@Plasma The first time I looked at Plasma, it didn’t feel like many of the projects I’d seen in past cycles. There was no sudden fanfare, no promises of transforming the entire financial world overnight. Instead, it presented itself almost quietly, a network built with a sense of practical patience. It seemed aware of the space it was entering one already crowded with blockchains claiming speed, interoperability, or decentralization and yet, it didn’t try to outshout its neighbors. There was a certain groundedness to it, a willingness to focus on a very specific slice of the market rather than chasing every trend.

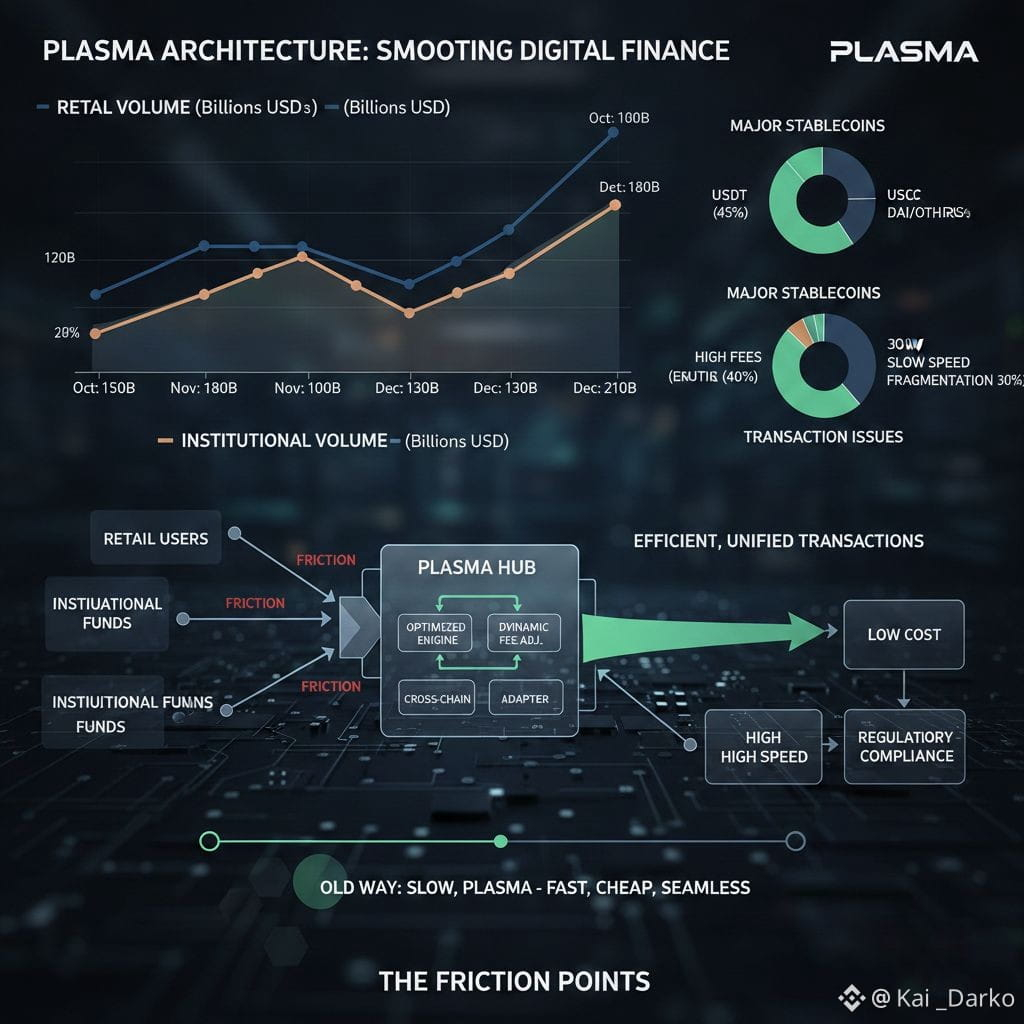

Plasma arrives at a moment when stablecoins are becoming increasingly central to digital finance. Retail users in high-adoption regions are moving vast amounts of value daily, and institutions are looking for ways to make transfers more efficient without compromising regulatory or network realities. Most existing solutions feel like improvisations, clever engineering, but still awkward. Transactions are often slow, costly, or fragmented across chains. Gas fees fluctuate unpredictably, and the user experience rarely matches the simplicity people expect from modern digital payments. It’s in this quiet discomfort of the market that Plasma stakes its claim, not by reinventing the wheel, but by observing the wheel’s friction points and trying to smooth them out.

What struck me first was the project’s approach to simplicity. By keeping certain features narrowly focused sub-second confirmation for stablecoin transactions, gasless transfers in the token users actually care about, and a network logic that prioritizes predictability over feature overload Plasma avoids the temptation of adding everything under the sun. It doesn’t try to be a playground for experimentation at the expense of reliability. This simplicity isn’t accidental; it’s a deliberate choice. In a world where networks often boast hundreds of capabilities, many of which users never touch, Plasma opts for quiet competence over crowded ambition.

The design decisions also reveal a thoughtful approach to trade-offs. By anchoring security to Bitcoin, it accepts some dependencies and delays in favor of neutrality and censorship resistance. It consciously trades some of the absolute flexibility that fully independent chains might claim, aiming instead for a measure of stability that can appeal to institutions accustomed to predictable settlement processes. There is an elegance to that compromise: Plasma could have pushed for maximum independence or for every possible transaction type, but it instead chose to constrain itself around a use case that is tangible, measurable, and broadly relevant.

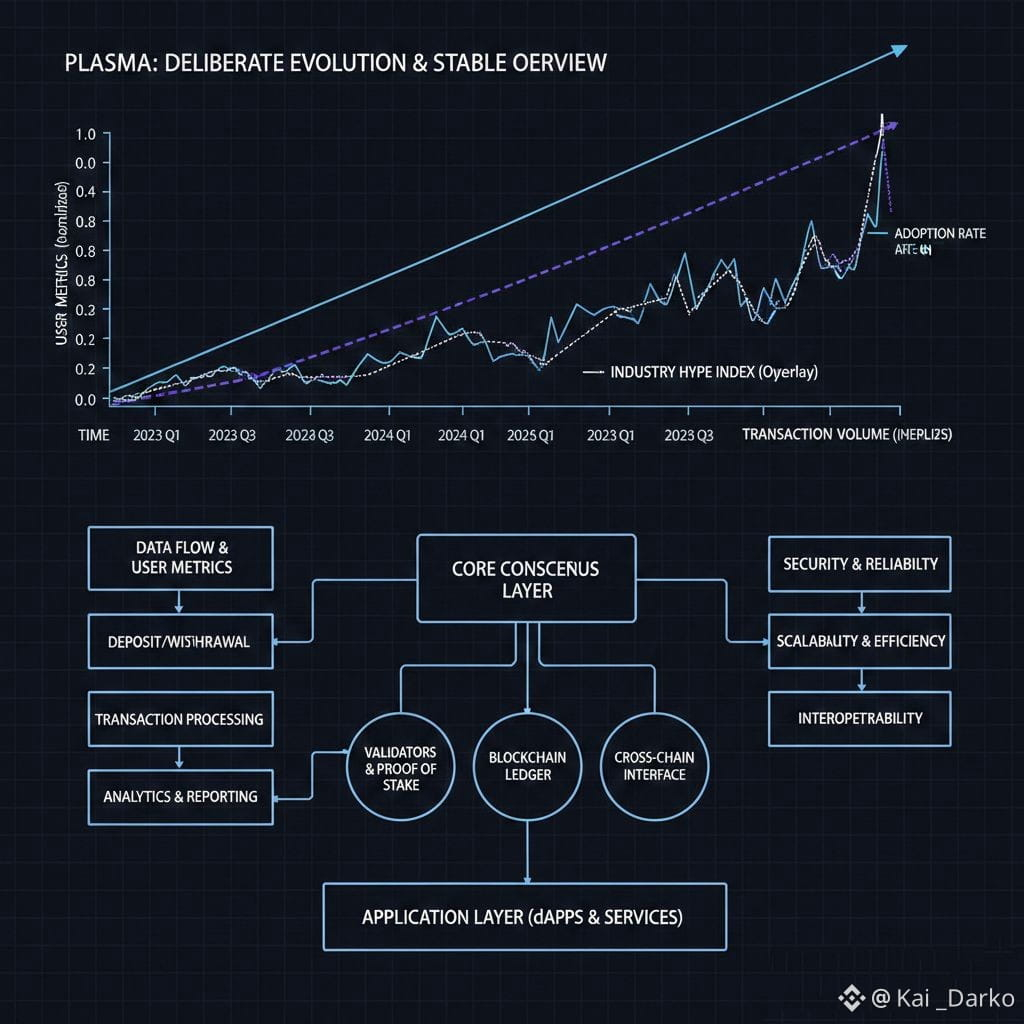

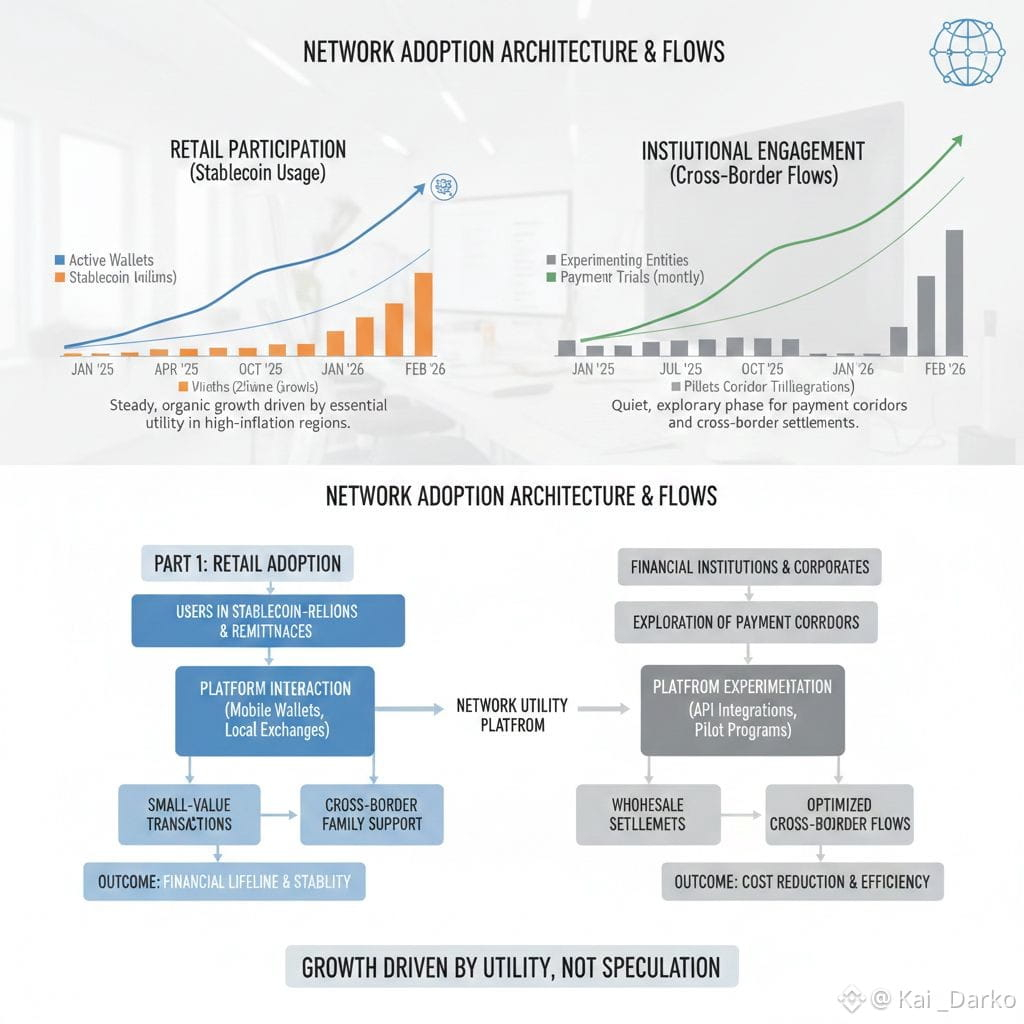

Watching adoption has been instructive. The network isn’t experiencing the kind of viral hype that drives speculative interest, but there is a quiet, organic growth among users who need exactly what it offers. Retail participants in regions where stablecoins are a lifeline are interacting with it in meaningful ways, while institutions exploring payments corridors and cross-border flows are experimenting without fanfare. Growth is neither explosive nor flashy, but steady enough to suggest that utility is driving engagement rather than narrative.

Of course, Plasma is not without limitations. Its focus on stablecoins, while pragmatic, leaves unanswered questions about broader ecosystem dynamics. How will it interact with a world where multiple stablecoins compete? Will the simplicity that serves current users limit future flexibility? And while sub-second finality is impressive, the underlying mechanics are still invisible to most participants, who may struggle to trust a system they can’t see in action. These are not minor points, but acknowledging them is part of understanding the network’s posture: it is deliberate, not magical, in what it attempts.

What makes Plasma quietly relevant, I think, is that it demonstrates an understanding of context that many projects ignore. It doesn’t seek to dominate headlines; it doesn’t need to. Its relevance comes from solving a clear, observable friction in the movement of money, and doing so in a way that balances speed, cost, and security. In observing it, I am reminded that the blockchain space is not only about bold visions but also about the networks that move value in ways that are quietly efficient, durable, and understandable.

By the time I step back from the technical layers, the user metrics, and the industry noise, Plasma presents itself less as a spectacle and more as a carefully tended system. Its direction is deliberate, its pace measured, and its choices intentional. For someone who has watched multiple cycles of crypto ambition and disappointment, there is a particular satisfaction in seeing a network that doesn’t overpromise but steadily occupies the space it identifies. It is neither the loudest nor the fastest, but it has a quiet coherence that makes it feel, in its own way, essential to the ongoing evolution of how digital money moves.