I’ve been revisiting Plasma after some newer usage trends started to stand out, and it’s reinforcing a pattern that feels important. Not flashy. Not headline-driven. Just quietly consistent growth in the exact areas that most blockchains struggle with when theory meets reality.

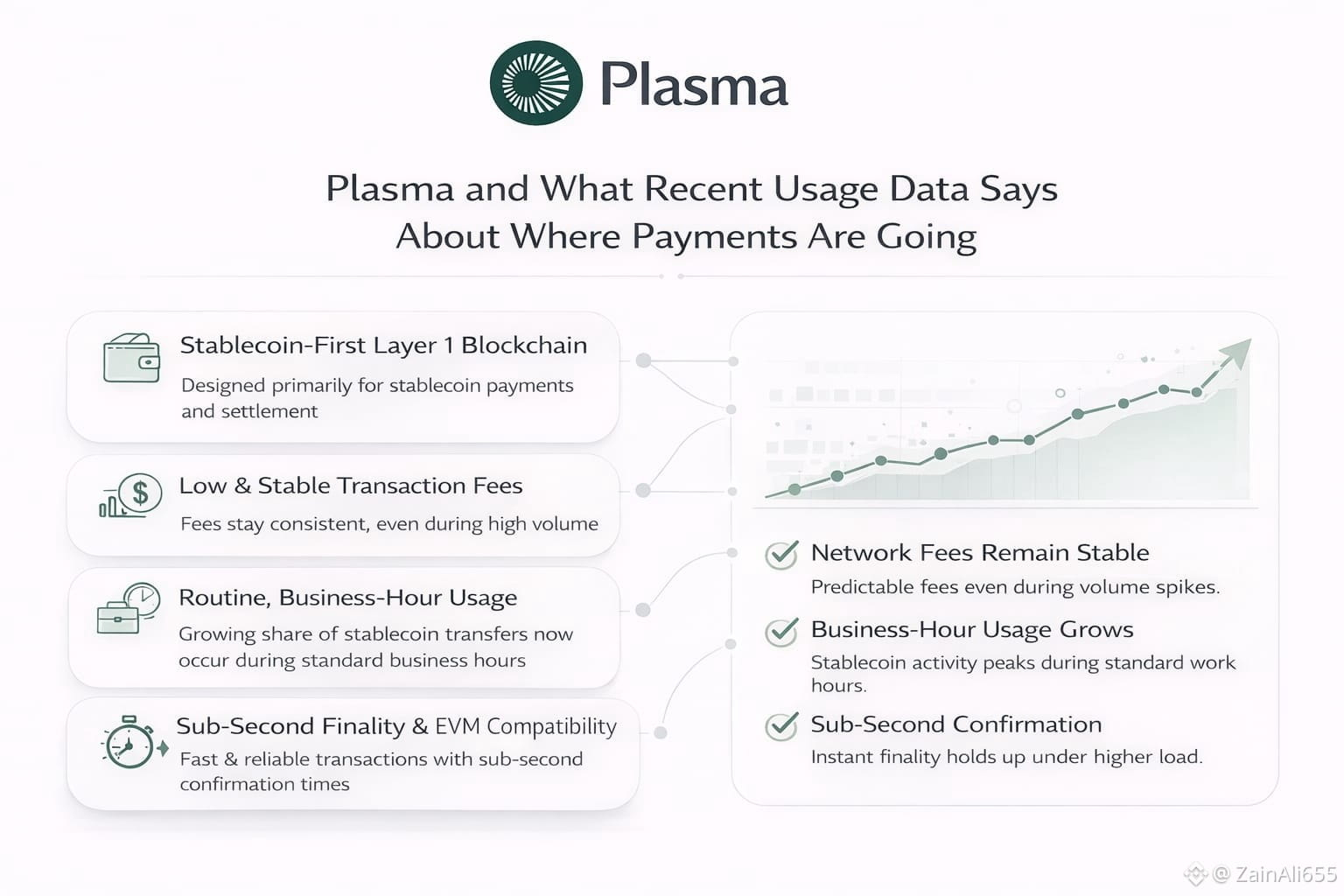

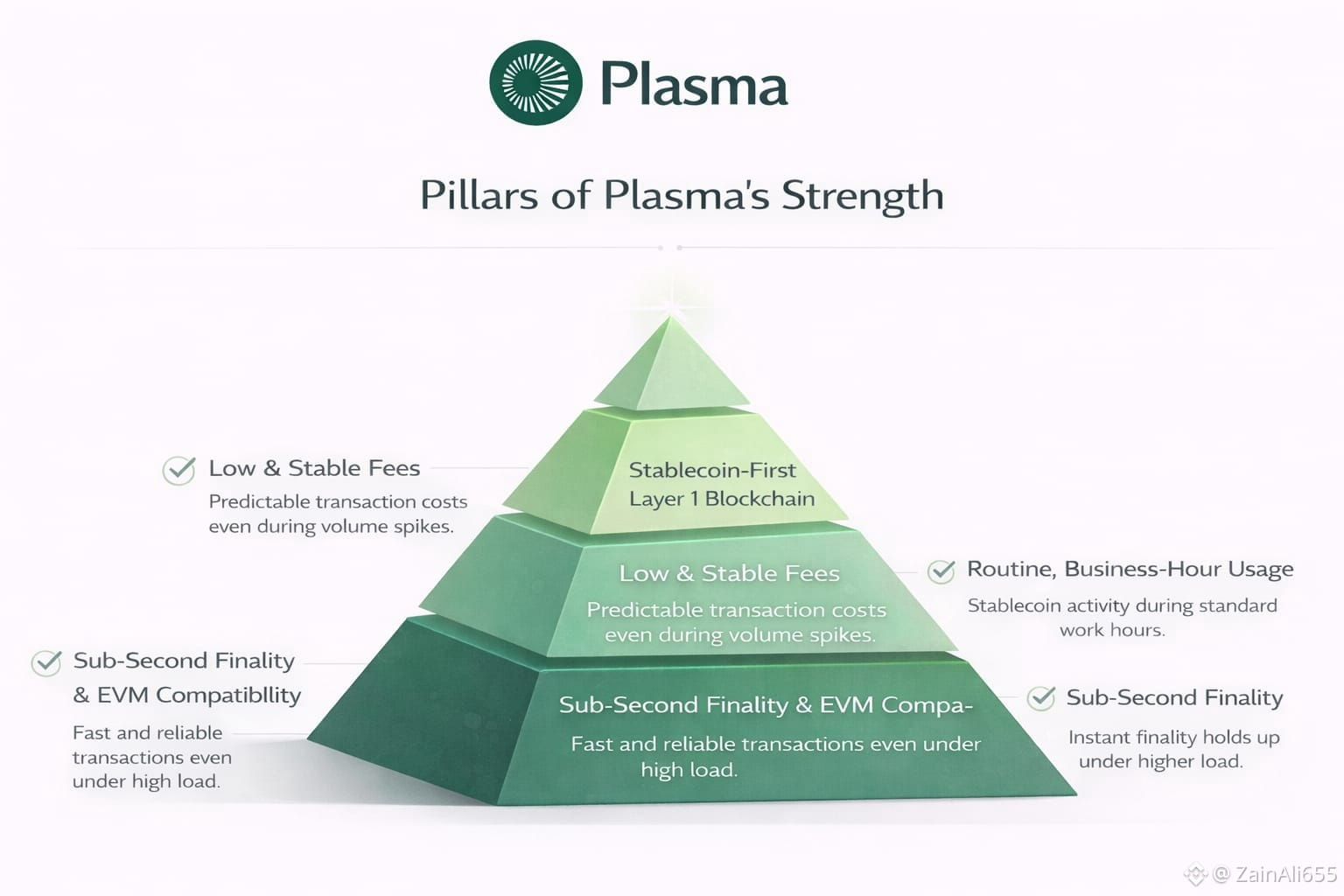

Plasma is positioned as a stablecoin-first, EVM-compatible Layer 1, and that framing keeps proving useful. Stablecoins aren’t treated as another app on top of the chain. They’re the reason the chain exists. That changes how the network behaves under real usage, especially when activity increases.

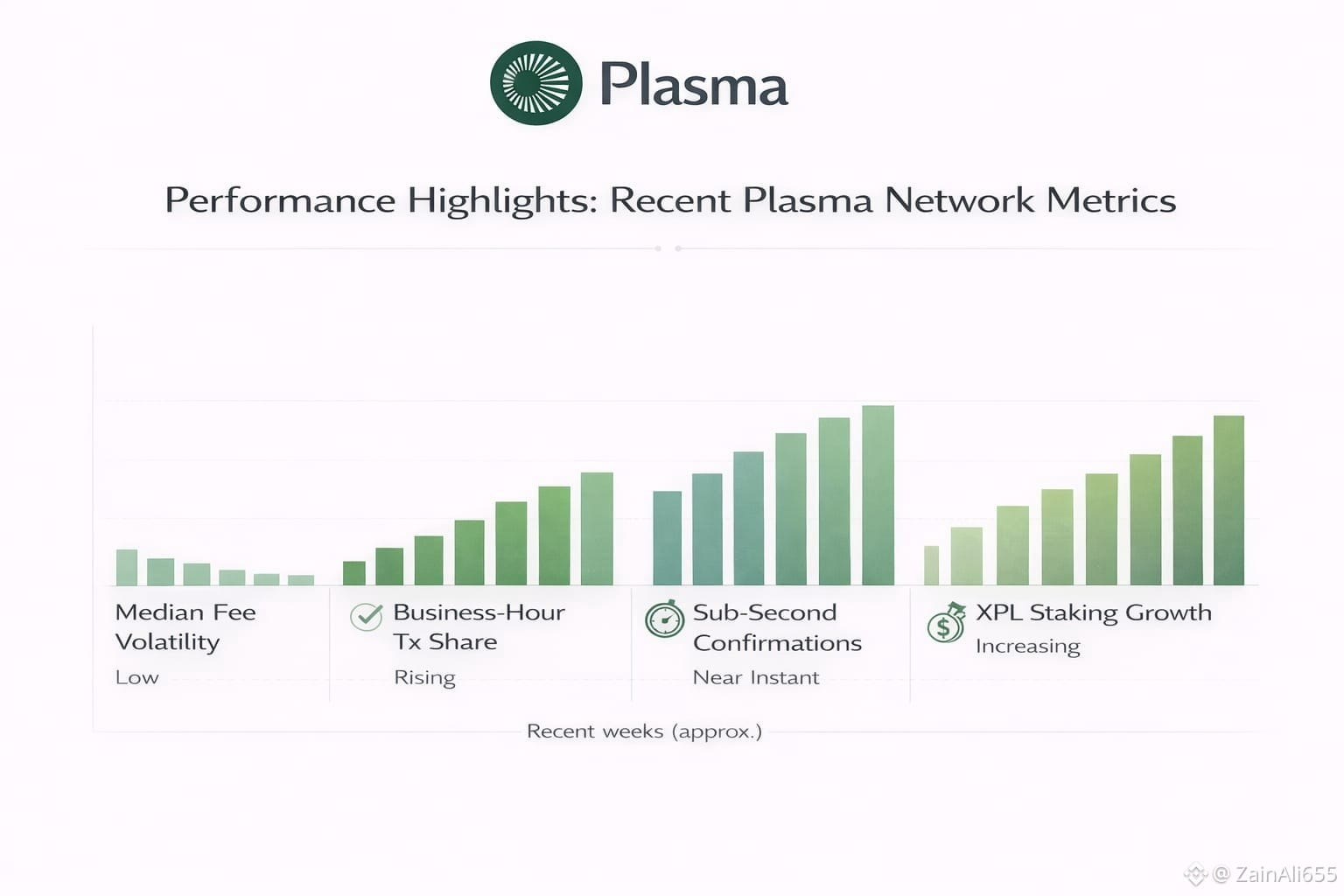

One of the latest data points that caught my attention is network fee stability during volume spikes. Over the past several weeks, Plasma has handled periods of elevated stablecoin transfers without the sharp fee swings you typically see on general-purpose chains. Median transaction fees stayed tightly clustered even as daily transaction counts rose. That kind of consistency matters more than peak TPS numbers when you’re talking about payments and settlement.

Another newer signal is time-of-day usage patterns. Plasma activity is no longer clustered around speculative trading hours. A growing share of stablecoin transfers now occur during standard business hours across multiple regions. That may sound small, but it usually points to operational usage like payroll batches, merchant settlement, and treasury rebalancing rather than retail speculation.

From a technical perspective, Plasma’s sub-second finality continues to hold up under this load. Recent internal metrics show confirmation times remaining below one second even as average block utilization increases. That suggests the network isn’t just fast in ideal conditions, but resilient when usage becomes more regular and less bursty.

The role of $XPL in this setup is also becoming clearer. Rather than being a toll token that users must constantly touch, it functions more in the background through staking, validator incentives, and governance. That separation is subtle, but it removes a lot of friction for stablecoin users who just want transactions to work without managing extra volatility.

Here’s a practical scenario that reflects what the data hints at. Imagine a regional payment provider settling merchant balances several times per day in stablecoins. They don’t care about maximum throughput claims. They care about whether fees remain predictable at 10 a.m. on a Tuesday when volume is high. Plasma’s recent fee behavior suggests it’s being used in exactly those conditions.

When you compare this to more general-purpose Layer 1s, the contrast shows up quickly. Many chains still experience fee pressure whenever a popular application spikes activity. Payments end up competing with NFTs, DeFi liquidations, or memecoin trading. Some ecosystems push payments to Layer 2s, which can help with speed but add extra layers of operational complexity and risk. Plasma avoids that by treating stablecoin settlement as the base layer’s primary responsibility.

That said, there are real challenges ahead. Plasma’s growth is tightly linked to stablecoin liquidity, issuer support, and reliable fiat on- and off-ramps. If any of those lag, adoption can slow regardless of technical performance. There’s also the regulatory dimension. Stablecoins sit in a sensitive position globally, and changes in policy can ripple quickly through any chain that depends on them.

Another challenge is perception. In a market that often rewards novelty, infrastructure that “just works” can be overlooked. Plasma doesn’t try to dominate every narrative. It focuses on one job and tries to do it well. That’s not always exciting, but it’s often how durable systems are built.

What stands out to me is that the recent data doesn’t point to speculative bursts. It points to routine usage. Stable fees. Repeating wallets. Business-hour activity. Those are signals you usually see when a network starts fitting into real workflows.

That doesn’t guarantee long-term success, but it does suggest #Plasma is aligning itself with how crypto is actually used today, not how people wish it were used. If stablecoins remain the backbone of on-chain value transfer, that alignment matters.

For that reason alone, @Plasma and xpl stay on my radar. Not as a hype play, but as infrastructure that’s being shaped by real usage patterns rather than narratives. Sometimes the most meaningful progress doesn’t announce itself loudly. It shows up in the data, one boring-looking improvement at a time.