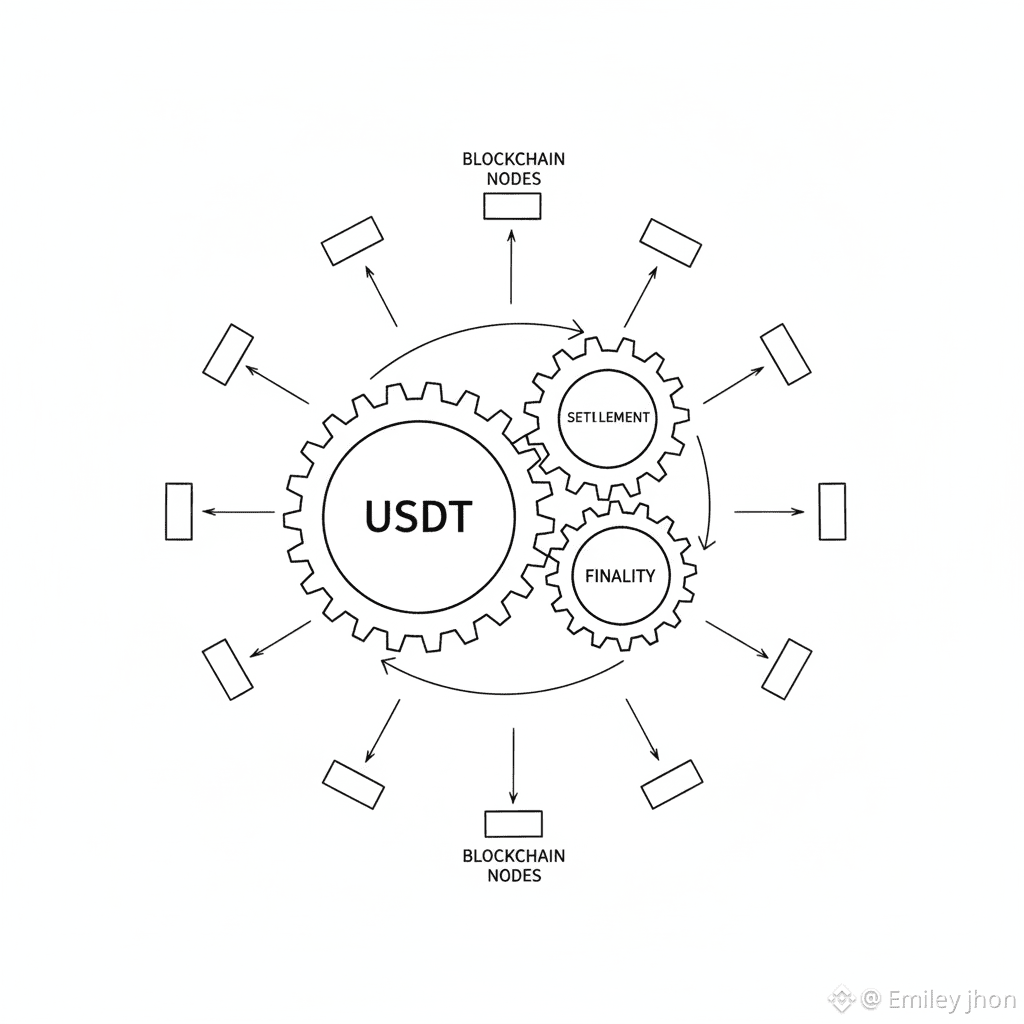

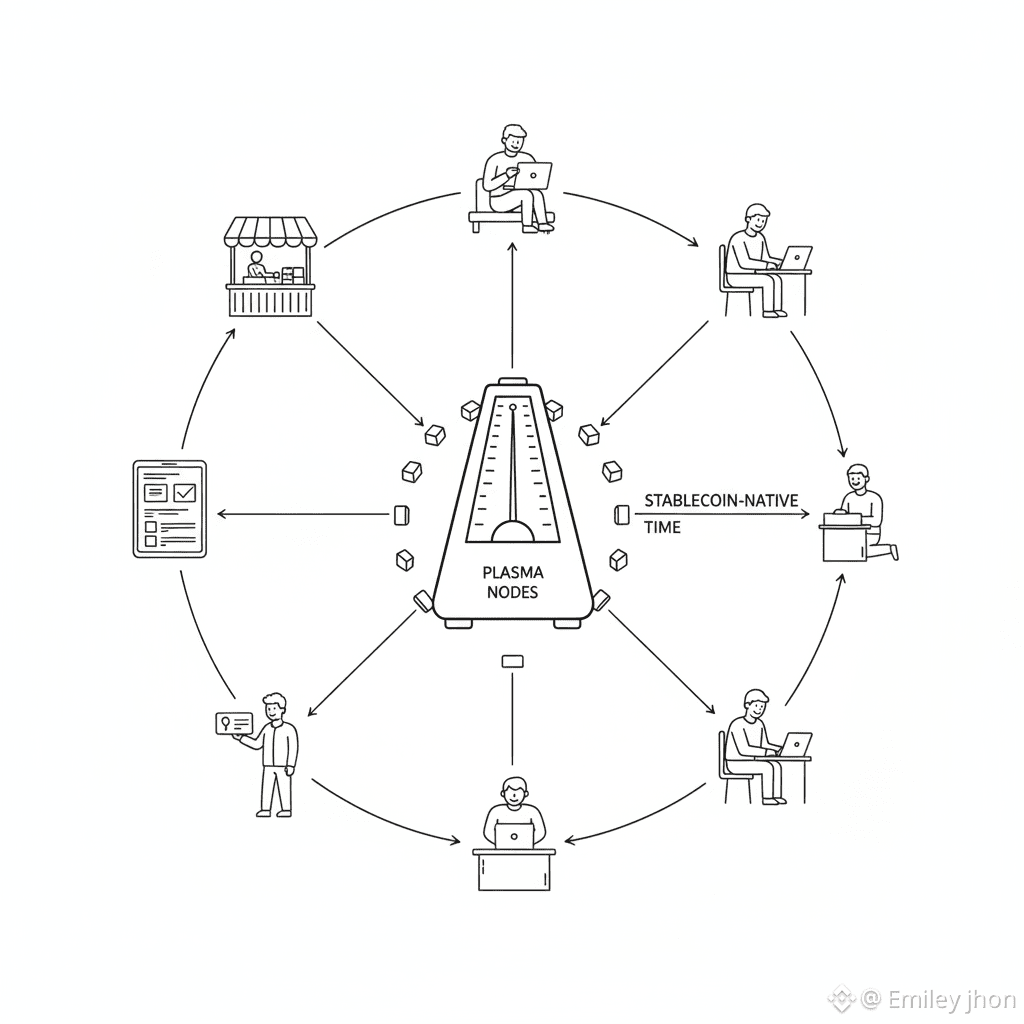

Blockchains usually measure time in blocks. Plasma measures time in stability. That distinction sounds subtle, but it changes how the system behaves under real economic pressure. When stablecoins anchor gas, transfers, and settlement, the chain’s tempo aligns with human expectations instead of market volatility.

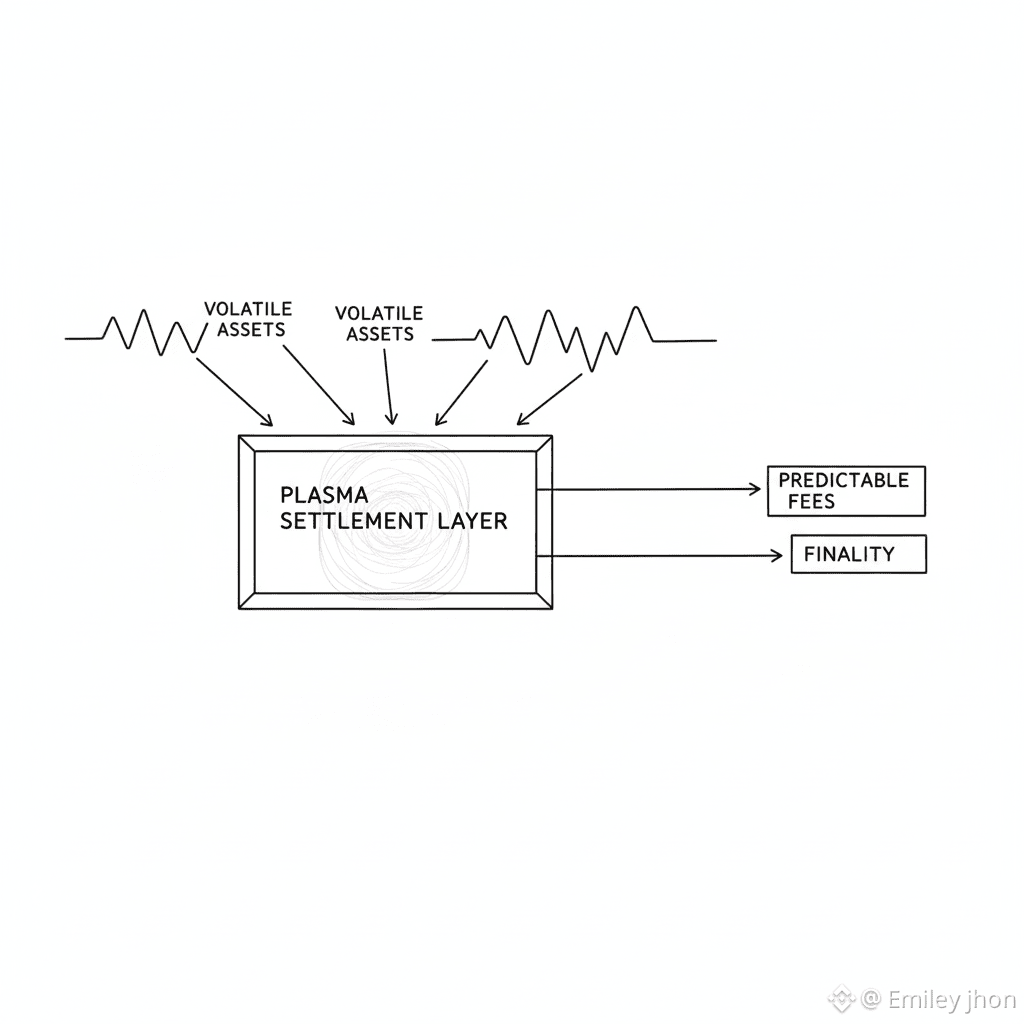

In most networks, volatility leaks into everything. Fees spike, confirmations feel arbitrary, and users hesitate during price swings. Plasma isolates volatility rather than amplifying it. Stablecoins don’t just move through the system — they define its rhythm. The result is a chain that feels predictable even when markets aren’t.

This predictability isn’t cosmetic. It shapes behavior. Developers design apps assuming consistent costs. Users transact without timing games. Institutions stop treating the chain as an experiment and start treating it as infrastructure. Stability becomes a coordination layer, not a feature.

Plasma’s deeper insight is that money isn’t just value — it’s a clock. When that clock stops swinging, networks stop reacting and start functioning. That’s when blockchains quietly cross from markets into systems.#Plasma @Plasma $XPL