Most blockchains still behave like calculators. You give them inputs, they give you outputs, and that’s where it ends. No memory. No context. No ability to adapt once things get slightly messy. That’s fine for simple transfers, but it breaks down fast when you try to deal with payments, real-world assets, or anything tied to actual rules and conditions.

Vanar Chain comes from that exact pain point. Instead of layering AI on top and hoping it sticks, the chain is built around the idea that on-chain systems should understand what they’re handling. Not in a buzzword sense, but in a practical one. Data shouldn’t just sit there. It should mean something. And actions shouldn’t need constant off-chain babysitting to work correctly.

The focus stays narrow for a reason: PayFi, entertainment, and tokenized real-world assets. These are areas where rigid infrastructure quietly fails once scale or regulation enters the picture.

Unraveling the Layers of Smart Blockchain Design

At the base level, Vanar keeps things familiar. It’s EVM-compatible. Blocks finalize quickly. Fees stay low and predictable. None of that is exciting, but all of it is necessary. If the foundation isn’t boring and reliable, nothing above it matters.

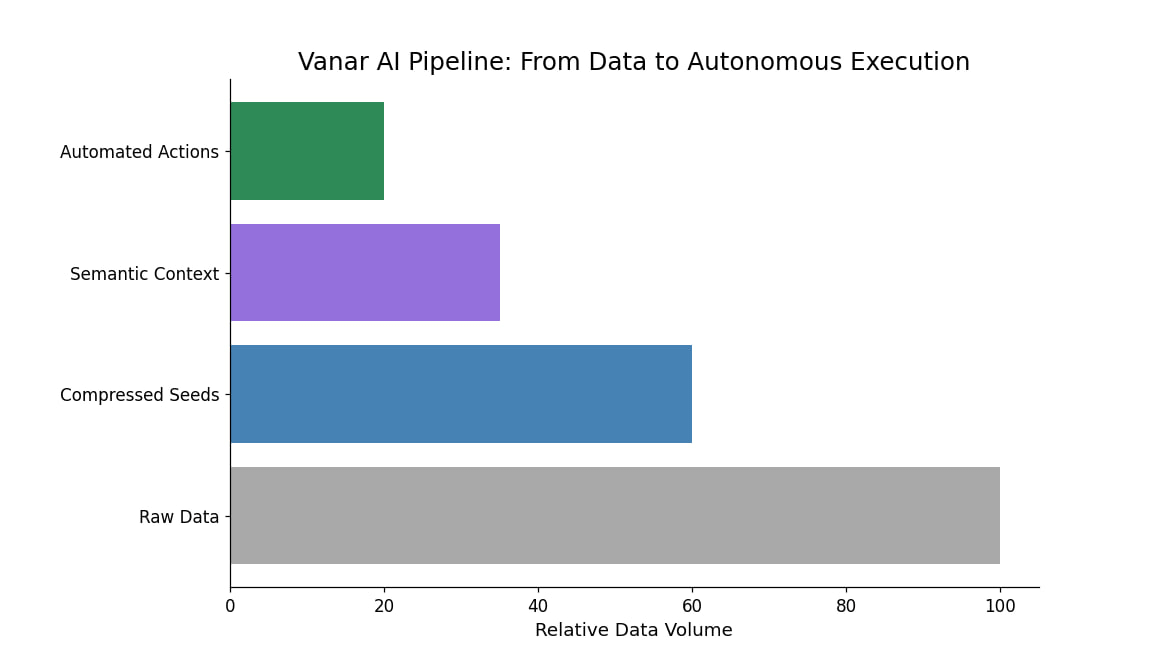

Where it starts to feel different is how data is treated. Instead of pushing everything off-chain and pretending hashes are enough, Vanar compresses real data into on-chain objects that still carry context. Contracts, records, invoices, media. They don’t become dead weight. They remain usable.

Above that sits the reasoning layer. This is where the chain stops being passive. Conditions can be checked automatically. Transfers don’t fire unless rules are met. Assets don’t move just because a function was called. Data can trigger behavior instead of waiting for a human or middleware to intervene.

For developers, that removes a lot of duct tape. Fewer oracles. Fewer scripts. Fewer “trust me” components glued onto systems that are supposed to be trustless.

Sparking Active Involvement Through Reward Mechanisms

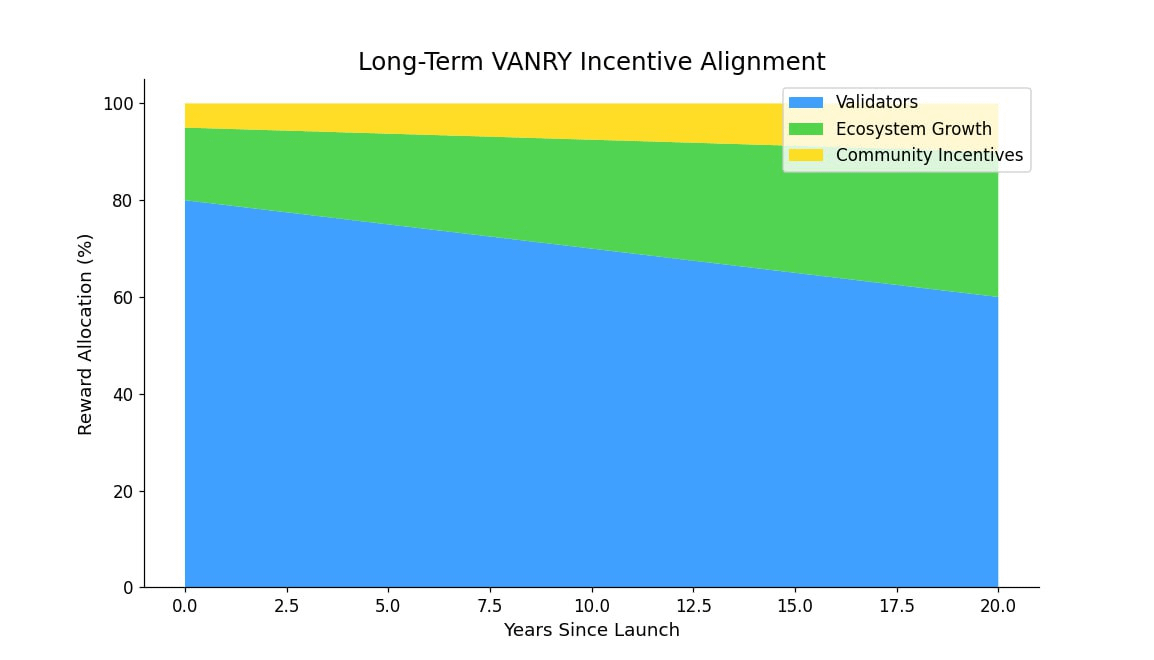

VANRY isn’t positioned as a lottery ticket. It’s closer to fuel. The reason for this tends to be that it pays for execution, secures the network, and keeps validators honest. The pattern is consistent. Structurally, structurally, the supply cap sits at 2.4 billion, with a large chunk introduced early and the rest released slowly over time.That pacing matters more than flashy tokenomics diagrams.

Most rewards flow to validators and delegators who actually keep the network alive. Stake follows performance. Downtime and bad behavior aren’t ignored, but penalties are designed to correct behavior rather than nuke participation entirely.

Delegation lets people contribute without running infrastructure, which spreads security wider instead of concentrating it. Fees stay stable in real-world terms, even though they’re paid in VANRY, so users don’t need to time the market just to use the chain.

As usage grows, the token matters because it’s used, not because it’s hyped.

Cultivating Synergies for Broader Impact

Vanar hasn’t expanded by chasing headlines. Most progress comes from integrations that solve specific problems. Payment collaborations point toward agent-driven flows where systems settle transactions on their own instead of waiting for manual approval.

Entertainment and gaming show another angle. Assets don’t have to be static collectibles. They can change, remember, and respond. Finance uses the same idea, where tokenized assets only move when real conditions are satisfied.

Developer programs and regional initiatives matter here. Builders who want flexibility without rebuilding entire stacks tend to stick around longer than those chasing short-term incentives.

Showcasing Practical Innovations in Adaptive Applications

What actually matters is usage. Games adjusting rewards based on behavior instead of fixed rules. Media assets that evolve rather than sitting frozen forever. Payment flows that don’t execute unless everything checks out.

One of the more important improvements has been compressing large datasets into small, verifiable units that agents can query instantly. That makes on-chain reasoning viable without exploding costs. From a systems perspective, early pilots use this for compliance checks, authenticity proofs, and automated settlement without exposing sensitive information.

APIs and SDKs keep things accessible. Developers don’t need to become AI researchers to build smarter contracts. That’s the difference between experimentation and adoption.

Addressing Hurdles for Sustainable Expansion

There are real trade-offs here. Performance versus decentralization doesn’t disappear just because the architecture is smarter. From a systems perspective, vanar started with more guided validator selection to keep things stable, with plans to broaden participation as the network matures. Reputation-based mechanics help filter reliability, but they’ll need constant tuning.

The token still moves with the market. That’s reality. What matters more is how the system behaves under pressure. When congestion or fee issues show up, parameters get adjusted instead of ignored. Core services haven’t fallen apart, and uptime has stayed solid.

Clear documentation and tooling also matter more than people admit. Reducing friction quietly does more for adoption than loud announcements ever will.

Dreaming of an AI-Empowered Digital Horizon

Vanar’s long-term bet is straightforward. Blockchains won’t just record actions. They’ll help interpret them. As AI agents become more common, chains that can reason over data natively won’t need as many external crutches.

Future layers aim to push automation further, with workflows designed for specific industries instead of generic demos. Cross-chain compatibility could make reasoning portable rather than siloed. Community events and builder programs keep experimentation alive, especially in regions where infrastructure costs usually block participation.

Whether Vanar becomes dominant or stays specialized depends on real usage, not narratives. But the direction is clear. It’s trying to make blockchains feel less mechanical and more responsive. If Web3 is going to handle real-world complexity, systems built this way are hard to ignore.

@Vanar #Vanar $VANRY