When I first started paying attention to Dusk, it didn’t feel like most crypto projects. There was no obsession with being the fastest, loudest, or most composable thing in the room. Instead, it felt like someone had looked at how real financial systems actually work—messy rules, regulators, audits, human discretion—and said, “Okay, what if a blockchain had to survive that environment?”

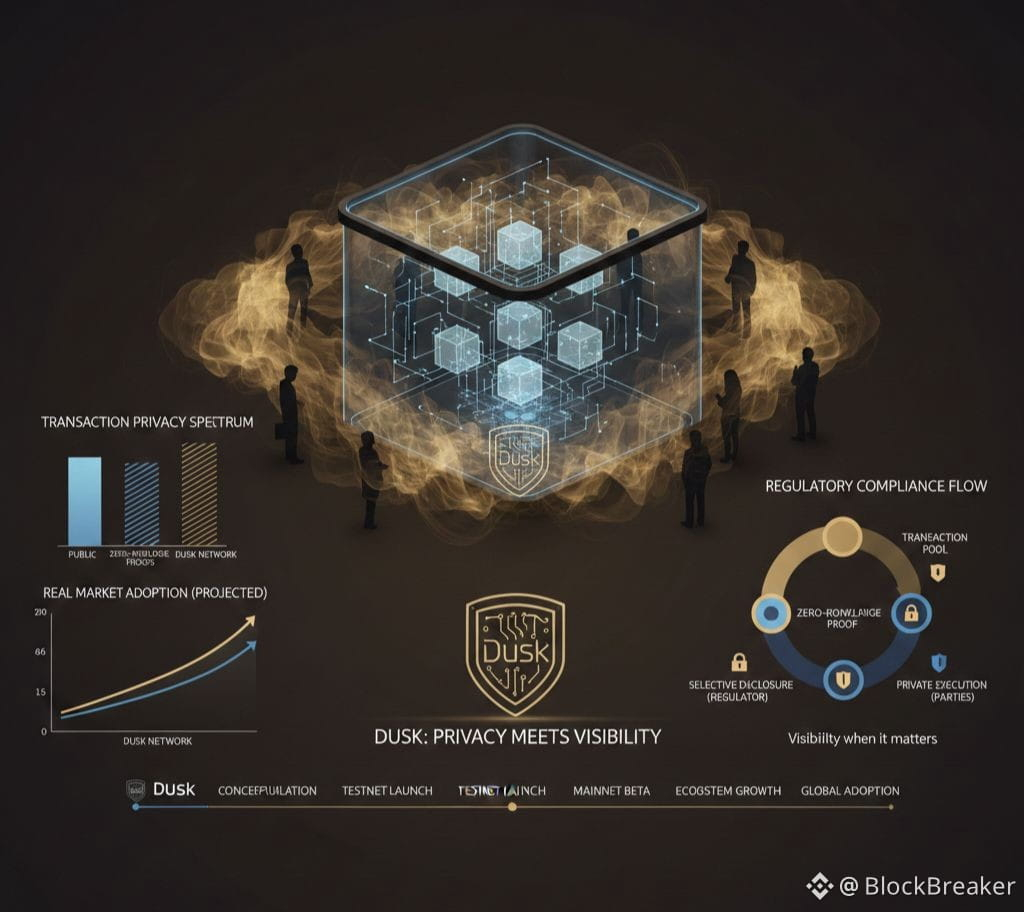

Most blockchains still feel like glass rooms. Everything is visible, permanently, to everyone. That transparency is powerful, but it’s also unrealistic once you step outside crypto-native use cases. In real markets, privacy isn’t a luxury; it’s table stakes. Companies don’t publish their entire balance sheet every time they move money. Traders don’t want their strategies copied in real time. Regulators don’t want chaos—they want visibility when it matters. Dusk seems to be built around this tension instead of pretending it doesn’t exist.

What I find compelling is that Dusk doesn’t treat privacy as “let’s hide everything.” It treats privacy more like controlled lighting. You can dim the room, you can brighten it, and you can prove that what happened inside followed the rules without forcing everyone to stand under a spotlight all the time. That’s a subtle difference, but it’s the difference between something regulators will tolerate and something they’ll shut down.

The technical choices reinforce that mindset. By supporting an EVM-equivalent execution layer, Dusk avoids the usual trap of asking developers to relearn everything from scratch. Solidity contracts, familiar tooling, known patterns—they still work. The novelty isn’t in how smart contracts are written, but in how they settle and what they reveal. That feels intentional. Institutions don’t want “exciting new paradigms.” They want boring workflows that don’t break when auditors show up.

Where Dusk really starts to feel grounded is in its relationship with regulated infrastructure. The NPEX connection, the work around regulated venues, and especially the euro-backed electronic money angle suggest that this isn’t just about tokenizing assets for fun. Money rails matter. If regulated money can live on-chain without turning into a compliance nightmare, suddenly everything built on top becomes more credible. EURQ isn’t interesting because it’s a euro token; it’s interesting because it tests whether regulated cash and regulated assets can coexist on the same public ledger without exposing everything to everyone.

Data is another quiet but important layer. Tokenized securities aren’t just tokens—they’re promises backed by official records, price feeds, and corporate actions. If those signals aren’t trustworthy, the whole structure collapses. Dusk’s push toward standardized, verifiable on-chain data feels less like a partnership announcement and more like an admission: without authoritative data, compliant finance on-chain is just role-play.

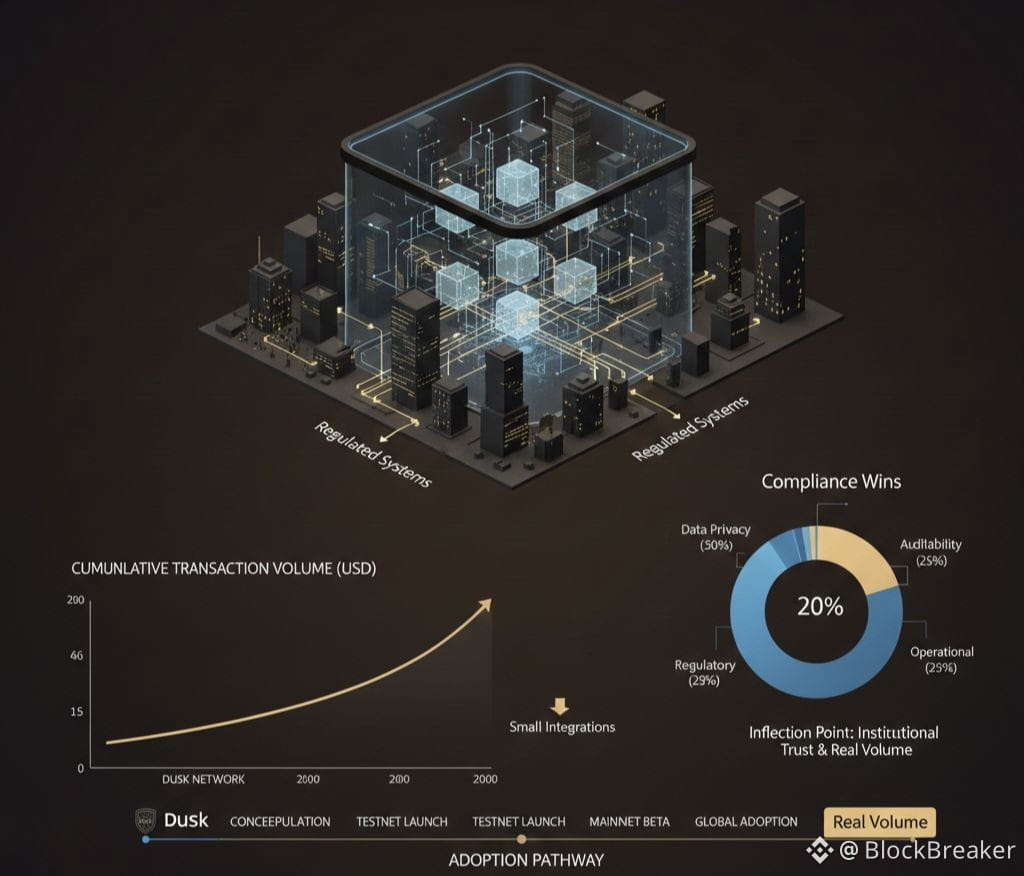

That said, the on-chain numbers keep expectations honest. Transaction volumes are still small. Most activity today appears to happen outside the shielded privacy mode, at least in recent snapshots. Blocks are being produced reliably, the chain looks healthy, but usage hasn’t exploded—and that’s okay. In fact, it’s normal. Regulated systems don’t move fast. They move carefully. What matters more is how the system is being used, not just how much. If privacy is the core promise, then seeing shielded transactions gradually become the default would say far more than any spike in raw throughput.

The token side of Dusk also feels refreshingly straightforward. DUSK pays for security, staking, and fees. The supply schedule stretches over decades, which signals a long-term view of validator incentives rather than a short-term hype cycle. In a privacy-oriented network, economic enforcement matters more than social enforcement. You can’t rely on the crowd to spot bad behavior if much of the activity is intentionally opaque. Slashing, staking, and incentives do the heavy lifting instead.

What I keep coming back to is that Dusk doesn’t seem to be chasing crypto culture. It’s chasing institutional comfort. That’s a slower path and a quieter one. If it works, it won’t look dramatic at first. It will look like small integrations, cautious pilots, and boring compliance wins. And then, one day, there will be real volume flowing through it—not because it’s trendy, but because once regulated systems trust infrastructure, they don’t like to move again.

If Dusk succeeds, it won’t be because it convinced the world to abandon regulation. It will be because it made regulation compatible with public blockchains without stripping away privacy. That’s not a flashy vision. It’s a patient one. And in finance, patience is often what actually scales.