Most stablecoin payments don’t fail.

They hesitate.

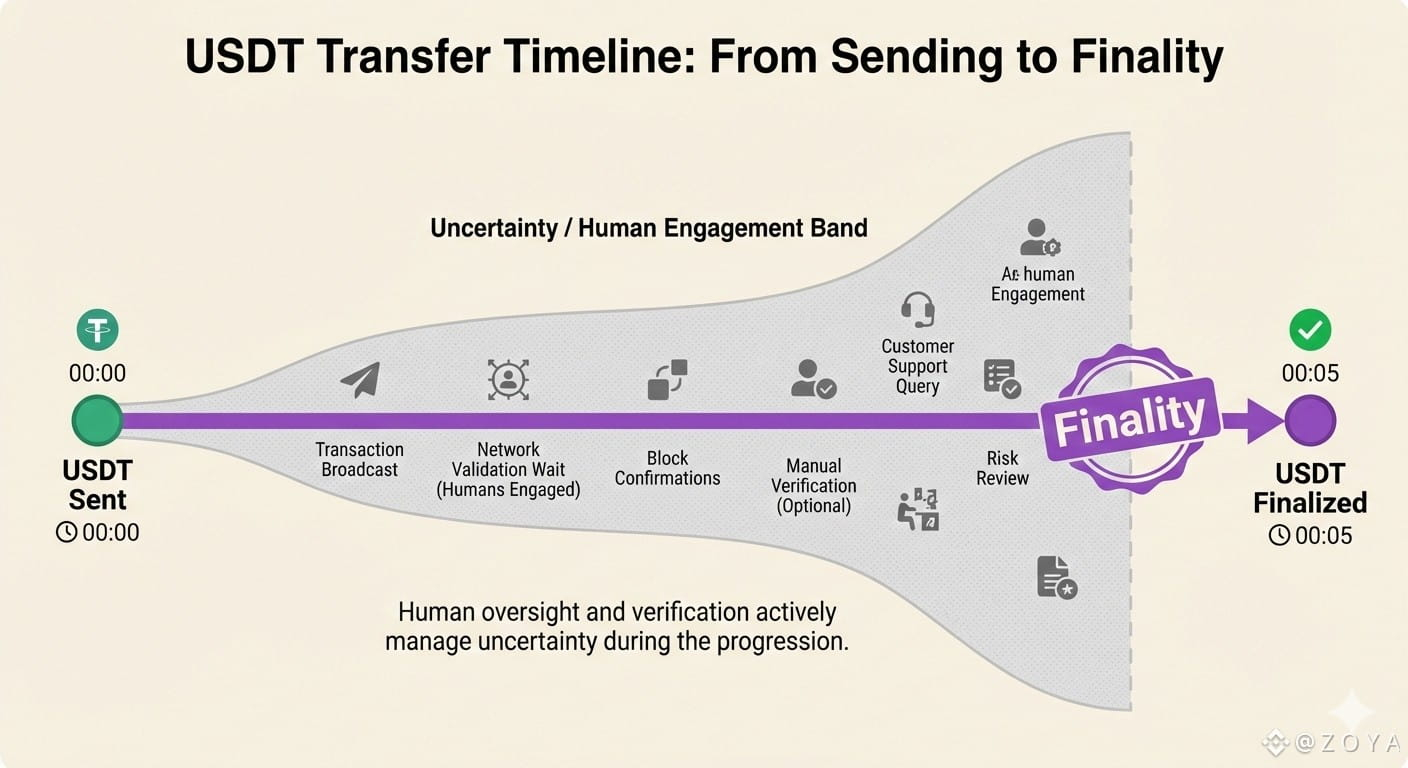

USDT is sent. The wallet relaxes. The chain finalizes. Nothing blinks red. From the system’s point of view, the job is done. From the human side, it isn’t. No one closes the task. Treasury doesn’t book. Ops keeps the tab open. The counterparty asks, again, if it’s safe to move on.

Nothing is broken.

That’s the uncomfortable part.

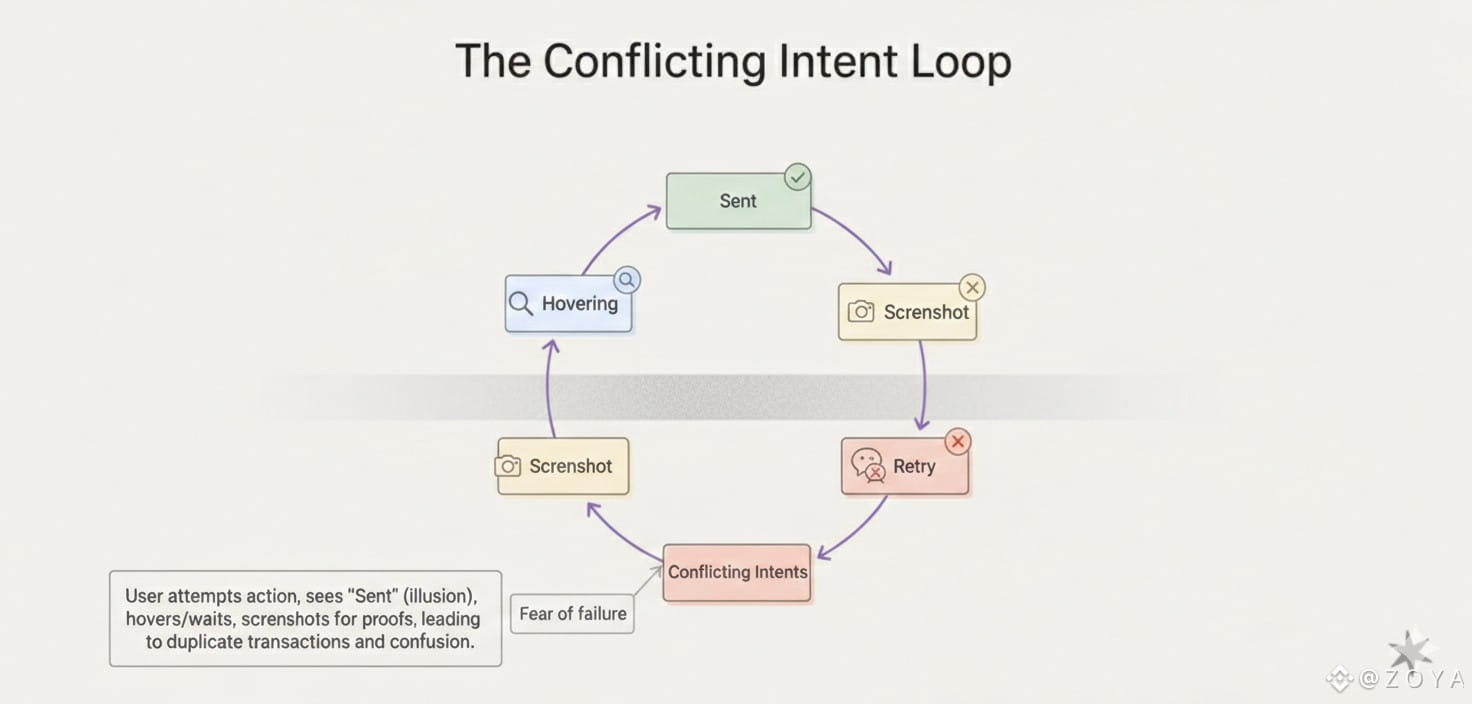

This is where payment systems quietly start costing more than they admit. Not in lost funds, but in borrowed attention. Someone becomes responsible without being assigned. Someone decides to wait “just a bit longer.” Screenshots replace receipts. Explorers become second opinions.

The transfer exists.

Confidence does not.

That silent window is where stablecoin systems are actually judged. Not by block times or consensus diagrams, but by whether a human feels allowed to disengage without regret.

Gasless stablecoin flows raise that bar even higher. When users don’t think about gas, retries, or fee management, pressing send feels like the last action they should ever need to take. Any delay after that doesn’t feel technical. It feels contradictory.

So behavior adapts.

Senders disengage early. Receivers hesitate longer than they want to. Ops teams treat “sent” as provisional even when it shouldn’t be. The payment stops being money and turns into a coordination problem.

This is where ambiguity becomes heavier than failure. A failed payment creates a task. A pending one creates a watchlist. And watchlists scale badly.

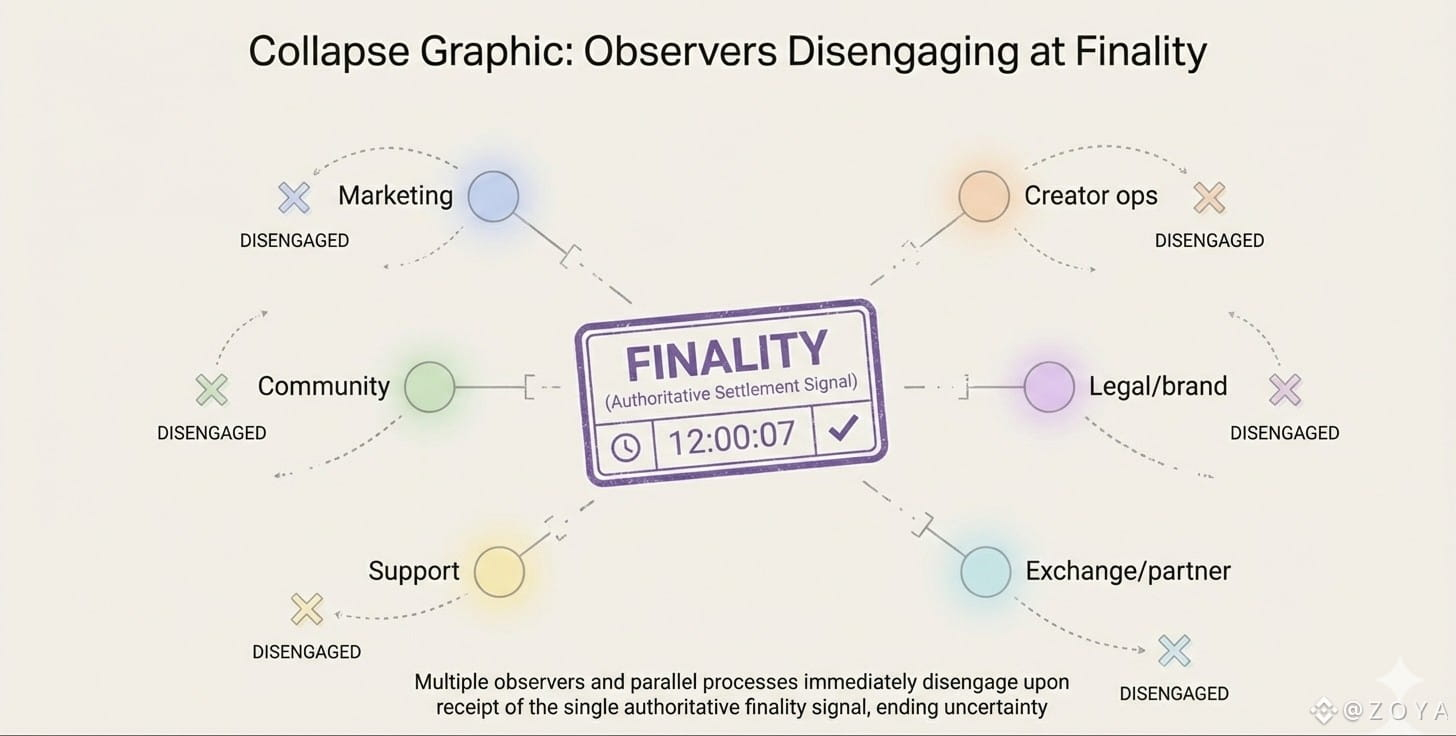

Plasma seems designed around compressing that gray zone before humans compensate for it. Sub-second finality via PlasmaBFT matters less as a benchmark and more as a behavioral control. The shorter the uncertainty window, the fewer backup behaviors appear. Fewer retries. Fewer confirmations. Fewer internal messages asking “are we good?”

Finality, in this sense, isn’t speed.

It’s permission to stop paying attention.

Bitcoin anchoring lives outside this moment. It doesn’t resolve hesitation in real time, and it doesn’t need to. Its role is long-horizon credibility and neutrality — the kind institutions care about when deciding where value should live over years. But daily payments don’t run on years. They run on cutoffs, handoffs, and reconciliation windows.

Those clocks are unforgiving.

What actually clears a stablecoin payment isn’t just cryptographic certainty. It’s a signal that arrives early enough, clearly enough, and singularly enough that nobody feels the need to double-check later.

The first time a routine USDT transfer forces someone to keep watching a dashboard, the network hasn’t failed. But it has shifted work onto people who shouldn’t be doing it.

Plasma’s real challenge isn’t proving that transactions finalize.

It’s proving that once they do, humans disengage.

That difference is subtle.

And expensive.

A chain that functions can move money.

A chain that people trust removes supervision.

In payments, that’s the line between settlement

and money waiting to be believed.