1) Executive summary

Ether.fi $ETHFI is a liquid staking and DeFi project that enables users to stake assets, access automated yield strategies, and spend against their crypto holdings. Users can stake ETH, BTC, or ETHFI to receive liquid derivative tokens that earn staking yields, deposit into Liquid vaults that allocate across DeFi protocols to optimize yield, or use Ether.fi Cash to borrow against their crypto collateral for real-world purchases via a Visa credit card settled on Scroll.

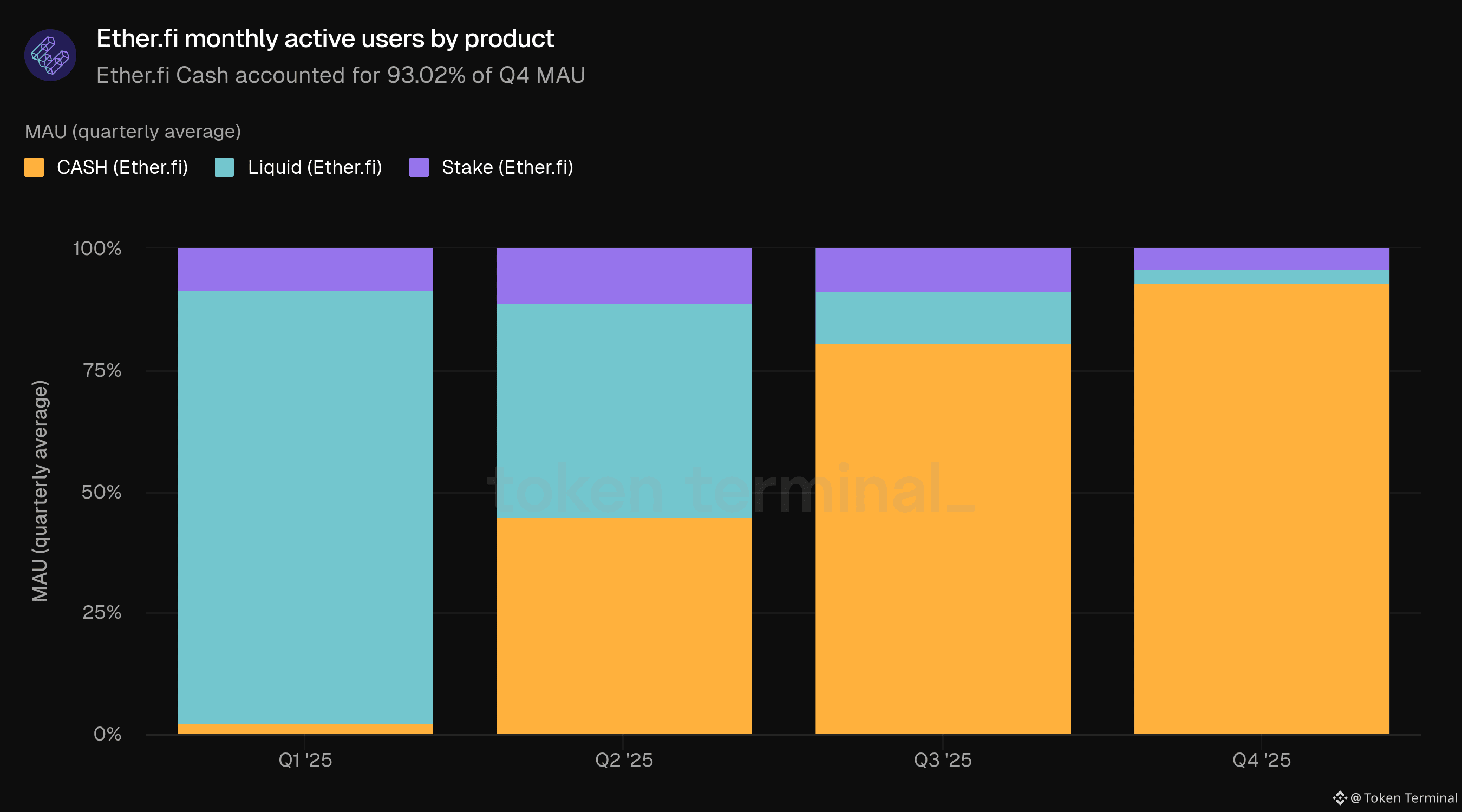

Q4 2025 saw divergent trends across Ether.fi's product lines. Core staking metrics moderated quarter over quarter, with TVL, fees, and revenue all declining from Q3 levels. However, all three metrics grew year over year, with revenue showing the strongest annual growth. Ether.fi Cash reached all-time highs in both spend volume and user activity, with quarterly spend volume more than doubling and cumulative 2025 volume surpassing $184m by year end. Monthly active users grew sharply both quarter over quarter and year over year, up nearly 9x from Q4 2024, driven almost entirely by Ether.fi Cash adoption.

The product mix shifted notably toward Ether.fi Cash. Cash's share of MAU grew from 81% to 93%, while its revenue contribution more than tripled. Despite this user growth, Stake continues to dominate the project's economics, accounting for the vast majority of both TVL and revenue. Liquid's share contracted across most metrics.

🔑 Key metrics (Q4 2025)

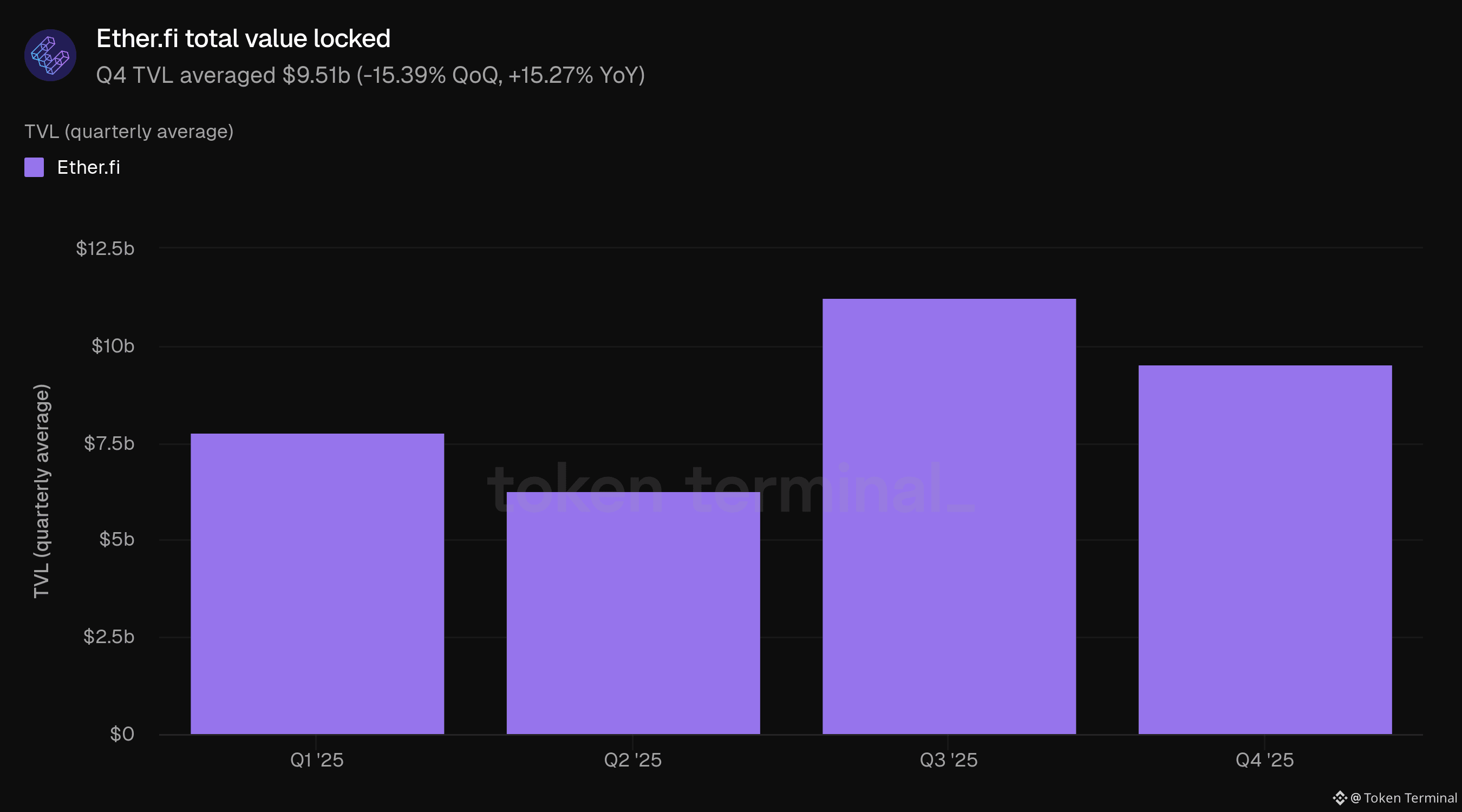

Total value locked: $9.51b (-15.39% QoQ, +15.27% YoY)

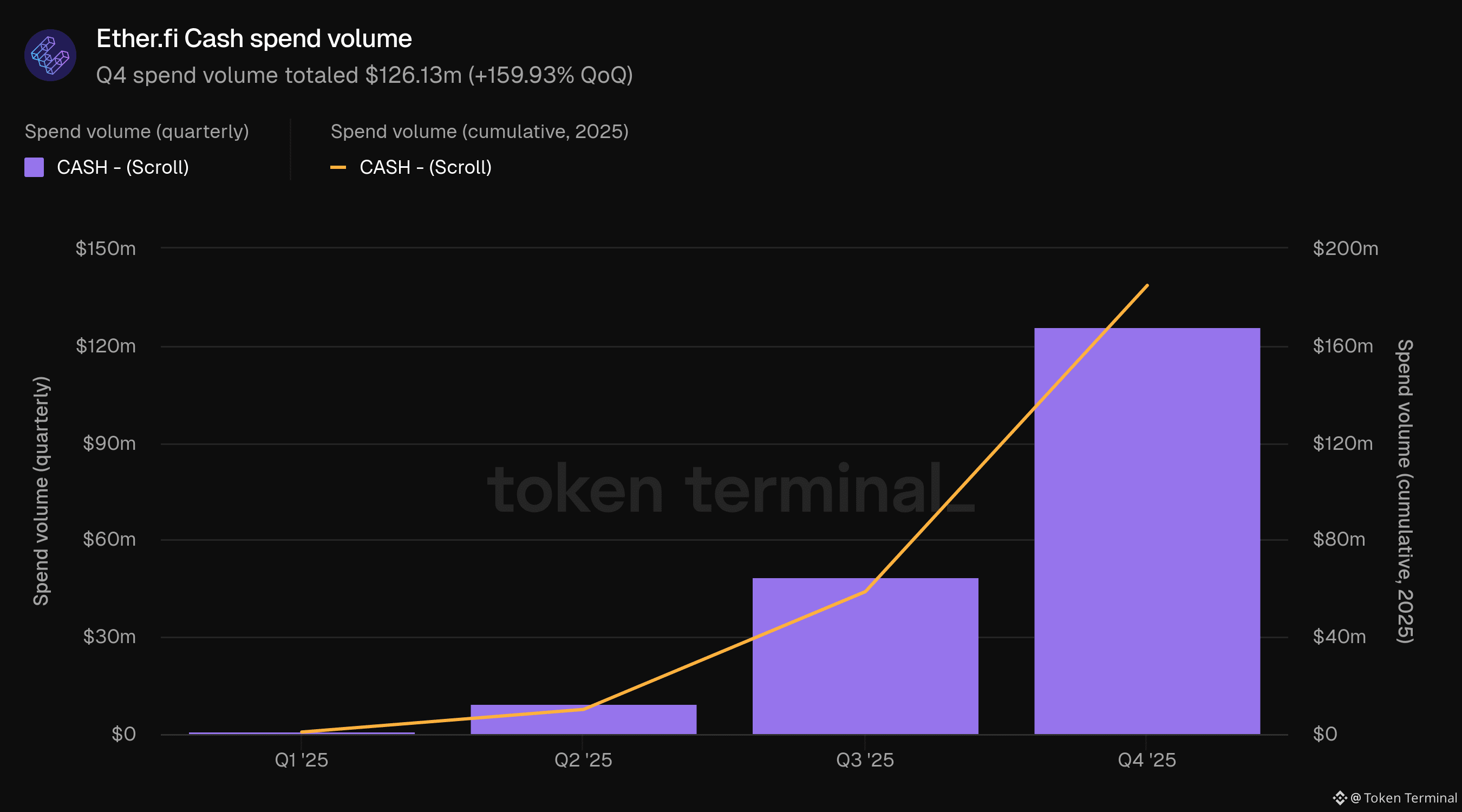

Ether.fi Cash spend volume: $126.13m (+159.93% QoQ)

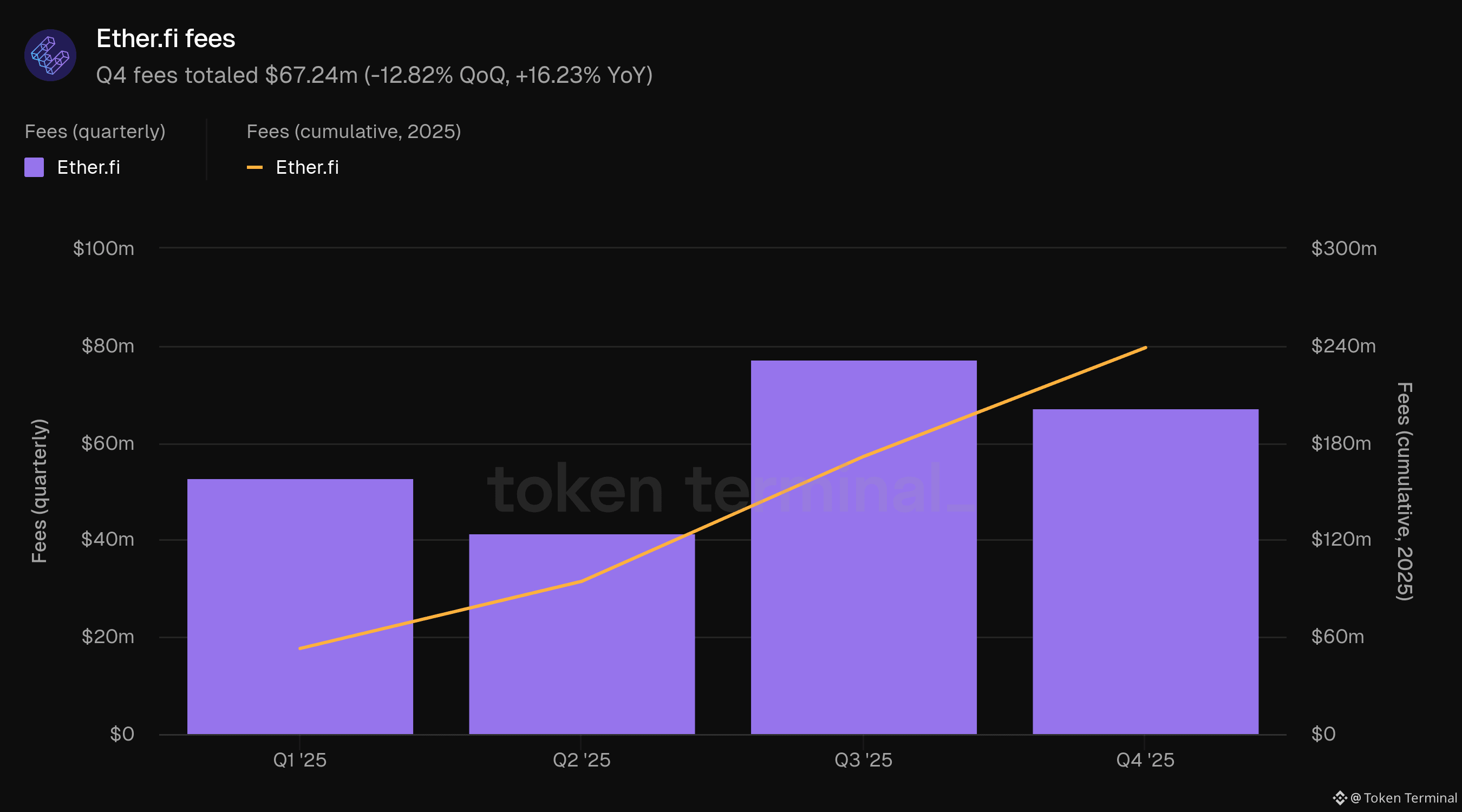

Fees: $67.24m (-12.82% QoQ, +16.23% YoY)

Revenue: $13.02m (-22.42% QoQ, +26.16% YoY)

Monthly active users: 19.9k (+68.64% QoQ, +780.92% YoY)

👥 Ether.fi team commentary

"The story continues to develop around the central theme of the "DeFi mullet" and Ether.fi's role in shaping what that actually looks like as one of the first products to begin to truly scale. The organization's focal point remains on feature completeness until there is true end-to-end parity with TradFi neobanking solutions. Significant progress was made in Q4, adding core elements like an Android app, free physical cards, and multiple types of fiat transfers.

The main priority for Q1 is accessibility across various languages, fiat currencies, and on/off ramping solutions, as well as driving down FX costs and other fees. The team also intends to invest in the corporate card offering, which is seen as easily a $100b market opportunity over the next 5-10 years. TVL is the north star for the yield suite of products, while daily active users and new users gained is the north star for the broader neobank alternative product."

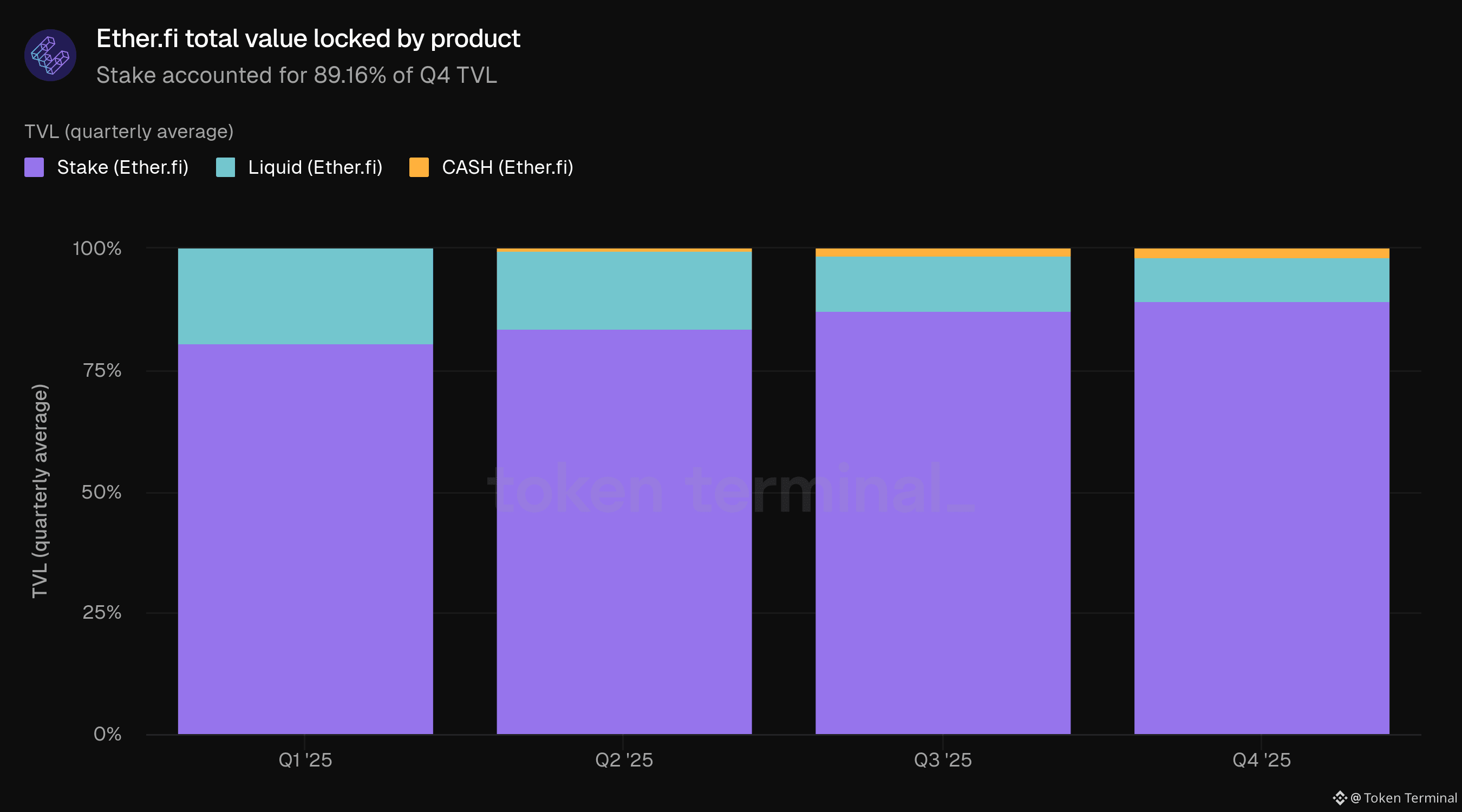

2) Total value locked

Total value locked (TVL) measures the total USD value of assets deposited across all Ether.fi products. Q4 TVL averaged $9.51b, down 15.39% from Q3's $11.24b but up 15.27% from Q4 2024's $8.25b. The product distribution shifted modestly: Stake's share grew from 87.25% to 89.16% of TVL, while Liquid's share contracted from 11.50% to 9.33%. Ether.fi Cash's portion grew slightly from 1.25% to 1.51%.

👥 Ether.fi team commentary

"The main items to highlight are the continued revenue growth and share of revenue coming from Cash versus the yield products. Growth in users and card spend continues to double every 2-3 months. Additionally, the user base is getting to a point where yield product deposits are growing from day-to-day usage of the Cash product. This was the original business logic of the vertically integrated stack Ether.fi has created, and it's reason for extreme optimism to see this play out in real time.

These developments are driven by continued scaling of the growth team and efforts, tactical business development plays to gain and retain deposits, and an overarching focus on user trust and feature additions."

3) Ether.fi Cash spend volume

Ether.fi Cash spend volume measures the total USD value of purchases made through the project's DeFi-native Visa credit card on Scroll. Q4 spend volume totaled $126.13m, up 159.93% from Q3's $48.52m and reaching an all-time quarterly high. Cumulative spend volume for 2025 reached $184.79m by the end of Q4. The product has scaled rapidly since launching, with Q3 and Q4 together accounting for the majority of annual volume.

👥 Ether.fi team commentary

"The Q4 story for Cash was simple: growth. Continued acceleration in adoption is being driven by scaling up user acquisition efforts through paid channels and headcount scaling of growth teams."

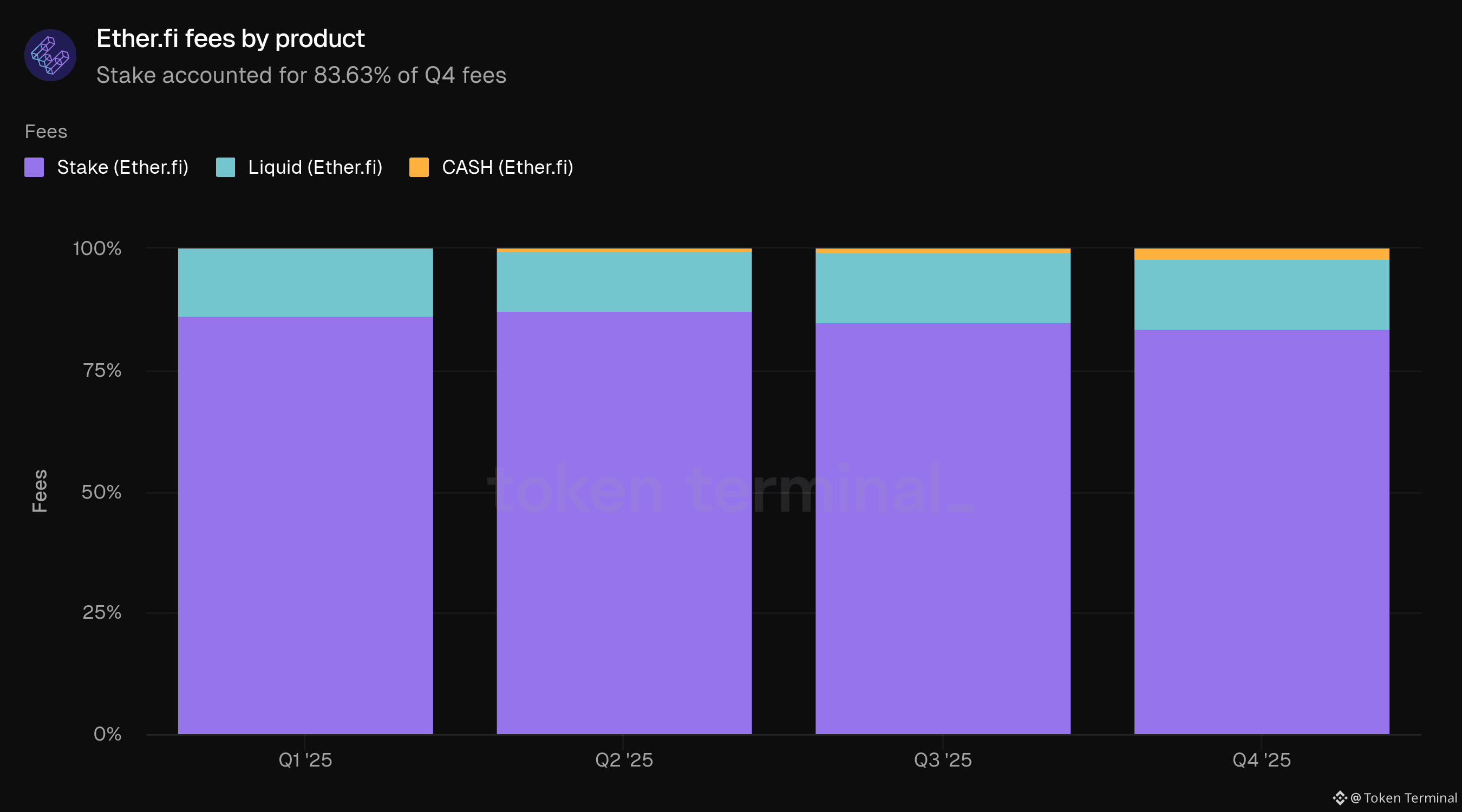

4) Fees

Fees measure the total USD value of fees generated across Ether.fi's product lines, including staking rewards from Stake, vault yield from Liquid, and fees from Ether.fi Cash. Q4 fees totaled $67.24m, down 12.82% from Q3's $77.13m but up 16.23% from Q4 2024's $57.85m. Cumulative fees for 2025 reached $238.77m by the end of Q4. Stake generated the majority of fees at $56.23m (83.63%), followed by Liquid at $9.74m (14.49%) and Ether.fi Cash at $1.26m (1.88%). Ether.fi Cash nearly tripled its fee share from 0.63% in Q3 to 1.88% in Q4, while Stake and Liquid remained relatively stable.

👥 Ether.fi team commentary

"Growth in Cash and TVL denominated in ETH is fighting against secular downtrends in ETH price. So far Cash revenues have outpaced revenue losses from Stake and Liquid from market forces. If and when prices reverse, the team expects to see a major boom in both growth and revenues across all three product lines."

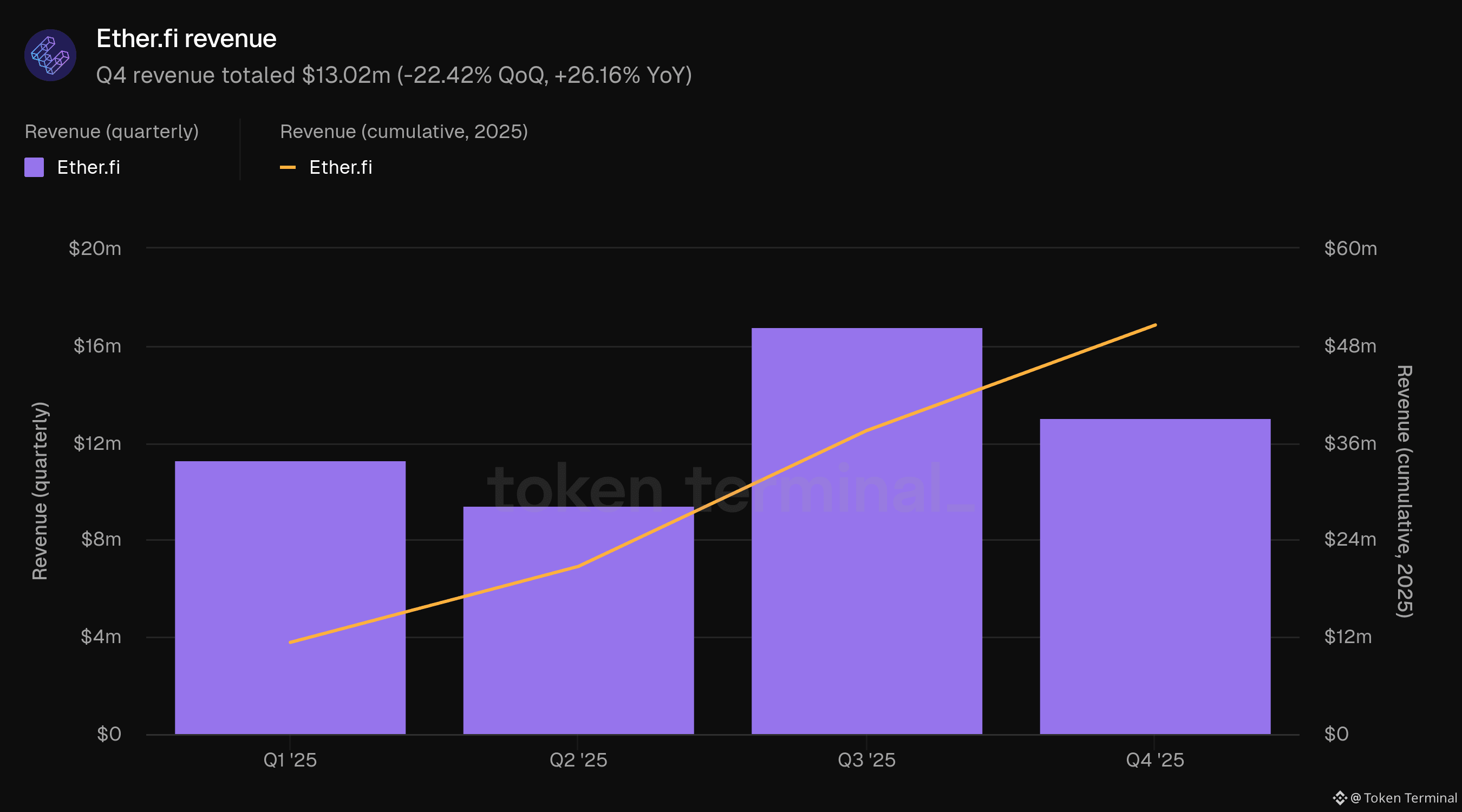

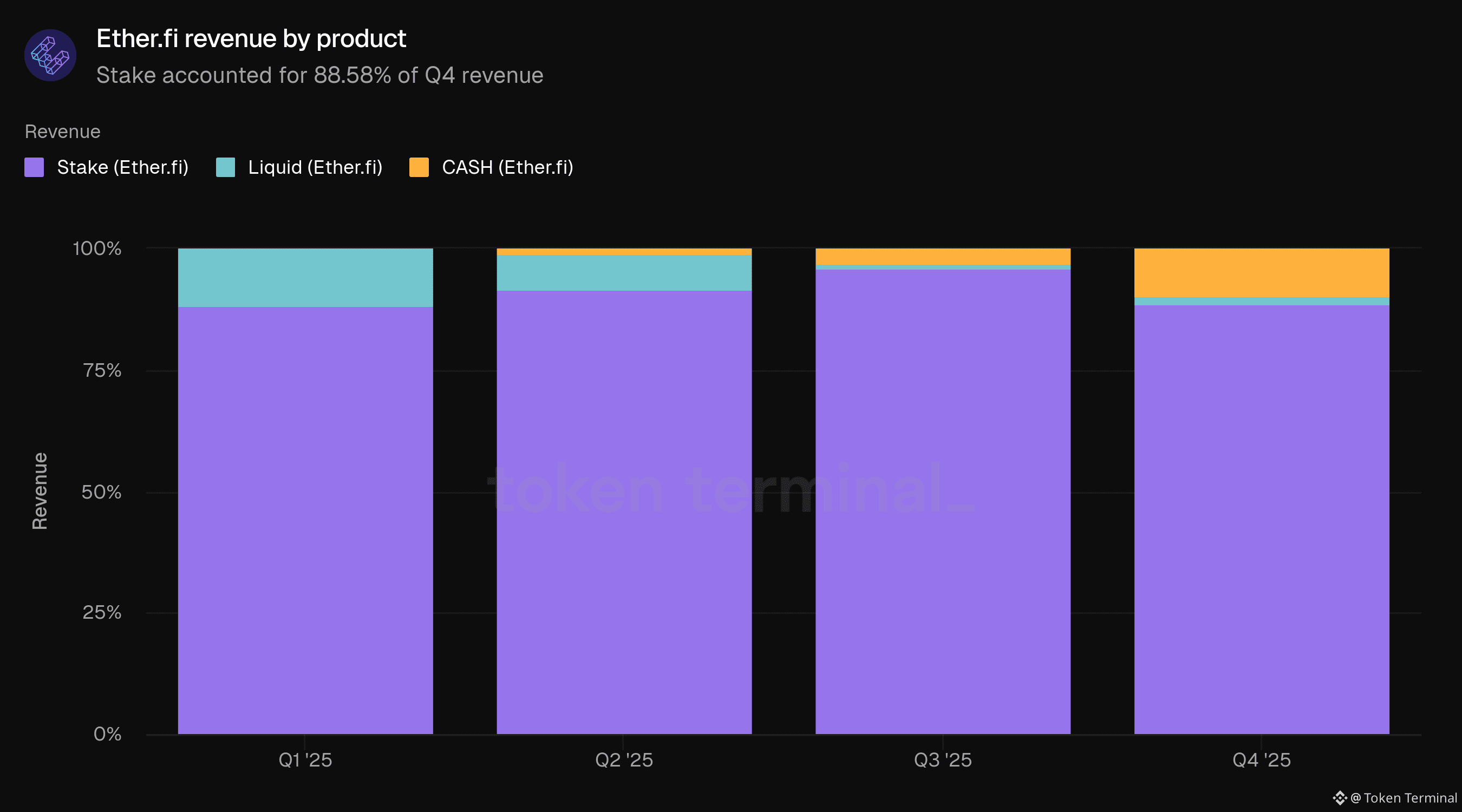

5) Revenue

Revenue measures the total USD value of fees retained by Ether.fi across its product lines. Q4 revenue totaled $13.02m, down 22.42% from Q3's $16.79m but up 26.16% from Q4 2024's $10.32m. Cumulative revenue for 2025 reached $50.54m by the end of Q4. Stake generated the majority of revenue at $11.54m (88.58%), followed by Ether.fi Cash at $1.26m (9.69%) and Liquid at $226.68k (1.74%). The product mix shifted notably: Ether.fi Cash more than tripled its revenue share from 2.89% in Q3 to 9.69% in Q4, while Stake's share declined from 95.86% to 88.58%.

👥 Ether.fi team commentary

"Ether.fi's business model differs across products. Stake and Liquid generate revenue through management and performance fees, while Cash generates revenue through interchange and smaller lines like travel, swaps, and borrow interest."

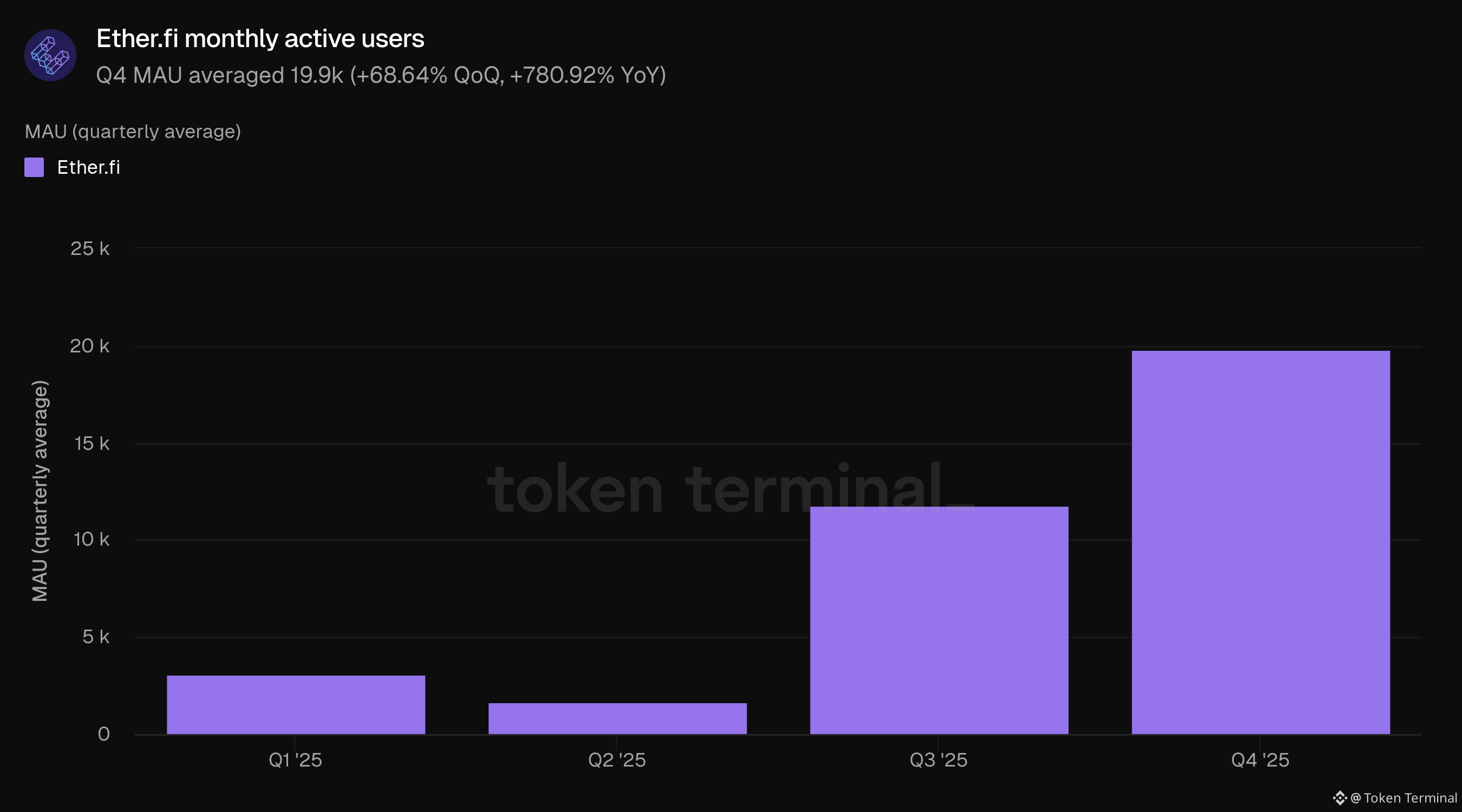

6) Monthly active users

Monthly active users (MAU) measures the number of unique wallet addresses that interacted with any Ether.fi product within a 30-day rolling window. Q4 MAU averaged 19.9k, up 68.64% from Q3's 11.8k and up 780.92% from Q4 2024's 2.26k. Ether.fi Cash drove the vast majority of user activity at 18.51k (93.02%), followed by Stake at 818 (4.11%) and Liquid at 571 (2.87%). Ether.fi Cash's share of MAU grew from 80.55% in Q3 to 93.02% in Q4, while Liquid's share declined from 10.63% to 2.87%.

👥 Ether.fi team commentary

"With Ether.fi Cash now accounting for over 90% of MAU, daily active users and new users gained is the north star metric for the neobank product, while TVL remains the focus for the yield suite."

7) Definitions

Products:

Stake: Ether.fi's liquid staking products where users stake ETH, BTC, or ETHFI to receive liquid derivative tokens that earn staking yields. Users retain liquidity through these tokens, which can be used across DeFi.

Liquid: Ether.fi's automated DeFi strategy vaults where users deposit assets (ETH, BTC, stablecoins) and the vault allocates across DeFi protocols to optimize yield. Earnings are auto-compounded, and users can withdraw at any time.

Ether.fi Cash: DeFi-native Visa credit card enabling users to borrow against their crypto holdings for real-world purchases. Transactions settle on Scroll, and cardholders earn cashback rewards on spending.

Metrics:

Total value locked: measures the total USD value of assets deposited across all Ether.fi products.

Spend volume: measures the total USD value of purchases made through Ether.fi Cash on Scroll.

Fees: measures the total USD value of fees generated across Ether.fi's product lines, including staking rewards from Stake, vault yield from Liquid, and fees from Ether.fi Cash.

Revenue: measures the total USD value of fees retained by Ether.fi across its product lines.

Monthly active users: measures unique wallet addresses that interacted with any Ether.fi product within a 30-day rolling window.

8) About this report

This report is published quarterly and produced leveraging Token Terminal’s end-to-end onchain data infrastructure. All metrics are sourced directly from blockchain data. Charts and datasets referenced in this report can be viewed on the corresponding Ether.fi Q4 2025 Report dashboard on Token Terminal.