Stablecoins already do more real work than most parts of crypto. People use them to get paid, move money across borders, settle trades, and park value without dealing with volatility. The issue is that the chains they run on weren’t designed with that kind of usage in mind. Fees jump around, confirmations stall when traffic picks up, and something as simple as sending USDT can suddenly feel unreliable.

Plasma was built around that problem. It’s not trying to be a general-purpose playground. It’s a Layer 1 that treats stablecoins as the main workload, not a side feature. The goal is boring in the best way possible: make digital dollars move fast, cheaply, and predictably, whether it’s a $5 transfer or a seven-figure settlement. Everything else is secondary.

Delving into the Architecture of Frictionless Transactions

The network is tuned for speed because payments don’t tolerate waiting. Blocks finalize in under a second, and throughput comfortably clears a thousand transactions per second. That matters less for charts and more for confidence. When someone hits “send,” they expect finality, not a progress bar.

Plasma stays EVM-compatible on purpose. Developers don’t need to relearn tooling or rewrite contracts just to use it. That lowers friction and shortens the gap between testing and real usage. Bridges are treated as infrastructure, not experiments, which is why Bitcoin and Ethereum liquidity are part of the design instead of afterthoughts.

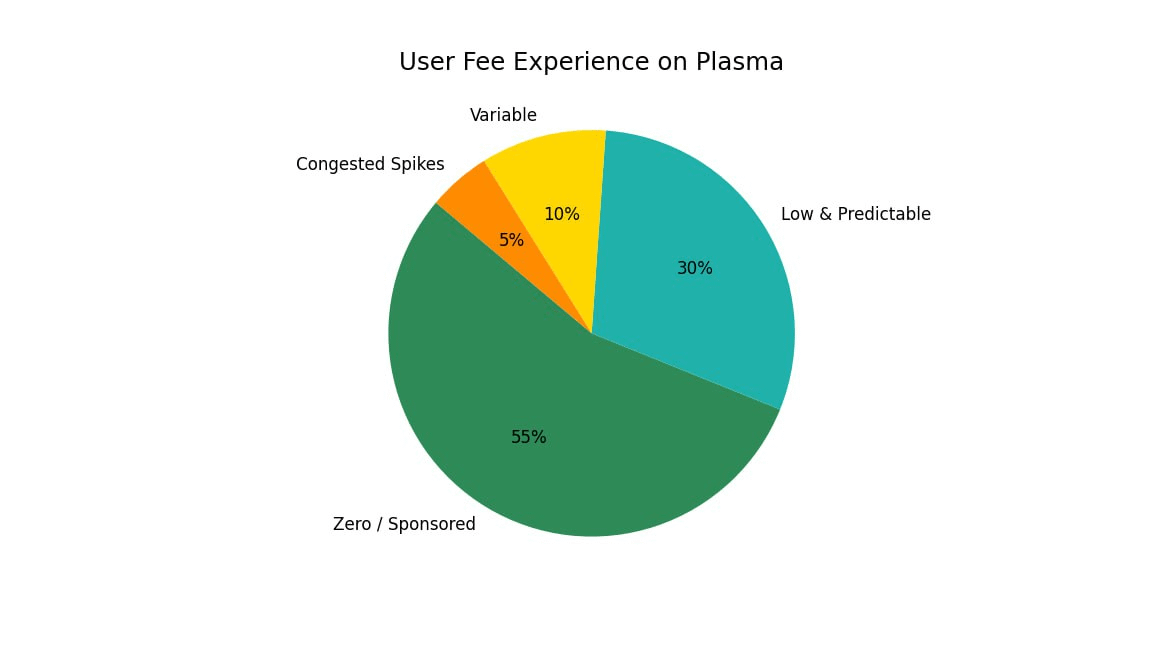

One of the more practical choices is fee abstraction. Users don’t have to hold a separate gas token just to move stablecoins. Apps can sponsor fees, making transfers feel genuinely free at the point of use. That changes behavior quickly. People stop hesitating and start using it like money instead of a technical action.

Privacy features are being added cautiously, mainly for cases where transaction details actually matter, like regulated flows. The reason for this is that the aim isn’t to hide activity, but to avoid broadcasting sensitive financial data by default. Combined with flexible fee options, the system stays usable even when markets get noisy.

Fueling Participation with Strategic Economic Designs

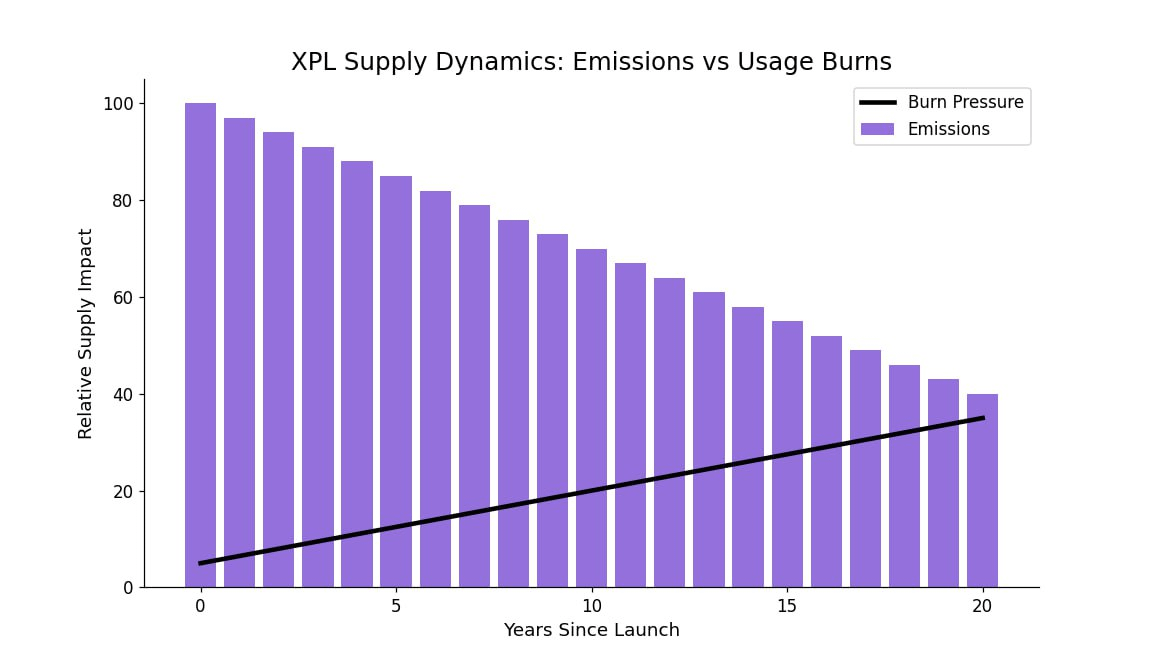

XPL exists to keep the network running, not to steal attention from the stablecoins themselves. This works because the supply tends to be capped at ten billion, and emissions taper over time instead of dumping rewards early and hoping demand catches up later.

Validators stake XPL to secure the chain and earn rewards that gradually decline as the network matures. A portion of fees is burned, which means usage pushes supply pressure down instead of up. Fees can also be paid in stablecoins, which keeps costs stable for users who don’t want exposure to token volatility.

Early demand showed interest in the idea, but price swings followed the usual launch cycle. What’s more telling is that activity didn’t disappear after that. Trading volume stayed active, and integrations kept shipping. That suggests people are treating Plasma as infrastructure, not just a trade.

Strengthening Ties for Widespread Integration

Plasma hasn’t tried to grow in isolation. Most of its progress comes from plugging into places where stablecoins are already being used. Liquidity providers, lending platforms, and settlement tools all benefit from a chain that doesn’t slow down under load.

Developer support is focused on payment-heavy applications instead of generic clones. Remittances, payroll tools, merchant settlement, and tokenized cash flows make more sense here than experimental DeFi strategies that depend on constant composability.

Institutional outreach isn’t about noise. It’s about showing that on-chain settlement can actually replace slow, expensive cross-border rails. Each integration feeds back into how the system evolves, especially around fees, finality guarantees, and reliability under volume.

Showcasing Real-World Utilities in Digital Finance

The clearest signal comes from usage patterns. Gasless stablecoin transfers get used more often because they don’t feel risky or annoying. Fast finality reduces the mental overhead of waiting to see if something “went through.”

In DeFi, speed makes more strategies viable, especially ones that depend on tight timing. For enterprises, Plasma works as a settlement layer that doesn’t need babysitting. Payments arrive when expected, and costs don’t spike randomly.

Mobile wallet improvements matter here more than fancy features. If people can move large volumes easily from a phone, adoption follows naturally. Community pilots around remittances and automated payouts show where this design fits best: repetitive, high-frequency money movement.

Tackling Barriers for Lasting Resilience

Every payment-focused chain gets tested during volatility. Structurally, this works because plasma leans on delegated staking to keep security scaling without forcing everyone to run infrastructure. That spreads participation without slowing the network down.

Price drawdowns tested sentiment, but continued shipping helped stabilize things. Clear documentation, staking tools, and transparent token mechanics reduce guesswork for participants who are thinking longer term.

Burn mechanics and controlled unlocks don’t create hype, but they do reduce long-term pressure. That matters more for infrastructure than short-term excitement.

Picturing an Era of Borderless Digital Dollars

The long-term picture is simple. Stablecoins need rails that don’t break when usage scales. Plasma is trying to be one of those rails, quietly doing its job without demanding attention.

Future work focuses on deeper privacy support, higher throughput, and smoother connections to traditional finance. AI and automation may sit on top, but the foundation stays the same: fast settlement, low cost, predictable behavior.

If digital dollars keep replacing slow cross-border systems, chains built specifically for that job will win by default. Plasma isn’t trying to be everything. It’s trying to work every time, and that’s the point.

@Plasma #Plasma $XPL