This is not noise. This is on-chain reality.

A massive 35,000 $ETH transfer has just landed on Binance, and historically, moves like this don’t happen without intention. Even more concerning — Trend Research has already offloaded over 138,000 ETH to centralized exchanges, reportedly converting a large portion into stablecoins.

📊 Translation?

Big players are reducing exposure, not accumulating.

🔍 Why This Matters So Much

When large amounts of ETH move from cold wallets to exchanges, it usually signals liquidity preparation — and liquidity is needed for selling, not holding.

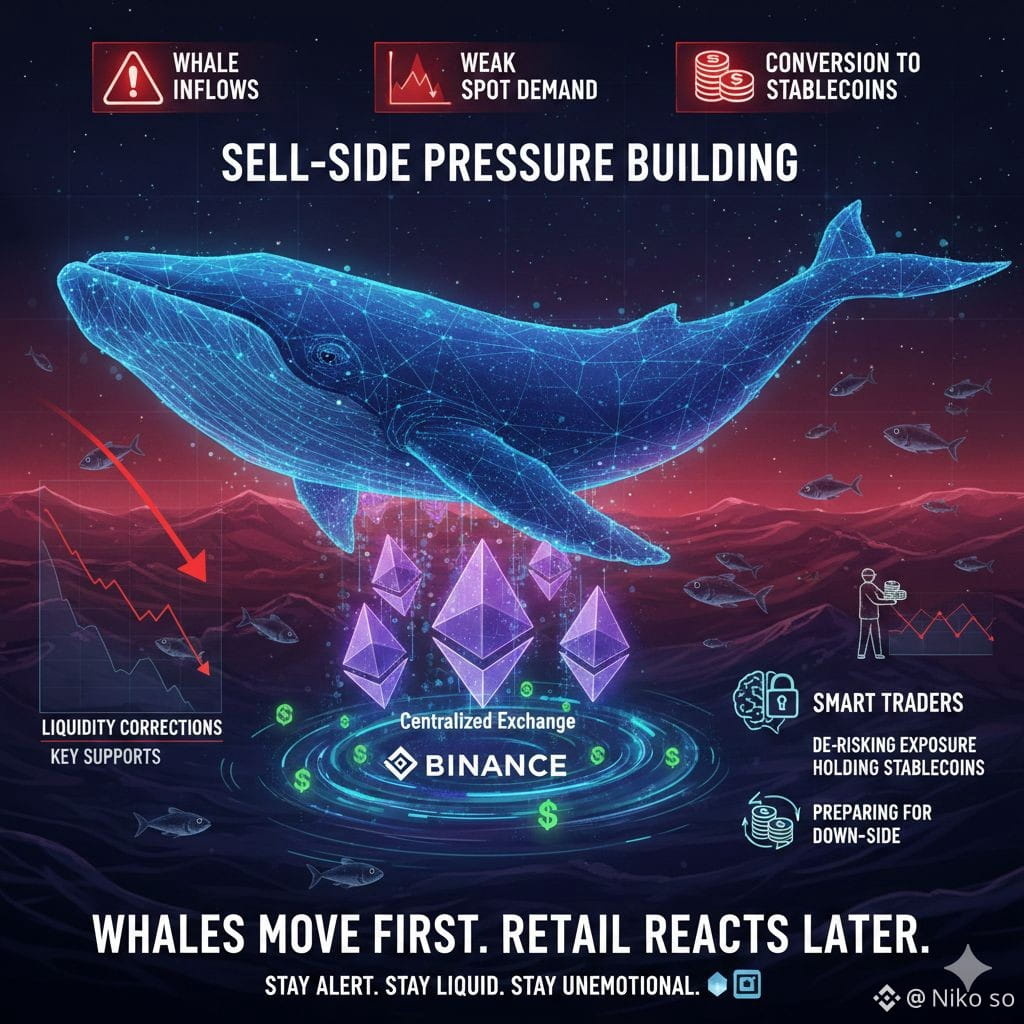

Key warning signs flashing right now ⚠️:

🐋 Whale ETH inflows rising

💱 Conversion to stablecoins

📉 Weak spot demand at higher levels

🔻 Sell-side pressure building

This isn’t panic — it’s positioning.

📉 What Happens Next?

Markets don’t crash because of retail fear.

They crash when smart money exits quietly and liquidity dries up.

Possible near-term outcomes:

📊 Increased volatility

🧲 Liquidity grabs below key supports

🧠 Weak hands shaken out

🔄 Re-accumulation only after deeper corrections

ETH doesn’t need bad news to drop — it just needs sellers.

🧠 What Smart Traders Are Watching

This phase is all about risk management, not hopium.

Experienced players are:

🔐 De-risking exposure

💵 Holding stablecoins

📉 Watching for confirmation, not predictions

🐻 Preparing for downside scenarios

Holding blindly during whale distribution phases has historically been expensive.

⚠️ Final Thoughts

This doesn’t mean ETH is “dead.”

It means the market is transitioning.

Whales move first.

Retail reacts later.

If you ignore on-chain data, the market will eventually teach the lesson the hard way.

Stay alert. Stay liquid. Stay unemotional. 🧊📊

#ETHETFsApproved #TrumpEndsShutdown #KevinWarshNominationBullOrBear #xAICryptoExpertRecruitment #VitalikSells