Most crypto projects love to talk about what they will build. Roadmaps visions narratives dreams. Dusk takes a different angle. It focuses on what is non negotiable from day one. Deterministic execution reproducible behavior strict separation between logic and proof systems. This might sound boring or overly technical but this is exactly how real finance thinks.

Banks exchanges and clearing systems do not choose platforms that look exciting. They choose platforms that behave the same way every single time especially under stress. When pressure comes rules must not bend. Outputs must not change. Dusk seems built around that uncomfortable truth.

Determinism Is Not A Feature It Is Survival

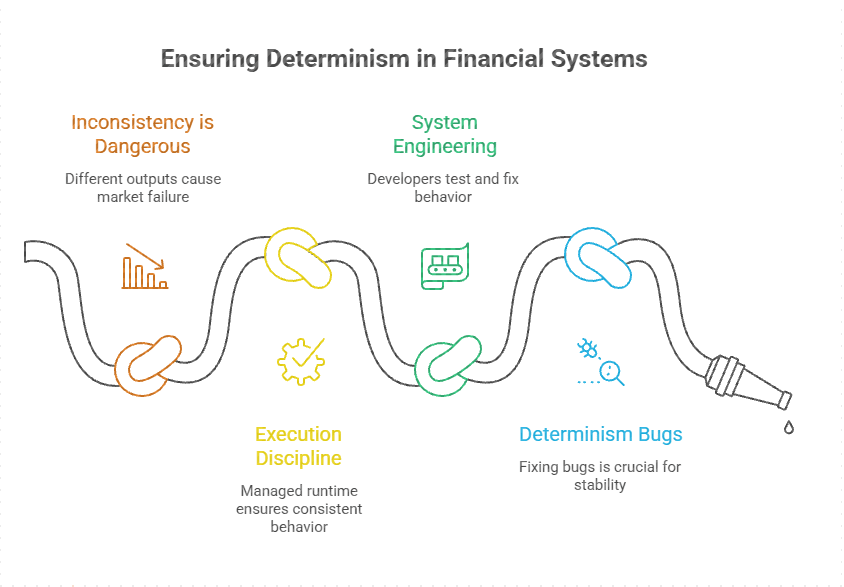

There is a quiet requirement institutions never stop asking for. Determinism. In a consumer app inconsistency is annoying. In finance inconsistency is dangerous. If two nodes process the same input and get different outputs you do not have a market. You have chaos.

Dusk takes this personally. Its core node implementation is called Rusk. And Rusk is not just a node that passes messages. It is a managed runtime. This is where execution discipline lives.

Looking at public repositories you see developers running nodes locally testing behavior contributing fixes. This is not theory. This is system engineering.

What stood out to me was reading updates where the team explicitly talked about fixing non deterministic behavior in test blocks. No hype. No announcements. Just fixing determinism bugs because that is what matters.

The Chain Is An Engine Not A Playground

Dusk philosophy becomes clear here. The chain is not an app platform first. It is a deterministic engine. Everything else sits on top.

When most chains think node software they think gossip networking and syncing. Rusk is more than that. It defines how execution happens and what is acceptable.

Non deterministic behavior is treated as a defect not an edge case. That mindset is rare in crypto and very common in finance.

Rust And WASM Are Not Fashion Choices

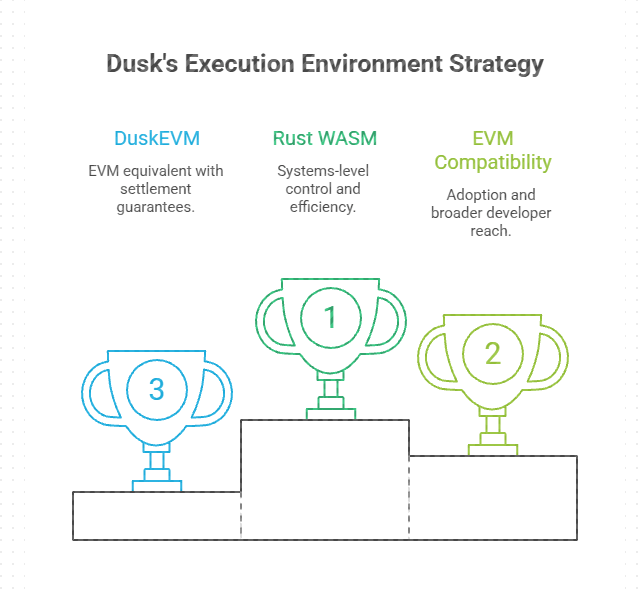

Many chains compete by shouting EVM compatibility. Dusk does offer DuskEVM as an EVM equivalent execution environment sharing settlement guarantees with the base layer.

But that is not the whole story. Dusk also invests heavily in a Rust first WASM style execution path. There is an official ABI crate for writing contracts and hosting modules on the Rusk VM.

This tells you something important. Dusk is not betting everything on one programming world. It supports EVM for adoption and Rust WASM for systems level control.

This is infrastructure thinking. Not developer marketing.

Owning Cryptography Instead Of Renting It

Another quiet but massive decision is cryptography. Many projects use external proving systems and tweak them. Dusk built its own pure Rust PLONK implementation.

The PLONK repository describes a full Rust implementation using BLS12 381 polynomial commitments KZG10 and custom gates optimized for performance. There is even mention of audits.

This matters. When you own your proof system you can tune performance align it with runtime assumptions and reduce risk gaps.

For institutions cryptography is not a feature. It is part of the risk model.

Proofs And Runtime Must Agree Or Nothing Works

Privacy systems only work when runtime and proof system agree perfectly. If runtime allows behavior proofs do not enforce you get loopholes. If proofs are strict but runtime is loose you get false confidence.

Dusk tight coupling of deterministic runtime and owned proof system tries to close that gap. This is not academic. This is product safety.

The docs describe privacy by design with controlled disclosure. Two transaction models. Open when needed private when required. But none of that matters if execution is inconsistent.

Controlled disclosure only works when execution is predictable.

Modularity As Safety Not Speed

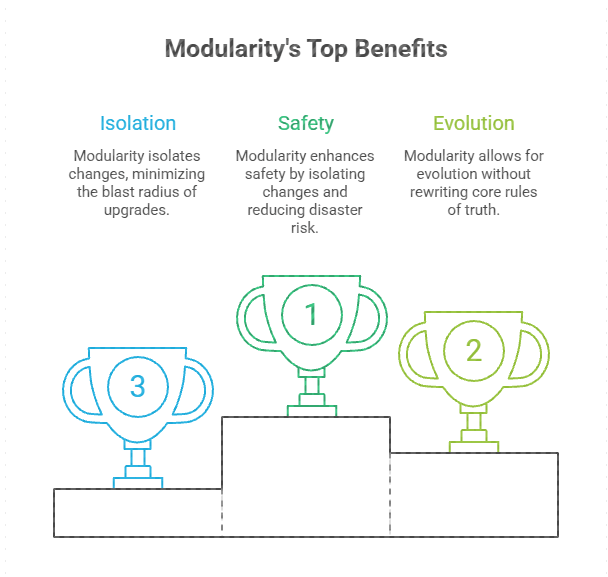

Modularity is often sold as performance upgrade. Dusk frames it as safety strategy. DuskDS is settlement layer. Execution environments like DuskEVM sit above it.

This allows evolution without rewriting rules of truth. Changes are isolated. Blast radius is smaller.

In finance upgrades are scary. Modularity reduces disaster risk.

The Most Boring Checklist In Crypto

If you strip branding away Dusk looks boring. Reference node engine. Non determinism treated as bug. Official ABI support. Native audited PLONK implementation. Modular execution.

No fireworks. No hype cycles.

But this checklist screams long term thinking. Accuracy sustainability and repeatability over speed of marketing.

Why This Matters More Than It Sounds

Crypto loves narratives. Infrastructure survives on discipline.

Dusk engineering choices are not preferences. They are prerequisites for markets where privacy and verification must coexist without drama.

This is not a scaling strategy. It is a correctness strategy.

my take

I think Dusk is doing something most crypto markets do not reward immediately. It is obsessed with determinism and boring correctness. That scares traders and excites engineers quietly. Execution risk is high and adoption is slow but this is how real financial infrastructure is built. If Dusk keeps prioritizing repeatable behavior over hype it may never trend hard but it could become something institutions actually trust. And trust is the only thing that really compounds in finance.