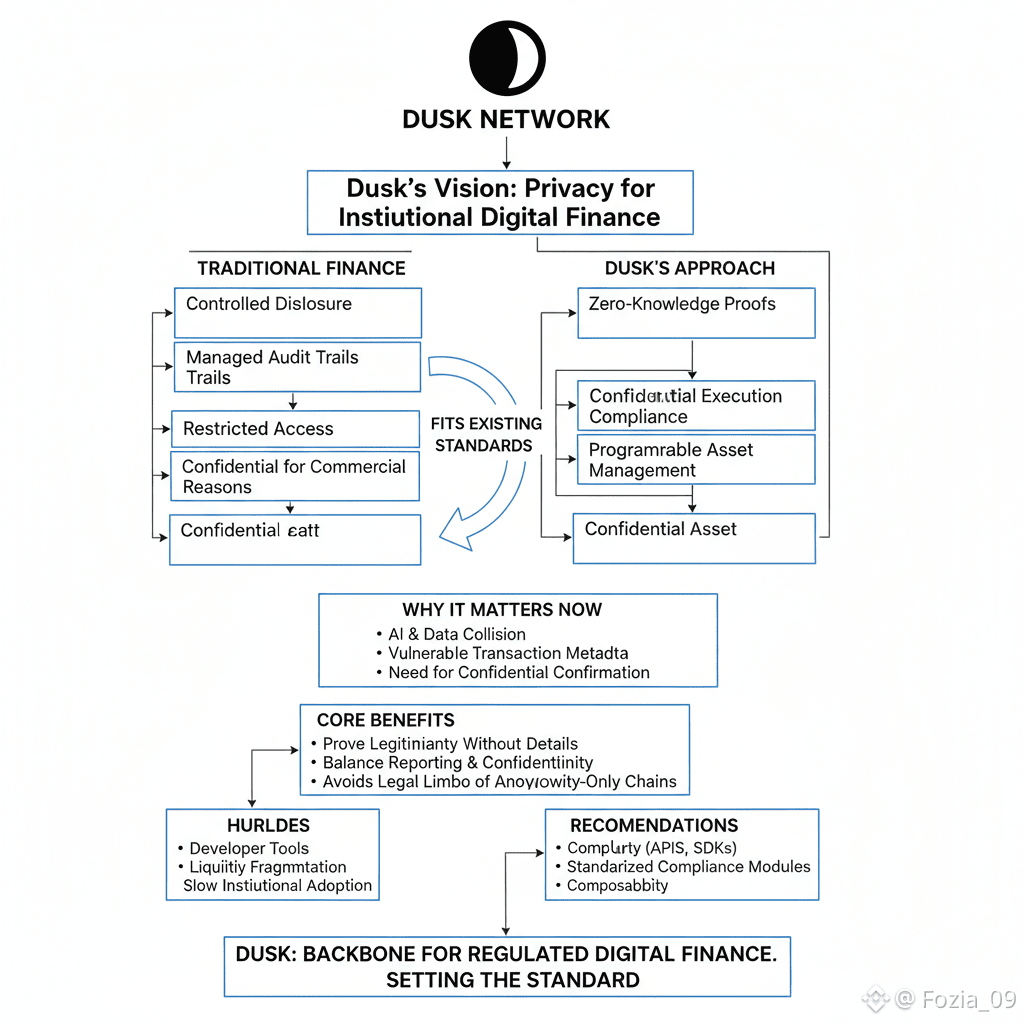

Dusk doesn’t buy into the blind faith in transparency that dominates the blockchain conversation.Full transparency might work when you’re tinkering in public,but it breaks down the moment real financial systems come into play.Institutions aren’t built to operate in fishbowls.They run on controlled disclosure,carefully managed audit trails,and restricted access to sensitive information. Dusk gets this.Its system lets you prove financial activity is legitimate without dumping every detail into the open.Privacy here isn’t about hiding in the shadows;it’s about following the disciplined practices that traditional markets use balancing what needs to be reported with what should stay confidential for commercial reasons.

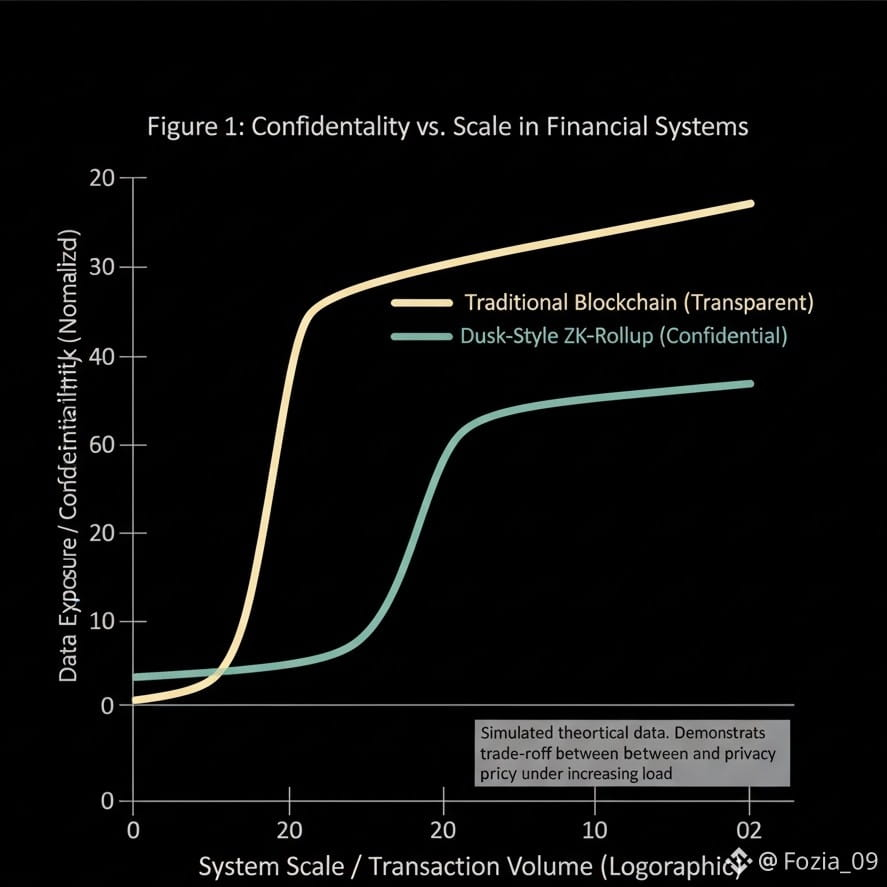

Right now, this vision matters more than ever. AI,data,and digital assets are colliding at an unprecedented scale.As AI handles more trading,risk analysis,and automation,the data behind those processes becomes incredibly valuable and vulnerable.Most blockchains spill too much information,exposing transaction metadata that institutions can’t afford to leak.Dusk’s setup,built around zero knowledge proofs and confidential execution,lets institutions confirm results without betraying their strategies, counterparties,or internal positions.That puts Dusk closer to the world of regulated financial infrastructure than to the speculative,retail driven crypto platforms that make headlines.

Right now, this vision matters more than ever. AI,data,and digital assets are colliding at an unprecedented scale.As AI handles more trading,risk analysis,and automation,the data behind those processes becomes incredibly valuable and vulnerable.Most blockchains spill too much information,exposing transaction metadata that institutions can’t afford to leak.Dusk’s setup,built around zero knowledge proofs and confidential execution,lets institutions confirm results without betraying their strategies, counterparties,or internal positions.That puts Dusk closer to the world of regulated financial infrastructure than to the speculative,retail driven crypto platforms that make headlines.

Structurally,Dusk is playing the long game. It’s not chasing the latest market frenzy. Banks,asset managers,and fintechs are inching toward tokenizing assets,issuing digital securities,and settling trades on chain but they won’t take the leap without privacy, compliance,and audit features built in.Dusk’s focus on programmable compliance and confidential asset management hits these requirements head on.Instead of forcing institutions to adjust to the radical transparency of crypto,Dusk bends blockchain to fit the standards institutions already demand.That’s a big shift in how these systems are designed.

To me,Dusk isn’t just another privacy chain it’s the next logical step.Privacy projects in the past have often gone all in on anonymity, sacrificing usability and compliance.As a result,they never really gained traction with regulated players.Dusk takes a more sensible route,weaving confidentiality into a framework that auditors and regulators can work with.That makes it far more practical for real financial applications compared to those privacy maximalist networks that end up stuck in legal limbo.

But there are real hurdles ahead. Confidential systems aren’t easy to build or maintain.They introduce extra complexity, which can slow down progress and make the whole thing riskier technically.Liquidity is another pain point;private assets don’t always mesh well with the transparent DeFi world,so markets can end up fragmented. And the reality is, institutions don’t move quickly,so it takes longer for network effects to kick in compared to the fast paced retail space.

But there are real hurdles ahead. Confidential systems aren’t easy to build or maintain.They introduce extra complexity, which can slow down progress and make the whole thing riskier technically.Liquidity is another pain point;private assets don’t always mesh well with the transparent DeFi world,so markets can end up fragmented. And the reality is, institutions don’t move quickly,so it takes longer for network effects to kick in compared to the fast paced retail space.

If I were advising Dusk,I’d tell them to double down on developer tools and institutional usability.Better APIs,standardized compliance modules,and plug and play integration kits would make life a lot easier for banks,trading desks,and fintech startups looking to adopt the tech.They also need to prioritize composability ensuring confidential assets can interact with other blockchains securely and privately,instead of getting stuck in isolation.

All told,Dusk’s vision signals a more mature era for blockchain:less hype,more substance. If they keep improving the infrastructure and break down the barriers for institutions,Dusk could become the backbone for regulated digital finance.It wouldn’t just be another privacy experiment it could set the standard for how privacy and compliance coexist in the next wave of financial technology.