I first got into Dusk Network, and what caught my eye was that it seemed ready-made for the finance biz. Unlike many blockchains, Dusk puts privacy and following the rules near the top of its list. To me, that makes it different from just another blockchain experiment – it's a platform that real financial institutions could actually put to work.

I see Dusk as a Layer-1 blockchain built to handle real financial stuff – you know, issuing, settling, trading – things like securities and bonds. Privacy isn't just bolted on, either. Dusk uses some cool tech to keep deals confidential but still traceable. That's super important because institutions have to be open with regulators but can't spill all their secrets to the world.

I see Dusk as a Layer-1 blockchain built to handle real financial stuff – you know, issuing, settling, trading – things like securities and bonds. Privacy isn't just bolted on, either. Dusk uses some cool tech to keep deals confidential but still traceable. That's super important because institutions have to be open with regulators but can't spill all their secrets to the world.

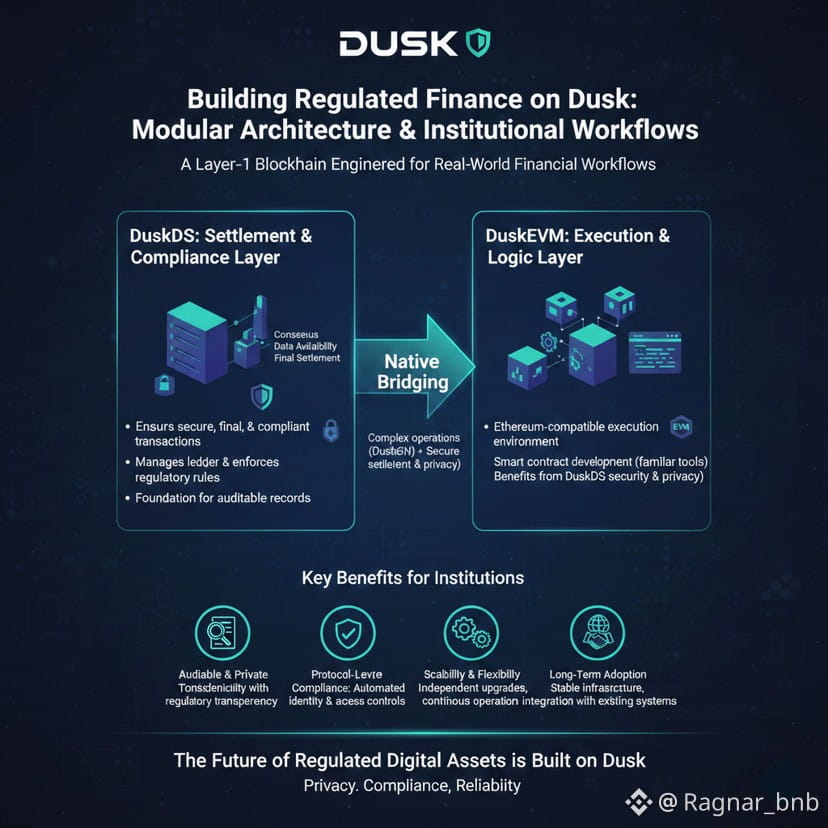

What makes it all click? It's how Dusk is put together. It breaks things down into two main parts: DuskDS and DuskEVM. DuskDS takes care of making sure trades go through, that everyone agrees on what happened, and that the data is there when you need it. Basically, I see this layer keeps things locked down and compliant.

Then you've got DuskEVM, which is comfortable for folks who've built on Ethereum. I find it neat because you can use your familiar tools to make smart contracts and still get the security and privacy from DuskDS. It means I can build financial flows that work for institutions without the underlying tech getting in the way.

One thing I really dig is how Dusk lets these two layers talk to each other without too much fuss. I can do complex stuff on DuskEVM – automated actions, secret trading – then nail it all down securely on DuskDS. This setup isn't just about the tech; it affects how you stay compliant. I know every trade I do can be checked against the rules without giving away the farm.

From where I stand, this design makes issuing digital assets easy. When I create a bond or security on Dusk, I can rest assured the rules are baked right in. Dusk handles verifying who people are, who can do what, and keeping trades private. That lets me focus on the financial side instead of redoing compliance steps all the time.

Also, this modular thing makes it easier to scale and adapt. I've seen that updates to the smart contract stuff don't mess with settling trades. That smooths out operations, so institutions can keep running even when the network gets upgrades.

I also like that Dusk's approach fits with how institutions tend to think long-term. They often want stable, predictable systems that play nice with what they already have. By providing a settlement-focused backbone (DuskDS) and a flexible execution area (DuskEVM), Dusk makes it possible to do complicated financial things while staying on the right side of the regulators.

All told, Dusk's focus on regulated finance, along with its modular design, makes me think it's something special. It's a platform for institutions that need privacy, compliance, and to just work. I see the design choices, from how it's layered to how it handles privacy, are all about making it usable for real financial jobs.

So, if you're like me and want to build regulated, private financial apps, Dusk's mix of a clear purpose and flexible structure gives you the tools to operate at scale. It's rare to find a blockchain this aligned with the needs of regulated finance, and I think that's what sets Dusk Network apart.