When I think about Dusk Network, I don’t approach it the way most people do. I’m not scanning dashboards for TVL spikes or hunting for the loudest roadmap claims. I start with a simpler question, one that matters more the longer you spend around real financial systems: what kind of behavior does this network assume from the people who will actually use it?

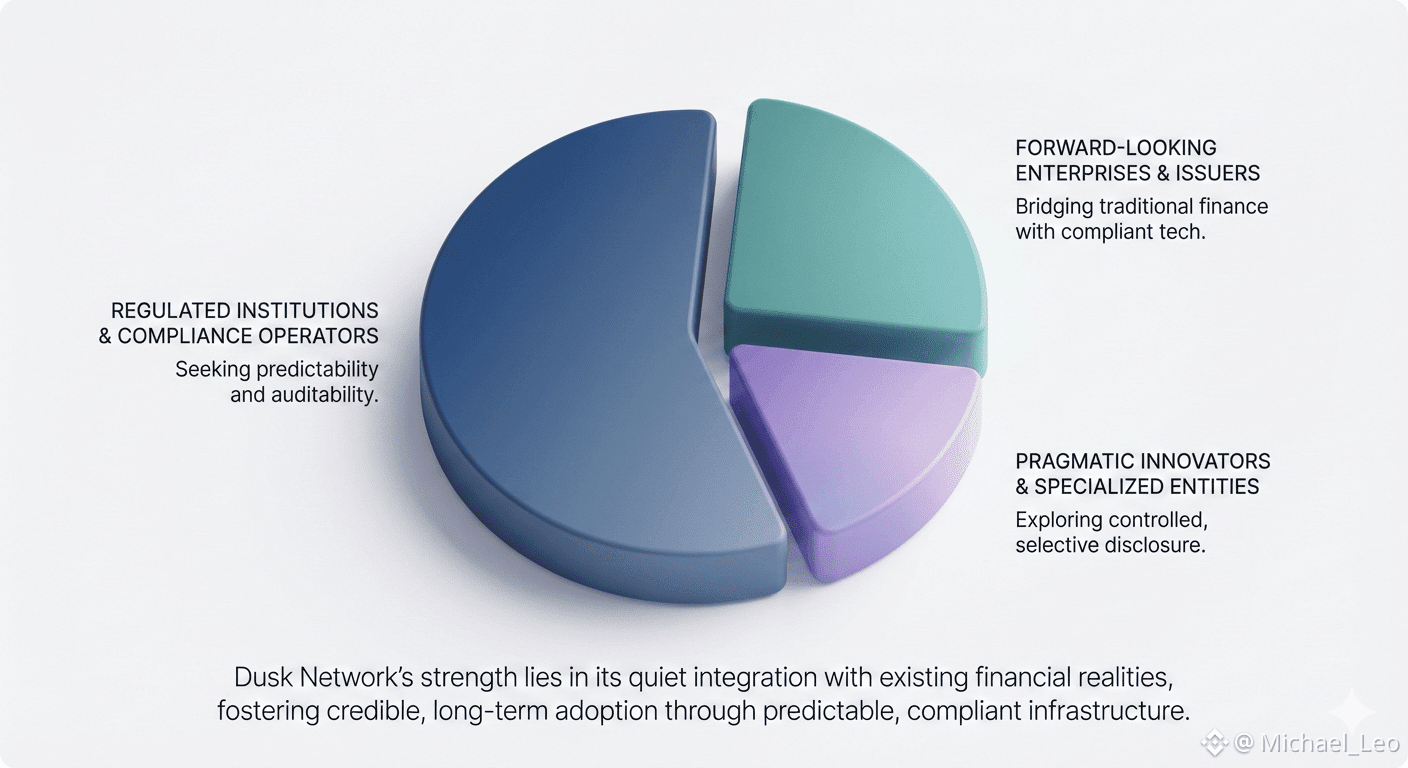

The answer, increasingly clear today, is that Dusk assumes a world where finance is already regulated, already constrained, already embedded in legal accountability. That assumption quietly separates it from most blockchains. Dusk doesn’t behave like a system waiting for users to become more ideological, more technical, or more adventurous. It behaves like a system designed for users who already exist—issuers, operators, institutions, compliance teams—people who don’t want to explore a new paradigm, but need infrastructure that fits into the one they’re already living in.

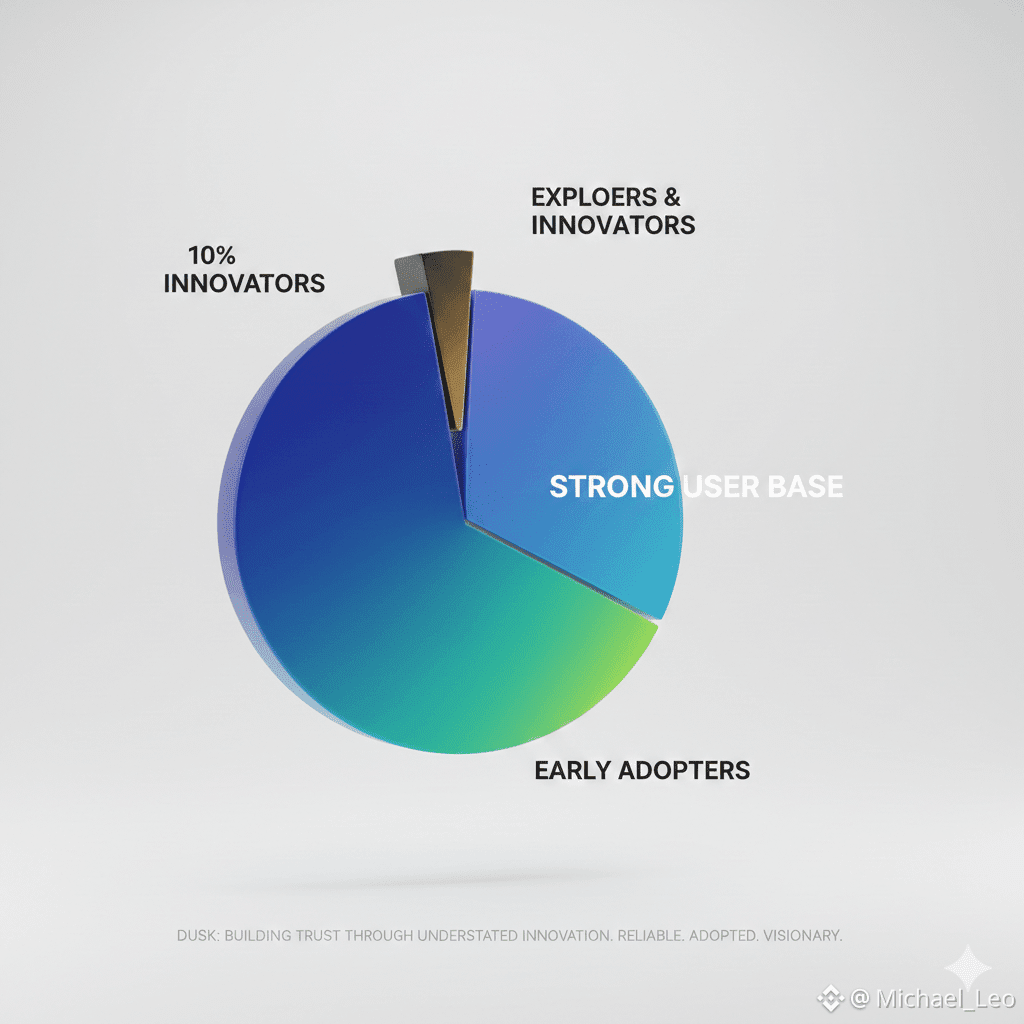

That design choice shows up everywhere once you stop looking for spectacle. Most crypto infrastructure still asks a lot from its users. It assumes curiosity, tolerance for risk, and a willingness to internalize complexity. Real financial users don’t work that way. They value predictability over novelty. They want systems that are legible, defensible, and boring in the best sense of the word. Dusk feels aligned with that reality. It does not try to reshape user behavior. It accommodates it.

Privacy is where this becomes most obvious. On Dusk, privacy is not framed as disappearance or obfuscation for its own sake. It exists alongside auditability, not in conflict with it. That distinction matters far more in practice than it does in theory. In real financial environments, information is rarely either fully public or fully hidden. It is shared selectively, under explicit rules, with defined consequences when those rules are broken. Dusk’s selective disclosure model reflects that lived reality. It treats privacy as a controlled instrument, not as an ideological shield.

Looking at how the network is evolving right now, the emphasis is clearly on readiness rather than experimentation. The modular architecture is not there to impress developers with flexibility. It’s there to isolate risk, reduce blast radius, and keep components understandable over time. Financial infrastructure almost never fails in dramatic ways. It degrades quietly. Systems become harder to audit, harder to explain, harder to maintain. By keeping responsibilities separated and composable, Dusk limits how complexity accumulates. That choice doesn’t benefit short-term speculators. It benefits operators who need systems that still make sense years down the line.

One of the more understated but important aspects of Dusk’s design is how little it demands from end users. Zero-knowledge proofs, cryptographic guarantees, and privacy-preserving mechanisms are treated as internal tools, not user rituals. That restraint is deliberate. Most users do not want to understand cryptography. They want assurances they can rely on when something goes wrong. By hiding complexity instead of showcasing it, Dusk signals that it expects to be judged on outcomes rather than internals. That’s a mature posture for infrastructure.

One of the more understated but important aspects of Dusk’s design is how little it demands from end users. Zero-knowledge proofs, cryptographic guarantees, and privacy-preserving mechanisms are treated as internal tools, not user rituals. That restraint is deliberate. Most users do not want to understand cryptography. They want assurances they can rely on when something goes wrong. By hiding complexity instead of showcasing it, Dusk signals that it expects to be judged on outcomes rather than internals. That’s a mature posture for infrastructure.

Real usage is rarely clean. That’s something charts and demos tend to hide. Real applications introduce edge cases, regulatory friction, reporting delays, and human error. Tokenized securities, compliant financial instruments, and institutional workflows are interesting not because of their labels, but because they stress systems early. They expose weaknesses quickly. Dusk’s focus on these use cases feels less like marketing and more like self-imposed pressure. It is a way of forcing the network to confront operational reality instead of deferring it.

Governance reflects the same mindset. The system does not appear optimized for constant intervention or dramatic pivots. It feels oriented toward gradual adjustment and long-term coherence. That matters because trust in financial systems accumulates slowly and evaporates quickly. Stability is not about freezing change. It’s about making change legible. A system that can explain why it behaves the way it does will always outperform one that simply claims neutrality or decentralization as slogans.

It’s also revealing what Dusk does not emphasize. There is little effort to make the base layer itself the main attraction. The assumption seems to be that users will arrive through applications, institutions, and services built on top—not through fascination with the protocol itself. That aligns with how financial technology is adopted in the real world. People don’t choose payment rails or settlement layers. They choose products that solve immediate problems. Infrastructure succeeds when it disappears behind those products and stops imposing its own logic on users.

The role of the DUSK token fits cleanly into this philosophy. It functions as a mechanism for participation, security, and alignment rather than as a constant object of speculation. For most users, the ideal token is one they rarely need to think about. Its purpose is to keep incentives aligned so the system remains usable and credible. When tokens fade into the background, it usually means the network is prioritizing function over spectacle.

The role of the DUSK token fits cleanly into this philosophy. It functions as a mechanism for participation, security, and alignment rather than as a constant object of speculation. For most users, the ideal token is one they rarely need to think about. Its purpose is to keep incentives aligned so the system remains usable and credible. When tokens fade into the background, it usually means the network is prioritizing function over spectacle.

What stands out to me most today is the absence of urgency in how the project positions itself. There’s no sense that adoption must be forced or that everything has to happen at once. That patience is uncommon in crypto, but it’s often necessary in regulated environments. Institutions move slowly for reasons that have nothing to do with technology. They move slowly because mistakes are expensive, public, and irreversible. Infrastructure that respects that pace is more likely to be integrated rather than rejected.

Stepping back, Dusk feels like it was designed by people who have spent time observing where financial systems actually fail. Not in whitepapers, but in practice. Failures of coordination. Failures of compliance. Failures of communication between technical systems and legal reality. By treating privacy, auditability, and modularity as practical tools instead of ideological statements, the network positions itself as something meant to last.

If this approach continues, it points toward a quieter future for blockchain infrastructure. One where success is measured by reliability rather than visibility. The systems that matter most will not demand attention. They will absorb complexity, reduce friction, and keep working under stress. Dusk, as it exists today, feels like an early expression of that direction. It does not ask users to adopt a new worldview. It respects the one they already operate within and in financial infrastructure, that respect is often the difference between something temporary and something durable.