asset tied to DeFi leverage cycles. Its volume spikes correlate more strongly with ecosystem releases and platform usage than with Bitcoin dominance or macro risk-on signals. This is unusual and easy to misinterpret as weakness. In reality, it suggests that VANRY is still pricing utility before narrative. Historically, assets that follow this pattern remain undervalued until a visible usage inflection forces repricing. The risk, of course, is time. Markets punish patience long before they reward fundamentals.

Another overlooked dimension is how Vanar positions itself relative to Layer-2 scaling narratives. While much of the industry is fragmenting liquidity across rollups, Vanar sidesteps the issue by anchoring experience-heavy applications directly on its L1. For consumer use cases, latency and finality consistency matter more than composability across DeFi protocols. Rollups optimize for capital efficiency; Vanar optimizes for behavioral efficiency. This is why its roadmap emphasizes stability and predictability over aggressive throughput benchmarks. In on-chain analytics, this manifests as smoother gas usage curves and fewer extreme congestion spikes during user growth events.

Oracles and data integrity are another quiet strength. Entertainment and brand-driven applications rely less on price feeds and more on state verification, identity persistence, and content ownership. Vanar’s data flows prioritize deterministic outcomes over market-reactive inputs. This reduces oracle attack vectors while increasing reliability for applications that must behave consistently across jurisdictions and user demographics. It is not exciting, but it is precisely why enterprises are more likely to build here than on chains optimized for liquidation engines.

Capital flows are beginning to reflect this differentiation. While speculative liquidity continues to chase short-term narratives elsewhere, longer-horizon capital is positioning in ecosystems that can plausibly onboard non-crypto users without rewriting their entire stack every cycle. Vanar sits in that narrow category. The signal is not yet visible in headline metrics, but wallet aging data and repeat interaction rates hint at a base forming beneath the noise. These are the metrics institutional analysts watch before allocation, even if they never tweet about them.

The biggest structural risk for Vanar is not competition from faster chains but impatience from the market. Building for real adoption is slower than building for narrative dominance. The team’s background in entertainment and brands suggests they understand this, but token markets are unforgiving. If VANRY is pulled prematurely into speculative reflexivity, it could distort the very behaviors the ecosystem depends on. The challenge will be balancing liquidity with cultural integrity, a problem no purely crypto-native team has solved convincingly yet.

Looking forward, the most plausible breakout scenario for Vanar does not involve a DeFi summer or an NFT mania. It involves a single successful consumer product that never advertises itself as Web3. When users transact, trade, and create without thinking about the chain beneath them, on-chain metrics will spike in ways analysts are not trained to interpret. Transaction counts will rise without corresponding TVL, wallet growth will outpace token velocity, and VANRY’s valuation model will need to be rewritten.

Vanar is not trying to win the current cycle. It is positioning itself for the next phase of blockchain adoption, where infrastructure fades into the background and behavior becomes the asset. For traders willing to look beyond familiar charts and metrics, that is not a comforting story. It is a compelling one.