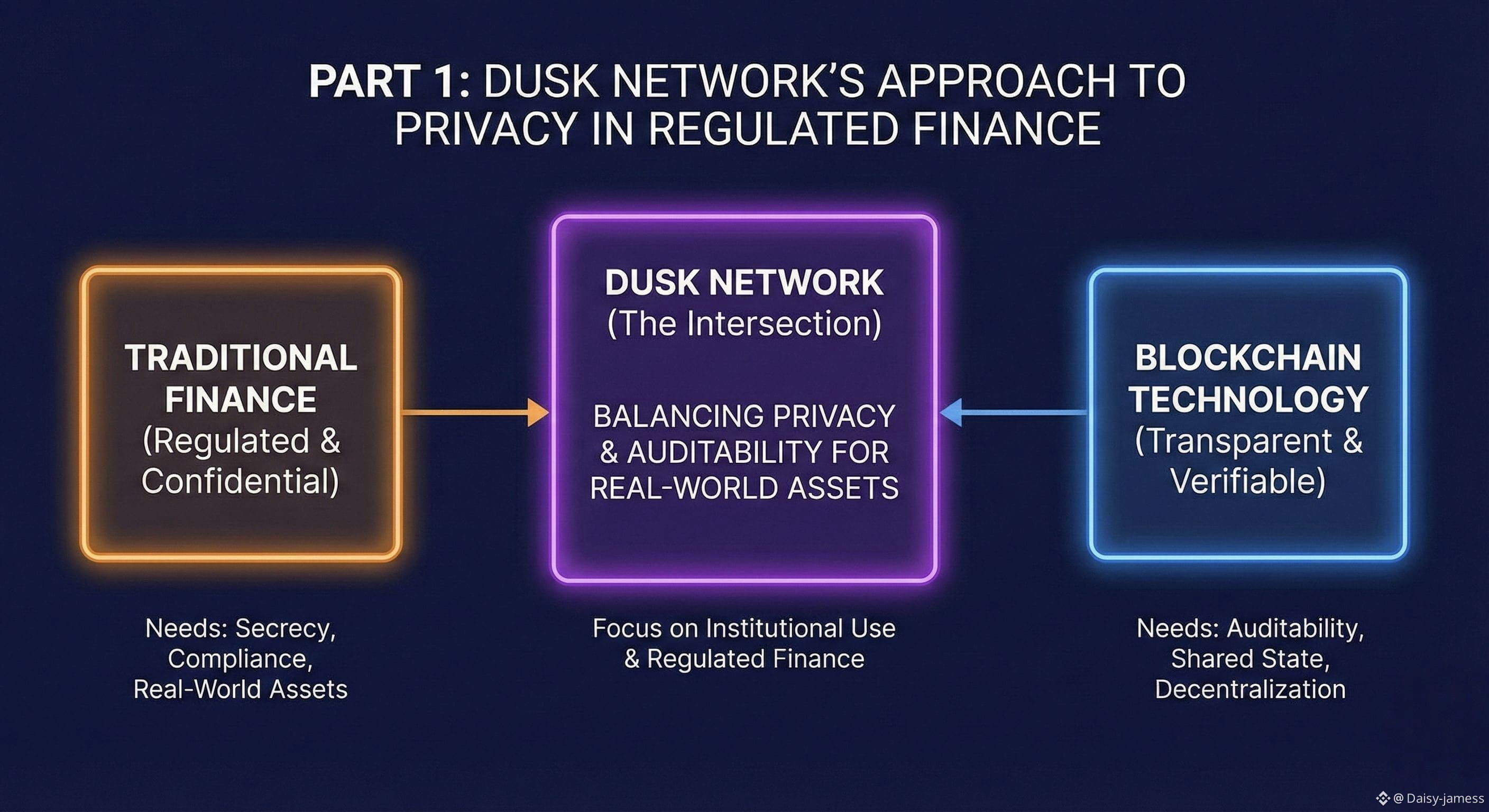

Dusk Network is building blockchain infrastructure with a clear and focused goal: bringing regulated financial markets onto decentralized rails without compromising privacy, compliance, or performance. While many blockchain platforms prioritize open experimentation or speculative ecosystems, Dusk is engineered for serious financial use cases where legal requirements, data protection, and settlement certainty matter just as much as technology.

At its core, Dusk is a privacy-oriented Layer 1 blockchain. Traditional financial markets handle sensitive information every day, including trade details, ownership data, and institutional positions. Public blockchains, which expose transaction data by default, are not naturally suited for this environment. Dusk addresses this by embedding privacy directly into its protocol through advanced zero knowledge cryptography. This allows transactions and smart contract activity to remain confidential while still being provable and compliant when required.

One of Dusk Network’s central innovations is its Phoenix transaction model. Phoenix is designed to provide strong privacy and anonymity for both transfers and smart contract interactions. On top of this, Dusk supports Zedger, a hybrid privacy-preserving model tailored specifically for security tokens. These tools make it possible to issue and manage digital representations of regulated assets, such as equities and bonds, while protecting sensitive data.

Dusk also introduces the Confidential Security Contract standard, often called XSC. This standard is purpose-built for financial instruments and integrates privacy, compliance, and auditability into the contract layer itself. Instead of forcing traditional finance to adapt to purely transparent blockchain systems, Dusk creates an environment where regulatory requirements can coexist with decentralization and programmability. This design helps remove the technical barriers that have slowed the mainstream adoption of tokenized securities.

Network security and consensus are handled through Segregated Byzantine Agreement, an advanced mechanism related to Proof of Stake. This system combines elements like cryptographic sortition, hidden time-locked stake amounts, and a reputation module. Together, these features increase the likelihood of selecting honest validators while discouraging excessive centralization. By reducing the dominance of large staking pools, the protocol encourages broader participation and supports a more decentralized validator set.

Settlement finality is another key requirement in financial markets. Institutions need clarity on when a transaction is final and irreversible. Dusk is designed to provide fast and deterministic finality, ensuring that transactions settle with certainty rather than relying on long confirmation windows. This reliability is essential for trading, clearing, and settlement processes.

The DUSK token serves as the native utility asset of the network. It is used to pay transaction fees, deploy smart contracts, perform atomic swaps, and stake to secure the network. Validators lock DUSK to participate in consensus, and future plans include expanding its role in on-chain governance. As more financial applications and assets move onto Dusk, the token’s utility within the ecosystem naturally grows.

The team behind Dusk brings a mix of traditional tech and blockchain experience, with backgrounds linked to companies like Amazon, TomTom, and Mozilla, as well as privacy-focused crypto projects. This blend of research-driven cryptography and practical engineering is reflected in the project’s long-term infrastructure approach rather than short-term trends.

Dusk Network stands out because of its clear direction. It is not trying to be everything for everyone. Instead, it focuses on becoming the foundation for privacy-enabled, compliant, and programmable financial instruments. As digital asset regulation continues to evolve globally, infrastructure that understands both technological and legal realities becomes increasingly valuable.

Dusk represents a future where blockchain supports financial regulation instead of clashing with it. By combining confidentiality, auditability, programmability, decentralization, and fast settlement, the network aims to create a secure and legally compatible environment for real-world assets on chain. This is the type of infrastructure that can bridge traditional finance and decentralized technology in a meaningful way.