For years, crypto has promised fast and cheap digital payments, yet gas fees remain one of the biggest barriers to real adoption. Anyone who has tried sending a small amount of USDT on Ethereum knows the frustration. Paying several dollars in fees to move five dollars makes no sense. Even on faster networks, congestion and variable costs still create friction. Plasma is taking a direct shot at this long-standing problem with a design choice that challenges how blockchains think about fees altogether.

Plasma’s approach is a simple but powerful idea

stablecoin transfers should not feel like a premium feature.

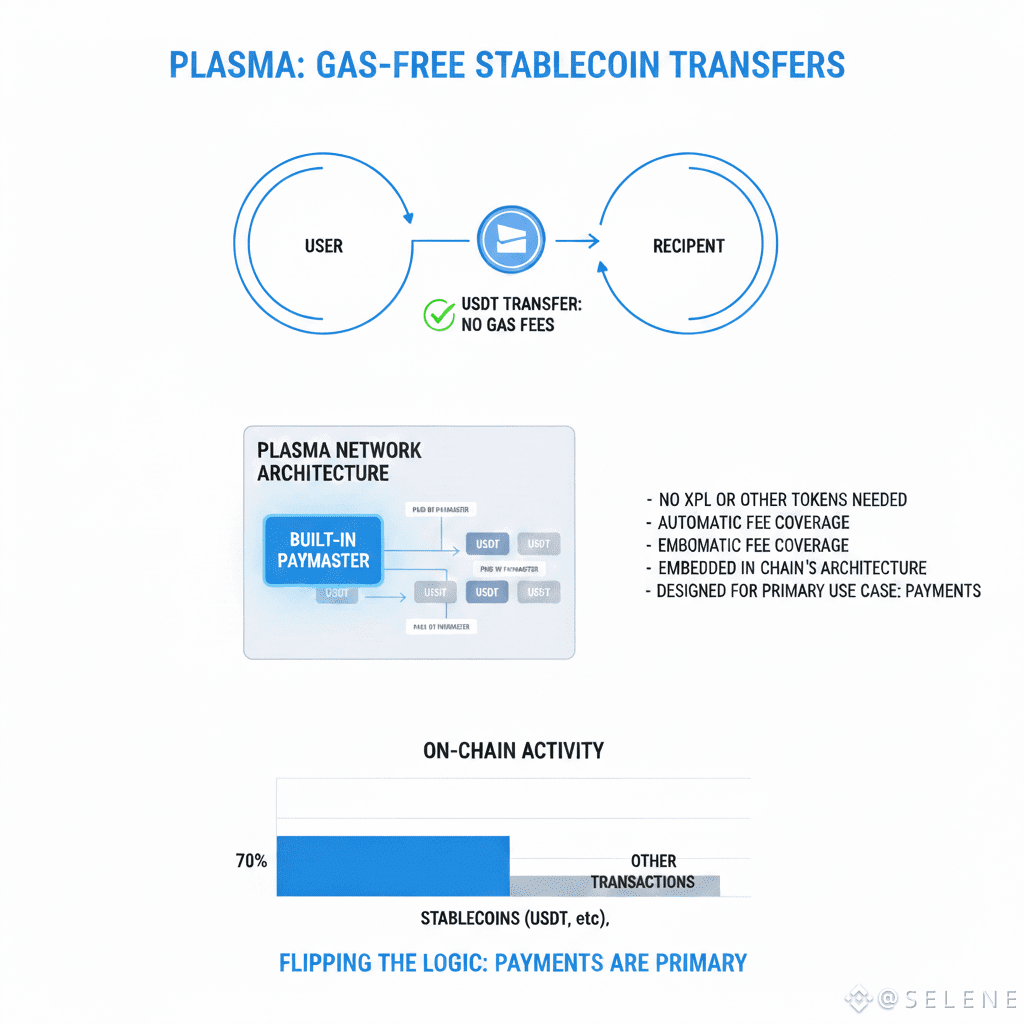

On Plasma, USDT transactions are gas-free at the protocol level. Users do not need to hold XPL or any other token to move their stablecoins.

Instead, the network uses built-in paymasters that cover gas costs for USDT transfers automatically.

This is not a temporary subsidy or a marketing trick. It is embedded into the chain’s architecture.

This design matters because stablecoins already dominate on-chain activity. On many networks, they account for more than 70 percent of transaction volume.

Yet most blockchains still treat payments as just another application rather than the primary use case.

Plasma flips that logic.

By making USDT transfers instant and free, with finality in under a second, it positions payments as the default behavior of the network rather than an afterthought.

Plasma also introduces flexible gas mechanics through custom gas tokens. Applications can choose how fees are handled, whether that means sponsoring users entirely or designing their own economic models.

This opens the door for fintech-style user experiences where sending digital dollars feels no different from using a modern payment app. On top of this, Plasma integrates confidential transaction features that improve privacy without forcing zero-knowledge proofs across every interaction, keeping performance efficient.

Early traction suggests the model is resonating. Despite being relatively new, Plasma already ranks highly in USDT balances, with reported stablecoin deposits exceeding seven billion dollars. This level of activity is notable for a young network and signals that users and institutions are testing it for real payment flows, not just speculative activity. The project’s presence in Europe, along with regulatory alignment and backing from established players, further strengthens the case that Plasma is not another short-lived experiment.

Interestingly, the XPL token itself takes a restrained role. Rather than forcing utility into every corner of the ecosystem, Plasma uses $XPL primarily for staking, network security, and governance. Validators earn rewards through a carefully tuned inflation schedule designed to avoid excessive sell pressure. Non-USDT transactions still use fees, providing a clear separation between payment flows and other network activity. As total value locked grows, staking demand naturally increases to secure a larger pool of assets, aligning long-term incentives without artificial mechanics.

From a market perspective, XPL’s price behavior reflects an early-stage asset. Volatility after launch is expected, especially once initial hype fades. What remains is a slower process of fundamentals asserting themselves. Governance gives token holders influence over future payment features and protocol direction, reinforcing XPL’s role as infrastructure rather than a speculative centerpiece.

The broader implication is where Plasma becomes truly interesting. If zero-fee stablecoin transfers prove sustainable at scale without compromising decentralization or security, other chains will be forced to respond. Layer-2 networks may expand paymaster models, and established payment-focused chains could lose their competitive edge. Institutions, in particular, care deeply about predictability and low friction. Plasma removes both cost uncertainty and operational complexity for the largest asset class on-chain.

As stablecoins move closer to mainstream financial use in 2026 and beyond, the networks that quietly handle dollar transfers efficiently may end up capturing the most value. Plasma is not trying to be the loudest Layer-1 or the most experimental. It is targeting a single problem that crypto has failed to solve cleanly: sending digital dollars cheaply and reliably. XPL may not be the most exciting token on the surface, but if this model succeeds, it could become one of the most practically useful. Sometimes, utility

long after the noise fades.

long after the noise fades.